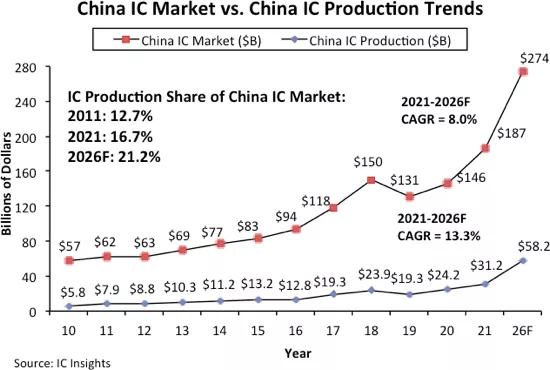

IC insights' previous outlook and forecast for the global economy in 2022 analyzed the development of chip markets around the world, with particular attention to the Chinese market. There is a very clear difference between China's IC market and China's local IC production. Although China has been the largest IC consumer since 2005, this does not mean that China's IC output will increase significantly.

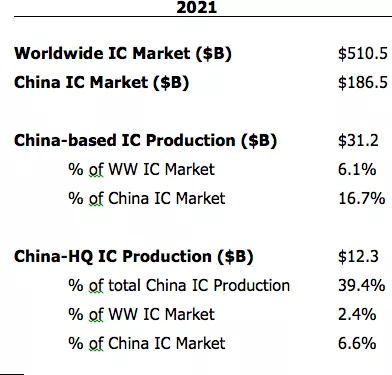

By 2021, China's IC output will account for 16.7% of its $186.5 billion IC market, up from 12.7% in 2011. In addition, IC insights predicts that this share will increase by 4.5 percentage points to 21.2% in 2026 compared with 2021. (an average annual increase of 0.9 percentage points).

Among the $31.2 billion worth of IC made in China last year, China based companies contributed $12.3 billion (39.4%), accounting for only 6.6% of the $186.5 billion IC market in China. TSMC, SK Hynix, Samsung, Intel, liandian and other foreign companies with IC Fabs in China contributed the rest. IC insights estimates that in the US $12.3 billion IC market made by Chinese companies, about US $2.7 billion comes from IDM (vertically integrated manufacturing plant) and US $9.6 billion from pure OEM plants such as SMIC international.

If China's IC manufacturing industry increases to US $58.2 billion in 2026 as predicted by IC insights, China's IC production will only account for 8.1% of the total global IC market (US $717.7 billion). Even after a significant increase in IC sales for some Chinese manufacturers, China's IC production will still account for only about 10% of the global IC market by 2026.