Byte beat has reached a 100 billion level track. On Friday (May 13), tiger sniff sought confirmation from byte beat. Byte beat did set up a food and beverage team in Beijing recently. In the job description of "food and beverage product planning" released by him, it is also clearly mentioned that "sort out the core selling points and product listing plan, and be responsible for the implementation". Immediately, the person in charge of Tiktok, a subsidiary of bytewo, responded that the company's food and beverage team mainly served internal needs.

Author / Huang Qingchun

However, industry insiders believe that once the tea business is mature, it will not be limited to internal supply, and there is a great possibility of facing the market in the future.

On the one hand, the tea circle is in the cold winter when the byte beats "into the game". After the "cooling" of the venture capital fever in the tea circle in 2021, the two tea "heavy warehouse cities" in Shanghai and Beijing suffered the deep impact of the epidemic in 2022. Many tea circle stakeholders told huolf that Shanghai and Beijing, as the cities with the most vigorous tea consumption, the impact of this round of epidemic is not limited to the decline in sales, and the logic of opening stores, drainage model and SKU iteration model are undergoing in-depth changes. "More tea brands will accelerate online in 2022 - when the offline world is full of uncertainty, online traffic and consumption power become particularly important."

On the other hand, since 2020, the products of byte system have become the "flow inlet" most concerned by the tea circle. Take Xicha and Naixue for example. Both of them have opened official accounts in Tiktok. However, there seems to be an internal logic between the "number of Tiktok fans" of tea brands and their "position in the Jianghu of the tea industry": as tea brands with the highest market value (valuation) in China, the number of fans of Tiktok accounts of Naixue and Xicha exceeds that of their peers in the industry - as of press release, the number of fans of Tiktok accounts of Naixue is 1033000 The number of tea loving fans is 963000 (as a comparison: 779000 tea Baidao fans and 142000 tea Yan Yue color fans).

This constitutes a picture worth pondering: when tea falls into a "cold winter", the "big brother of flow" in the tea circle ends up "making tea". And this leads to a deeper problem. In the tea circuit with the increasingly solidified market pattern, how many variables will the entry of bytes bring?

Why are you eyeing new tea

In 2022, the businesses of many large Internet companies are shrinking, trying to reduce costs and increase efficiency by increasing revenue and reducing expenditure. Only this Internet upstart still rushes left and right on new business, just like a "catfish" bringing a new wave of discussion and attention to its industry.

I've been salivating for a long time and jumping into the new business.

In 2021, byte beat significantly accelerated the "shopping" rhythm of the new consumption track - there were nine investments in just one year, covering new brands such as manner, lemon season, yinwei tea, lazy bear hot pot, shark fit and empty card. According to the rough estimation of the media, the investment amount of byte beat in the new consumption field may have exceeded 800 million yuan.

In addition, byte beat also took shares in the "new consumption catcher" black ant capital, which is listed in the investment list of Xi tea, Yuanqi forest, Jane Eyre yogurt, harmay plum, Wang satin and KK group.

It is worth noting that he Yu, the founder of black ant capital, once worked for byte. When communicating with Hu olfactory in 2021, he Yu once mentioned his views on the online world: "the change trend of the whole online is to go in the direction of experience and content. How to find the combination and consistency between experience, content and consumption is related to the iteration of consumers. This is the development of online and offline."

As for the layout of bytewo's own tea business, bytewo has launched an internal tea brand "Taoyuan jade leaf", mainly tea bag products, which has recently opened an official flagship store in Tiktok; In November last year, Beijing byte beating Network Technology Co., Ltd. has applied for the registration of "byte tea" and "bytetea" trademarks, which are internationally classified as beer, beverage and convenience food.

According to previous reports of Tech planet, Bai Guang and Liu Yuzhang, director of strategic cooperation, took over the newly established Beijing Xingang Trading Co., Ltd. as early as 2018, which mainly explores new consumer businesses such as tea and red wine.

Industry insiders speculate that the reason why byte jump began to bet on the new consumption track is due to the slowdown in the growth of its main business. Previously, the media reported that the annual revenue in 2021 was about US $58 billion, an increase of 70% year-on-year, significantly lower than the growth rate of 111% last year.

In addition, according to the Shanghai Securities News, the domestic advertising revenue of byte beat stopped growing in the first half of 2021 (the first time since the commercialization began in 2013). The revenue of two core products of byte beat, Tiktok, stopped growing, and today's headlines are even on the edge of loss.

Even, a person close to byte beating disclosed to the reporter of Shanghai Securities News that since last year, it has been an open secret that the growth of Tiktok and other related businesses has slowed down significantly, "it is mainly because the ceiling of the number of domestic users of short video has been here at present. Tiktok, built by strong marketing, must have diminishing marginal benefits."

This can also be exemplified from the data end. As of September 2021, the dau of Tiktok system application is 640million, the master station is about 500million, and the speed version is about 140million; Back in June, 2020, the dau announced by Tiktok has exceeded 600million, and the traffic growth is obviously weak.

To sum up, online traffic will naturally go offline. As a popular consumption track, new tea is obviously a good choice - relevant data show that the scale of China's tea market reached 262.66 billion yuan in 2020, with a compound growth rate of 7.2% in the past five years, and the demand is constantly increasing; In addition, according to the data of prospective industry research institute, the scale of China's current tea market has reached 113.6 billion yuan in 2020, with a year-on-year increase of 6.87%.

The deeper reason is that tea, as a huge blue ocean market of 100 billion, now has a historical window of subversion and change.

The advantage of tea over coffee is that compared with the initial Chinese coffee market, tea is easier to break the circle at the cultural level - especially outside super cities such as Shanghai and Beijing, the penetration rate of tea culture is significantly higher, which means that compared with coffee, tea has less pressure on "market education and user consumption mental construction".

However, the weakness of tea compared with coffee is also obvious. In the investment circle, the "addiction" of coffee is regarded as the key to ensure repurchase. In contrast, most tea products are difficult to realize the deep repurchase of "American coffee" and "latte". This means that the tea track needs to find a user deep cultivation strategy other than "product addiction" - digitization and the private domain traffic strategy behind it are regarded as the key.

It is worth noting that the Internet gene of new tea has brought an industry change. Represented by a number of new tea brands such as Xicha, Naixue and chayan Yuese, China's tea is rapidly completing digital evolution: they generally have Internet genes. After combining traditional tea with milk tea, they can quickly open the market through marketing channels, and standardize and scale the raw materials, production and channels to a certain extent (the taste innovation of assembly line can be realized by matching the sweet recovery characteristics of tea with various accessories), This market demand has been greatly activated, and the hot money invested in the Internet has naturally poured into the new tea track.

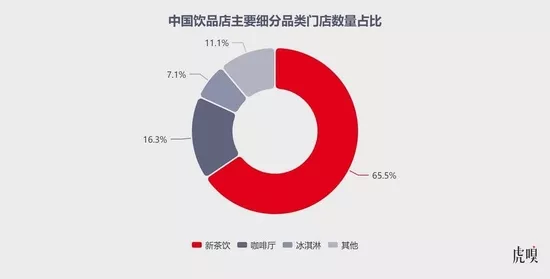

Data source: meituan / Catering boss internal reference: China catering big data 2021

Taking the number of offline stores as an example, the 2021 new tea research report shows that the total number of beverage stores in China was about 427000 by the end of 2019 and 596000 by the end of 2020. Among them, the proportion of new tea stores is the highest, up to 65.5%, and the number of stores is about 378000. This wave not only listed Naixue, but also spread the news of IPO of Xi tea, Lele tea and other brands.

Combing the consumer business that byte beat has frequently attacked since the first half of the year, it is not uncommon to build a new tea team from the word byte beat to the wine business and perfume business.

An investor who pays attention to the consumption track believes that the expansion of new business seems disorganized on the surface. In fact, there is an underlying logical connection between these consumption targets. "Byte beating always embraces young people, and the fit between new business and basic disk users is relatively high."

According to the 2020 new tea white paper released by Naixue and cbndata, it is expected that by the end of 2020, the number of domestic new tea consumers will exceed 340 million, nearly 70% of which are post-90s and post-00s.

In addition, the core audience of this batch of cutting-edge tea drinking enterprises is young people, who have a very high degree of overlap with Tiktok and watermelon video users - according to McKinsey's 2020 China consumer survey report, the "young shopping masters" in the second tier and below cities in the survey sample only account for 25% of the respondents, but they have contributed nearly 60% to the growth of consumer spending that year. Young people are becoming the new main force in the consumer market.

The above investors further added, "Some people think that Internet companies such as bytek have the advantage of always doing business online, and it is a false shot to do offline entity probability, just to 'support valuation' and 'improve user penetration'. In fact, in the new consumption track, light alcohol, smell perfume and new tea have become a lifestyle and a trend in a certain sense, with a strong sense of consumer identity, which can be said to be the social currency and consumer aesthetics of young people at present."

Moreover, the milk tea business model has matured. This asset light and high profit business model has become more and more dependent on popular models. With the faster and faster pace of new models among various brands, more and more marketing and promotion expenses will be invested by Xi Cha, Naixue and cha Yan Yuese in Tiktok and xiaohongshu, while Tiktok is obviously superior to these new forces of tea under the huge traffic, algorithm recommendation and business efficiency.

However, the new tea drinking track is accelerating in 2022. Some insiders believe that the epidemic superposition industry has slowed down, and the whole new tea track is entering the era of stock competition, which forces the head players to compete across borders and begin to penetrate each other in business (for example, Yuanqi forest began to make beer, milk tea and other products, while Ruixing coffee launched new products different from the periphery of coffee and tea drinks). The product forms are more diversified and differentiated, giving birth to lemon tea, tea bags, tea freeze-dried powder Cold tea extract, freshly made pure tea, health tea, etc.

Another thorny problem is that the operation of offline stores of new tea brands is becoming more and more difficult.

Affected by the epidemic and several stagnant shipping, since last year, the costs of raw materials (coffee beans, milk, etc.), manpower and rent (some insiders said that the rent in 2022 may be 2.5 times that in 2020) have been rising. Starbucks, Tim Hortons, Yidian, chayan Yuese, Ruixing coffee and other brands have announced to raise product prices one after another. Even, with the soaring labor costs of tea tracks, tea brands such as Xi tea, Naixue and LeLe tea have frequently heard news of store closures, salary cuts and layoffs.

In this environment, if you want to build your own tea brand, the operating cost will only remain high. Moreover, tea drinks are highly dependent on the construction of logistics, cold chain and other service facilities, and the competition between brands will become more and more concentrated on products and supply chain, which are not dominant.

Infinite War of Tiktok

In fact, byte jump not only covets the consumption track, but has penetrated its power territory into various fields such as medical treatment, education, enterprise services, social networking, consumption, real estate and so on by virtue of its advantages in technology, algorithm and business efficiency. Moreover, its expansion of new businesses is mostly based on the coordination and supplement of business and technology, and quickly grafted external resources into its own business system to achieve data anti transcendence in the subdivision track "arms race" in the way of Blitzkrieg. This is also one of the logic that byte system always "worked hard to achieve miracles" on the product side in the past.

To this end, some investors told Hu olfactory, "with the rise of the rebound after the event, the strategic significance of the combination of business and investment has been underestimated. Sometimes the risk of business expansion lies not only in the business itself, but also in the order of the Jianghu. However, Zhang Yiming successfully integrated the talent advantage of the subdivided track into the product ecology through investment and M & A, and built his own evolution system for the core business."

Following this logic, as the marching route of byte beating business territory becomes more and more radical, Tiktok will also adjust its growth path in the new ecology, and the organization, business architecture and product form will be iterated.

However, in order to realize the ecological advantages of Tiktok, the business of selling traffic is obviously too shallow, as is the case with meta now - when products become the "basic components" like pipelines, how to open up a new business model outside of advertising becomes particularly important.

The author points out that the flow of the Internet giant is "realized before the flow of the mainstream", and the author points out that the flow of the Internet giant is "realized" before the flow of the mainstream, and then reflects the value of the "view". Today, byte beating advertising resources are upgrading and evolving in two directions:

Today's headlines and Tiktok belong to the extensive traffic products made in the early stage of byte beating; Understand that chedi, zhuxiaobang and xingfuli are all products of vertical flow expansion in the middle and later stage, and their value lies in undertaking generalized flow and increasing flow value with the help of vertical products, so as to extend more realization scenarios;

Overseas traffic resources are being commercialized rapidly, strongly boosting the growth of international revenue. In 2021, overseas promotion and marketing resources were officially added to a large number of engines, and overseas product resources (tiktok, buzzvideo, topbuzz) were opened to meet the overseas promotion needs of advertisers.

Reflected in the organization side, compared with Alibaba, Tencent and Baidu, there is an obvious difference that they like to break up into parts.

For example, bat, the big Internet companies of the older generation, are very fond of building a skyscraper with dozens of floors and building an employee office ecosystem within a few miles; More than 40 office locations are scattered in Beijing, and various teams are scattered offline and cooperate online. Even the headquarters of byte beating is only the low building of AVIC located at No. 48, Zhichun Road, Haidian, Beijing.

Zhang Jun, the author of tiger sniff, once mentioned Zhang Yiming's view on office space in TikTok Insider: Zhang Yiming's journey of huge waves. "Many companies are depressed when they move to a good headquarters." he cited sun, Yahoo and impression notes as examples. The environment changes the mood. The luxurious and comfortable headquarters not only stifles innovation, but also breeds competition - for example, some company executives have to equip with independent elevators. "It's very tacky."

Focus on specific business. According to media reports, when byte beating realizes a product function, it takes only one week from preparing to go online to resuming the disk, and the mobility advantage of "small front desk" is fully amplified; As for the "big middle platform", it is more like an operation center supported by technology, user operation and commercialization, so as to ensure the collaborative efficiency and resource allocation of various business segments to the greatest extent.

"The game of 'great efforts and miracles' has shaken bat in the information and short video track. After that, it skillfully uses traffic backflow to quickly start new business. Its purpose is to infinitely granulate the people and teams in the business body, and it becomes a' God '." Yin Jun (enterprise management executive, pseudonym) said to Hu olfactory.

In other words, bat, TMD and other large Internet companies have centralized thinking in their organizational structure and business; Byte beating culture is decentralized. This corporate culture will link various businesses into ecology for a long time, and the expansion of business territory will become borderless.

In this regard, a researcher focusing on the consumption track told huolf that the four portals are 1.0 Internet companies, bat is 2.0 Internet companies, and byte beat has the prototype of 3.0 Internet companies. "Now Internet companies are all pursuing IP. Focusing on IP rich products and user needs, Tiktok has a high probability of becoming such an IP based company - not only providing products, but also providing value recognition beyond products."

Taking Xiaomi as an example, although it has built a huge brand IP, many users' consumption cognition of Xiaomi is limited by hardware, which limits the ecological expansion boundary of Xiaomi IP. For example, Xiaomi also sells some food and daily necessities, but many users' mental construction has been completed, and they will not take purchasing food from Xiaomi as a default option.

Tiktok's situation is completely different. As a content platform, it includes all kinds of consumption forms such as food, clothing, housing, food, entertainment. Even though new businesses with byte beating frequently cross borders and cross tracks, its brand IP is easier to be accepted in the process of cultivating users' minds. Therefore, simply comparing the IP boundary ductility between Tiktok and Xiaomi, Tiktok is an IP based brand with more penetration in all aspects.

This judgment is very consistent with the byte beating strategy. Previously, there was a mall called "bytemall" in bytehop, which can be used for employees to purchase byteip (byte surrounding and joint names) goods, including tea filters, gift boxes, umbrellas, etc.

Even as early as 2019, Chen Rui, chairman of BiliBili, said in an interview with latepost later, "there is a saying in the lion king that where the sun shines is my territory. I think Zhang Yiming's real dream is to be a super company, a super company that breaks through all the boundaries and patterns of human business history in the past."

However, whether you are an IP company or a super company, it is essentially to cultivate ecology.

This is exactly in line with the "super platform" theory put forward by "venture capital Queen" Xu Xin. "In the era of mobile Internet, there is no regional boss, all competition is a national battle, and all business is concentrated on mobile app. In such a new era, Internet enterprises either become a super platform or get out."

#I'm Huang Qingchun, deputy leader of huolf commercial consumption group. I pay attention to entertainment, social networking, game video and other fields. Industry communication plus wechat: 724051399. News clues can also be emailed to [email protected].