Another 12 days will be the first anniversary of listing. However, Youxian may not be happy every day. In just a few months, the "first share of fresh e-commerce", which once had unlimited scenery, was already in the mire. Now it is more concerned: the market value has dropped by 98%; So far, no financial report of 2021 has been released; In the past half a month, we have received two notices from stark; The supplier comes to collect debts; Listed as executor by the court; Informed by the Ministry of industry and information technology

The "capital darling" listed on NASDAQ last June is facing delisting crisis. Questions from the outside world are also pressing down like mountains: when will the financial report be issued? In the next 180 days, is it expected to return to compliance and continue to stay in the US stock market? And, from the darling of capital to mired in the mire, why has daily Youxian come to this stage?

Optimize 40% every year. Is the layoff strategy unbalanced

In november2014, Xuzheng and Zeng bin, who had worked for Lenovo Group for more than ten years, founded daily Youxian and served as CEO and coo respectively. In the next month, daily Youxian officially began operation.

In the first half of 2018, the proportion of daily Youxian in the fresh e-commerce industry exceeded 50%, leading the industry for four consecutive quarters. At the end of that year, daiyouxian completed the distribution of fruits, vegetables, snacks, meat and eggs, and established a cold chain logistics system of "urban sorting center + community pre warehouse" in 20 major cities across the country.

A former employee of dairyfresh mentioned that he witnessed its rapid development and decline in the past two years. "The decline of daily excellent fresh food should start from the beginning of 2020. Before that, daily excellent fresh food developed rapidly without lack of money. The number of stores reached more than 700. It also put forward the slogan of turning over and buying vegetables in a year and a half."

The decline of daily excellent fresh food may be earlier. According to the data of the fourth quarter of 2019, Ding Dong has surpassed daily excellent fresh food.

In his opinion, Xu Zheng is good for his employees. Although the company is small, the office environment is OK. Although the conditions are general compared with those of large factories, it is relatively good compared with the developing small and medium-sized companies. However, due to the drawbacks left in the development stage, dairyfresh has been separated from the initial development track.

For example, the imbalance caused by the company's layoff strategy. After rounds of layoffs, there are more excellent leaders and fewer people working steadily every day. Internally, the credibility of the leadership has gradually declined, and capable employees have fled.

In the interview, many former employees of daily Youxian disclosed to Sina technology that daily Youxian really has the tradition of eliminating 10% at the end of each quarter.

The survival of the fittest seems to be the law of daily excellence. As early as 2018, zengbin, the co-founder of dairyfresh, emphasized the company's last elimination system: to make this company the place where excellent people are most willing to come and those who want to muddle along are the least willing to come.

Sunyanlei, vice president of human resources of daily excellent fresh, mentioned in a media interview earlier that daily excellent fresh adopts the "12421 rule", that is, talents are divided into five levels: A, B, C, D and E. The top 10% and 20% belong to the objects of key concern and cultivation; The middle 40% belong to stable export talents; The next 20% belong to the objects to be observed and "to be improved"; The remaining 10% will be eliminated by the bottom. The company conducts performance appraisal once a quarter, and 10% of the last employees will be "optimized".

"The boss thinks this is an incentive to work harder." A former employee of Youxian daily revealed that 40% of the employees will be eliminated after one year. But after optimization, there will be new moves. He believes that now the Internet companies are laying off workers as a whole, and Youxian will certainly lay off workers every day, but there are not as many rumors from the outside world.

Another former employee also said that the daily turnover of excellent and fresh personnel is relatively frequent, and the internal staff likes the elimination system. Generally, some people can be eliminated within three months, and even senior executives at the level of CXO are easy to lose power. Frequent optimization actions have led some competent employees to choose to leave under the torture of double pressure.

The supplier has been waiting for payment for goods for more than half a year, and some of them have stopped supplying goods

The crisis is also spreading outside.

Since the beginning of this year, suppliers have revealed that Youxian has been in arrears with payment and deposit every day. In March this year, some suppliers appeared in the daily Youxian Beijing headquarters building to collect debt and protect their rights.

A supplier in Beijing told sina science and technology that he had not violated any rules in the course of business, but he has been in arrears since last year, and the deposit has not been refunded.

"The normal accounting period is half a month. Last year, a notice was issued to extend the accounting period to one month, and the payment for goods was deducted for one month. Up to now, it has not been settled directly." The supplier said that he has supplied goods to several major e-commerce platforms, but the daily quantity of Youxian is not large, usually hundreds of thousands. After the payment is in arrears, he will no longer supply goods.

During this period, the supplier contacted the docking person of Youxian daily, and received replies within 24 hours, and then there was no following; Asked customer service and was kicked back and forth. As of May 16, I had contacted them for more than ten times, but they still hadn't solved the problem.

The above-mentioned supplier disclosed that he was in arrears of 38800 yuan in total, but a supplier friend of his has been in arrears of more than 3million yuan and has not been found yet.

The black cat platform has many complaints about similar problems, and many suppliers have been in arrears for millions of dollars. "At present, the daily Youxian South China warehouse has been basically shut down, 90% of the suppliers have stopped goods, and daily Youxian still has no repayment plan." One supplier said.

At the beginning of June, the case that Youxian daily was executed for 5.32 million yuan attracted attention. It is reported that this case is a business dispute between Youxian and its suppliers. After mediation by the court, the two sides have reached a settlement. At present, the case is being closed in accordance with normal procedures.

However, there are far more suppliers in arrears, and the payment event may continue to surround the company in the future.

How much money does Youxian owe the supplier? According to its financial report for the third quarter of 2021, as of the third quarter of 2021, the outstanding net debt of Youxian daily reached RMB 1.652 billion, an increase of 34% year-on-year. These accounts payable include three categories of supplier payments, freight of outsourcing distribution companies, and service fees of marketing service providers.

Compared with 2018-2020, the outstanding net amount of suppliers owed by Youxian daily was RMB 739million, RMB 1419million and RMB 1088million respectively, with a payment cycle of 40 days, 55 days and 72 days in the same period. It can be seen that the arrears have been increasing in recent years, and the payment cycle has been lengthening.

The dispute between Youxian and its suppliers is not a cold day, but a historical problem accumulated for a long time. In the future, this problem may continue to affect the credibility of Youxian daily in the market.

From capital darling to "being kidnapped by capital"

"Daily Youxian likes to learn from Ali, such as the logic of Ali people's freight yard, and then package some concepts for business publicity. In addition, Xu Zheng pays more attention to the to B business because it can be told to investors." An internal employee of Youxian daily disclosed to Sina Technology.

Once the daily excellent fresh food was indeed a sweet pastry in the eyes of capital.

According to tianyancha data, 10 rounds of financing have been completed before the listing of Youxian daily, with a total financing amount of more than US $1.5 billion. Investors include Qingdao Guoxin, Qingdao municipal government guidance fund, sunshine venture capital, CICC capital, tiger Global Fund, Tencent investment, Goldman Sachs Group and other well-known capitals.

In the past 5 or 6 years, daily Youxian has the largest financing amount among many fresh e-commerce providers. In July, 2020, daily Youxian announced that it had completed the round e financing of USD 495million, which was the largest single financing in the industry at that time.

After getting the real money from investors, Xu Zheng, who was once in the limelight, was confident that we had no financial difficulties.

Daily Youxian uses the front position model to tell investors a beautiful long-term value story. However, before the arrival of long-term value, daily Youxian is only playing the game of burning money repeatedly, making huge losses for years, and even people can not see the hope of profit.

Since 2018, daily Youxian's revenue has been growing, but by the third quarter of 2021, daily Youxian had accumulated a loss of more than 10billion yuan.

The daily fresh cash flow that has been burning money is red. By the end of the third quarter of 2021, its cash and cash equivalents were only RMB 2.172 billion, far lower than the current liabilities of RMB 3.223 billion. In the fourth quarter of 2021, if the loss expands again, its cash flow will not be able to support its debt scale.

With online shopping + instant distribution as the core, the front warehouse mode is a supply chain mode of "origin sorting center front warehouse user". In terms of site selection and coverage, the front warehouse stores fresh commodities in the community 1-3 kilometers away from users, which has a low site selection threshold and covers a wide number of communities. In terms of cost and stability, the cost of stores is reduced. The 1km distribution range reduces the logistics cost, shortens the distribution time, and is less affected by the epidemic.

However, the profitability of the front position model is weak, it is difficult to obtain and convert customer traffic, and the performance cost cannot be significantly reduced.

For daily fresh, the current growth mainly depends on losses. In addition, the business performance is poor and the cash flow is dangerous. On the other hand, without price advantage, it is difficult to expand the market in the third and fourth tier cities. In the limited space, if the profitability cannot be continuously improved, it will not be able to support its long-term stable development.

Urgent need for recovery, "joint stock" may solve the delisting crisis

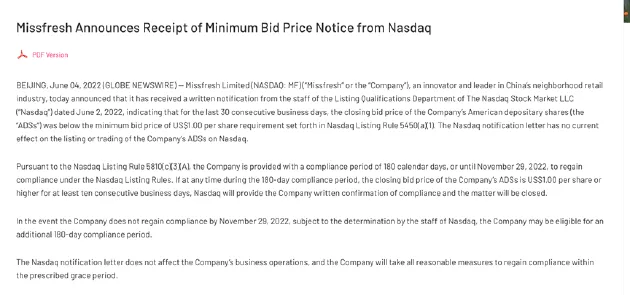

Previously, Youxian responded to the notification letter from Nasdaq through the investor relations website every day, which will not affect the company's business operation and the listing and trading of ads on NASDAQ. The company will take all reasonable measures to resume compliance within the specified grace period.

Next, in order to meet the compliance requirements, Youxian daily may have some positive actions or information. According to the market analysis, daily Youxian may adopt the way of joint stock (capital accumulation by shares, a way to avoid delisting) to save the market.

Haojunbo, the chief lawyer of Beijing haojunbo law firm, told sina science and technology that the simplest and feasible way for Youxian to increase its share price in the short term is to combine shares. Two shares are combined into one share, and ten shares into one share. In this way, nothing else needs to be changed, which is equivalent to reducing the total circulation of shares. In the past, many Chinese stocks have adopted this method.

An insider close to daily Youxian disclosed to sina science and technology that daily Youxian itself has a small plate, and it is possible for the share price to recover to more than $1 in a short time, so it will not go to the point of delisting.

He said that fresh e-commerce companies generally face the problem of large losses, including Ding Dong's shopping for vegetables, which has not come up with a particularly good solution. "But the good thing about Ding Dong's buying vegetables is that the US stock market believes in growth. This is its traditional mindset. When you see the growth of scale, you will feel that one day you will make a profit. In fact, fresh e-commerce is not the same as traditional e-commerce. The US stock market still maintains the thinking inertia of traditional e-commerce to treat fresh e-commerce." He believes that daily fresh food may be more balanced than Ding Dong's buying vegetables.

Of course, Ding Dong is still at a loss when buying vegetables, and the loss is larger than that of daily Youxian. Since the beginning of this year, the epidemic has been repeated, and the life of fresh e-commerce platforms has been difficult. HEMA has closed five stores in a row, and dingdong has also been exposed to closing stores, layoffs and salary cuts in some cities. From the once hot new economy track to the current problems, "rout" seems to be a problem facing the whole fresh e-commerce industry.

However, daily Youxian is the first one to go into the mire. Its story may also alert the fresh e-commerce industry. The dazzling capital story cannot withstand the burning of money, nor can financing support long-term growth. How to seek breakthrough and healthy growth is the key factor to cross the long slope and thick snow.