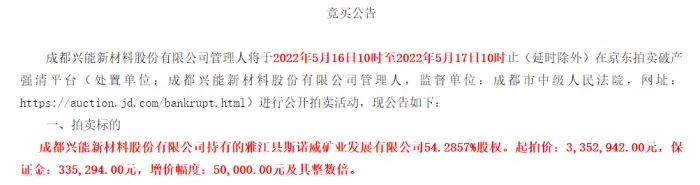

On May 16, on the Jingdong bankruptcy auction platform, a special bankruptcy liquidation equity auction attracted great attention. It is understood that the subject of this auction is the 54.2857% equity of Yajiang snowway mining held by Xingneng new materials, which is actually a bidding for lithium resources (auction details) 。

Due to the current explosion of lithium battery industry, this auction has really staged a white hot war, it was finally announced that it ended early this morning, with a transaction price of 2000202942 yuan, or 2 billion yuan**

However, the starting price of the auction was only 3.35 million yuan. After 3448 bids, fierce overnight bidding and nearly one million onlookers, a winner was finally won among 21 newspaper celebrities.

Compared with the starting price, the transaction price of snowway mining equity this time is equivalent to 596 times

It is worth noting that the bidder needs to pay more than 2 billion yuan. According to @ titanium media, some analysts said that with the company's debt of 1.6 billion yuan, the cost of winning 54.29% equity of snowway mining is as high as 3.6 billion yuan**

At the same time, the person also stressed that it would still be cost-effective if calculated according to the current lithium price. But the biggest risk is how long the lithium cycle can last.

According to the data, Yajiang snowway mining has the exploration right of delanongba lithium mine. Delanongba lithium mine is located in the northeast of Yajiang County, Ganzi Prefecture, Sichuan Province. It belongs to methylkalibxene mining area. The mine reserves are 18.14 million tons, with an average grade of 1.34%, belonging to super large lithium mine.

Under the background that the current price of lithium carbonate exceeds 450000 yuan / ton and the enterprise "has lithium as the king", the unprecedented white heat of this auction is indeed reasonable.