Is it a charging pile or an "insurance vending machine"? The old man was "Insured" when he scanned the code and charged in the community. Recently, the father of Ms. Hu, a citizen of Nanjing, inexplicably "Insured" two insurances, one for 255 yuan and one for 156 yuan, when scanning and charging the electric vehicle in the community. Relevant insurance brokerage companies are headquartered in Beijing, and it is not easy for consumers to surrender in Nanjing.

After complaining to multiple departments, Ms. Hu finally withdrew her insurance. The reporter's field experience found that at present, the charging pile installation company has carried out rectification, and the insurance advertisement set on the charging page has disappeared. The lawyer said that the practice of insurance brokerage companies has certain irregularities; This sales method is easy to cause disputes over claims. Senior insurance agents believe that this insurance process may be misleading, and it may be difficult for the policyholder to settle the claim successfully if he gets out of danger later.

Event restore

The old man went downstairs to scan the code and charge the electricity. He was inexplicably deducted more than 400 yuan of premium

Ms. Hu, who lives in Yingbin village, Jianye District, Nanjing, told Yangzi Evening News / Ziniu news that on the afternoon of May 5, her father charged in the public electric bicycle shed downstairs of the community, scanned the QR code next to the charging pile normally, entered the charging applet and paid the fee. After returning home, I found that there were two more insurance deduction records on wechat payment. One is 255 yuan for serious illness insurance, and the other is 156 yuan for China hiking world medical insurance. After careful communication with her father, Ms. Hu found that her father was misled into buying insurance.

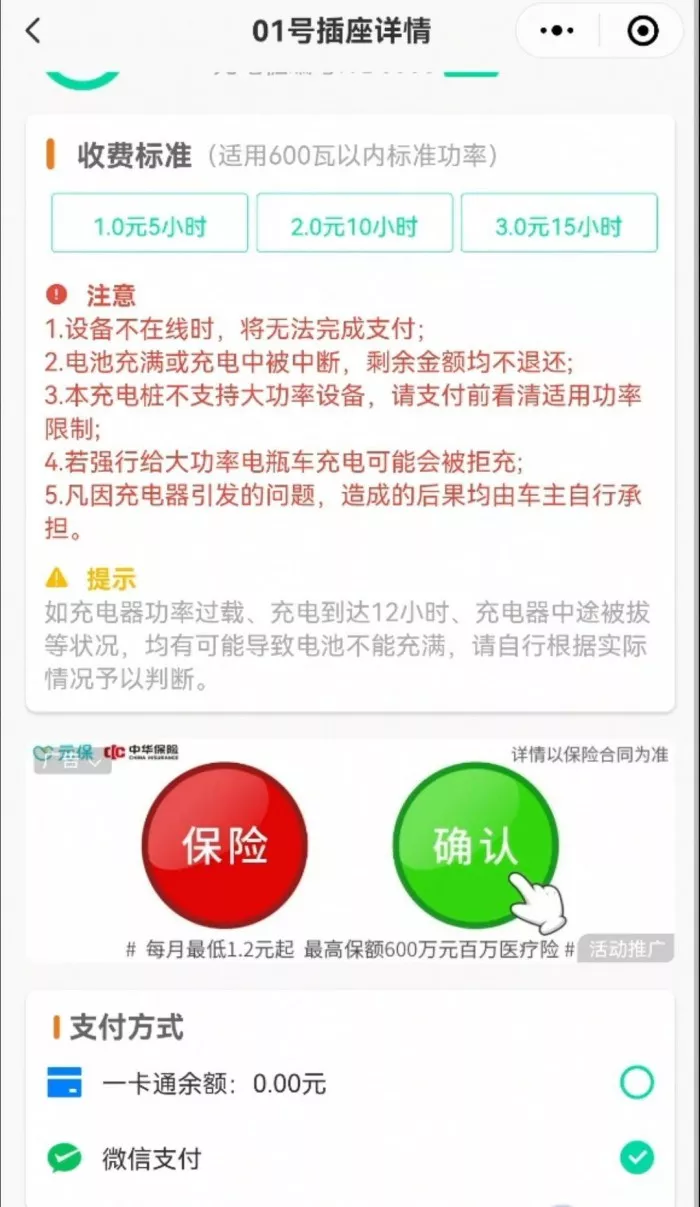

According to Ms. Hu, click the interface of the charging applet. The payment button of the charging fee is at the bottom, and the word is small and can't be seen clearly; The green "confirm" button of the insurance advertisement set above the payment button is large and obvious. The old man has poor eyesight, so it's easy to confuse the two.

In addition, after clicking the "confirm" button of the insurance, there are not too many risk prompts and detailed introduction to the insurance. The relevant information filling options are set to the sliding "fool" mode, which can be completed step by step. Therefore, Ms. Hu's father bought the insurance by mistake.

Ms. Hu hopes to surrender. However, when she communicated with the customer service of Yuanbao insurance broker, the other party said that she had fulfilled the obligation of disclosure and could not return; She also said that her father could only call when she withdrew her insurance. But after her father called, he not only didn't return it, but also continued to deduct money. "It's like kicking the ball." Later, she complained to many departments and was exhausted before the surrender was successful.

Latest progress

The installation company has rectified and the insurance advertisement on the page has disappeared

It is understood that the charging pile in Yingbin village is installed and maintained by Nanjing weijiehao company. Beilei community, Mochou Lake Street, Jianye District, Nanjing, where Yingbin village is located, has contacted the company to make rectification.

On May 10, the reporter had a field experience in Yingbin village, scanned the QR code next to the charging pile and found that the insurance advertisement on the charging page had disappeared.

However, if there is a similar situation in other communities, what will happen if consumers want to surrender? On May 12, the reporter of Yangzi Evening News / Ziniu news called the customer service number of Yuanbao insurance broker, saying that the old man scanned the code wrongly and wanted to surrender the insurance. After the robot customer service was transferred to the manual service, it took about 2 minutes for someone to answer. The manual customer service said that its headquarters is in Beijing. If it is a family misoperation, I need to call to deal with the surrender problem.

When the reporter asked, is it suspected of misleading for the charging pile to scan the code and charge but jump out of the insurance advertisement? The other party said they were sorry for the bad experience, but they had advertisements on major platforms and tips on the page. Maybe the insured didn't check it clearly.

Lawyer comments

There are certain irregularities in the practice of brokerage companies. It may be difficult to settle claims without informing the health status of insurance

Tang Hao, director of the insurance law professional committee of Nanjing Lawyers Association, believes that in the above cases, the practice of brokerage companies has certain irregularities.

First of all, insurance products are different from ordinary commodities. Insurers (i.e. insurance companies) need to make specific information and explanations on the protection contents of insurance contracts, insurance clauses, especially exemption clauses, so that policyholders can make insurance choices on the basis of full understanding. This kind of sales similar to the "pop-up window" on the web page can not let readers understand the content of the insurance in a short time, nor can it ensure that the insurer fully performs the obligation of disclosure. Moreover, this kind of sales method has great fuzziness due to factors such as place and time, which is easy to cause misoperation.

Secondly, according to the regulations of the regulatory authorities, insurance has a "hesitation period" (also known as the "cooling off period"), that is, the applicant can apply for cancellation of the contract and refund all premiums within a certain period of time (10 days for some companies and 15 days for others) after receiving the insurance contract. From the above case, Ms. Hu's father insured on May 5. Even if it was not misoperation, she could fully surrender the insurance during the "hesitation period".

In addition, for serious illness insurance, medical insurance and other types of insurance, the insurer shall inquire about the applicant's age, health status and past diseases, and the applicant shall truthfully inform them. The above sales methods cannot guarantee the procedure of health inquiry and notification to the applicant. If the applicant fails to inform, it is easy to cause disputes in the settlement of insurance claims.

Mr. Gu, a senior agent of an insurance company in Nanjing, believes that in the above case, the insurance process design of purchasing health insurance without providing relevant health instructions is flawed, and the normal health insurance sales interface needs to clearly indicate the health notice and fill in the health questionnaire. The elderly are likely to have basic diseases. "If there are health problems before insurance but they are not informed, it is difficult to get claims even if they are in danger in the later stage."

Say one more sentence

Don't let QR code become network "psoriasis"

Nowadays, there is usually a QR code next to the charging pile in the community. It is very convenient to scan the code for charging, but I didn't expect that there would be a mystery. Some consumers said that in fact, after scanning the code, there are not only insurance advertisements, "all kinds of things have been encountered."

In the past, small advertisements on electric poles, known as "psoriasis", have become a stubborn disease of urban environmental governance. With the popularity of the Internet and smart phones, the hidden advertisements in QR codes and network "pop ups" are like another kind of "psoriasis", which is disgusting.

Objectively speaking, insurance sales on the Internet platform, in addition to agent sales, give consumers a new choice channel, which is convenient and desirable. But insurance products are different from ordinary commodities. When selling insurance on the Internet, we should pay more attention to the appropriateness of sales, rather than "playing tricks", "playing a marginal ball" or even deliberately misleading. If this is done, it may be profitable in the short term and will damage the reputation and integrity of the company in the long term. It will be "voted with your feet" by consumers and may be punished by regulators.

QR code was originally intended to provide convenience for people. The Internet advocates openness and sharing. Businesses should provide clear space for consumers. The damage of network "psoriasis" to this kind of environment will eventually lose a lot because of small gains.