In the morning of May 16, Beijing time, it is reported that U.S. technology stocks fell sharply last week, but rebounded on Friday, which seems to indicate that the endless selling is close to the end. Still, Apple The stock price has sent a warning signal, and even Friday's rebound is difficult to make up for. Over the past year or so, Apple's stock has been playing a role in stabilizing the market, but Apple's stock price fell sharply last week, falling 9% as of last Thursday.

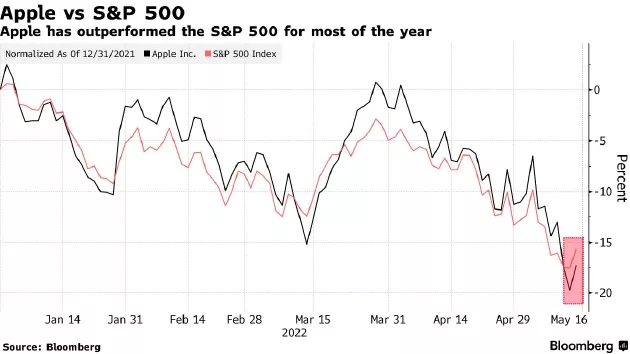

Despite the rebound on Friday, this year Apple Stocks still underperform the S & P 500. Analysts warned that the situation was worrying.

Nicholas colas, co-founder of datatrek research, said: "such signs are disturbing. The market is so difficult. Apple is one of the best stocks, but investors are still not interested." He believes that investors selling Apple shares is part of the general trend, and avoiding risk is the general trend.

For most of this year, Apple's stock outperformed the S & P 500 index. Apple has the largest weight in the S & P 500 index. After all, its valuation is more than $2 trillion, which will largely affect the direction of the index. If Apple's share price continues to fall this week, it may trigger another decline in the index.

Kim Forrest, chief investment officer and founder of bokeh capital partners, said: "when the stocks with the largest proportion continue to decline, it is mathematically impossible to want the S & P 500 index to rise." She believes that the sharp drop in Apple's share price has chilled investors.

On Friday, Apple's share price rose 3.2%, but it fell more than 6% last week, and its market value evaporated $165 billion. Last Wednesday, Saudi Aramco surpassed apple in market value thanks to rising oil prices.

When the market is volatile, investors often take Apple stock as a safe haven because of high profits. But now investors are selling speculative growth stocks because their valuations are based on future profit commitments and they are more vulnerable to high interest rates and inflation.

Forrest believes that from another point of view, selling may mean that investors finally give in and the stock price may rebound.

Despite the sell-off, retail investors continue to invest money and they are still buying Apple shares. On the second day of May, retail buyers of Apple's shares were ranked in the second day of May.