Musk's merger and acquisition of Twitter has risen again. According to foreign media reports, on May 25 US Eastern time, a new document from the US Securities and Exchange Commission (hereinafter referred to as the SEC) shows that musk has added US $6.25 billion in equity financing to support twitter transactions, bringing the total amount of equity commitments in the US $44billion transaction to US $33.5 billion**

Text / lvjingzhi

Source: combustion dimension

It is also reported that musk is negotiating with Jack Dorsey, the founder and former CEO of twitter, and other investors to help him raise funds and promote the progress of the transaction. Affected by this news, Twitter's share price rose more than 5% after hours that day. As of the closing of US stocks on May 28, Beijing time, twitter closed at US $40.17 per share, with a total market value of US $30.65 billion.

Since musk first disclosed his shareholding in twitter in April and submitted an early warning announcement, this has been the nth reversal of the capital play.

On April 4, musk submitted a report to the SEC and became the largest shareholder of twitter at that time, accounting for 9.1% of the total outstanding shares. Upon the news, Twitte's share price soared from $39.31 to $45.08, up 14.68%. On April 14, when investors were expecting musk to save Twitter's depressed share price, musk suddenly announced that it would purchase 100% of twitters outstanding shares at a price of $52.40 per share and privatize them.

However, the road to privatization has ups and downs.

Twitter's board of directors first blocked Musk's acquisition with the "poison pill plan" valid for one year, but the plan was only released for ten days. On April 25, twitter reached an acquisition agreement with musk, that is, it agreed that musk would purchase 100% of twittershares at a total price of $44billion. As a result, netizens joked that "this is the shortest anti takeover war in history" and "no way, he (MuSK) gave too much."

Regarding the reversal of the attitude of Twitter's board of directors, Liu Tao, a former JPMorgan Chase analyst, told ran finance that it is unknown what Twitter has talked with musk in the past ten days. However, Liu Tao believes that Twitter's revenue has been weak in recent years, and its share price has also been flat. The price of $52.4 per share has been a good bargaining price for twitter shareholders, which may be the reason for the great turn in the attitude of the board of directors.

Figure /twitter stock price trend source / screenshot of tiger securities finance

Obviously, as a major shareholder, musk cannot be unaware of the current situation of twitter. On May 13, musk suspended the acquisition on the ground that "the zombie account on twitter may be four times the number previously announced by the company". And said, "it is possible to consider the acquisition at a price lower than US $44billion."

However, things did not go according to Musk's wishes.

"Obviously, Musk's attempt to use Twitter's fake account as a bargaining chip failed." As for musk, instead of reducing the total purchase price, it increased the share of equity fund-raising in the total price. Liu Tao analyzed this and said that the possibility of twitter being acquired at $44billion further increased. The response of the secondary market also showed that investors' confidence in this transaction had improved.

Although the outcome of this century acquisition is still unknown after nearly two months of reversal, as with the acquisition of twitter, things that are almost "Crazy" and are concerned by netizens all over the world are very common in mask, an investor and corporate administrator known as "crazy genius".

In the past two years, after completing the accumulation of original funds through continuous entrepreneurship, musk has frequently launched in-depth exploration of science and technology as an investor. He believes that new energy, batteries and power transportation will become the most important fields to change the future. Therefore, he invested in Tesla, founded SpaceX, acquired SolarCity, and built an ecological chain integrating production, marketing and research around new energy.

In addition to new energy, he is also very fond of artificial intelligence, games and enterprise services. He has successively invested in everdream, deepmind, gametrust and other enterprises, and has successfully exited with high returns.

No doubt, as the richest man in the world, Musk's success is obvious to all. But the controversy that accompanies his success, like his wealth, is unmatched. Whether it is the acquisition of Twitter or the strong holding of Tesla, SpaceX and other enterprises, it has made "arrogance" and "paranoia" his indelible labels. As a "Twitter maniac", his remarks are always speculated whether he has the intention of "manipulating stock prices", "malicious competition" and "making profits through public opinion".

Master musk of "Yin and Yang"

Unlike other CEOs and politicians who speak cautiously on twitter, musk has taken an unusual path since he signed up for twitter. According to incomplete statistics, musk has posted 11394 tweets since he registered twitter in 2009, with an average of 5.9 tweets per day.

Soon, musk proved that more words make more mistakes. On April Fool's day in 2018, musk tweeted that "Tesla has completely closed down", which instantly reduced Tesla's share price by 7%. However, musk, who didn't learn a lesson, pushed that Tesla would be privatized in the same year, so he "liked" the SEC subpoena.

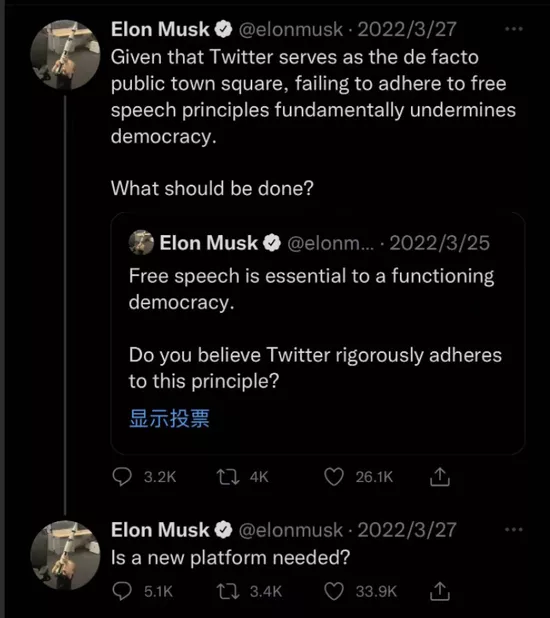

It is Musk's daily life on Twitter to participate in discussions on sensitive topics, such as marijuana and the legalization of abortion. It is not difficult to understand why, on March 25, musk launched a twitter poll to let netizens evaluate whether Twitter has safeguarded everyone's freedom of speech. Netizens have already seen it.

After more than 2million people participated and 70% thought that "Twitter did not protect their freedom of speech", musk asked again on March 27, "do we need a new platform?" Received more than 30000 likes.

Source / screenshot of musk twitter

As everyone knows, this vote is just a step in Musk's big game of acquiring twitter. While the public was focusing on "Musk questioned twitter on twitter", musk began to hold more shares of twitter.

According to the SEC's public information, musk began to buy twitter liquid stocks on January 31 this year. It is worth noting that, according to the provisions of the SEC, when the holder holds 5% of the outstanding shares of a company, the holder shall submit an explanation to the SEC within ten days. According to the data, musk completed the purchase of 5% of twittershares on March 14. According to the regulations, he should submit an explanation to the sec before March 24.

But in fact, musk not only delayed the public news for more than ten days, but also tweeted on the second day of the deadline to incite people to discuss "Twitter freedom of speech" and "whether it needs to be replaced by other platforms". "It does not rule out the possibility that musk wants to use public opinion to affect Twitter's share price and increase his position at a lower price." Colin, the overseas investment manager, said frankly.

In fact, on March 25, twitter did drop slightly by 0.57%. On the other hand, musk, who appeared to be "hitting hard" on twitter that day, actually bought 3.49 million twitter shares at a price of $38.2 per share.

For this controversial behavior, a person familiar with the matter disclosed to Caijing that the SEC had questioned Musk on April 4 about why it did not disclose its shareholding information within 10 days of buying shares as required, and asked musk to respond to the public remarks about Twitter on the twitter social platform.

However, as of the day before the press release, musk has not publicly replied to any relevant news.

However, no matter whether musk replies or when, in the view of the industry, he will play it out in the dark. Musk's "yin-yang" method is not only used in the process of buying twitter shares, but also reflected in the "hard and soft" acquisition book.

In its twitter acquisition book, which has only four paragraphs, it clearly expresses three core points, namely, "the company is a good company, but the person in charge is not good, so it should be left to 'I come'"; The news of "I" investment made Twitter's share price soar, and "I" gave a very kind price. If Twitter's privatization is not successful, then "I" have no confidence that twitter can become the best. "I" will also reconsider the shares I now hold.

Source / sec Gov financial screenshot

Industry insiders said that although musk specifically noted that this was not a threat in the acquisition book, judging from his current shareholding in twitter, if he decided to sell shares, his influence on twitter could be imagined.

As a result, under the combined fist of "public opinion + control", twitter, which had weak revenue, could not resist. However, as musk once again questioned the authenticity of Twitter users, the industry had to question whether he wanted to carry out "Yin and Yang" to the end.

Risk king with full leverage

The big play of Musk's acquisition of Twitter is not over yet. Jessica, a former Morgan Stanley analyst, told the finance and economics, "even if the acquisition is unsuccessful, musk will still get enough benefits from the public opinion and the changes in Twitter's share price."

Colin has a different view on this, "I think that having a 'free speech' platform is his ultimate goal, and privatization is just a means, not a necessity. But I don't think that making profits during this period is Musk's original intention to acquire twitter“

However, no matter what Musk's original intention is, in the process of acquiring twitter, "why must we privatize twitter?" And "where does $44billion come from?" It has become an issue of particular concern to investors.

As for the former, one voice believes that musk, under the guise of "freedom of speech", is actually trying to get rid of the restrictions of the CSRC and the twitter mechanism and turn twitter into a public opinion platform that he can fully control.

Colin said that such a statement is too one-sided. "Musk once said publicly that if the acquisition is successful, he will disclose Twitter's algorithm. If his ultimate goal is just public opinion manipulation, he does not need to disclose Twitter's algorithm."

Colin believes that Musk's acquisition of Twitter is to create a "Market Research" platform with large daily users and high speech authenticity. "Most of his fans are Tesla and energy industry consumers, and he often interacts with them. After privatizing twitter, he can bypass the restrictions of the Securities Regulatory Commission and the existing twitter platform and get more and more real views from these people."

As for the latter, that is, where the $44billion came from, it is more traceable than the reason for the acquisition.

According to the information submitted by musk to the SEC, he has prepared $46.5 billion for the acquisition of twitter. Of this, 33.5 billion US dollars was contributed by him. Of the $33.5 billion he contributed, $21billion was in cash and $12.5 billion was in mortgages.

Foreign media pointed out that musk has always been very mysterious about the source of the $21billion in cash. However, many analysts in the industry speculate that this part of the funds may mainly come from selling Tesla shares. After all, the stock liquidity of other companies held by musk, such as SpaceX and the shipping company, is worse. Some analysts estimate that the world's richest man, who has always advocated high leverage and heavy assets, may use only $3billion in cash.

For the other $12.5 billion loan, according to CNBC reports and analysis, he needs to mortgage Tesla shares worth $65billion, which is about a quarter of his current Tesla shares. It is undoubtedly good news for Twitter's board of directors to increase the mortgage of Tesla's shares to buy twitter with leverage, but it is a "disaster" for Tesla's shareholders.

According to Tesla's report to the SEC, musk has pledged 88000 Tesla's outstanding shares. The increase of Tesla stock mortgage loan undoubtedly increases the systematic risk of the company.

According to the statistics of audit analytics, an American data company, musk has mortgaged more than $90billion of shares by the end of 2021, becoming the largest stock mortgagor in the United States, far exceeding the $24billion mortgage amount of Larry Ellison, chairman of Oracle, the second largest stock mortgagor.

The secondary market responded quickly to Musk's operation. That is, Tesla's share price plummeted 3.66% on the day musk announced its acquisition of twitter.

"Stabilizing Tesla's share price is one of the important reasons why musk chose to increase equity mortgage instead of the original Tesla stock mortgage plan." Colin told fuel finance that musk is likely to use the equity of SpaceX as collateral this time.

"The essential difference between equity mortgage and stock mortgage is that equity needs to be traded in the private market and has poor liquidity. Therefore, it will not seriously affect the share price of the secondary market like stock mortgage, or even have the risk of closing positions. On the other hand, equity mortgage may affect the valuation of enterprises, which is not conducive to the next financing activity." Colin analyzed.

It is worth noting that on May 24, Beijing time, it was reported that SpaceX had just completed a new round of valuation, and its valuation had risen to about $127billion.

Colin said that it could not be ruled out that musk improved his equity premium ability in SpaceX through this valuation, so as to further promote the smooth progress of the equity mortgage for the acquisition of twitter.

Genius and "madman"

Musk's boldness in the investment process may be inseparable from his identity as an entrepreneur.

In 1995, musk founded Zip2, an online version of the enterprise yellow page, which can query basic information such as the founder and address of the enterprise. In 1999, the company was acquired by Compaq for us $307million, and once became one of the largest Internet acquisitions at that time.

Musk, who earned $22million from the acquisition, immediately invested $10million to create x.com. In 2001, x.com changed its name to PayPal, which will be well known in the future. In 2002, it was purchased by eBay for $1.5 billion. Musk left the site with $180million.

However, in these two startups, musk has experienced the unpleasant experience of dilution of shares and loss of control of the company. This has also directly affected Musk's management of the three companies he most valued in the later period - SpaceX, Tesla and SolarCity, that is, he attaches great importance to control.

As early as the early days of SpaceX, musk invested more than $100million in its own funds and gained overwhelming control. According to CNBC, he still holds more than 50% of SpaceX.

Tesla, the shares invested by musk and the equity obtained through the incentive mechanism after the appointment of CEO have made him the largest shareholder of Tesla with 23% equity. For SolarCity, musk completed the merger between Tesla and it in 2016. After the merger, SolarCity, which is mainly engaged in photovoltaic power generation, and Tesla, which is mainly engaged in electric vehicles, have unified processes, shared resources and cross sold, saving us $150million in costs in the first year.

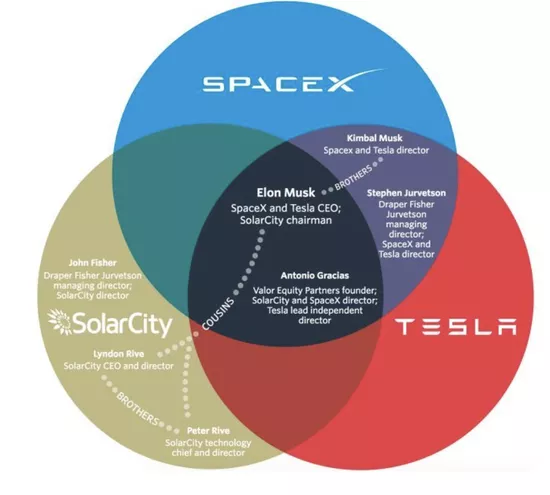

In addition to his absolute control over capital, musk also places people he trusts in these three core companies. It is reported that Musk's younger brother kimbal musk, and his long-term venture capitalists Antonio Gracias and Stephen jurtevson are both board members of SpaceX and Tesla.

Figure /spacex, Tesla, SolarCity and musk source /pitchbook financial screenshot

The investment experience of musk also follows the investment of acquaintances. For example, Lyndon Rive, the founder of everdream, was his cousin, and rive was also one of the later co founders of SolarCity; Adeo ressi, the founder of gametrust, is his college roommate; Jason Calacanis, founder of Mahalo, and Musk's mutual friend are adeo ressi; Oneriot was founded by Musk's brother; The founders of deepmind and vicarious also have many mutual friends with musk.

As for Musk's style of conduct, the New York Times once described it as "based on temporary interests, preferences and 100% confidence in his decision-making ability."

However, 100% confidence does not mean 100% success. Musk's most profitable investments are everdream and deepmind, which have brought him more than $100million in investment income. Gametrust and oneriot bring about basically the same income and investment amount. Mahalo became the most failed investment of musk after its closure in 2014.

In the view of the outside world, musk has repeatedly reinvested the investment income into the project over the years. In addition to his unique vision, he also has superhuman energy.

At the Ted conference held in April this year, musk revealed that he was a patient with Asperger's syndrome.

Xiao Lin, a psychologist, told Caijing that Asperger's syndrome patients may have difficulties in expression and social skills, and will stubbornly maintain a certain fixed behavior. "This may explain why many people think musk is paranoid and stubborn. But on the other hand, it may also make him more focused in his obsessive field and less affected by emotions."

Maybe this is what is often said that "genius is on the left, madman is on the right".