On the evening of May 20, Shanghai Stock Exchange (hereinafter referred to as "Shanghai Stock Exchange") and China Securities Index Co., Ltd. announced that they would officially release the Shanghai Science and innovation board chip index (hereinafter referred to as "science and innovation chip") on June 13, 2022. This is another major index characterizing the science and innovation board market after science and innovation 50, science and innovation information and science and innovation biology.

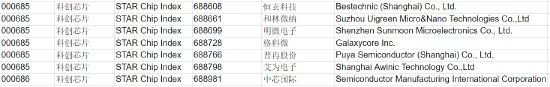

After liquidity screening, Kechuang chip selects no more than 50 securities of Listed Companies in the fields of semiconductor materials and equipment, chip design, chip manufacturing, chip packaging and testing with large market value as the index sample. The top five heavyweights are SMIC international, Lanqi technology, Zhongwei company, Jingchen shares and Shanghai silicon industry, with a total weight of 44%.

Integrated circuit industry is the core of information technology industry and a strategic, basic and leading industry supporting economic and social development and ensuring national security. Chip is the main carrier of integrated circuits. As one of the key areas supported by the science and innovation board, 57 scientific and technological innovation enterprises in chip related industries have been listed on the science and innovation board, accounting for about 60% of A-share chip companies. Four of the top 10 companies in the total market value of Kechuang board are chip industry companies.

Chip design, chip manufacturing, chip testing and other fields of listed companies.

In 2021, the net profit and operating revenue of the listed companies of Sci-tech Innovation Board chips increased by 181% and 43% year-on-year respectively, and all the companies achieved positive growth in operating revenue; The annual R & D investment was 17.66 billion yuan, with a year-on-year increase of 15.4%. The R & D investment accounted for 15.1% of the operating revenue, which was higher than the overall level of the science and innovation board and a shares (13% and 2.1% respectively). At present, the overall P / E ratio is 38 times (excluding losses), which is at a low level since the opening of the science and innovation board.

"The release of Kechuang chip index not only provides an important market observation angle, but also provides the market with a tool to share the development achievements of China's chip industry." Xu Xingjun, general manager of Guangfa Securities Development Research Center and chief of the electronics industry, said.

The relevant person in charge of huitianfu fund also said that after the release of the Kechuang chip index, it is expected to launch relevant index products such as Kechuang chip ETF. When there is a threshold for individual investors to participate in Kechuang board transactions, it can provide investors with tools for value investment, long-term investment and rational investment.

Some institutions concluded that as a subdivision ruler reflecting the trend of important themes of the science and innovation board, the launch of the science and innovation chip index will have three beneficial effects: first, it is conducive to further increase the observation dimension of the science and innovation board. Index release can enrich the observation dimension of various investors and the analysis dimension of financial media. Second, it is conducive to serving the majority of investors. In the future, the issuance of index products will provide investors with richer tools to participate in the development of science and innovation board and share economic growth, so as to better meet the needs of asset allocation and wealth management. Third, it is conducive to optimizing the allocation of resources. The science and innovation theme index focuses on leading companies in strategic emerging industries, which is conducive to guiding resources to further tilt towards hard technology companies represented by the science and innovation board.

The Shanghai Stock Exchange said that in the future, it will continue to improve the index system of the science and innovation board and advocate the concept of value investment, long-term investment and rational investment through index investment.

Author / Huang Siyu