According to the news of titanium media app on May 20, Weilai was officially listed on the main board of the Singapore Stock Exchange today, and the stock code is NiO together with US stocks** Weilai has become the world's first auto enterprise to complete listing in three places, and also the first Chinese enterprise to be listed in the United States, Hong Kong and Singapore.

On this day, it was only 71 days since Weilai was listed in Hong Kong stocks for the second time, and 15 days after it was listed in the Sixth Batch of pre delisting list by the US Securities and Exchange Commission (SEC).

Wei Lai today struck the gong at the Singapore Stock Exchange (photo source: live broadcast of the Singapore Stock Exchange)

The choice of listing in Singapore is a last resort choice for Weilai after smelling the danger of being delisted in US stocks in advance? Or is it a step already designed in the capital market? Is the Singapore stock exchange the last stop of Weilai in the capital market, or is it just a transit point to other markets?

Pass by the A-share market

Weilai's entry into the SEC's pre delisting list is like the second boot that finally landed, which makes its secondary listing in Hong Kong and its third listing in Singapore a matter of course.

Since the SEC began to require Chinese listed companies included in the "pre delisting list" to provide audit working papers for listing in accordance with the "foreign company accountability law", some of the medium concept shares in the list began to face the dilemma of one of two: privatization delisting, or secondary listing on A-share, Hong Kong stock exchanges and other exchanges.

Audit draft refers to all records and materials generated during the company's audit process, including but not limited to audit plan, summary of major events, problem memorandum, analysis form and other materials, among which the summary and copy of the document records of the auditee are particularly important. Some Chinese companies listed on US stocks will inevitably involve sensitive information in their business. Chinese regulators are extremely sensitive to the risk of losing control of national information, and explicitly require overseas listed companies not to provide audit drafts to overseas institutions without authorization in the form of legislation.

Like many Chinese concept stocks, Weilai must have yearned for the A-share market of Shanghai and Shenzhen Stock Exchange, which raised 1674.3 billion yuan in 2021. Unfortunately, the long queue time in the mainland capital market has left the new car building forces with great demand for capital at a loss. Although the registration system has lowered the threshold compared with the main board, the science and innovation board has extremely high requirements for the profitability of listed enterprises, which discourages the new forces of car making that are difficult to make profits due to continuous investment.

According to the data disclosed by Weilai, the net losses of Weilai in the four years from 2018 to 2021 were RMB 9.639 billion, RMB 11.296 billion, RMB 5.304 billion and RMB 4.019 billion respectively. It can be seen that although the loss range is shrinking, Weilai's sustainable profitability has not been fully demonstrated. With the promotion and expansion of Weilai's business, the current situation of "burning money" will continue. This makes Weilai have to pass by the A-share market and choose other capital markets instead.

Singapore stock exchange with open doors

In the prospectus submitted to the Hong Kong stock exchange, Weilai disclosed that it had submitted an application for the second listing by introduction to the main board of the Singapore Stock Exchange, and this application has been examined by the Singapore Stock Exchange. "Listing in Singapore can further increase the global tradable time and liquidity, provide an alternative stock trading place and further protect the interests of investors," Wei Lai said publicly

*Compared with the extremely strict A shares, the listing conditions of the Singapore stock exchange are quite relaxed *, and there are no mandatory requirements for the profitability of enterprises, which is quite friendly to Weilai. In addition, among Weilai's investors are Temasek and other companies from Singapore, which has a favorable location and people to promote the third listing in Singapore. Moreover, Singapore's main board market is more enthusiastic about technology stocks than the European trading market, which is convenient for Weilai to obtain higher financing in the follow-up.

In addition, Singapore also supports the development of new energy and automatic driving, and has repeatedly encouraged and supported it at the policy level In 2013, the Singapore government took the lead in putting forward the "Singapore automatic vehicle plan" and officially opened the road of automatic driving application in Singapore. In 2017, the government amended the road traffic law to allow autonomous vehicle to be tested on public roads. Since then, the autonomous driving area of Singapore has been expanding. By 2019, more than 1000 kilometers of roads in the west can be used to test autonomous vehicle, accounting for one tenth of the total area of the city-state.

In terms of new energy, in order to phase out all diesel locomotives by 2040, Singapore plans to increase the number of electric vehicle charging points from 1600 to 28000 by 2030, and encourage the purchase of electric vehicles. All these will help Weilai to further expand the layout of overseas markets in the future.

Li Bin expressed his thanks to Weilai users online (picture source: live broadcast of Singapore Stock Exchange)

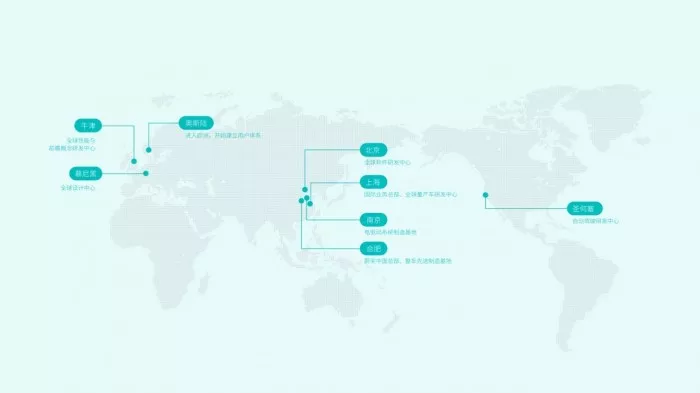

Weilai founder, chairman CEO Li Bin said at the listing ceremony: "Today is a new milestone for wellcome. Listing in Singapore is of great significance to Wellcome's global business development plan. With Singapore's important strategic position in the global capital market, Wellcome has further improved the layout of the global capital market; we will also take advantage of Singapore's international economic and technology center to carry out in-depth cooperation with local scientific research institutions in Singapore and establish an artificial intelligence and autonomous driving R & D center in Singapore , further improve the global R & D and business layout of Weilai. "

This coincides with Singapore's plan to build the global headquarters and R & D center of multinational corporations in recent years. Titanium media app noted that global top 10 semiconductor companies such as Qualcomm, NVIDIA, Broadcom, Infineon and Intel all set up their Asia Pacific headquarters or R & D centers in Singapore, which is of great help to Weilai's industrial chain layout in related fields.

"Whether going to Hong Kong or new listing, Weilai is to expand investor channels, stabilize stock prices and enhance international popularity," Zhang Junyi, a senior expert in the automotive and private placement industry, told titanium media app. In his opinion, in the face of trade risks brought by uncertain political factors, multi listing is actually a way for enterprises to protect themselves and seek opportunities for international layout and development.

Singapore may not be able to meet all Weilai's dreams of capital

Weilai adopts the "Introduction listing" method in the Singapore stock exchange this time, which does not involve the issuance of new shares and fund-raising. However, the class A shares listed on the Singapore stock exchange can be fully converted from the American depositary shares listed on the New York Stock Exchange.

Weilai also adopts the "Introduction listing" method for "secondary listing" in Hong Kong stocks, which is different from Xiaopeng's ideal "dual listing" The difference between the two is that "dual listing" means that the two capital markets are the first place to be listed, the rules they need to comply with are completely consistent with the requirements of the company issuing shares for the first time, and the shares in the two markets cannot circulate across the market, and the stock price performance is relatively independent. The "introduction method for secondary listing" adopted by Weilai in the Hong Kong Stock Exchange and the Singapore stock exchange is to adopt the same type of shares in each exchange, and does not involve the issuance of new shares or the raising of funds. It is only listed in the exchange to obtain the trading qualification.

"The second listing option introduces the listing method. Because the company currently has sufficient cash reserves, there is no urgent financing demand in the short term," Wei Lai said when returning to Hong Kong for listing in March. To put it bluntly, there is no shortage of money and no financing for the time being. However, this does not mean that Weilai will not finance through the capital market.

From the current cash flow situation of Weilai, as of February 28, 2022, the available working capital sources of Weilai include cash and cash equivalents of RMB 11.829.1 billion and short-term investment of RMB 37.780.4 billion. In addition, from the current trading environment, since this year, the secondary market has been in a downturn, which is not a good time for financing.

Weilai will launch three new models of et7, et5 and ES7 in succession this year. Although the initial R & D investment has been completed, the subsequent production, delivery, sales and operation still need capital expenditure. In terms of expanding the sales service network, Weilai plans to add no less than 100 sales outlets and more than 50 Weilai service centers and authorized service centers in 2022.

In terms of R & D investment, according to Weilai's plan, R & D investment will more than double year-on-year in 2022, and R & D personnel will increase to 9000 by the end of the year.

In terms of power exchange, in 2022, China will build a total of 1300 power exchange stations, 6000 overcharge piles and 10000 destination charging piles. By the end of 2025, the total number of Weilai replacement power stations in the world will exceed 4000.

At the international level, Weilai plans to launch its products and whole system services in Germany, the Netherlands, Sweden, Denmark and other countries this year. At the beginning of this month, Weilai released the Norwegian strategy, announced its entry into the Norwegian market, and officially took the first substantive step of internationalization. According to its plan, it will provide services to users in more than 25 countries and regions by 2025.

In, business development needs a lot of capital as support; In addition, Weilai also needs sufficient financial capacity to resist the uncertainty brought by the external environment.

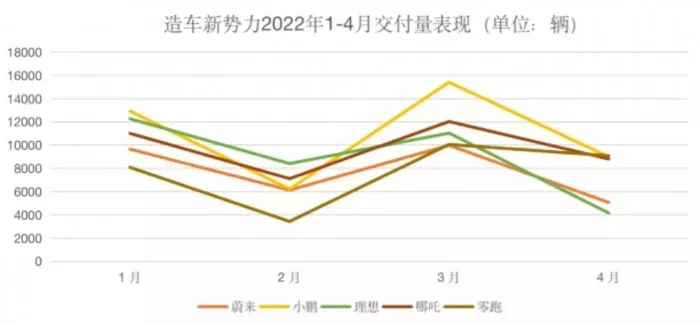

Affected by the epidemic and tight supply chain, the production rhythm of Weilai has been disrupted. Since this year, its delivery has repeatedly lagged behind in weixiaoli, and has even been overtaken by car enterprises such as Nezha and Zero run of the second echelon.

In addition, the rise in the price of upstream raw materials has gradually radiated to terminal manufacturers. In April this year, Weilai, who has always claimed not to increase the price, also adjusted the price of some complete vehicles because it was difficult to bear the pressure of rising raw material prices - which is enough to confirm the pressure of rising raw material prices on vehicle enterprises.

It is not difficult to predict that with the rapid expansion of Weilai's business, its expenditure will also enter a rapid growth stage. In the face of increasing business demand and the uncertainty brought by the epidemic, supply chain, raw materials and other aspects, Weilai's existing financial capacity may be difficult to support its planning vision.

Therefore, it is not difficult to see that the listing of weilaiduo is not only a risk aversion measure for the transaction risk of geopolitical spillover, but also a plan for the capital pressure generated by the development of business operation.

Next stop, conjectures related to London

According to the prediction of the Singapore Stock Exchange, the market value of Weilai will reach S $38.586 billion (about US $27.936.2 billion); This is very close to the total market value of US $27.831 billion reached by Weilai after the closing of US stocks at US $16.66.

Perhaps due to its listing in Singapore, Weilai's US stock price rose yesterday (photo source: Snowball)

It can be seen that when the US stock market is turbulent, the new stock exchange undertakes the financing pressure brought by its delisting storm to a certain extent. But for Wei Lai, listing on the Singapore stock exchange is far from over.

In the early communication of Weilai's third listing in Singapore, there is a thought-provoking sentence: "Singapore is located in the East 8 time zone, with an 8-hour time difference from London. When London ends a day's financial transactions and New York has not yet started financial transactions, Singapore can carry out financial transactions, making up for the vacancy in the financial trading hours in London and New York, and realizing 24-hour uninterrupted financial services around the world."

Why does London appear with New York and Singapore when it comes to 24-hour uninterrupted financial services?

The London Stock Exchange, one of the world's four major stock exchanges, is often ignored in the eyes of domestic investors, perhaps because it has been covered up by a shares, US stocks and Hong Kong stocks. The exchange, which has the largest number of international issuers, members and investors and ranks seventh in the world in terms of total market value, pushed London to the runner up of the global financial center index (GFCI) in 2021, only surpassed by New York, while Hong Kong and Singapore ranked third and fourth. And the stock exchanges in New York, Hong Kong and Singapore have all appeared. Will London be far behind?

The city manages almost half of the European shareholding institutions and accepts more than two-thirds of the international stock underwriting business. As the largest stock fund management center in the world, if Weilai can land in London, it will appear in front of many large institutional investors.

The difficulty of going to London for listing may be much less than ringing the bell on NASDAQ a few years ago. The main board of the London stock exchange requires the enterprises to be listed to have a three-year business history, make profits in recent two years, or make a substantial increase in profits in recent six months or turn losses into profits, and it is expected that the profits will continue to grow in the next three years. In addition, the net profit after tax of the enterprise to be listed in the current year shall not be less than 10 million yuan, of which 90% shall come from the main business. Aim board and tech mark board are more relaxed, and there is no expectation of profitability.

If the worst happens - the SEC puts Weilai on the delisting list, and Weilai is unable to provide audit drafts for three consecutive years, it will be banned from trading securities in the United States, and the volume of the London Stock Exchange will become the best substitute for NASDAQ. Considering that Singapore was a colony of Britain for more than 140 years, the social system here is very close to that of Britain. Everything Weilai tries in Singapore will make it listed on the London stock exchange without cultural identity barriers.

Will London be the next stop after Singapore?