Author / Li Ailin

What is a stable currency

Ust is an algorithmic stable currency issued by a Korean company called terra, whose value is anchored to the US dollar 1:1. Ust is not linked to the US dollar through US dollar assets such as cash or bonds, but is anchored by issuing a token called Luna. Investors buy Luna coins with legal currency to hold UST.

The operation principle of the stable currency is as follows: if the price of ust falls below US $1, investors can "destroy" UST, that is, permanently remove it from circulation in exchange for Luna currency worth US $1, which will reduce the supply of ust and boost its price; On the contrary, if ust rises below US $1, investors can "destroy" Luna coins in exchange for us $1 UST, which will increase the supply of ust and push its price down to US $1 again.

Theoretically, the market will carry out arbitrage spontaneously through the above two operations to objectively help maintain the anchoring relationship between ust and the US dollar. However, when the market encounters severe fluctuations, the stability mechanism that spontaneously regulates the relationship between supply and demand will fail, and with a large-scale run, the stable currency will no longer be stable, and then fall into a "death spiral".

According to coingecko, the cryptocurrency data platform, at present, the value of the whole stable currency market exceeds US $160 billion. The usdt issued by tether is the largest stable currency in the world, with a market value of about US $80 billion.

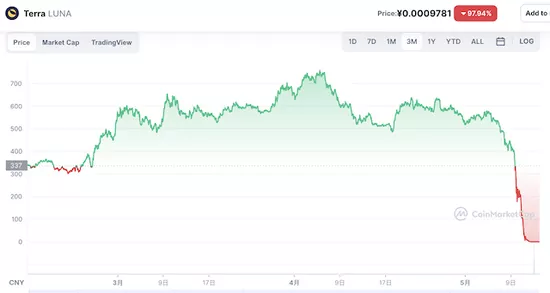

Xiaoka (a pseudonym), a senior user of the currency circle, said in an interview with the first financial reporter that before the collapse of UST, Terra promised investors that the annualized return on buying Luna coins was close to 20%, so it attracted a lot of funds to enter the market and raised the price of Luna coins. It was less than one dollar at the beginning of 2021 and soared to nearly 120 dollars in April this year. Therefore, the market value of ust expanded to 18 billion dollars.

Until May 8 local time, both ust and Luna coins started a sharp decline. Luna coins only took one week to return to zero. By May 13, ust price fell to 10 cents, falling 82% in the past 24 hours.

Coin circle Soros's accurate sniper

So how did the UST crash happen? Xiaoka told the first financial reporter that the coin circle called the incident a deliberate attack by "coin circle Soros". The sniper's "modus operandi" was the same as Soros, the hedge fund boss of that year.

In 1997, Soros first borrowed a large amount of Thai baht, and then suddenly sold a large amount in the market, resulting in the sharp decline of Thai baht. The Central Bank of Thailand tried to use foreign exchange reserves to buy Thai baht. However, the subsequent market selling pressure led to the sharp decline of Thai Baht against the US dollar, the collapse of the fixed exchange rate system, and finally ended with the sharp depreciation of Thai baht.

Xiaoka said that on May 8, Terra temporarily withdrew some ust liquidity due to the need to adjust the UST capital pool, resulting in a short decline in ust liquidity. Using this time window, the "currency circle Soros" sold a large number of ust in its hands, making the UST price deviate from US $1. The decoupling event immediately triggered a large-scale panic selling by ust holders, causing the UST price to accelerate the decline, and automatically triggered the implementation of the destruction mechanism between ust and Luna.

"When the price of ust falls, investors run on ust and turn it into Luna. The supply of Luna increases, the price drops sharply, and then trigger the selling of Luna holders... This forms a 'death spiral'. The value of ust is supported by investors buying Luna with real gold and silver. Once the price of Luna is gone, the value of ust will no longer exist." Xiao Ka explained.

The stable currency shock affected the mainstream cryptocurrency. On the 12th, bitcoin once plunged to near $25000, a new low since the end of 2020. Ethereum fell to $1700, and the market value of cryptocurrency market evaporated by $200 billion a day.

Xiaoka said that Terra had previously purchased bitcoin and Ethereum worth $3 billion as reserve assets of the UST project to mobilize funds and maintain the stability of the UST price when the anchor release triggered a sell-off. In this incident, the above funds, together with the funds of ust and Luna holders, have been burned.

As for the true face of "currency circle Soros", Xiao Ka said that people in the currency circle generally speculate that it is the mainstream financial institution on Wall Street. It is reported that citadel, one of the world's top ten hedge funds, launched the financial attack. The last time the agency went out of the circle, it also dates back to the retail investor war on Wall Street in February 2021.

From the beginning to the end of the UST crash, Xiao Ka concluded that the air side used two points to successfully snipe the stable currency. "First, Terra is used to carry out the operation of liquidity transfer and short ust and Luna in the contract market; second, cryptocurrency is more and more strongly correlated with US stocks. The NASDAQ index is deeply in a bear market and the market bearish sentiment reaches an extreme, resulting in a slight decline in the price of cryptocurrency, which will lead to a downward herding effect."

As of the 13th, the NASDAQ fell 27% from its record high set in November last year, and the market value of cryptocurrency market has been erased by $1 trillion in the past six months. Last November, bitcoin and Ethereum both hit new highs, climbing above $67800 and $4800 respectively. Now, their prices have fallen 58% and 60% from their historical highs.

"In front of traditional financial giants, digital currency has exposed its biggest weakness, that is, all behaviors are recorded in the chain and all transactions are made public to the public. It is a clear card, while traditional financial institutions are in the dark and can plan strategies. However, digital currency is still an experimental industry. I believe there will be innovation to solve the exposed problems in the future. This event has a far-reaching impact on the currency circle." Xiao Ka said.

US Treasury Secretary Janet Yellen expressed concern about the incident. At a congressional hearing on the 10th, she once again called on Congress to regulate the stable currency, saying that legislation was imminent. "I think the stable currency is a rapidly developing product and poses a risk to financial stability. We need a consistent legislative framework."

Last year, the supervision team led by the U.S. Treasury Department recommended that Congress enact legislation to regulate stable currency issuers similar to banks. Yellen said it is appropriate to complete the legislative goal this year.