I. Origins

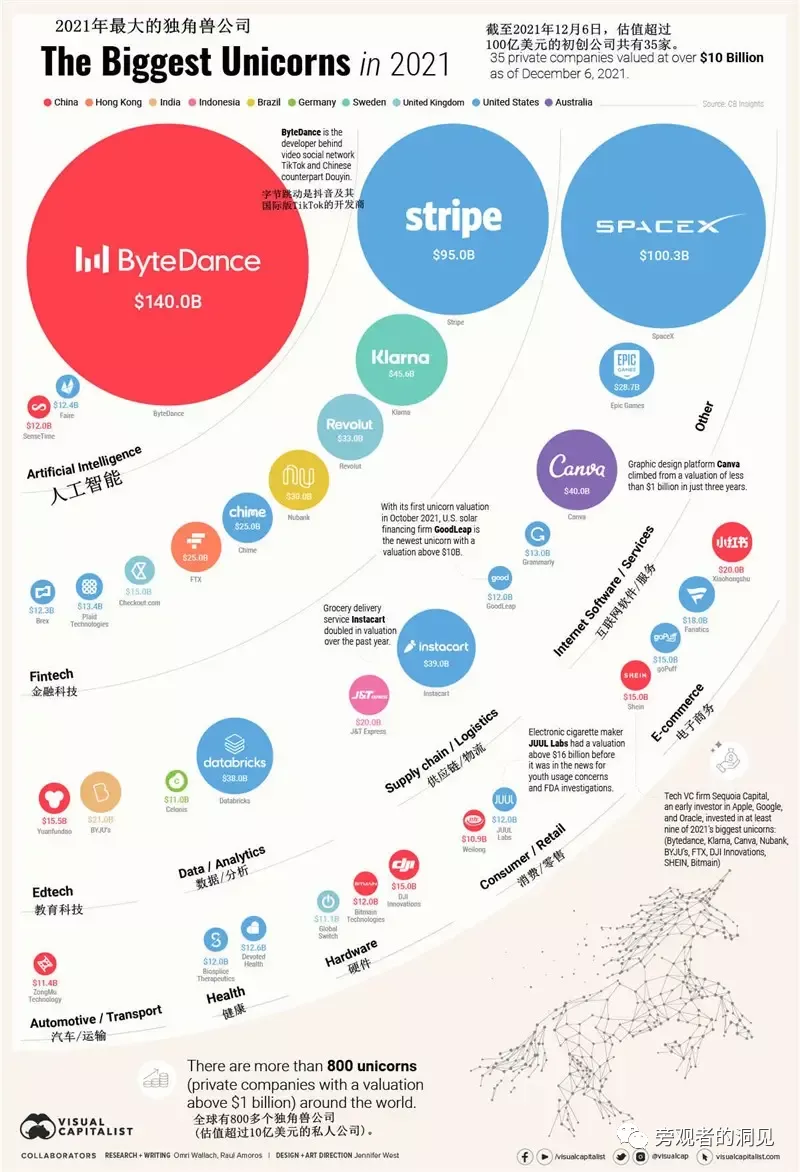

Stripe is a very unique sample to observe among the unicorns approaching $100 billion valuation globally. Three simple words to sum up Stripe are Brotherhood of Entrepreneurship, American Dream, and YC Alumni.

1. Brotherhood in Business

While there are countless examples of successful brother startups in the entertainment industry, such as Ginger Woo and the Coen brothers. But in the list of unicorn companies, there are actually very few truly successful brother entrepreneurs.

Brothers Patrick and John Collison were born in 1988 and grew up in Dromineer, a small village of just over a hundred people in Ireland, a quiet and picturesque village in the middle of nowhere.

Influenced by their engineer father and microbiologist mother, the brothers showed an interest in science from an early age. Particularly fascinated by mathematics and physics, the brothers had nine computers in their home by the time they were teenagers and paid 100 euros a month to rent satellite broadband connected to their home via Germany.

In 2004, Patrick took his artificial intelligence project to the 40th Annual Young Scientists and Technology Fair and was the individual runner-up. He re-entered the following year and won first place.Patrick's project involved the creation of Croma, a LISP-type programming language.He entered MIT in 2006 with SAT scores taken when he was 13, but dropped out of MIT in 2009. He is said to have completed the last two years of his high school curriculum in just twenty days. His younger brother John was no slouch either, enrolling at Harvard in 2009 after scoring 8 A1s and 2 A2s on the Irish Leaving Certificate exam, but ended up dropping out to start his own business just like his predecessors Bill Gates and Mark Zuckerberg.

In 2007, the brothers founded Shuppa, a variation on the Irish word for "store." The Collison brothers' plan to directly challenge eBay received no interest from Enterprise Ireland, but did receive backing from Y Combinator. It's worth noting that YC was founded by LISP guru Paul Graham.

2. YC alumni

At YC, the Collison brothers were encouraged to join forces with brothers Kulveer Taggar and Harje Taggar, recent graduates of Oxford University, to start a business. the Taggar brothers' first venture, boso, was a huge success and, with the support of YC, they started a second venture, Auctomactic. auctomactic provides tools for the eBay e-commerce service. Shuppa later merged with Auctomactic.

Just one year later, in March 2008, Patrick, 19, and John, 17, sold Auctomatic to Canadian company Live Current Media, a company that owns premium domains such as Communicate.com and Brazil.com. The two brothers turned into millionaires.

In 2009, Patrick and John started their second venture and came up with a super cool name for the product: /dev/payments, the precursor to Stripe. /dev/payments reflects the brothers' genius idea of providing tools geared towards developers.

To launch /dev/payments, the Collison brothers raised $20,000 from YC. As with the Chibi Creation Forum, YC's alumni network proved to be a particularly useful way to find their first customers. Two weeks after the brothers released their MVP, /dev/payments processed its first transaction, with 280 North's Ross Boucher being the first to use the system with a $40.00 transaction. Soon, /dev/payments had about 30 customers from YC and grew further by word of mouth.

But no one would have thought that Stripe would become YC's greatest startup story.

3. The American Dream

In March '21, Stripe became another Silicon Valley legend when its valuation soared to $95 billion with the announcement of a new $600 million funding round. Growing at the same time was the value of the Collison brothers, both of whom ranked among the youngest billionaires. From a small village in Ireland to the co-founders of Silicon Valley's most star-studded unicorn, the Collison brothers represent a new generation of the American dream.

So what makes Stripe work?

II. Investment highlights

1. Executive summary

Overall, the payments market has tremendous TAM and strong network effects. stripe is an excellent investment target with clear value and innovative model as an e-commerce infrastructure, strong business growth, strong user stickiness, extremely deep moat and outstanding management team capabilities.

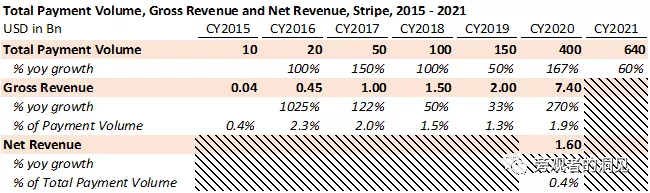

As a super unicorn that hasn't gone public yet, Stripe rarely makes its financials public. According to the company's just-released annual letter, TPV in 2021 is $640 billion, yoy up 60%. 2029 TPV is $400 billion, Gross Revenue is $7.4 billion, Net Revenue is $1.6 billion, and Gross Take Rate and Net Take Rate are 1.9% and 0.4%. Stripe's growth potential and profitability is proven compared to its competitors.

On the other hand, the company's high valuation is the mainconcern. in March 2021, Stripe managed to raise $600 million in its latest round, valuing the company at $95 billion post-investment, a 2.5x increase in valuation from a year ago. If we calculate $7.4bn Gross Revenue in 2020, the company was valued at 12.8x P/S in the last round.

Given that the Fed has entered a rate hike cycle, coupled with all the geopolitical uncertainty, the overall FinTech sector has seen a huge pullback in valuation, so valuation expectations at the time of the company's IPO need to be taken into account in this investment round. Considering Stripe's growth potential outperforms its competitors and is one of the highest quality scarce assets in FinTech, the company can be given a valuation of 8.5x-10.0x P/S on Gross Revenue in 2021.

2. Investment highlights

E-commerce penetration in the global market continues to rise, and the payment track has an extremely high ceiling. The outbreak of the epidemic has accelerated the shift of offline sales to online, consumers are increasingly accustomed to online consumption, at the same time, omnichannel sales, omni-domain marketing and other online and offline integration has become a major common trend in the current retail development, more merchants have accepted software embedded payment methods, the resulting demand generated by online payments will continue to grow rapidly;.

Stripe has become the utility of e-commerce, with an extremely strong network effect in its infrastructure role, creating an extremely deep moat.Stripe has attracted hundreds of millions of business users with its integrated and easy API payment platform. Transaction data is deposited on the platform, which helps Stripe to better detect fraud and money laundering in enterprises, ensuring the security of transactions while providing enterprises with compliance requirements for their transaction behavior. Based on this, more enterprises will be attracted by the convenience and security of Stripe payments, forming a flywheel effect, thus building Stripe's data moat.

Stripe's product features hit the core user pain points, user stickiness is very strong, has a huge upsell space. stripe through mergers and acquisitions to extend the product from the beginning of the payment to financial services and company operations, not only enhance the user's stickiness to the platform, but also broaden Stripe's revenue model in addition to the payment function. Research shows that half of Stripe customers' transactions are completed through the Stripe platform, and 94% of customers use multiple Stripe products, while 84% of businesses use Stripe's services in multiple countries.

3. Main considerations

Companies are overvalued, and high valuations can significantly increase the uncertainty of investment returns in a deflationary cycle where secondary markets are valuing technology companies lower.

The payments industry is extremely competitive in the long term, with old and new players competing in the same arena, and there is uncertainty about the company's competition with PayPal and Adyen.

The payments industry faces regulation from various governments around the world, and there is some political risk now in a time of increasing geopolitics.

III. Business model

1. Business model

Founded in 2009, Stripe is a leading global provider of digital technology financial services. With online aggregated payments as the starting point and cornerstone, supported by powerful API interfaces and automation technology, the company provides Internet payment infrastructure for corporate customers. Compared to other payment solutions, Stripe's core competencies include.

- Minimal API interface and upfront configuration to help customers build payment systems without hassle.

- Lower-than-market rates that reduce business costs.

- Support for over 135 currencies and multiple payment methods such as Bitcoin, Alipay, WeChat Pay and Apple Pay, with automatic exchange rate conversions.

- Meet strict legal and regulatory compliance;

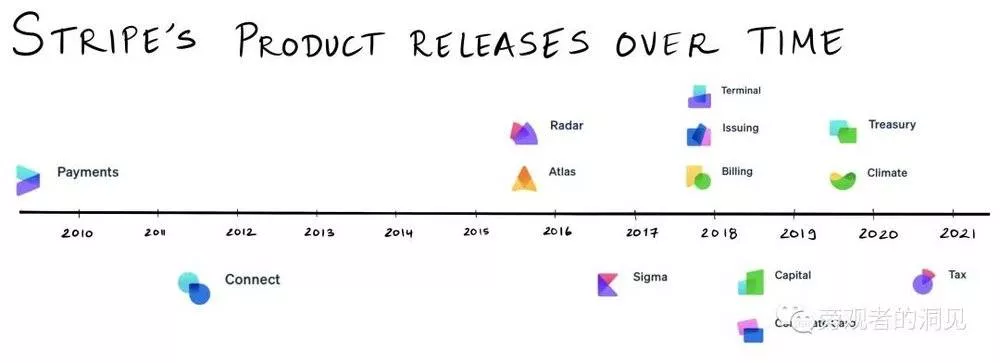

2. Product Features

Stripe's product features are divided into three main categories: payment services, financial services and operational services.

Payment services: Stripe's basic service, with a strategy of doing it right and doing it heavy.

- Payments helps B-side customers with global payments collection and funds transfer via API

- Checkout offers pre-built hosted payment pages

- Elements offers a full set of rich UI building blocks

- Payment Links offers a payment model that does not require a code or a website

- Connect provides a set of programmable APIs and tools to help B-side customers quickly build trading platforms

- Invoicing offers the ability to customize invoices

- Billing allows businesses with recurring business models to automate billing and invoicing processes

- Terminal offers POS for offline payments

Financial Services: an add-on service to Stripe to achieve full reach of the financial segment of online transactions.

- Corporate Card provides corporate cards to customers

- Capital provides financial lending services to its customers

- Issuing lets customers create, manage and distribute virtual and physical cards

- Treasury provides an API interface to Banking as a Service

Business Operations: Stripe's value-added services that dive into customer operations to bind customers.

- Radar uses machine learning to detect suspicious gold flows, skimming and money laundering

- Atlas helps clients set up startups safely, easily and cheaply

- Sigma leverages SQL to provide customers with a database tool for rapid analysis

- Treasury enables Stripe users to bank for its subscribers

- Climate allows clients to use a portion of their revenue for carbon cleanup projects

- Identity provides online identity verification services to prevent fraudster attacks

- Revenue Recognition provides a faster and more accurate close process, automating and configuring revenue reporting

3. Profit model

Stripe's revenue comes from a commission per transaction from customers. Typically, the commission for each successfully executed transaction is 2.9% of the transaction amount + $0.30. But Stripe's other services incur additional fees, such as financial services and operational services. The following lists the fees for some important features.

Payments: 2.9% + $0.3 per transaction

Terminal: 2.7% + $0.1 per transaction- Connect: $2 per user or 0.25% + 25 cents per transaction

- Billing: 0.5 - 0.8% of recurrent costs

- Issuing: 10 cents per virtual credit card, $3 per physical credit card; 0.2% + $0.20 per transaction

- Radar: 5 cents per transaction

- Sigma: 1.4-2 cents per transaction or $0-$100 per month

- Atlas: $500

- Tax: 0.4 - 0.5% per transaction

4. User strategy

Unlike other payment software that is geared toward salespeople, Stripe has chosen to operate with a developer-first strategy, relying heavily on open-sourcing its code on developer platforms like Github and spreading the word of mouth among developers to promote the product. Founder Collison believes that the future of e-commerce will be dominated by developers, who will be more involved in decisions about vendor selection. As a result, Stripe has created an online payment feature for developers that can be integrated with just a few lines of code, greatly simplifying the process compared to competitors and quickly building a large developer following with its lightweight nature.

Stripe's services are also adaptable to all types of industries, from e-commerce, retail businesses, internet, SaaS and O2O industries. Representative clients such as Amazon, Google, Salesforce, Shopify, Microsoft, etc.

5. Value Proposition

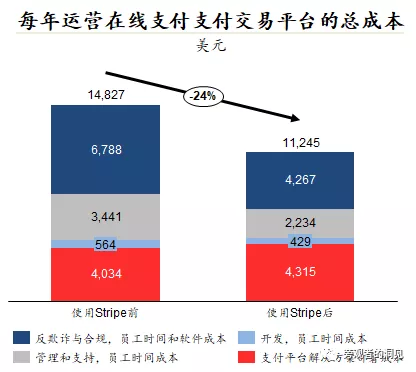

Easy to operate and enhance the efficiency of business building. Stripe helps businesses quickly build and manage payment systems with integrated API tools, saving labor and getting them to market faster.

Simplify developer work and reduce platform development costs. The automated processes in the Stripe platform help streamline the development process by allowing companies to improve and expand their development platforms without expanding their development teams, saving manpower and thus reducing development costs.

Freeing productivity and increasing employee productivity. Stripe helps clients to free employees from repetitive activities related to the payment process, allowing them to spend more time on more important matters, therefore increasing employee productivity and output.

Helping businesses tap into new markets. Stripe platform supports more than 135 currencies, reducing the complexity of the payment process and associated costs for businesses accepting cross-border transactions. Minimizes the cost of transferring funds across borders by accepting and paying for settlements similar to those of businesses to reduce foreign exchange rates.

Provides a stable payment platform to avoid user churn caused by poor payment experience. Stripe minimizes the frequency and impact of platform downtime and avoids order churn due to users' inability to pay, thus helping customers increase paid conversion rates.

6. Iteration of payment instruments

Era 1.0 → Era 2.0: PayPal emerges

Before the advent of PayPal, online payments were a complex endeavor. When a company wanted to receive online payments, it first had to set up a public account, which involved a variety of complex manual and approval processes that could take days or even weeks to complete. Not only that, but the process involved hurdles such as regulations, fees, compliance standards and payment card issuers, which would become even more complicated in cross-border transactions.

In addition, the company itself had to take on the risk of not only verifying the identity of the counterpart, but also the risk of potential fraud or returned goods. With the rise of e-commerce, new startups sought to simplify the cumbersome process of online payments. PayPal began offering new online payment solutions for emerging e-commerce sites such as eBay. 2000 saw the launch of PayPal's corporate account, which allowed merchants to accept online credit card payments. Before PayPal came along, eBay merchants needed to use checks and money orders to accept payments.

Era 2.0 → Era 3.0: Stripe emerges

In 2009, ten years after PayPal began offering online payment services, Stripe was born to redefine the online payment experience with an integrated, convenient payment system.Stripe's gradual capture of PayPal's market share can be attributed to the following factors.

The clear positioning of targeting SMEs as customers and the customizable payment functions are well suited to meet the complex needs of SMEs. In response to the lagging payment market in Europe and the United States, inefficiencies, high fees, complicated procedures and the urgent need for SMEs to improve their online payment business, Stripe has introduced a payment tool that allows payments to be made with just a few lines of code, greatly improving the efficiency of merchant openings and transactions.

Stripe offers an integrated payment system with a wide range of payment tools to solve your business's payment needs without hassle. Stripe accommodates a wide range of credit cards, e-wallets and mobile payment tools, providing a one-stop-shop for completing transactions on Stripe's platform without the need for complex selection and deployment by merchants.

Lower rates than competitors. Stripe's standard rate is 2.9 per cent + $0.3 per order, while it is free for the average SME to sign up as a Stripe customer, compared to PayPal's standard rate of 4.4 per cent + $0.3 per order.

Stripe is the easiest and most efficient way to make international payments for businesses that need to pay across borders and platforms. Stripe has designed the easiest and most efficient way to make international payments in response to strict laws and regulations.

7. Summary of user interviews

IDC had published a study, The Business Value of the Stripe Payments Platform, in March 2018, and the data from this study can be analyzed to conclude that Stripe's customers have the following characteristics.

Stripe customers rely heavily on Stripe products. Stripe customers use Stripe to support a significant portion of their online payment transactions, averaging 66% of online transaction volume and an average of $40.15 million per year. In total, this means that nearly half of the average total revenue of these organizations is achieved on the Stripe platform, reflecting the importance of Stripe to their digital commerce business model.

Stripe has improved efficiency for its clients in building, maintaining and running online payment platforms. Stripe clients are more efficient and operate with less cost overhead than all surveyed institutions.

Stripe's customers are willing to try other features of Stripe and pay extra for them. According to a September 2020 Nasdaq public report, Stripe: The Internet's Most Undervalued Company, 94% of business customers use multiple Stripe products, and 84% of business customers use Stripe's services in multiple countries/regions.

IV. Industry overview

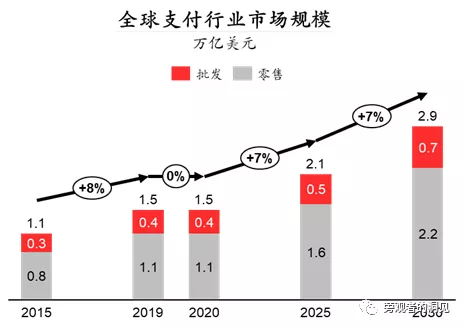

1. Size of the industry

Global payments revenues remain at ~$1.5 trillion year-on-year in 2019/2020 due to the impact of the epidemic. At the same time, the epidemic has accelerated the shift from cash to non-cash payments and the spread of e-commerce, both of which are important drivers of booming global payments activity.BCG research shows that global payments revenue will maintain a solid growth rate of 7.3% from 2020 to 2025.The same growth rate will be largely maintained from 2025 to 2030, with total global payments revenue in 2030 expected to reach 2.9 trillion USD.

Source: BCG's Global Payments Industry Report 2021

2. Driving factors

Increasing online payment penetration: as users' demand for payment convenience grows with each passing day, while the outbreak accelerates the shift of offline sales to online, the resulting demand-generated online payments will continue to grow rapidly. According to a Fortune poll, the percentage of Americans making weekly online purchases climbs rapidly from nearly 30% in 2019, through the epidemic period, to nearly 40% in 2021.

More mature cross-border payments: With the narrowing scale of cross-border transactions and the uneven pace of recovery across economies after the outbreak, cross-border payment business will face certain challenges. But on the other hand, as the trend of cross-border seafood continues to be hot, the infrastructure of cross-border e-commerce, such as hardware and software, warehousing and logistics, has also matured rapidly in the past few years. Not only Amazon for integrated e-commerce, but also Ebay or independent sites like Shein have brought a new, affordable consumer experience to consumers, increasing the demand for cross-border payments.

Omnichannel payment integration: omnichannel sales, omnidomain marketing and other online and offline integrated formats have become a common trend in the current retail development. Driven by the epidemic, more merchants have embraced software-embedded payment methods, thereby driving the growth of e-commerce, curbside pickup and other omnichannel contactless transactions, increasing the demand for online payments.

3. The competitive landscape

Stripe covers a wide range of businesses and hence faces stiff competition from both traditional players and new companies in each segment. Competitors for the company's main products are as follows.

- Payments(SMB):Braintree(PayPal), Square, Mollie

- Payments(Enterprise):Adyen, Braintree(PayPal),FIS,Worldpay, checkout.com

- Billing:Zuora,Changelee,Recurly, Gocardless

- Radar: Adyen, Sift Science, Kount

- Issuing: Adyen, Marqeta, Brex

- Capital: Pipe, Clearco, Capchase

- Connect: Adyen, Braintree(PayPal)

Stripe's main competitors are PayPal, Square and Adyen. after comparing products, I think Stripe is more likely to gain market dominance in the future with its well-positioned product and solid growth rate.

PayPal: Stripe's top competitor with similar clientele and scenarios to Stripe. Its Braintree division competes directly with Stripe, with higher pricing than Stripes. stripe is better than PayPal in terms of usability, API tools. paypal currently holds ~55.58% of the online payments industry market share. revenues in 2020 were $21.45 billion. paypal's competitive advantage lies in its brand recognition and products, less than Stripe in terms of product capability and innovation.

Adyen: Mainly large enterprises and multinationals, serving the omnichannel business of KA customers Stripe outperforms Adyen in terms of usability, API tools and connectivity to other business services. Essentially, Stripe is a payment service provider, while Adyen is a merchant account provider, the difference between the two is the thickness of the business. When using Stripe to accept payments, all of a merchant's funds will be deposited into a merchant account along with other businesses' funds, while Adyen will provide a dedicated account for the merchant

Square: focuses on brick-and-mortar SMB customers, with offline payment products at its core, POS solutions better than Stripe, pricing slightly lower than Stripes. smaller market share, US market at its core, more homogeneous product scenarios.

Source: Public Information

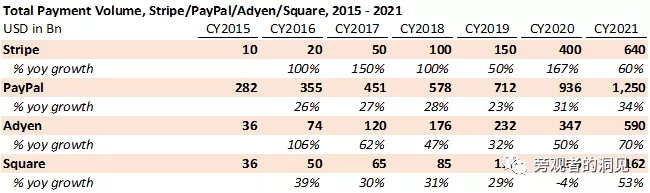

In terms of TPV, Stripe has maintained the highest annualized growth rate over the past 3 years and is now about half of industry leader PayPal's. PayPal's growth rate is more stable but lags behind emerging companies and has remained at ~30% over the past several years. adyen's 70% TPV growth in 21 was surprising. square has rebounded in 21 due to a larger share of offline business Square has rebounded in FY21 due to a large share of offline business and some contraction in business volume in FY20 due to the epidemic.

Source: Public Information

V. Financial data

Stripe 2015 to 2019 data from CB Insights In the 2021 annual letter, the CEO first disclosed that the company's TPV was $640 billion, up 60% from 2020, resulting in a reverse 2020 TPV of $400 billion. According to the WSJ interview, Stripe's Gross Revenue in 2020 is $7.4 billion, and it has a Net Revenue of $1.6 billion in 2020 after related payments to financial institution partners. This implies a Gross Take Rate and Net Take Rate for Stripe of 1.9% and 0.4%, respectively.

Source: Public Information

VI. Valuation considerations

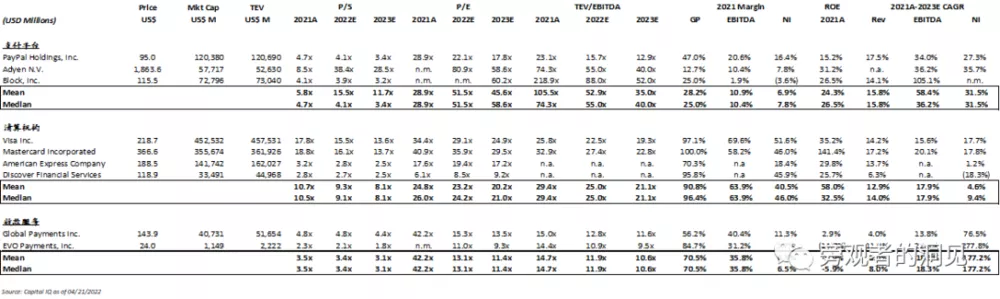

In March 2021, Stripe successfully raised $600 million in its latest funding round, boosting its valuation to $95 billion, making it the highest valued unicorn in the US, behind China's Byte Jump and Ant Financial Services. If the company is valued at $7.4bn Gross Revenue in 2020, the company was valued at 12.8x P/S in the last round.

By comparison, PayPal has a current market cap of $120.3 billion and FY2021 revenues of $25.4 billion, corresponding to a P/S of approximately 4.7x. Adyen has a current market cap of $57.7 billion and FY2021 revenues of $6.6 billion, corresponding to a P/S of approximately 8.5x. Square has a current market cap of $72.8 billion and FY2021 revenues of $17.7 billion, corresponding to a P/S of approximately 4.1x. This corresponds to a P/S of approximately 4.1x.

Since the start of 2022, there has been a huge pullback in valuations in the overall FinTech sector due to uncertainty in the macro-political environment and the impression of Fed rate hikes, with over-valuations creating significant uncertainty and exit risk. Given Stripe's superior growth potential to Adyen, the company can be given a valuation of 8.5x-10.0x P/S. Assuming the company's Gross Take Rate remains at 1.9% in 2021, this would result in a Gross Revenue of $11.8bn in 2021, corresponding to a valuation of $100.6bn-$118.4bn.

Source: CIQ

VII. Appendix

A complete payment includes the acquiring segment and the acquiring segment. In simple terms, companies such as Stripe, PayPal, Adyen, etc. are acquiring platforms that help with transaction processing, risk control, and card organization clearing, etc. And acquiring companies include Global Payment, EVO, Alipay, WeChat Pay, etc. in the US.

Acceptance: First, the consumer makes a payment to the merchant, the merchant submits the payment information to the acquirer, the acquirer then submits the transaction information to the issuing bank of the consumer's credit card through the credit card organization, the issuing bank receives the transaction information, debits the consumer's credit card, informs the consumer of the debit information, and transmits it back to the credit card organization, and if the debit goes smoothly, the money is credited to the acquirer, and until that point the acquiring is not complete

Collection: It can be simply understood as the process by which a seller withdraws sales payments from an acquiring tool to a bank account. Currently, while some platforms have launched their own collection tools, which allow sellers to transfer money directly to their bank accounts through the platform's collection tool, in most cases, sellers still need to transfer funds from the acquiring tool to a third-party collection service provider, which will then transfer the money to the seller's domestic account