On May 15, Weilai said that it had submitted a form 6-k to the U.S. Securities and Exchange Commission, which related to the introduction documents and some supplementary materials submitted by the company's class a common shares for the proposed second listing on the main board of the stock exchange of Singapore Limited Statistics show that Weilai has applied to the Singapore stock exchange for secondary listing through introduction, and the New York Stock Exchange will continue to be its main listing place. It is expected that the listing will not lead to a large number of new compliance or disclosure responsibilities. Weilai expects its shares to be traded on the main board of the Singapore Stock Exchange on May 20, 2022.

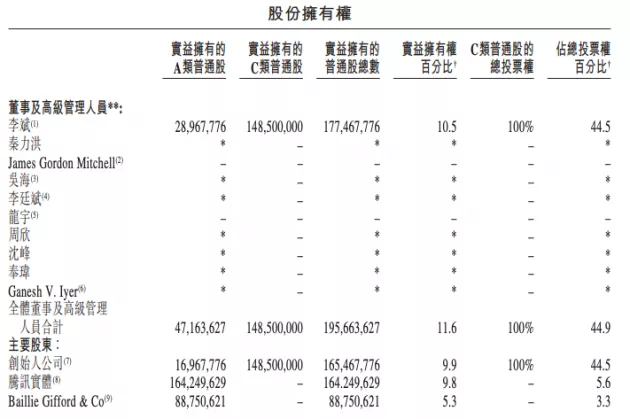

In addition, supplement information and disclose the latest financial information of the company. As of February 28, 2022, Weilai had a total of 52.65 billion yuan in cash and cash equivalents, restricted cash and short-term investments. In terms of share ownership, Li Bin has 44.5% of the voting rights and Tencent entity has 5.6% of the voting rights.

Weilai adopts the way of introducing listing on the Singapore Stock Exchange, which does not involve the issuance of new shares and fund-raising. Velai's class A shares listed on the New York stock exchange can be fully converted from its American depositary shares listed on the New York Stock Exchange.

Statistics show that in November 2014, Weilai was founded by Li Bin and invested by dozens of well-known institutions such as Temasek, baidu capital, Sequoia, Magnolia officinalis, Lenovo Group, Warburg Pincus, TPG, GIC, IDG and pleasure capital; On September 12, 2018, Weilai automobile was successfully listed on the New York Stock Exchange; On March 10, 2022, Weilai automobile officially landed on the Hong Kong stock exchange.

If it successfully lands on the new stock exchange this time, Weilai will also become the first intelligent electric vehicle enterprise listed in three places.