On April 20, streaming giant Netflix released its first-quarter 2022 earnings report.

Netflix reported first-quarter revenue of $7.87 billion, up 9.8% year-over-year, and net income of $1.6 billion, down 6.4% year-over-year, both of which missed expectations, according to the earnings report.

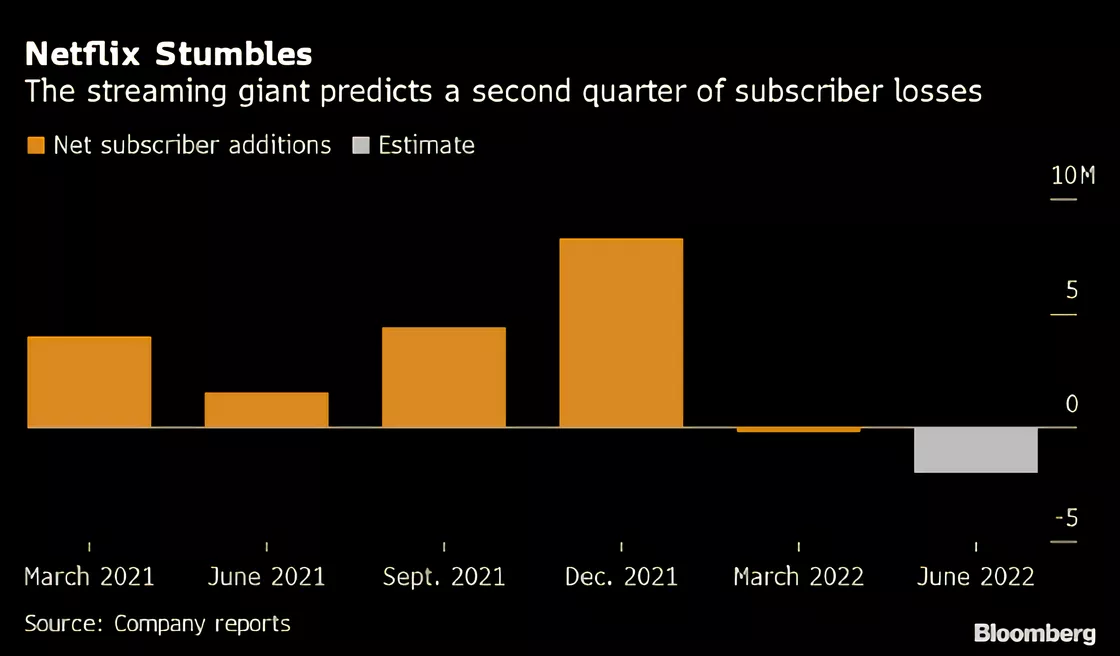

More concerning than stagnant growth is subscriber loss: Netflix lost a net 200,000 subscribers in the first quarter of 2022 and is expected to lose 2 million subscribers worldwide in the next quarter, the first time since 2011 that Netflix has faced negative subscriber growth.

Netflix set for first 'winter' since IPO|data from Company reports Netflix shares fell more than 25% as of Tuesday after hours EST, and other streaming stocks were also hit, causing a strong shakeup in the stock market that is unprecedented since the IPO. There is widespread speculation that the reopening and reactivation of offline theaters due to the gradual normalization of the epidemic overseas will cause the streaming industry to struggle.

Netflix set for first 'winter' since IPO|data from Company reports Netflix shares fell more than 25% as of Tuesday after hours EST, and other streaming stocks were also hit, causing a strong shakeup in the stock market that is unprecedented since the IPO. There is widespread speculation that the reopening and reactivation of offline theaters due to the gradual normalization of the epidemic overseas will cause the streaming industry to struggle.

Netflix's internal and external problems

There's no comparison, and Netflix's rise to prominence has definitely not been without the 'help' of cable providers. Before online streaming became prevalent, cable TV was the source of almost all of the viewing experience for subscribers and outside of theaters.

The lack of competition has led to unbridled price hikes and near-compulsive bundling, which has become almost a consensus in the cable industry. Take US media and telecoms giant Comcast, for example: the basic package costs $30 a month for just 10 digital channels, while the standard and premium packages, which include 140 and 220 digital channels, cost $67 and $70, making the intention of such pricing obvious. Netflix's subscriptions starting at just $8.99 are clearly attractive compared to monthly subscriptions that can cost tens of dollars.

$8.99 for unlimited access to all movies and variety shows, Netflix was like the $10 billion subsidized Jodo of the US streaming industry back then On the other hand, Netflix relies on a constant stream of content from Hollywood, and the movies and variety shows on line cover the aesthetic needs of viewers from almost all walks of life in the U.S. Netflix understands the importance of localization in the streaming business, and has laid out a lot of global IP resources in the process of going abroad, and has made bold attempts to diversify its original content.

$8.99 for unlimited access to all movies and variety shows, Netflix was like the $10 billion subsidized Jodo of the US streaming industry back then On the other hand, Netflix relies on a constant stream of content from Hollywood, and the movies and variety shows on line cover the aesthetic needs of viewers from almost all walks of life in the U.S. Netflix understands the importance of localization in the streaming business, and has laid out a lot of global IP resources in the process of going abroad, and has made bold attempts to diversify its original content.

Boldly embracing the 'Korean Wave', the explosion of 'The Squid Game' proves Netflix's insightfulness Since the airing of 'House of Cards' Netflix has proven its ability to create "hits" with a number of critically acclaimed series, and its popularity has even sparked a nationwide "unplugging" craze, breaking the monopoly of the cable industry, which is no less successful. Does Netflix's business model still have the makings of a long-term operation?

Boldly embracing the 'Korean Wave', the explosion of 'The Squid Game' proves Netflix's insightfulness Since the airing of 'House of Cards' Netflix has proven its ability to create "hits" with a number of critically acclaimed series, and its popularity has even sparked a nationwide "unplugging" craze, breaking the monopoly of the cable industry, which is no less successful. Does Netflix's business model still have the makings of a long-term operation?

A single business model that exacerbates industry in-rolls

Netflix's revenue comes from a stable user base and a quality content ecosystem, but this business model is very easy to replicate for today's Internet giants and media conglomerates. Internet giants have a huge user base and control the trend of online public opinion, so they have an advantage in the creation and distribution of original content; while media conglomerates have a large number of classic IPs and a loyal fan base, and may also hold the license of Netflix's online content, which may cause the loss of both Netflix content and users once they enter the streaming media.

HBO Max and Disney+ have come from behind: the former added 5.3 million subscribers nationwide in 2021, with 1.3 million in the fourth quarter alone already exceeding Netflix's total U.S. growth for the year, while the latter relied on IP adaptations and started from scratch with 118 million subscribers in 16 months subscribers in 16 months.

Despite a bad start, Warner Bros.-backed HBO Max can live without original content A more dramatic scene occurred at the At the 94th Academy Awards recently, Apple TV+, the latest to enter streaming, won the Best Picture award, which Netflix had failed to win for seven years in a row, for a small, inspirational film called "Girls Who Can Hear" (CODA), creating the first-ever miracle of a streaming movie upsetting theaters for less than $50 million.

Despite a bad start, Warner Bros.-backed HBO Max can live without original content A more dramatic scene occurred at the At the 94th Academy Awards recently, Apple TV+, the latest to enter streaming, won the Best Picture award, which Netflix had failed to win for seven years in a row, for a small, inspirational film called "Girls Who Can Hear" (CODA), creating the first-ever miracle of a streaming movie upsetting theaters for less than $50 million.

"Kin Listening to Girls" became the first streaming movie to win Best Picture in Oscar history, and Apple TV+ are winning hemp More importantly. Traditional giants are putting far more capital into the streaming industry than Netflix, with the Walt Disney Group allocating a budget of $33 billion to streaming in 2022, almost twice as much as Netflix. With London research firm Ampere Analysis predicting that spending in the streaming industry will total more than $230 billion in 2022, the market has become an absolute red sea, and Netflix's position is being challenged as capital continues to pour into the fray.

"Kin Listening to Girls" became the first streaming movie to win Best Picture in Oscar history, and Apple TV+ are winning hemp More importantly. Traditional giants are putting far more capital into the streaming industry than Netflix, with the Walt Disney Group allocating a budget of $33 billion to streaming in 2022, almost twice as much as Netflix. With London research firm Ampere Analysis predicting that spending in the streaming industry will total more than $230 billion in 2022, the market has become an absolute red sea, and Netflix's position is being challenged as capital continues to pour into the fray.

Shared accounts proliferate and user stickiness decreases

In a shareholder letter, Netflix acknowledged that it had deliberately deregulated out-of-home shared accounts because they tended to attract more potential subscribers to become addicted to the show and start subscribing to a membership, which Netflix intended to keep the momentum of its subscriber base growing.

Initially, shared accounts were a mechanism for Netflix to filter and convert subscribers with a clear intent to pay, but for the more ambiguous potential subscribers, the existence of shared accounts is certainly the best way to get the same viewing experience at a lower price. A Netflix main account subscription service can typically be shared by five sub-accounts, and the number of such shared accounts exceeds 30 million in North America, a number that would grow to 100 million if we look around the world.

Everywhere you look, the "free Netflix account" service is offering shared accountsNetflix loses $9 billion a year to the proliferation of shared accounts With $9 billion in subscription fees, 'group buys' and 'white whoring' seem to have become a form of political correctness among the Netflix user base, and the incremental subscribers that letting shared accounts bring to Netflix has long since failed to offset these deepening negative effects.

Everywhere you look, the "free Netflix account" service is offering shared accountsNetflix loses $9 billion a year to the proliferation of shared accounts With $9 billion in subscription fees, 'group buys' and 'white whoring' seem to have become a form of political correctness among the Netflix user base, and the incremental subscribers that letting shared accounts bring to Netflix has long since failed to offset these deepening negative effects.

Audiences return to theaters as epidemic situation improves

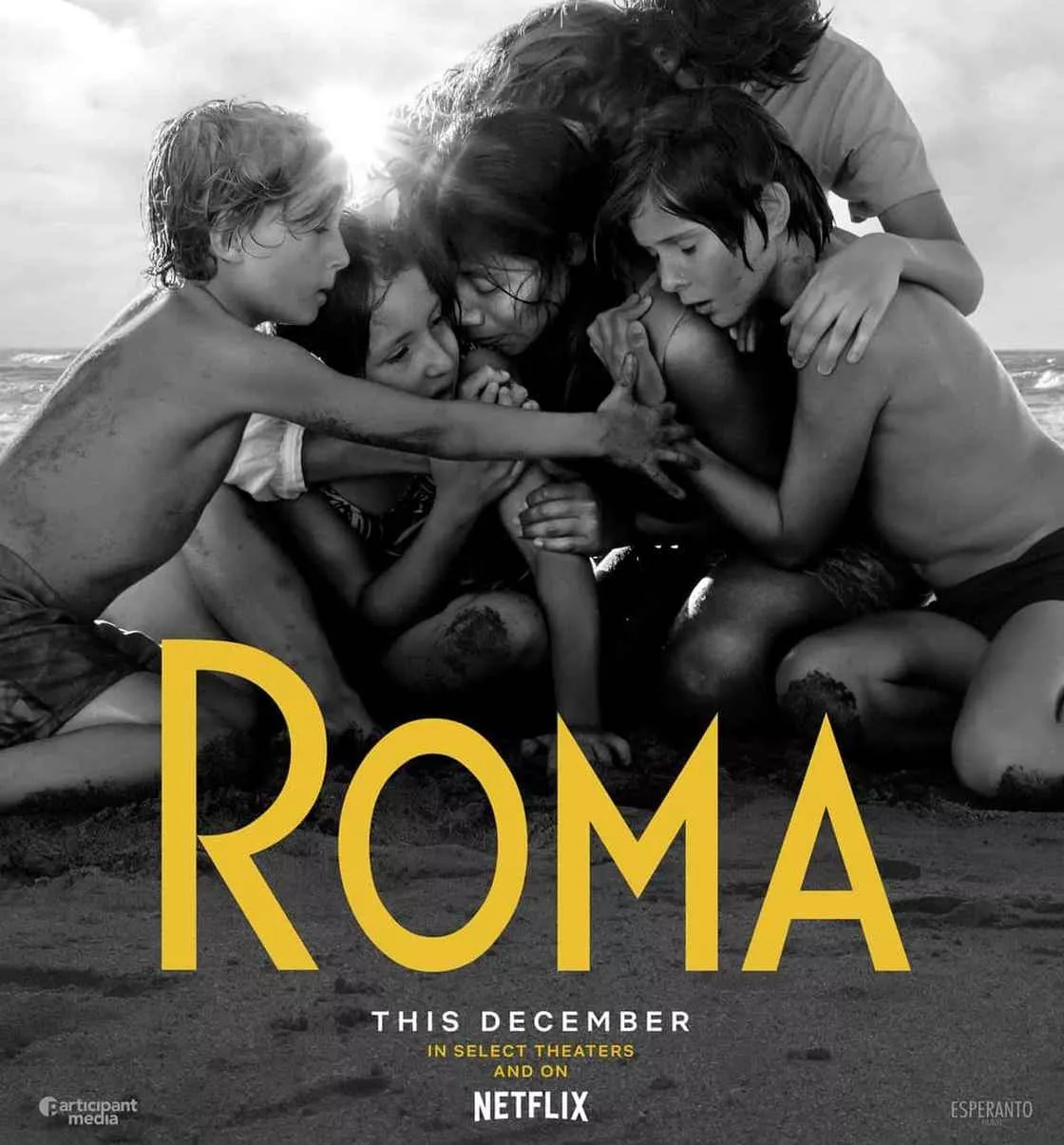

Netflix has challenged the traditional rules of the film industry by insisting that its films should be released 'simultaneously online and offline'. The crossover between streaming and theaters has led to streaming films frequently missing out on Best Picture Oscars due to jury bias, with Roma, a Netflix production released in 2018, being a very representative example of this segment of streaming films.

The winner of the Golden Lion at the 75th Venice International Film Festival, Roma, which had already garnered much attention, lost out to the almost unpopular Green Book at the 91st Academy Awards. Since then, Netflix has been nominated for Best Picture every year, but has never won for it, and Netflix has missed out on the perfect opportunity to make an impact in offline cinemas time and time again.

The artistic achievement of "Roma" is clear for all to see, and the 91st Academy Awards ceremony was controversial as a result. Although Netflix has been improving its streaming specifications to compete with offline cinemas, there is still an insurmountable gap between the audiovisual enjoyment and entertainment offered by cinemas and mobile devices. As the epidemic abroad becomes normalized, film schedules return to normal, and theaters reopen, Netflix has eaten up the dividends of the epidemic without a good follow-up to offset the negative impact of the fading dividends.

The artistic achievement of "Roma" is clear for all to see, and the 91st Academy Awards ceremony was controversial as a result. Although Netflix has been improving its streaming specifications to compete with offline cinemas, there is still an insurmountable gap between the audiovisual enjoyment and entertainment offered by cinemas and mobile devices. As the epidemic abroad becomes normalized, film schedules return to normal, and theaters reopen, Netflix has eaten up the dividends of the epidemic without a good follow-up to offset the negative impact of the fading dividends.

Netflix has chosen to accelerate its theatrical content at a time when the global epidemic of the new crown beginning in 2020 has taken an incalculable toll on offline box office, an act seen as taking advantage of the fire to further harm the traditional film industry. time and time again, Netflix has tested Hollywood's boundaries, but has never been able to break free from its dependence on Hollywood, so perhaps it's time for Netflix Perhaps it's time for Netflix to rethink and try to repair its relationship with the traditional film industry.

Broadening revenue hindered by absence of value-added services

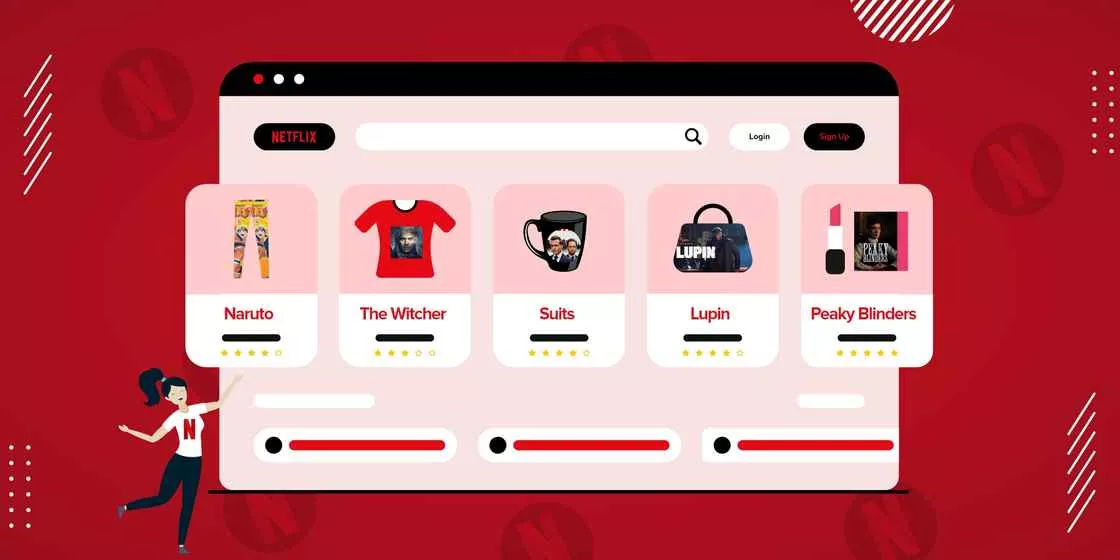

In addition to expanding offline, Netflix is also trying to change its single subscription-based service to bring more value-added content to paying subscribers, which could help save Netflix's dwindling subscriber stickiness, share the cost of developing original IP, and generate additional revenue for implementing ad-free streaming content. Diversification of presentation is an important channel for cashing in on content, but it's clear that Netflix is going in the wrong direction.

The main items sold on netflix.shop are IP peripherals, a job that could have been left to a specialist e-commerce company rather than a self-sustaining one. Netflix's attempts to do so are focused on e-commerce and games. However, its online store Netflex.shop had to start with the basics of building a platform service and setting up a licensing system, which not only missed out on the massive IP bonanza, but also lagged significantly behind its competitors in terms of development progress.

The main items sold on netflix.shop are IP peripherals, a job that could have been left to a specialist e-commerce company rather than a self-sustaining one. Netflix's attempts to do so are focused on e-commerce and games. However, its online store Netflex.shop had to start with the basics of building a platform service and setting up a licensing system, which not only missed out on the massive IP bonanza, but also lagged significantly behind its competitors in terms of development progress.

Looks good?Netflix Games doesn't even need a handleNetflix's game service Netflix Netflix Games has been targeting mobile devices from the start, and the few games that have been released on the platform are almost always small productions that replicate scenes from episodes while adding limited interactive experiences. Netflix seems to be moving out of its streaming comfort zone, but in reality it's still playing in a small circle it created.

Looks good?Netflix Games doesn't even need a handleNetflix's game service Netflix Netflix Games has been targeting mobile devices from the start, and the few games that have been released on the platform are almost always small productions that replicate scenes from episodes while adding limited interactive experiences. Netflix seems to be moving out of its streaming comfort zone, but in reality it's still playing in a small circle it created.

Netflix is in an innovator's dilemma

Netflix's ecological moat comes from producing original content from scratch, turning popular episodes into IP that generates sustainable revenue, which in turn creates systems and generates brand value. brand value. However, these conditions were mastered by established players such as HBO and Disney before they started streaming, which means that Netflix's competitors do not have to focus too much on content innovation in the process of streaming, nor do they have to take the high risk and investment that comes with innovation, and the ratio of effective output to content cost is higher compared to Netflix.

Disney+ has a content ecosystem that Netflix will never catch up with overnight. Netflix is not HBO Max or Disney+. Netflix is not HBO Max or Disney+. Netflix has bet its life and limb on streaming as opposed to these competitors who have made it a long-term business. Content is Netflix's core competency, but it's also its only source of business growth, and membership subscriptions are pretty much the only source of revenue to support Netflix's massive operating costs, which will inevitably have an impact on subsequent content creation once subscriber numbers stop growing. The problem has already begun to emerge, but Netflix has responded with a series of passive measures, including price increases, locks and bans on shared accounts.

Disney+ has a content ecosystem that Netflix will never catch up with overnight. Netflix is not HBO Max or Disney+. Netflix is not HBO Max or Disney+. Netflix has bet its life and limb on streaming as opposed to these competitors who have made it a long-term business. Content is Netflix's core competency, but it's also its only source of business growth, and membership subscriptions are pretty much the only source of revenue to support Netflix's massive operating costs, which will inevitably have an impact on subsequent content creation once subscriber numbers stop growing. The problem has already begun to emerge, but Netflix has responded with a series of passive measures, including price increases, locks and bans on shared accounts.

Netflix needs a new story, but when and where will this story take place? The term 'innovator's dilemma' is defined in Glossary of Management Science and Technology as a phenomenon and dilemma in which the innovation aspect of a firm does not yield the expected benefits due to the high risk of innovation, high investment and the inevitable requirement of development for the firm to innovate. Apparently, the previously high-flying Netflix has been caught in a dilemma, with company CEO Reed Hastings saying on Tuesday that Netflix is considering a lower-priced subscription option for ad-insensitive subscribers, which may be the first 'edge' Netflix has been smoothed out - but by no means the last. but by no means the last.

Netflix needs a new story, but when and where will this story take place? The term 'innovator's dilemma' is defined in Glossary of Management Science and Technology as a phenomenon and dilemma in which the innovation aspect of a firm does not yield the expected benefits due to the high risk of innovation, high investment and the inevitable requirement of development for the firm to innovate. Apparently, the previously high-flying Netflix has been caught in a dilemma, with company CEO Reed Hastings saying on Tuesday that Netflix is considering a lower-priced subscription option for ad-insensitive subscribers, which may be the first 'edge' Netflix has been smoothed out - but by no means the last. but by no means the last.

This article is from my WeChat public number: Xiaotong students absolute praise in the draft, the content and layout of a slight modification