Fund managers need to be more cautious in naming their funds, according to the rules proposed by the securities and Exchange Commission on Wednesday According to the SEC's proposal, a growth or value fund must keep 80% of its investment in this category, and those funds claiming to be green or low-carbon must explain how they achieve their environmental goals.

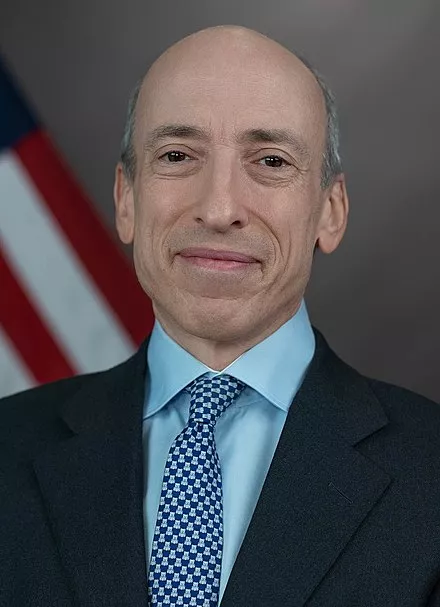

Data map

Gary Gensler, chairman of the SEC, said in a speech: "fund names are usually one of the most important information used by investors when choosing funds. Investors should be able to have an in-depth understanding of the situation behind these funds."

The SEC is increasingly focusing on environmental, social and Governance (ESG) investments. The rules come as the agency is cracking down on investment funds that label themselves as ESG without disclosing the meaning of the label.

This week, bny Mellon investment advisors, a New York based mutual fund management company, paid $1.5 million to settle the SEC's allegation that it made false statements in the ESG investment evaluation. The company did not admit the allegations.

The SEC passed two proposals by a vote of 3-1 on Wednesday, with Republican Commissioner Hester Peirce opposing them.

According to the ESG disclosure proposal, fund companies or investment management companies that claim to consider ESG factors must specify the factors they consider and how to implement them. Funds that focus on ESG and aim to affect their company's greenhouse gas emissions must report on the emission targets of their portfolio and the annual progress in achieving ESG goals.

The SEC said the new disclosure requirements would prevent "green money laundering" by funds that claim to be concerned about ESG factors but are not. However, the dissenting committee member pels believes that the new regulations will create new pressure points that activists can use to force investment companies.