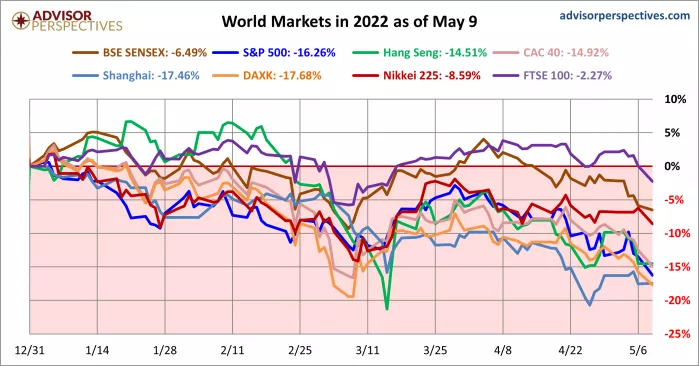

This week, the FTSE global index recorded the longest weekly decline since mid-2008, equivalent to the decline before the catastrophic collapse of Lehman Brothers caused by the subprime mortgage crisis. As the threat of US economic recession exacerbated investors' concerns, coupled with factors such as the epidemic and the continuation of the conflict between Russia and Ukraine, US and global stock markets fell for the sixth consecutive week this week.

The FTSE all world index is in its longest weekly decline since mid-2008, equivalent to the decline before the catastrophic collapse of Lehman Brothers caused by the subprime mortgage crisis. Despite the rebound late Friday, it was not enough to offset the brutal sell-off earlier this week.

The index fell 2.2% this week, while the US benchmark Standard & Poor's 500 index fell 2.4% and the technology dominated Nasdaq composite index fell 2.8%.

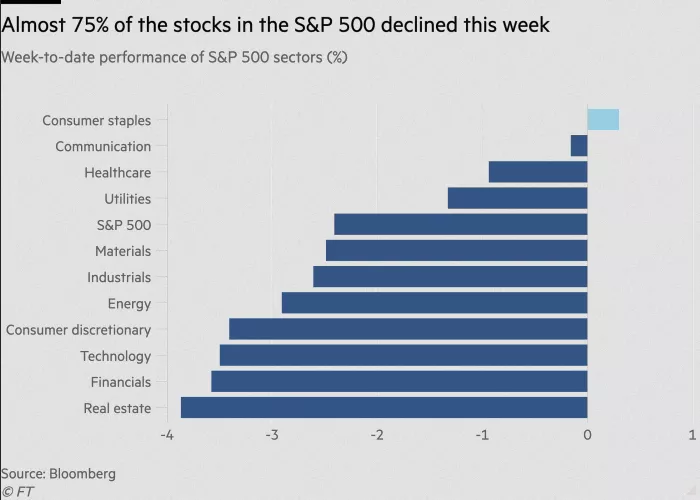

This week, the number of US stocks fell to a 52 week low, once exceeding 4100, the highest level since March 2020. Nearly 75% of the stocks in the S & P 500 index fell. According to the statistics of the financial times, the constituent stocks of the widely covered Russell 3000 index have fallen by nearly 40% on average from the 52 week high.

Friday's rally narrowly prevented the S & P 500 from officially falling into a bear market, but few investors would think the recent volatility would end.

Matt Stucky, portfolio manager at Northwest mutual wealth management, which manages $237 billion in assets, said:

"When the market is so unstable, it's really dangerous to try to play that game with your market timer hat. In fact, the market rebound will depend on whether the U.S. economy will fall into recession in a year."

The Fed's efforts to raise interest rates to fight inflation have put pressure on the stock market since the beginning of the year. The yield on 10-year US bonds has almost doubled so far this year, reducing the relative attractiveness of riskier assets such as stocks and putting pressure on the valuation of corporate bonds.

Even industries that usually benefit from higher interest rates are under pressure. The S & P 500 financial sector index fell 3.6% this week as investors bet that the increase in loan default rates will fully offset the increase in bank profit margins during the recession.

Earlier this month, Fed chairman Powell stressed that the Fed "will not hesitate" if it is necessary to take further measures to control inflation. On Thursday, he warned that the target of reducing inflation to 2% might not be achieved without experiencing "some pain", that is, curbing inflation would bring "some pain".

The latest April CPI data show that US inflation has hardly slowed, which increases concerns that the Fed may not be able to achieve a "soft landing" - slowing inflation while avoiding economic contraction.

Florian ielpo, cross asset portfolio manager of Lombard Odier, a Swiss investment agency, said:

"There is only one way out of the inflationary period we are currently experiencing - that is, a slowdown in economic activity."

Growth concerns have also temporarily halted the recent surge in government bond yields. As the stock market fell, investors were looking for safe assets, driving the 10-year US bond yield down 20 basis points to 2.93% this week.

Some investors are optimistic that any potential recession is now largely reflected in asset prices. T Rowe price, an asset management company with a scale of US $1.4 trillion, began to reduce its shares at the beginning of this year and shifted some of its shares from defensive stocks such as utilities to more impacted fields such as industry and semiconductors. Since then, the company has been gradually expanding its stock exposure.

David Giroux, who manages one of the company's flagship funds, predicts that the market will continue to fluctuate in the short term, but he is more optimistic about the longer-term outlook.

"If you wait for certainty to return and everything to return to normal, then you will be able to buy stocks that have risen by 30 percent."