Today, the world's top ten CMOS image sensor company Stevie updated its listing prospectus and is about to land on the science and innovation board. Like many semiconductor companies, behind the upstart of the sci-tech innovation board is the investment of SMIC's companies, which will soon become the sixth IPO of SMIC since April.

In the 11 days from April 12 to April 22, five newly listed chip companies, vijiechuangxin, tuojing technology, yingjixin, Fengyi technology and nano chip micro, have invested by companies and funds under SMIC international.

Specifically, SMIC Haihe holds 3114300 shares of Weijie Chuang core, Suzhou Juyuan holds 1.8 million shares of tuojing technology, Suzhou Juyuan casting core holds 1442700 shares of Yingji core, Juyuan Juxin holds 2075600 shares of Fengyi technology, and Juyuan Juxin and Juyuan casting core hold 243000 shares of nano core micro. These investment companies with the words "SMIC" and "Juyuan" in their names are SMIC's SMIC wafer equity investment or SMIC Juyuan equity investment companies, and they are also the main force of "SMIC series" investment companies.

This is just the tip of the iceberg of SMIC international investment Empire, 25 of its invested companies have been listed on a shares , and many IPOs such as Jiang Bolong and Juquan optoelectronics have been held on the science and innovation board or gem.

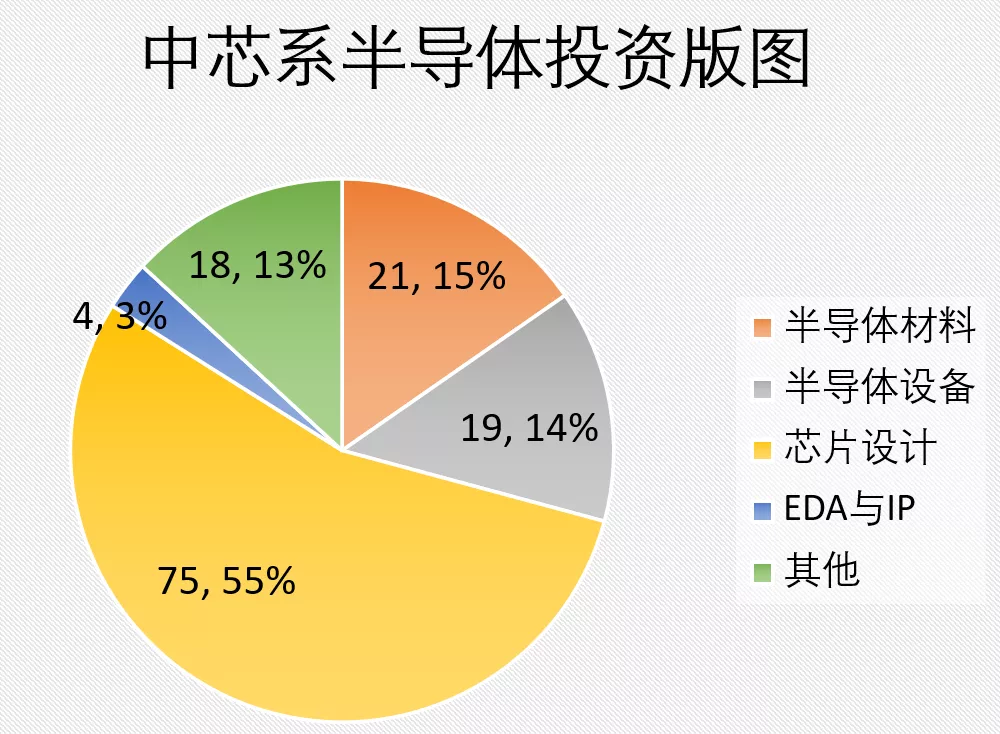

According to the incomplete statistics of SMIC, the number of enterprises invested and held by SMIC has reached 137 , including 21 semiconductor material manufacturers , 19 semiconductor equipment manufacturers , 75 chip design manufacturers , 4 EDA and IP manufacturers , and 18 other chip related supply chain manufacturers such as IDM (vertical integrated manufacturing), packaging and testing, CIM (Computer Integrated Manufacturing).

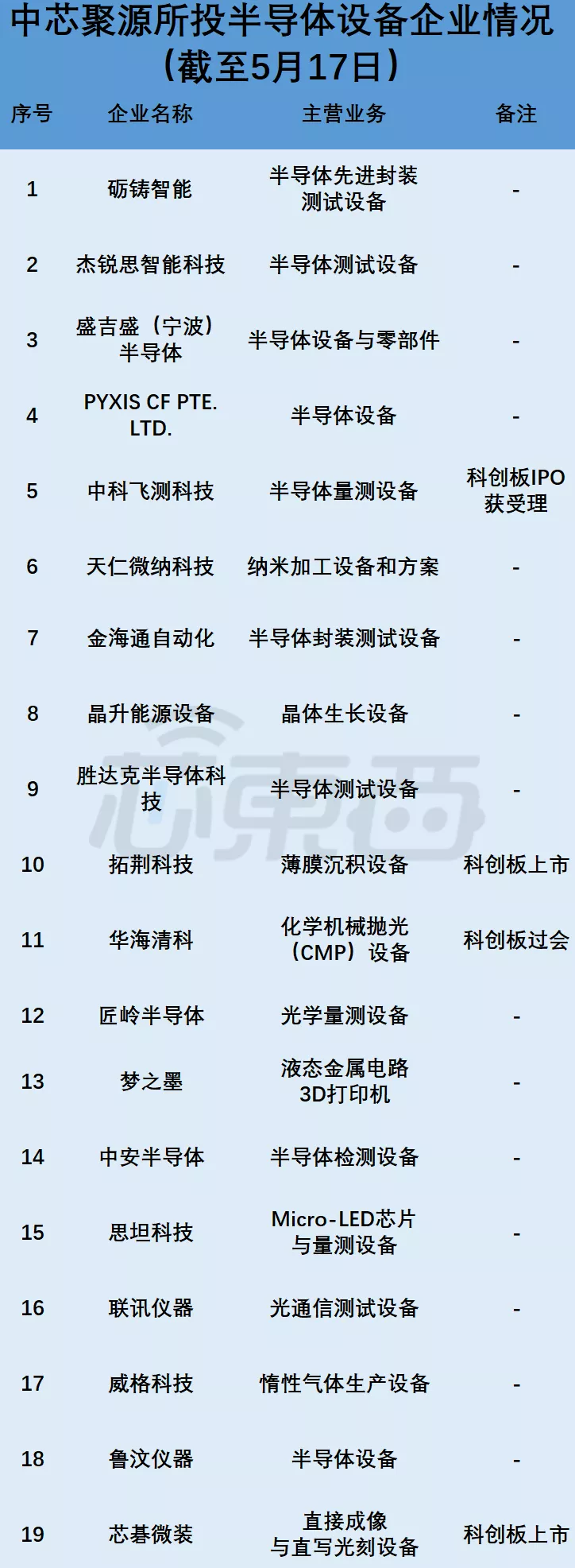

▲ status of enterprises invested by SMIC Juyuan as of May 17 (data source: Official Website of SMIC Juyuan and Enterprise Investigation)

SMIC Juyuan under SMIC international has more than 26 billion yuan of assets under management. It is China's top semiconductor CVC (enterprise venture capital fund). According to the annual report of SMIC in 2021, the cash recovered from investment was 39.355 billion yuan and the cash obtained from investment income was 890 million yuan.

The following core things are the beginning and end of SMIC international investment territory.

01 .

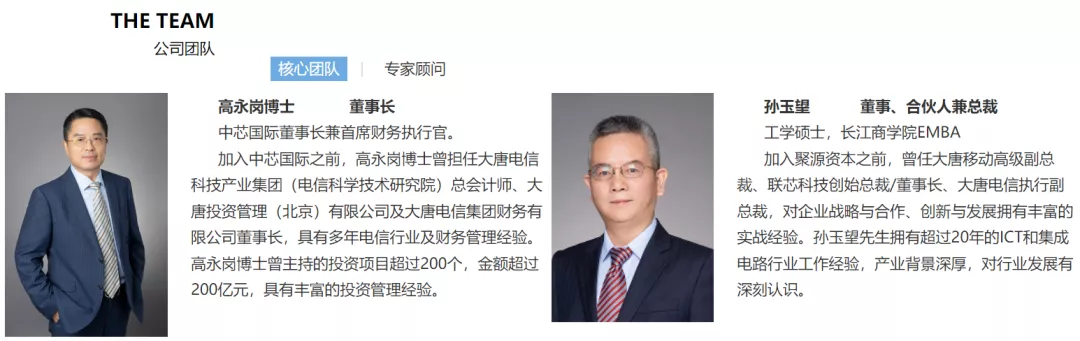

The core team comes from SMIC international and Datang Telecom

SMIC Juyuan supports the investment empire of SMIC system

Behind the five semiconductor IPOs intensively listed this time are mainly SMIC Juyuan equity investment management (Shanghai) Co., Ltd. Through multi-layer shareholding and managing other investment companies, SMIC Juyuan has become the center of "SMIC" investment companies such as Qingdao Juyuan silver core, Suzhou Juyuan, Shanghai Juyuan Juxin and Suzhou Juyuan casting core, and is the core of SMIC international investment territory.

As an important part of SMIC international, SMIC Juyuan's core team has a deep semiconductor background. Its chairman is Gao Yonggang, chairman and chief financial officer of SMIC. Its director, partner and President sun Yuwang once served as senior vice president of Datang Mobile, founding president / Chairman of Lianxin technology, executive vice president of Datang Telecom, etc. Datang Telecom is now the largest shareholder of SMIC.

▲ Gao Yonggang, chairman of SMIC Juyuan and sun Yuwang, director, partner and President

The official website of SMIC Juyuan said: "... The company was initiated by a leading enterprise in the domestic integrated circuit industry and a senior investment team, and jointly established with other shareholders. ······································································································

However, it is worth noting that SMIC Juyuan does not directly invest in semiconductor companies, but through the "SMIC" companies controlled at all levels. Take SMIC wafer equity investment (Ningbo) Co., Ltd. as an example. The company is an investment company indirectly 100% controlled by SMIC through SMIC power collection investment (Shanghai) Co., Ltd., SMIC international integrated circuit manufacturing (Shanghai) Co., Ltd. and SMIC wafer equity investment (Shanghai) Co., Ltd.

For Qingdao Juyuan silver core, Suzhou Juyuan, Shanghai Juyuan Juxin, Suzhou Juyuan casting core and other "Zhongxin" companies, the share proportion of Zhongxin wafers ranges from 31% - 49%, and participated in the establishment of small and medium-sized enterprise development fund, Beijing integrated circuit design and sealing test equity investment center and Shanghai IOT phase II fund.

▲ ownership structure of SMIC (picture source: enterprise check)

From the perspective of ownership structure, SMIC wafers and SMIC Juyuan are not subordinate, but the website of the investment community shows that SMIC wafers are managed by SMIC Juyuan and mainly invest in IC related industries and relevant strategic emerging industries (such as energy conservation and environmental protection, information technology and new energy).

Behind many "SMIC" companies, SMIC Juyuan is the core node.

02 .

Invested in 25 A-share listed companies

Design, materials and equipment are listed

Previously, SMIC had interviewed Zhang huanlin, the managing partner of SMIC Juyuan. He mentioned that SMIC Juyuan focused on the semiconductor industry and its investment territory covered the subdivided fields of semiconductor materials, equipment, chip design, EDA and IP.

According to the incomplete statistics of SMIC East and West, SMIC Juyuan has invested in more than 137 companies, of which 25 are listed on a shares.

▲ "medium core system" semiconductor investment layout

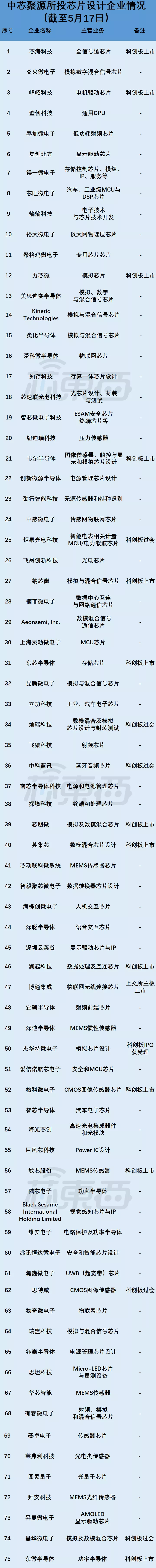

According to the field, the largest investment of SMIC Juyuan is all kinds of chip design companies, with a total of 75, including domestic segmentation leaders such as Lanqi technology, Weier semiconductor, nano chip micro, Geke micro and Minxin Co., Ltd., as well as AI chip entrepreneurs such as exploration technology and Bi Ren technology.

A total of 12 chip design companies invested by SMIC Juyuan are listed in a shares, including Lanqi technology, Weier semiconductor, Broadcom integration, Xinhai Technology, Fengyi technology, Lixin micro, nano micro, Dongxin semiconductor, Xinpeng micro, yingjixin, Geke micro and Dongwei semiconductor. Their fields include data interconnection chip, motor drive chip, medical chip, touch display chip, signal chain chip, TWS chip AI chip and battery management chip.

Among them, weir Co., Ltd., founded in 2007, is a semiconductor design company under Howell group, with an annual shipment of 13.5 billion. It is a domestic leader in the fields of sensors, analog solutions, touch screen and display solutions.

In May 2017, weir shares were listed on the Shanghai Stock Exchange, and the share price on the listing day was 9.5 yuan / share. As of today's closing on May 17, the share price of Weill shares was 162.79 yuan / share, with a total market value of 142.752 billion yuan.

Founded in 2004, Lanqi technology is one of the first listed companies on the science and innovation board and a domestic leader in the field of data processing and interconnection chips. As of the closing on May 17, the share price of Lanqi technology was 59.46 yuan / share, with a total market value of 67.3 billion yuan.

Lanqi technology was listed on the science and innovation board in July 2019, with a closing price of 74.32 yuan / share on the day of listing. As of today's closing on May 17, the share price of Lanqi technology is 63.14 yuan / share, with a total market value of 71.527 billion yuan.

Founded in 2003, Geke minimally invasive is a domestic CMOS image sensor supplier. According to the statistics of shipment volume in 2020, Geke micro has a global market share of 29.7%, ranking first among CMOS image sensor suppliers in the global market.

Gekewei was listed in August 2021, and the closing price on that day was 35.25 yuan / share. After today's closing, the price of Geke micro single share was 18 yuan, with a total market value of 44.980 billion yuan.

▲ chip design companies invested by "SMIC"

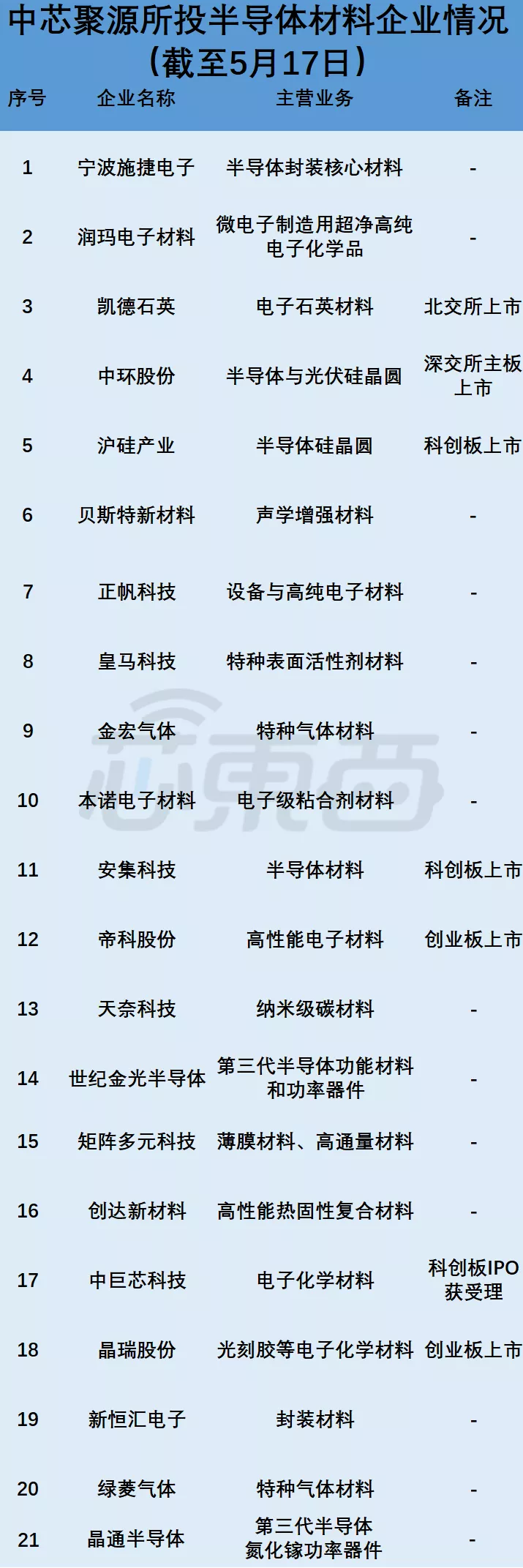

The upstream semiconductor materials and equipment are also the key areas of focus of SMIC source. Among the 137 enterprises invested by SMIC Juyuan, there are 21 material suppliers and 19 equipment suppliers.

In the field of materials, SMIC Juyuan has invested in 6 A-share listed companies, including Zhonghuan Co., Ltd., Shanghai silicon industry, Kaide quartz, Jingrui Co., Ltd., dike Co., Ltd. and Anji technology.

Among them, Shanghai silicon industry is the leader of domestic silicon wafers, and its subsidiaries include Shanghai Xinsheng, Shanghai Xinao and other enterprises. Shanghai Xinsheng is the first batch of domestic manufacturers capable of producing 300mm silicon wafers; Shanghai Xinao is one of the few enterprises in the world with SOI silicon wafer production capacity.

Shanghai silicon industry was listed in April 2020, with an issue price of 3.89 yuan / share and a closing price of 10.91 yuan / share on the same day. As of today's closing, the share price of Shanghai silicon industry was 22.71 yuan / share, with a total market value of 61.778 billion yuan.

▲ semiconductor material companies invested by "SMIC"

In semiconductor equipment, SMIC Juyuan has invested in two listed companies on the science and innovation board, tuojing technology and SMIC Acer micro equipment.

Founded in 2010, tuojing technology is the leader of domestic film deposition equipment. Its products have been widely used in the production line of wafer factories with processes of 14nm and above. SMIC is not only the first customer of tuojing technology's first mass production machine, but also a major customer of tuojing technology.

Tuojing technology was listed on the science and Innovation Board on April 20 this year, with an issue price of 71.88 yuan / share and a closing price of 92.30 yuan / share on the day of listing. After the closing of a shares today, its share price was 138.17 yuan / share, with a total market value of 17.476 billion yuan.

Founded in Hefei in June 2015, Xinqi micro packaging is mainly engaged in the R & D and production of direct imaging equipment and direct writing lithography equipment with micro nano direct writing lithography as the technical core. It is "the first share of domestic lithography".

Acer micro packaging was listed on the science and innovation board in April last year, with an issue price of 15.23 yuan / share and a closing price of 44.10 yuan / share on the day of listing. Today, the closing price of Acer micro packaging was 47.17 yuan / share, with a total market value of 5.698 billion yuan.

In addition, Huahai Qingke, the only 12 inch CMP (chemical mechanical polishing) equipment supplier in China, also has the investment of "Zhongxin system". It passed the listing meeting of the science and innovation board in June last year, and is likely to land on the science and innovation board after that.

▲ semiconductor equipment companies invested by "SMIC"

In the field of EDA and IP, "SMIC" has invested in companies such as SMIC Huazhang, Ruicheng micro, SMIC and semiconductor, Xingxin technology, etc.

Founded in March 2020, xinhuazhang is a new force of domestic EDA, with nearly 300 employees around the world. Last November, xinhuazhang launched four self-developed EDA products, realizing multi tool collaboration in the field of digital verification, which can improve the overall verification efficiency of the chip.

▲ four EDA products of xinhuazhang

03 .

The investment income in 2021 is 2.9 billion yuan

Strategic financing accounts for 30%

As one of the earliest semiconductor CVCs, the team of SMIC Juyuan almost all came from the semiconductor industry and focused on investment in the semiconductor field, generally not involving other industries. For China's semiconductor investment, Zhang huanlin said at the 2020 smart East-West AI chip Summit: "in recent years, the semiconductor industry has encountered development opportunities. From the perspective of the integrated circuit industry, it is also the time for the whole industry to transfer to China."

He also stressed that chip entrepreneurship is not only to do chips, but also to do ecology. For the world's leading semiconductor enterprises, most of their teams come from large group companies and system companies, without lack of product direction and market. However, for start-ups, they need to find out the direction of the market, and even explore the way of product promotion and the needs of customers. There is still a long distance from chip design to landing products.

In this regard, the official website of SMIC Juyuan wrote: "... (SMIC Juyuan will) accelerate the integration of domestic industries and the improvement of enterprise quality, and continuously improve the domestic integrated circuit industry ecosystem."

From the 137 enterprises invested by SMIC Juyuan, it is not limited to one of the hottest track, but has made investment layout in various fields such as semiconductor materials, equipment, chip design, packaging and testing.

Although the largest number of enterprises have been invested in the field of chip design, the investment of SMIC Juyuan covers all fields such as general GPU, signal chain, display driver, RF, MCU, network communication, Internet of things, storage, power semiconductor, photoelectric chip and even optical quantum chip. There are not only mature links with limited domestic supply, but also emerging tracks where all countries are on the same track.

In addition, in the field of semiconductor materials and sealing and testing, SMIC poly source has also made general investment and invested in many domestic material and equipment manufacturers.

▲ core Acer micro packaging invested by SMIC Juyuan

For semiconductor enterprises invested, SMIC has two options: venture capital and strategic financing. Generally speaking, venture capital is for the purpose of profit. When investing, it will do a good job in the exit mechanism and expect a high return on capital; Strategic investment tends to long-term cooperation and seeks long-term cooperative relations and interests, focusing on the development of the business itself.

The strategic investment of SMIC Juyuan is an important link. In view of the investment fever, Zhang huanlin once said that the development of the semiconductor industry cannot rely on the stacking of funds alone. What the industry really lacks is time. Both the capital side and entrepreneurs should give themselves some patience. Start-ups do not need to talk about "overtaking in corners" every day, but they need to refine and strengthen their products in order to exchange value with others, form sustainable development and have industry influence.

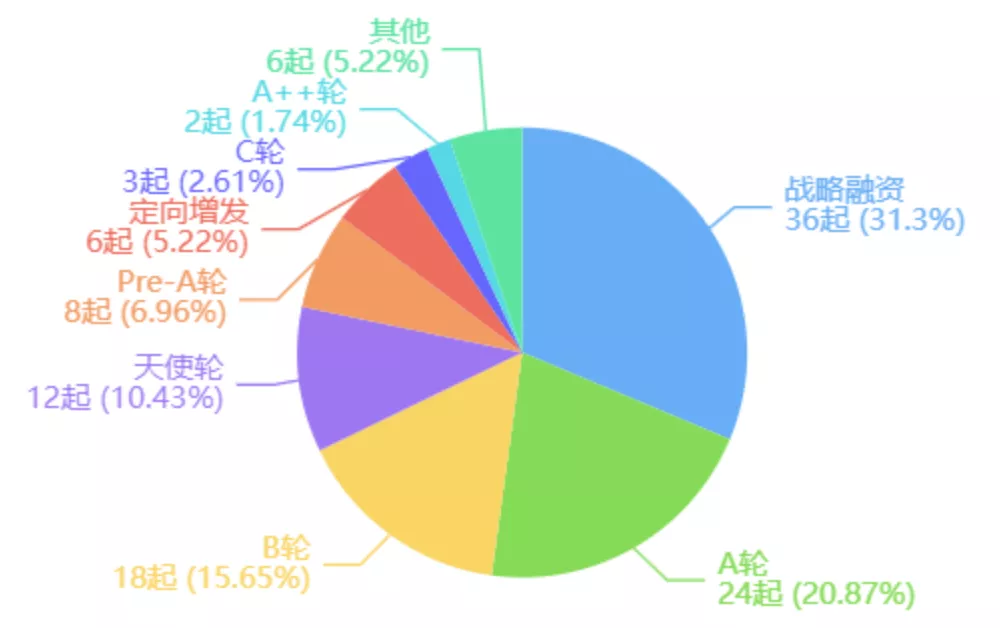

Enterprise investigation data show that SMIC Juyuan investment accounts for a relatively high proportion of strategic financing, round a financing and round B financing, and the number of financing events accounts for 30.36% (34), 21.43% (24) and 16.07% (18) respectively.

▲ distribution of investment rounds of SMIC Juyuan (picture source: enterprise check)

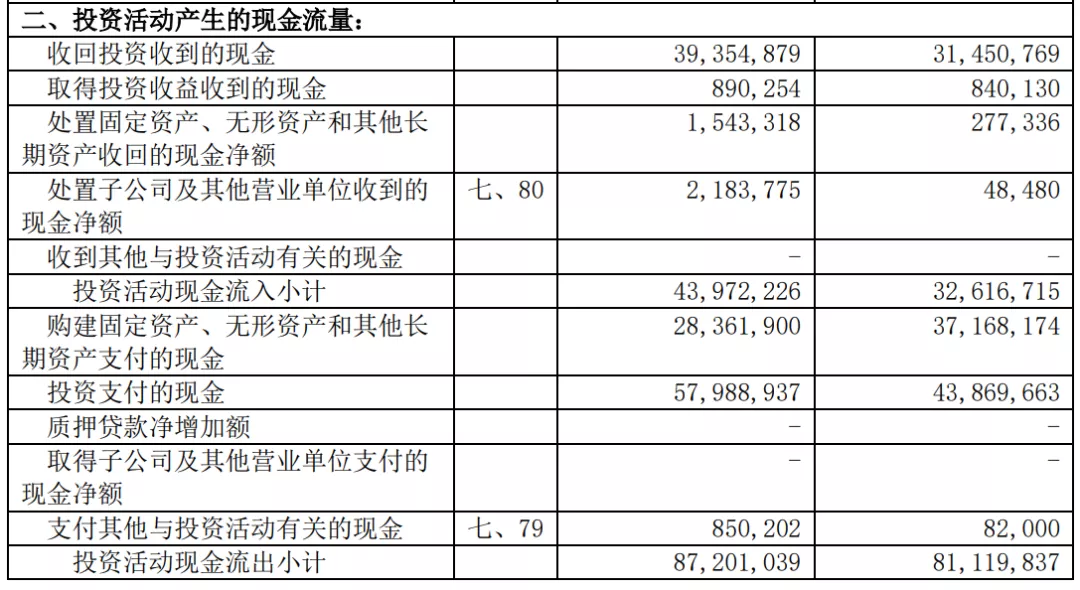

While paying attention to strategic investment, SMIC Juyuan did not "lose money and earn money". In 2021, SMIC's investment income exceeded 2.9 billion yuan and the cash recovered from investment was 39.3 billion yuan. As the investment core of SMIC international, the role of SMIC Juyuan is self-evident.

In 2020, SMIC received 31.629 billion yuan in cash from selling goods and providing labor services, and 31.451 billion yuan in cash from its investment, which is very close to each other.

▲ consolidated cash flow statement of SMIC in 2021

From the perspective of industrial chain, "SMIC" participated in the establishment of dozens of industrial funds, which supported the whole semiconductor industry.

Through SMIC Juyuan and other platforms, SMIC international has invested in track leaders in various sub sectors, such as Galaxy micro electronics, Acer micro packaging, Dongxin semiconductor, Huahai Qingke, Lixin micro, Geke micro, vijiechuang core, yingjixin, sitway, tuojing technology, nano core micro, Dongwei semiconductor, Fengyi technology, Haoda electronics, Dongxin Co., Ltd., jiangbolong electronics, accelerating the localization of semiconductor supply chain.

04 .

Conclusion: make up for the short board of the process

Investment boom accelerates the development of domestic supply chain

As the leader of China's wafer manufacturing, SMIC is a key link in the development of the whole industrial chain and has attracted the attention of domestic semiconductor industry and investors. As Zhang huanlin of SMIC Juyuan said, ecology is the key to semiconductor enterprises. The manufacturing process gap between SMIC and TSMC, Samsung and other companies is not a simple technical and process problem, but the gap between domestic semiconductor supply chain and international leaders in all links such as materials, equipment and EDA software.

Since 2021, "the first share of domestic CPU", "the first share of domestic lithography machine" and "the first share of domestic baseband" have successively landed on the science and innovation board. Behind them, most industrial investment companies such as SMIC Juyuan, Xiaomi Changjiang and Huawei Hubble have participated, which reflects the importance of industry giants such as SMIC international, Xiaomi and Huawei to the growth of domestic supply chain.

Meanwhile, with the investment and participation of these funds, there has been an upsurge of entrepreneurship in EDA, AI chip design, third-generation semiconductor and other fields. After the harvest of six IPOs this month, SMIC can not only obtain a lot of investment income, but also develop together with the domestic semiconductor supply chain, make up for the short supply board and expand the downstream market.