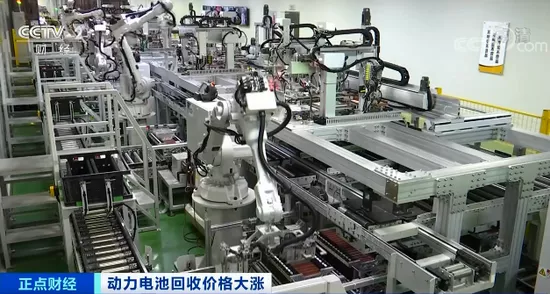

In the current global shortage of raw materials, power battery recycling has become a hot business. On May 11, the passenger car Association released the list of retail sales of automobile manufacturers in April 2022. Among them, BYD, which had previously stopped producing fuel vehicles, became the only car company that sold more than 100000 vehicles in the same month, which was the first time that BYD topped the monthly sales list of passenger vehicles in China.

The continuous growth of new energy vehicle market is reshaping the industrial pattern.

According to the data of the transportation administration bureau of the Ministry of public security, as of March, the number of new energy vehicles in China reached 8.915 million, and 1.11 million were newly registered in the first quarter, a year-on-year increase of 138.2%. Since 2015, China has ranked first in the world's production and sales of new energy vehicles for six consecutive years. The huge production and marketing scale also means that the number of retired power batteries is also amazing.

However, the reality is that there are many problems in China's power battery recycling market, such as unclear pricing mechanism, high price, "black workshop" in power, and most of them flow into the black market, resulting in the failure of the regular army to receive batteries. Under the pressure of price rise, the heat of the power battery recycling industry of "turning waste into treasure" is rising.

Source: CCTV Finance

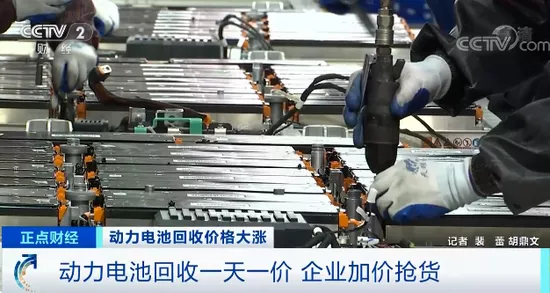

One price a day

For the disposal of retired power batteries, in fact, the Ministry of industry and information technology formulated industry specifications as early as 2016 and successively published three batches of power battery recycling white list enterprises. However, with the soaring price of raw materials, many small workshops are stepping into this "gold mine", and the whole recycling industry is full of chaos.

"At present, only about 30% of the 3 million tons of waste lead-acid batteries retired every year in China are recycled through formal channels." Liu Yong, Secretary General of energy storage application branch of China chemical and physical power industry association, once said.

"At present, there is no clear pricing mechanism for domestic power battery recycling. There is a phenomenon that batteries are recycled by bidding in the informal market. The price given by small workshops is higher and the cost is low, and more batteries flow to the informal military market." Insiders said that small workshops do not need to take into account environmental protection and fire protection. With lower labor, plant and equipment costs, they can afford to buy retired power batteries.

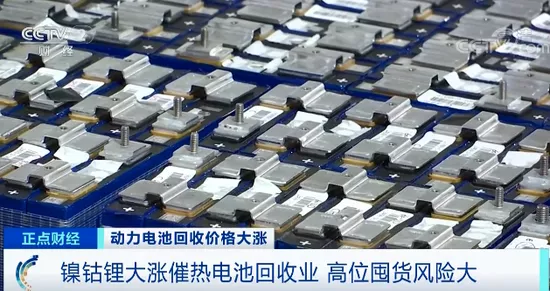

There are two final destinations for most recycled batteries: echelon utilization and disassembly and recycling.

At present, the mainstream waste batteries in the market are divided into ternary lithium batteries and lithium iron phosphate batteries. Ternary lithium batteries are generally used for recycling, extracting valuable metal materials from waste batteries, and the finished products include nickel sulfate, cobalt sulfate, lithium carbonate, etc; Lithium iron phosphate batteries are mainly used in energy storage power stations, low-speed electric vehicles, electric tools and other echelon utilization scenarios. With the rise of lithium carbonate price, more and more enterprises directly use the recycled lithium iron phosphate batteries for lithium regeneration.

Source: CCTV Finance

In the power battery recycling market, the current price of waste lithium iron phosphate batteries has increased from about 2000 yuan / ton at the beginning of 2021 to nearly 20000 yuan / ton at present. The recycling price of waste ternary batteries has exceeded 40000 yuan / ton, and the higher value lithium cobalt oxide has even exceeded 100000 yuan / ton; And there is also a price one day in the recycling market.

In addition, the increase in the price of waste also exceeded that of batteries. Li Baohua, a professor at the Shenzhen International Graduate School of Tsinghua University, said that when the price of battery grade lithium carbonate was 37000 yuan / ton, the waste of lithium iron phosphate was 2500 yuan / ton; At present, the price of battery grade lithium carbonate is 500000 yuan / ton, while the price of lithium iron phosphate waste is 82000 yuan / ton. This means that the price of raw materials has increased by 12.5 times, while the corresponding waste has increased by 31.8 times.

Source: CCTV Finance

Despite the rising tide of raw material prices in 2021, the enterprise has a certain prediction of this year's rising price, but it still did not expect to rise to such a high price. In the extreme case of insufficient supply of new goods, some enterprises purchase "decommissioned materials" at a discount rate of 110% (the ratio of waste price to new goods price), while others increase the discount rate to 115% or even 120% to grab goods.

"For fear of buying late and raising the price, lock the price in advance." Cai zepeng, a waste battery supplier, said that the price of power battery recycling has risen too fast this time, which has far exceeded expectations.

Stimulated by this high profit, there is no lack of hoarding in the industrial chain. Many people in the industry have begun to worry that there is a huge risk behind the high price. Once the price of relevant metals falls, it will be a stampede crash.

Source: CCTV Finance

Stricter supervision

For the current chaos in the power battery recycling industry, relevant departments have also begun to strengthen supervision.

Recently, Xin Guobin, Vice Minister of industry and information technology, said at the press conference of the state information office that this year, we will focus on meeting the production needs of power batteries, moderately accelerate the development progress of domestic lithium, nickel and other resources, and crack down on unfair competition such as hoarding and raising prices. At the same time, we will improve the recycling system of power batteries, support technological breakthroughs such as efficient disassembly and recycling, and continuously improve the recycling rate and resource utilization efficiency.

On February 10, the eight ministries and commissions also jointly issued the notice on accelerating the implementation plan of promoting the comprehensive utilization of industrial resources, which mentioned the implementation of standardized management of the comprehensive utilization of renewable resources such as waste power batteries and waste mobile phones, and made separate guidance notes on improving the recycling system of waste power batteries.

Picture: beehive energy source

The policy orientation has been very clear: on the one hand, encourage enterprises to increase the mining scale of source resources, accelerate the refining speed of raw materials, improve the supply of raw materials, and alleviate the mismatch contradiction between supply and demand; On the other hand, we should curb the market speculation on the resource side, crack down on the behavior of pure hoarding and speculation in prices, and maintain the order of normal transactions in the market. In addition, the industry also needs to establish a recycling system for retired batteries as soon as possible to solve the supply bottleneck of lithium battery materials from multiple channels.

In addition to the attention of regulators, on the eve of the national two sessions this year, retired battery recycling has also become one of the hot topics. Among them, Dong Mingzhu, deputy to the National People's Congress and chairman and President of Gree, suggested that "we should standardize the lithium battery recycling market and avoid the large-scale inflow of low-quality waste lithium batteries into the market. We should clarify the subject of law enforcement and improve the comprehensive law enforcement mechanism to ensure the safety of power batteries in the whole process from delivery, use to recycling."

Zeng Yuqun, member of the CPPCC National Committee and chairman of Ningde times, also said that the current supply and demand situation of lithium resources is severe and the development of the industry is facing challenges. We should speed up the exploration and development of domestic lithium resources, strengthen independent innovation and scientific and technological research, and improve the level of recycling and efficient utilization of resources.

Wang Qi, deputy to the National People's Congress and chairman of Qiyang (Chengdu) Investment Management Co., Ltd., proposed to further standardize the management mechanism of power battery recovery of new energy vehicles.

Picture: beehive energy source

Yin Tongyue, deputy to the National People's Congress and chairman of Chery Automobile, proposed to promote the integration of new energy vehicles into carbon trading management and bring power battery raw materials into strategic reserves.

How to standardize the power battery recycling market? Wang Yao, Assistant Secretary General of China Automobile Industry Association and Minister of Technology Department, said: first, we need to promote recycling legislation, clarify the main responsibilities of all parties, and strengthen the punishment of "black workshops"; Second, improve industry access, continue to implement the "white list" management, and encourage and support enterprises with strong recycling capacity to carry out recycling in an orderly manner.

Giant entry

China Automotive Technology Research Center predicts that the capacity of waste power batteries to be recycled in China is expected to reach 137.4gwh in 2025, more than five times that in 2020. GF Securities predicts that by 2030, the battery recycling market space will reach 100 billion yuan, of which power batteries account for 84%.

Facing the 100 billion level "cake" of power battery recycling, more and more enterprises are competing to enter the Bureau. Enterprise survey data show that there are 36000 existing power battery recycling related enterprises in China. Among them, 24000 enterprises were newly registered in 2021, with a year-on-year increase of 644.3%.

Tian yongqiu, an analyst in the automotive industry, said, "the main reason for the explosive growth in the registration of battery recycling related enterprises in 2021 is that the industry generally believes that the first batch of electric vehicle batteries in the market are entering the retirement period and the market prospect is clear. In addition, the supporting industries related to power batteries are also gradually landing."

Photo source: Ningde Era

On April 14 this year, puqin times, a holding subsidiary of Ningde times, signed a tripartite agreement with Pt Aneka tambang (antam) and Pt industri baterai Indonesia (IBI) in Indonesia to jointly build a power battery industry chain project including nickel mining and smelting, battery materials, battery manufacturing and battery recycling, with a total investment of no more than US $5.968 billion (about RMB 38.02 billion).

Coincidentally, BYD also entered the power battery recycling track the day before. On April 13, BYD established Taizhou Verdi Battery Co., Ltd. in Taizhou, Zhejiang Province, which is indirectly wholly owned by BYD. Its business scope includes battery manufacturing and sales, recycling and echelon utilization of waste power batteries of new energy vehicles, research and development of new materials and technologies, etc.

The overweight or entry of head power battery manufacturers and relevant parties in the industrial chain will add another fire to the power battery recycling track which is already in a high temperature state.

Picture: beehive energy source

With the increasing number of entrants, it is expected to not only improve the recycling value of domestic power batteries and alleviate the mismatch between material supply and demand, but also help build a recycling network of "use recycling echelon utilization / material recycling".

"In the future, there may be a linkage and closed-loop B2B model among battery manufacturers, automobile enterprises and recycling enterprises, and third-party recycling enterprises will become the providers of social responsibilities of automobile enterprises and battery manufacturers. It is expected that a virtuous circle will be formed around 2030." Zhao weiduo of Shunhua lithium said so.