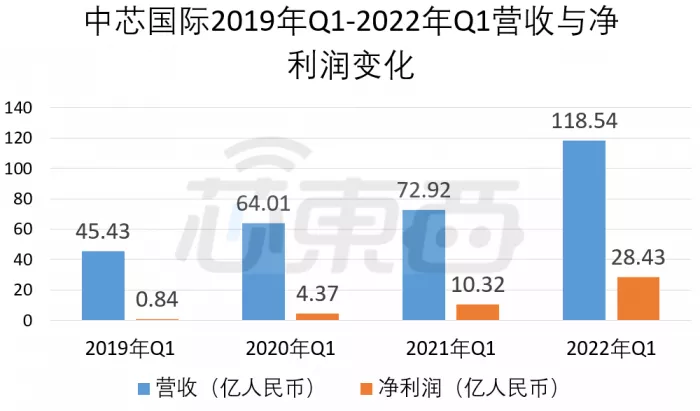

Today, SMIC held a teleconference on the financial report for the first quarter of 2022. SMIC's revenue in this quarter was 11.854 billion yuan, a year-on-year increase of 62.6%; Its net profit was 2.843 billion yuan, with a year-on-year increase of 175.5% and a gross profit margin of more than 40%**

**Author singing

*Edited by * panken

In the first quarter of 2022, SMIC invested 1.051 billion yuan in R & D, a year-on-year increase of 3.4%, accounting for 8.9% of the total revenue.

Gaoyonggang, chairman and chief financial officer of SMIC, zhaohaijun, CO chief executive officer and other senior executives attended the meeting and shared with analysts the situation and views on the impact of the COVID-19 epidemic, chip inventory and wafer OEM prices.

Zhao Haijun mentioned that SMIC was not affected by the epidemic in Tianjin and Shenzhen in the first quarter , the production and expansion of the plant can be completed as planned . For the Shanghai epidemic in the second quarter, SMIC has adopted closed-loop production and other measures, can barely deliver the customer orders in this quarter .

For chip inventory, the proportion of smartphone terminal revenue decreased , but MCU, power management, fast charging protocol, Wi Fi and other types of chips are still in short supply . In addition, SMIC did not comprehensively raise the OEM price, but focused on long-term cooperation and friendly negotiation with customers.

As of the noon closing of the science and innovation board, SMIC International reported 42.28 yuan / share, down 2.4%, with a total market value of 334.368 billion yuan.

01 .

Net profit soared 175%, and R & D investment exceeded 1 billion yuan

In the first quarter, the international revenue of Zhongxin increased by 11.86 billion yuan, with a year-on-year increase of 2026.2%; Its net profit was 2.843 billion yuan, a year-on-year increase of 175.5%. In the first quarter of 2022, SMIC invested 1.051 billion yuan in R & D, a year-on-year increase of 3.4%, accounting for 8.9% of the total revenue.

▲ changes in revenue and profit of SMIC Q1 from 2019 to 2022

In the first quarter of 2022, the gross profit margin of SMIC exceeded 40%, and the revenue and gross profit margin of SMIC exceeded expectations. Zhaohaijun said that there were two main reasons. First, due to the COVID-19, SMIC postponed the annual maintenance of some of its original factories; Second, the impact of the epidemic on factories in Tianjin and Shenzhen in the first quarter of 2022 was lower than expected.

In the teleconference, the epidemic was the focus of SMIC's management and analysts.

Zhao Haijun stressed that the epidemic in the first quarter mainly affected SMIC's Tianjin Factory . The volume of Tianjin factory is small, and the Tianjin epidemic ended in 9-10 days. has little impact on SMIC as a whole , or even "it will affect it if it affects it". At the same time, the 8-inch capacity of Tianjin plant is expanding, its expanded capacity has made up for the lost capacity**

Some analysts asked: if the epidemic continues to the third quarter, will it put some pressure on SMIC?

Zhao Haijun responded that the closed-loop production is mainly in Shanghai. At present, the epidemic in Shanghai is still continuing, and SMIC has not been able to give a complete and accurate reply. At the same time, the epidemic in Shanghai mainly affected the internal and long supply chain of SMIC .

Within the factory, it has little impact . However, in terms of the whole supply chain, the impact on downstream packaging, testing and transportation is different, the whole supply chain is greatly affected . How big the specific impact is, SMIC still has to wait until the second quarter or the complete end of the epidemic in Shanghai before giving a definite answer.

He added that at present, the delivery of SMIC's orders in April and may is a little slower, but delivery can still be completed by the end of June . However, from today to the next time, its further impact may not be able to end in the second quarter.

02 .

Cancel the division of process node revenue

The proportion of smart phones continues to decline

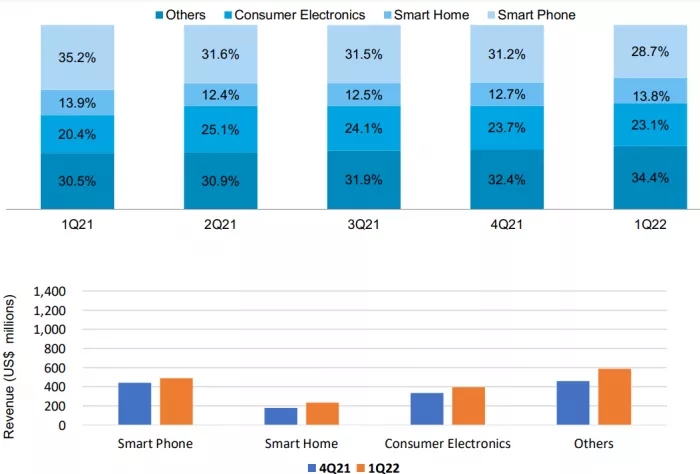

In terms of terminal applications, SMIC accounted for 28.7%, 13.8% and 23.1% of smartphone, smart home and consumer electronics applications in the first quarter respectively. Compared with the previous quarter, the proportion of Smartphone Application revenue continued to decline by 2.5%, which has decreased by 6.5% compared with the first quarter of 2021.

Compared with the first quarter of last year, the proportion of smart home has not changed much, with an increase of only 0.1 percentage points; The proportion of consumer electronics revenue increased by 2.7 percentage points.

▲ comparison of terminal application and international revenue

For the decline of smart phone terminal business, Zhao Haijun said that due to the factors of the Ukrainian war, it has a great impact on mobile phone brands, and the sales in relevant regions have been completely lost. In his view, global mobile phone sales should be reduced by at least 200 million , and mostly affects Chinese mobile phone brands .

But at the same time, the situation of chips used in smart phones is different. Chips such as power management, MCU and Wi Fi are still in short supply , so the situation is different.

Since this quarter, SMIC no longer provides the revenue proportion of each process node , but provides the revenue proportion divided by wafer inch.

Zhao Haijun said that SMIC has many characteristic processes, and 40nm, 28nm and other processes are later than those of peers. The construction of the factory is not divided according to the node, but according to the process. In its separate factory, 55nm, 40nm, 28nm and 22nm are done. The specific node wafer statistics are difficult and of low practical significance. Now, it emphasizes the market share and technical reserves of SMIC in specific terminal fields.

In the first quarter of this year, SMIC added 28000 pieces of 8-inch wafer capacity. It is expected that the capacity increment will exceed that of last year by the end of this year.

In this quarter, SMIC accounted for 33.5% of 8-inch wafers and 66.5% of 12 inch wafers. Compared with the fourth quarter of 2021, the proportion of SMIC 12 inch wafers increased by 2 percentage points.

▲ changes and comparison of the revenue of SMIC wafers with different sizes

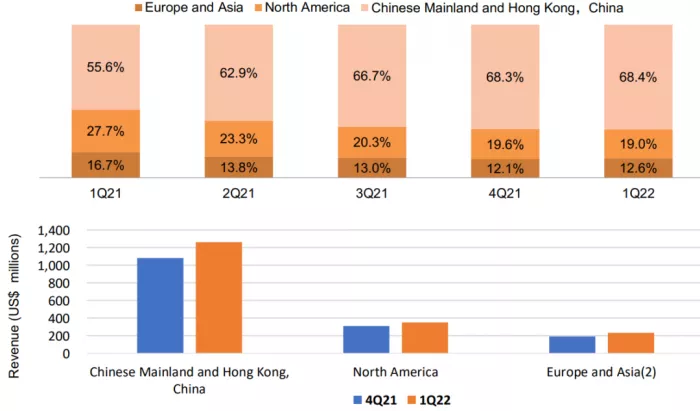

By region, the main shipping places of SMIC in this quarter are mainland China and Hong Kong, which accounted for 68.4% of the total revenue, basically the same as 68.3% in the previous quarter.

"North America" and "Europe and Asia" are the second and third largest markets of SMIC respectively, with North America accounting for 19% and Europe and Asia accounting for 12.6%.

On the whole, the proportion of revenue in mainland China and Hong Kong is still increasing.

▲ changes and comparison of regional revenue of SMIC

03 .

There is still a gap in wafer capacity

Supply chain delivery delay has the greatest impact

Zhao Haijun said that on the whole, the demand and increment of terminal silicon content have not been met due to the continuous upgrading of products, the general trend of interactive digitization of all things, the large increase of cloud storage volume, the demand for automotive electronics, the rise of industries such as Shanghai and green energy.

In contrast, the average growth of global integrated circuit wafer manufacturing capacity is still single digits. Even if wafer factories have accelerated the pace of capacity construction in the past two years, the tension of supply chain still makes the capacity unable to be completed in the short term . At the same time, the industrial transfer's concern about the regionalization and segmentation of the supply chain has accelerated the demand of end customers for production in various places, and there is a capacity gap in various places .

For the epidemic situation, SMIC carried out closed-loop management for the first time, implemented site zoning and classification management, and dredged transportation logistics. It also stabilized staff morale, stored epidemic prevention materials, and did a good job in emergency treatment and prevention, basically ensuring the continuity of production and operation and the delivery of customer orders.

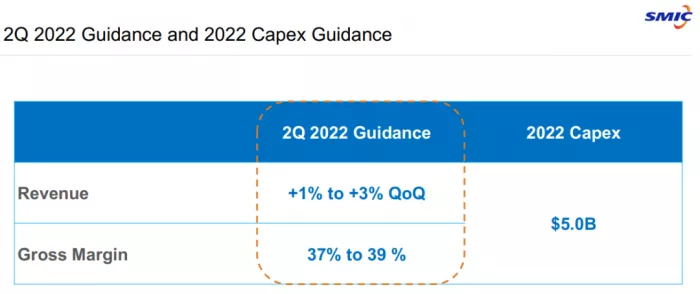

Because the annual repair of some SMIC factories was postponed to this quarter, and the short-term impact of the Shanghai epidemic on its capacity utilization. For the second quarter, SMIC holds a relatively conservative attitude, and its sales revenue is expected to increase by 1% - 3% month on month; The gross profit margin is in the range of 37% - 39%, slightly lower than that in the first quarter.

▲ SMIC's financial guidelines for the second quarter of 2022

Compared with the impact of the epidemic in Shanghai on production, SMIC's plan to build a factory and expand production in Shenzhen is relatively smooth.

Its 8-inch capacity in Shenzhen has been expanding, and the expansion is in line with SMIC's expectations. The 12 inch factory equipment in Shenzhen has been moved in since December last year. At present, it has been in trial production, and mass production can be realized as planned by the end of this year.

For the specific capacity impact, Zhao Haijun said that at present, the main impact is the delivery delay of suppliers , which is several months . The epidemic has little impact on the production and assembly in the plant. The reduction of shipping flights has an impact on the capacity supply of SMIC, and its delay has been included in the capacity.

Gao Yonggang, chairman and chief financial officer of SMIC, added that these factors have been taken into account when formulating the indicators for the second quarter, but they are not necessarily so comprehensive. At present, the impact of the epidemic on wafer output is expected to be 5%. SMIC is trying to control the impact within this range.

Some analysts mentioned that the prices of upstream raw materials and equipment are rising, and there are rumors of rising prices in wafer foundry. How does SMIC look at the future trend.

Zhao Haijun responded that it was mentioned in the previous teleconference in February that the prices of government managed supplies such as hydropower, gas and heat have increased, and some have increased very greatly. Raw materials are indeed rising, and some are even rising by more than 30%. In addition, employees' salaries will rise.

Therefore, SMIC expected that could erode 10% of SMIC's gross profit margin . In this quarter, many of SMIC's raw materials were purchased last year. In the second and third quarters, more new raw materials will be used, and the depreciation of equipment is also high, and the rise of cost will be slowly shown. This is also the reason why SMIC expects the gross profit margin to decline in the second quarter.

In terms of price increase, SMIC's principle is to conduct friendly negotiation with customers, and more consideration is given to long-term strategic cooperation rather than making more money in the short term. Some customers didn't raise the prices of SMIC in an all-round way, so some customers didn't raise the prices of SMIC.

Chip inventory is a topic of concern in the industry. Zhao Haijun mentioned that some products such as power management, mobile phone fast charging, Wi Fi and other chips are still out of stock. However, at present, electronic equipment products are being iterated, and the types of chips in shortage need to be divided again. For example, the demand for old Wi Fi 4 and Wi Fi 5 chips in mobile phones may not be so high.

He concluded: for inventory, what everyone can do must be surplus; It must be good to be an international head customer, but it must be bad to be in the back; It must be good to be in the international market, but it must be bad to be in the Chinese market** At present, SMIC is still in short supply, because its production capacity is largely inclined to the shortage of power management, MCU, Wi Fi 6 and so on.

04 .

Conclusion: the sales of low-end chips are damaged

The epidemic continues or impacts the supply chain

This quarter, SMIC's financial report and teleconference provided a certain reference for the current chip supply and the wafer manufacturing industry under the epidemic.

Overall, the current global wafer manufacturing market is still in a tight production capacity, but it has changed from the previous overall shortage to the shortage of MCU, power management chip and Wi Fi chip. At the same time, due to the iteration of terminal electronic equipment, the shortage of more advanced products intensifies and the demand for more mature products decreases.

For downstream chip design enterprises, enterprises with unique technology and can open the international market will have certain advantages in the competition. With the increase of chip production capacity and inventory, the sales of low-end chips will be affected.

Under the impact of the epidemic, wafer manufacturers such as SMIC have been less affected in Q1 and Q2 this year through closed-loop management. However, its downstream sealing and testing, transportation and supply chain have been impacted. If the epidemic continues, the supply capacity may be greatly affected.