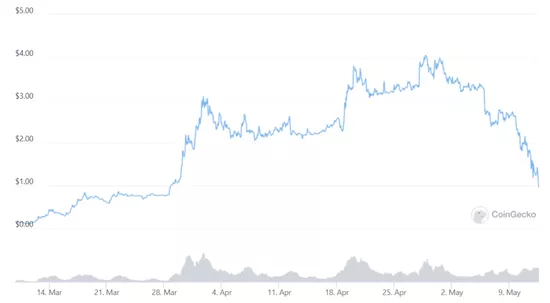

A crash set off another storm in the currency circle. The protagonist of this event is the blockchain project stepn, which once had the aura of "the light of the coin circle". In April this year, the GMT daily transaction volume of the project "governance token" exceeded US $2.5 billion, once surpassing bitcoin and Ethereum. However, in just one month since the end of April, it has plummeted by more than 79%, even collapsing the entire virtual currency market.

On May 27, stepn suddenly announced that users in Chinese Mainland would be refunded, and then triggered a sudden collapse in the prices of GMT and GST of "governance token" and "game token" of the project. As of 14:00 on May 29, GMT currency price fell by 32.6% in 24 hours.

The stepn project adopts a dual currency model. The "governance token" GMT is mainly used to encourage players to contribute to community governance, so as to improve the recognition of the platform value. It can be traded in the secondary market. "Game token" GST is mainly used for daily tasks and upgrades in the game. It is supplied in unlimited quantities and cannot be traded in the secondary market.

GMT currency price flash crash

GMT this round of sharp decline began with an announcement on May 27.

On the same day, stepn released the announcement on clearing and returning accounts in Chinese Mainland on social media, saying that in order to actively respond to relevant regulatory policies, move to earn app stepn announced that it would check accounts in Chinese Mainland. If users in Chinese Mainland were found, stepn would stop providing GPS and IP location services for their accounts at 24:00 on July 15, 2022 (East 8th District time, i.e. Beijing time) in accordance with the terms of use.

Stepn said in the announcement that if users expect to log in and use their accounts at GPS or IP locations in Chinese Mainland for a long time, they are encouraged to make their own decisions to deal with the assets in the application.

Subsequently, the currency circle was full of rumors such as "the founding team was arrested" and "GPS data was regulated", which caused a large number of investors to panic and began to sell GMT tokens on a large scale.

On May 28, yawn, co-founder of stepn, responded that there was no team in Chinese Mainland, and it was nonsense to be taken away for investigation.

However, this has not changed the depressed trend of GMT price. From the peak of $4.18 at the end of April to $0.87 today, GMT prices fell as much as 79%. According to mytoken data, compared with the decline of about 30% in Ethereum and bitcoin in the past month, the currency has been seriously oversold. Since May 3, in the GST token flow pool, the cancellation volume has shown a steady growth, resulting in the overall transaction volume in the downward stage.

Image source: CMC

Yujianing, executive director of Yuanyu Industry Committee of China Mobile Communications Federation, told the reporter of China Securities News that for projects such as stepn, new users and funds are the key to the long-term sustainable development of the project.

"The light of the coin circle" exploded

Stepn is one of the hottest projects in the coin circle at the beginning of 2022, with many participants. Statistics show that this blockchain based game focuses on the concept of "move to earn" and encourages players to earn rewards by walking, jogging and fast running.

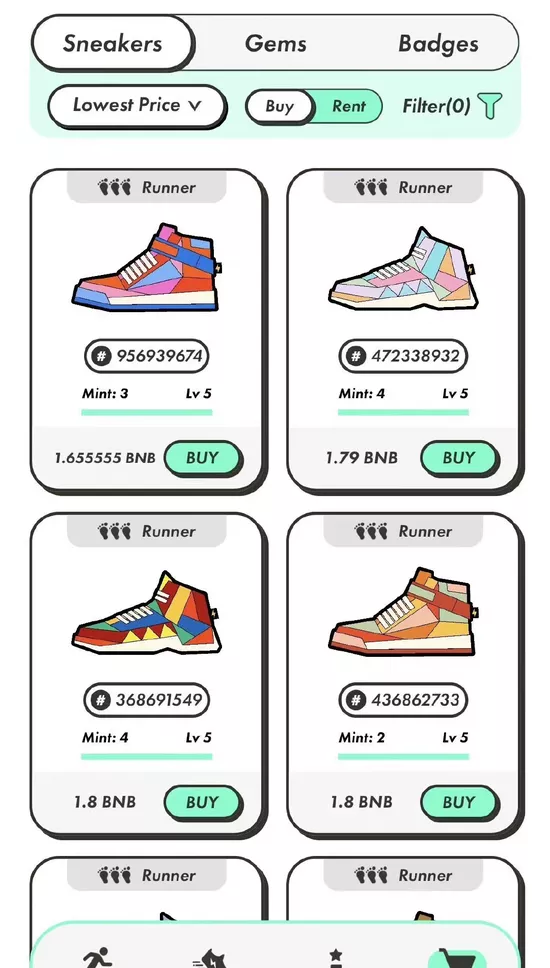

Users first need to buy NFT sneakers launched by stepn, and then earn "game token" GST and "governance token" GMT by walking or running outdoors in the real world. Among them, the supply of GST is unlimited, which is mainly used to upgrade the game experience, such as making, repairing and upgrading running shoes, or upgrading gems, unlocking sockets, etc. GST will be generated when users move in single person mode or background mode. GMT is mainly used for trading or in-game mortgage.

The playing method of earning tokens while running has enabled stepn to achieve rapid growth in the number of users in a short time and accumulated huge wealth. In November last year, stepn was launched for beta. During the beta phase, more than 1000 players from 43 countries were invited to participate, achieving a player retention rate of more than 70% a week. In only one month from March to April this year, the daily live users of stepn increased from 30000 to 400000, and the registered users exceeded 1million.

According to the disclosure of stepn, in the first quarter of this year, stepn made a profit of more than US $26million through the transaction royalties and handling fees in the application NFT market, with a valuation of more than US $1billion.

On January 20 this year, stepn announced that it had completed the seed round financing of USD 5million, and Sequoia Capital India and folius ventures led the investment, which made a great reputation at that time. Subsequently, Qian'an announced that it would soon launch stepn "governance token" GMT.

According to the information on the official website, the stepn team is mainly composed of overseas Chinese and was founded in Australia. Adidas Scott Dunlap, vice president of the group and CEO of Adidas runtastic, is the consultant of the project.

NFT investment is risky

So, buying a pair of NFT sneakers, can you really easily make money through sports?

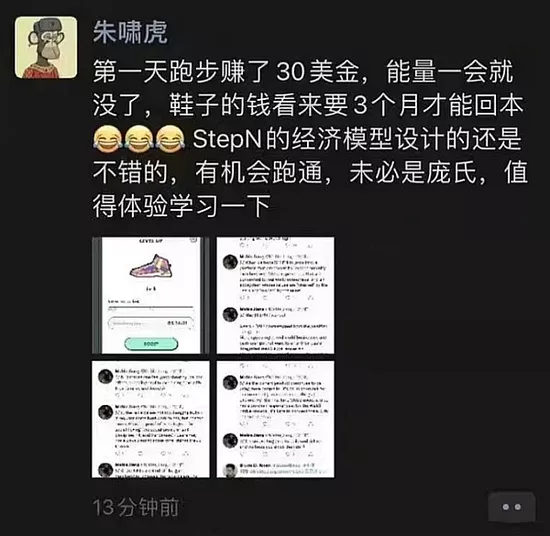

According to media reports, zhuxiaohu, managing director of Jinshajiang venture capital, recently bought a pair of stepn shoes. He shared his experience in his circle of friends: "on the first day of running, I made $30, but my energy was gone. It seems that it will take three months to get back the money for my shoes." Based on this calculation, the value of this pair of shoes is about 2700 dollars.

A currency circle investor even spent money on several houses to buy 1100 pairs of stepn shoes at one time.

An investor told a reporter from the China Securities Journal about her investment process: "this project was very popular at the beginning of the year. At that time, many communities called for four days' return of capital, making nearly five times a month, and more than 50 times easier for a young man. Who doesn't want to make money like this? I wondered if it could last forever."

She also said that in the early stage, users made some money. At that time, watching them go out and run every day would expose thousands of dollars of income. But now, when you go in, you pay for it. The price of the currency has fallen too much. The current cycle is very long, and many people have been set up.

In this regard, Yu Jianing said that the transaction flow of NFT involves the issuing public chain, trading platform, and even the defi architecture, among which there are relatively many processes involving smart contracts. Once there is a security risk, it is prone to large losses. In addition, NFT will appreciate or depreciate according to market demand. Once the market heat is relatively reduced and the phenomenon of following the trend of speculation is cooled, the asset value of NFT will also be greatly reduced, which will have an impact on its token price on another level.