According to cryptocompare data compiled by the financial times, the market value of the top 500 digital currencies has fallen 50% from the record high reached in November 2021 to $1.6 trillion. Bitcoin, the world's largest digital currency, also fell by half during this period, and the market value of the third largest stable currency of cryptocurrency evaporated by more than 30%.

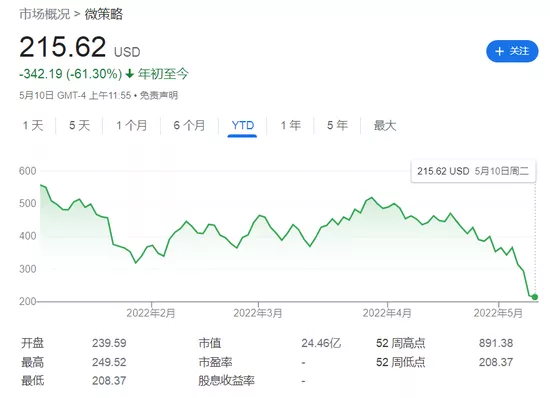

Under the tightening policy of the Federal Reserve, it may be expected that the price of bitcoin, a risky asset, will continue to fall. However, as the price of bitcoin continued to fall, the share price of MicroStrategy, a listed company and business intelligence company with the most bitcoin holdings in the world, plunged 24% on Monday, reaching the lowest level since 2020. On Tuesday, U.S. stocks continued to decline, with a decline of more than 1.5% to $215.62. Since the beginning of the year, the cumulative decline of micro strategy has reached more than 60%.

To make matters worse, in the past week, bitcoin has fallen by 20% to below $31000, and even fell below the $30000 mark this week, getting closer and closer to the margin call level of micro strategy companies; If bitcoin falls below $21000, the micro strategy company will be called upon to pay the loan deposit, that is, the micro strategy company may be forced to sell some of its bitcoin.

According to the documents of the securities and Exchange Commission of the United States, MicroStrategy purchased bitcoin worth US $215 million in the first quarter of this year. The average purchase price of each bitcoin was US $44645, bringing its total holding of bitcoin to 129218, and the purchase cost was US $3.97 billion, or us $30700 per bitcoin.

It is worth noting that MicroStrategy's basic software business does not have enough profits to repay these debts, so the success of the company's highly leveraged bet on cryptocurrency depends entirely on the rise of bitcoin price, far exceeding its average payment price of $30700.

The company's chief financial officer, phone Le, commented on the company's recent earnings conference call, which will force the company to either provide more collateral for loans or sell some of its bitcoin holdings. With regard to the margin increase of bank loans, Le said:

We make loans at the loan ratio of 25%, and the margin recovery occurs at the loan ratio of 50%. Therefore, basically, bitcoin needs to be halved or about $21000 before we have margin calls.

Bitcoin "madman"

Michael Saylor, co-founder and CEO of MicroStrategy, is probably one of the most enthusiastic supporters of bitcoin in the world. At the 2022 bitcoin conference held in Miami, the United States, his popularity was still vivid. At that time, he told people never to sell their cryptocurrency. Seiler believed that bitcoin was "freedom" and "generally speaking, the most ideal property in time and space", In terms of corporate strategy, he once said:

We will continue to assess opportunities to raise additional capital to implement our bitcoin strategy.

Saler not only said that, but also did so. The CEO borrowed heavily from the bank to add more cryptocurrencies to the balance sheet of his micro strategy company.

Last December, MicroStrategy said it spent about $82.4 million between November 29 and December 8 to buy these bitcoins, with an average price of $57477. Some of them were bought in the crash on December 4, when bitcoin prices fell by more than 20%. Although bitcoin prices have rebounded since then, they are still well below the recent high of about $69000. At that time, the company held a total of 122478 bitcoins, with an average cost of $29861 each.

Micro strategy reported last week that its net loss in the first quarter expanded to $130.8 million from $110 million in the same period last year, due to the inclusion of a $170.1 million bitcoin impairment charge. Earlier this year, the SEC said it would not be allowed to exclude the impact of sharp fluctuations in bitcoin prices from its results through unofficial accounting methods previously sold to investors.

In March this year, MicroStrategy applied to Silvergate bank for a $205 million bitcoin mortgage loan to buy more bitcoins. The total value of bitcoin held by the software company is now just over $4 billion.

"The tree fell and the monkeys scattered", and many coin speculation companies broke into a cold sweat

As of Monday, 43 companies or institutions, including gray-scale investment, held 1225600 bitcoins, according to the sky eye data on the chain of Oko cloud chain. Since the Federal Reserve announced the interest rate hike on May 4, it has fallen by tens of thousands of dollars, which also means that the bitcoin held by these institutions and companies has evaporated by more than $12 billion.

The current round of decline of bitcoin has fallen below the cost price of bitcoin of many institutions or companies. According to public information, bitcoin currently held by 12 institutions or companies, including Tesla, is at a loss at the price of $30800. Among them, Aker ASA lost US $21.62 million, metu lost US $19.75 million and plunwra lost US $16.95 million, ranking in the top three. In addition, Tesla holds 40900 bitcoins, with an average price of $32000.

Not just institutions, according to bcoin, a third-party data service provider, as of 12:00 on May 10, Beijing time, 271300 people around the world had sold out $970 million in the past 24 hours, including $262 million in bitcoin and $220 million in Ethereum.

However, Cathie wood, founder of ark invest, said in an interview that the correlation between cryptocurrency and traditional assets is growing, indicating that the bear market will soon end.

Cryptocurrency, as a new asset class, should not look like Nasdaq, but it is now highly correlated. You know you're in a bear market, and maybe it's coming to an end when everything starts to look similar.

In addition, she also said that despite the current market downturn, she still maintains long-term confidence in cryptocurrency, because like other investment categories of ark, she believes that cryptocurrency will grow exponentially with economic and social development. However, an earlier article on Wall Street pointed out that the net assets of ark innovation ETF (arkk), the flagship fund of "wooden sister", rose from $20.12 when it was established in October 2014 to $45.59 on May 4, 2022, with a return of 127%. However, according to the data compiled by Bloomberg, the return of the S & P 500 index in the same period was 136%, and the so-called excess return has disappeared.