The second quarter of 2020 will go down in history as the most prosperous period of the mobile economy. People download a lot of apps when they are isolated at home. With the closure of gyms in many countries, the number of health and fitness app downloads soared from 565million to 811million in the quarter (the second quarter of 2020). After soaring at the initial stage of the blockade, the download volume of health and fitness apps gradually stabilized last year.

Under the influence of the epidemic, 2020 has become a special year. As we enter 2022, there is still a continuous growth trend in this category of applications. According to data According to AI's 2022 mobile market report, the total number of downloads of this category in 2019 was 1.97 billion. By 2021, this figure will reach 2.48 billion.

Everything in mind: Meditation applications reach new heights

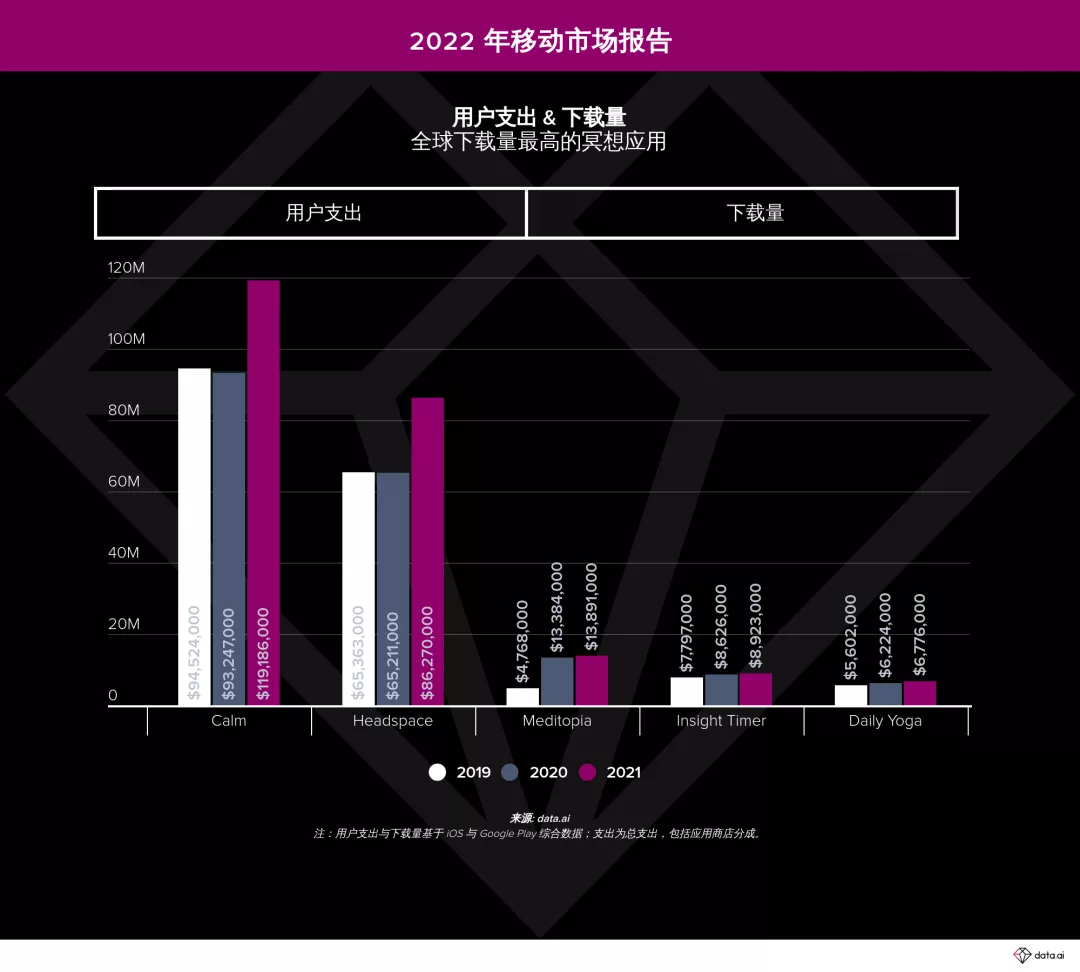

The health and fitness app has performed well this year, and one of its biggest factors is the success of the meditation application. During the epidemic, people paid great attention to mental health, which promoted people's interest in applications such as calm, headspace, meditopia and insighttimer. According to data According to AI's mobile market report in 2022, the top three apps in terms of downloads occupied a dominant position in the market, attracting a total of 37million downloads in 2021.

In terms of user behavior, among the top ten meditation apps in the world in 2021, the average number of times insighttimer users open on Android phones is the highest, more than 40% higher than the second highest meditation app. In addition, they are also the first in terms of average usage time per user. This means that compared with other major users in this subcategory, people not only spend more time on insighttimer, but also use the app more frequently in general.

In terms of app store spending, the top five meditation apps increased by 25% year-on-year compared with last year. In 2021, the two meditation apps with the highest user spending, calm and headspace, generated a total revenue of $205million. However, it is worth noting that this is not the only way for mobile terminals to realize cash. Some apps also take advantage of in app advertising, enterprise cooperation or complementary ways with mobile e-commerce.

And the two companies are now focusing on the next phase of growth. Calm has raised $217million for expansion, and headspace has begun to invest - it acquired sayana, a mental health and healthcare company driven by artificial intelligence, in january2022.

Age factor: millennials download more than other age groups in different countries

Health and fitness app

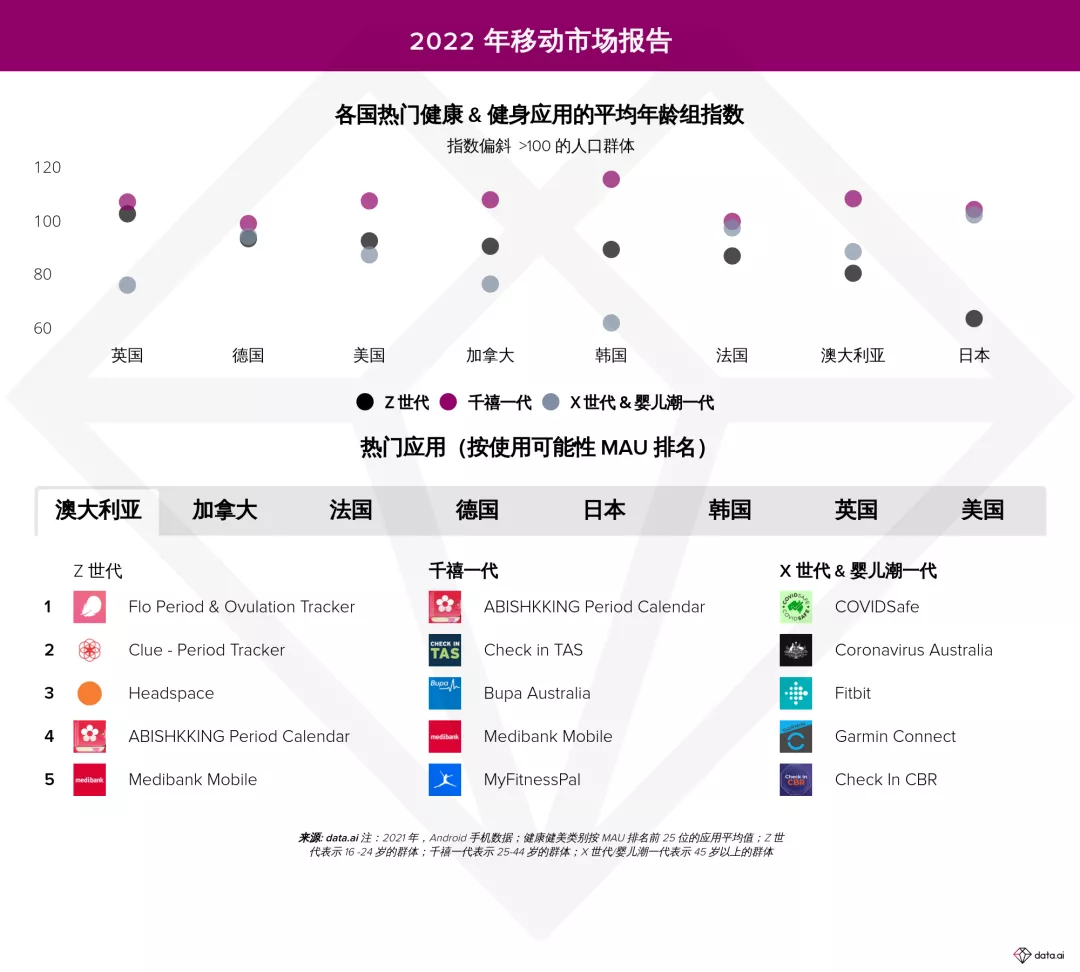

The mobile market report 2022 also revealed the differences in user characteristics in the field of health and fitness apps. Generally speaking, this is a millennial focused application category. In 2021, they are more inclined to health and fitness apps than the total population of Gen Z or Gen X and baby boomers. For example, in Korea, among the top 20 health and fitness apps with active users last month, the average index of millennials was 120. This means that in Korea, millennials are 20% more likely to use health and fitness apps than the overall population on average (at least in terms of monthly live users, the top 20 apps are the same).

In terms of application product selection, Gen X and baby boomers show a preference for self quantifying apps. They prefer pedometer, weight loss, walking and hiking apps. In the other age group, Gen Z prefers health and female health apps.

Floperiod& Ovulationtracker stands out in the subcategory "women's technology". This app developed in the UK ranks first or second in terms of monthly active users of generation Z in 7 of the 8 countries for specific analysis. This may be one of the reasons why the company is currently valued at about 675million euros.

In the near future, generation Z will be an age group worthy of attention. It seems that they are more willing to try the concept of innovative health and fitness app, such as the artificial intelligence driven mood diary app reflect, which will provide specific feedback according to users' records and daily feelings. In the next few years, they are most likely to lead the trend of the health and fitness subcategory.