Key points: 1, the revenue of Huawei's consumer business in 2021 directly returned to the level in 2017. In order to survive, Huawei returned to the tob field. However, analysts believe that this will have an impact on Lenovo, which relies on the commercial market 2. Lenovo attaches importance to the new actions of Huawei terminals, but it is also waiting and watching. At present, the product line of Huawei terminals in the commercial field is still relatively thin, and the supply is also a major problem. 3. Huawei terminal also needs to handle the relationship with Huawei enterprise business. After all, the two are independent accounting, and this kind of business coincidence is not the first time.

(sina science and Technology Co., Ltd. Zhang Jun)

At the end of 2010, Ren Zhengfei, founder of Huawei, held a symposium with Huawei terminal team. At the meeting, Huawei decided to shift from low-end mobile phones to high-end mobile phones, and shift its target users from tob (operator) to TOC.

The symposium was called the "Zunyi Conference" of Huawei mobile phones, which laid the foundation for the subsequent rise of Huawei mobile phones. The next year, Huawei's consumer business was officially established, and Yu Chengdong went into battle.

Ten years is a cycle.

Today, Huawei's consumer business has once again reached a turning point in history. Yu Chengdong recently announced that Huawei's consumer business was renamed back to China as a terminal, and its business scope was expanded again from TOC to tob (commercial).

In the face of force majeure, Huawei had to expand its business boundaries to seek survival. However, with Huawei's current business volume and R & D strength, every time it enters a new field, it is bound to set off a bloody storm.

Many industry experts believe that Huawei's terminal is largely Lenovo's cake this time. For a long time, the two companies have been compared by the outside world with different development routes. When they are really close to each other, what will be the result?

Huawei, back to four years ago

In 2021, Huawei ended several years of revenue growth and experienced annual revenue decline for the first time. The main reason behind this is the consumer business led by Yu Chengdong.

According to the financial report, Huawei's revenue in 2021 was 636.8 billion yuan, a year-on-year decrease of 28.6%; Among them, the consumer business income was 243.4 billion yuan, a year-on-year decrease of 49.6%, nearly halving compared with the same period of last year.

This is in sharp contrast to the situation in the past few years.

In 2012, the volume of Huawei's consumer business was less than a fraction of that of the operator's business. By 2018, it surpassed the operator's business for the first time with a rare annual growth rate and became Huawei's largest source of revenue.

Leading the rise of Huawei mobile phones has also established Yu Chengdong's position within Huawei. In March 2018, Huawei completed the general election of the board of directors, and Yu Chengdong became a member of the board of directors and managing director of Huawei; Within Huawei, there has always been a system and tradition of job rotation. Now Yu Chengdong has been in charge of consumer business for more than 10 years. Although there were rumors of job rotation in the middle of the journey, it was still as calm as a mountain in the end.

However, in 2021, the volume of Huawei's consumer business has returned to the scale in 2017, which can be said to return to four years ago overnight.

Yu Chengdong is also trying his best to expand new business, such as expanding the ecology of 1 + 8 + N, and even cooperating with car enterprises to sell cars offline.

In fact, when expanding the 1 + 8 + n ecosystem, Huawei has quietly laid out the commercial field.

In 2020, Huawei released its first commercial desktop package, named Huawei matestation b515, which is mainly aimed at the government, enterprises and other commercial desktop fields. Smart collaboration is one of the main selling points; In 2021, Huawei launched its first laser printer, Huawei pixlab x1, which is mainly equipped with Hongmeng OS, which can be close to the pop-up distribution network and print when the mobile phone touches.

Recently, Huawei officially announced its entry into the commercial field. Huawei's product layout in the commercial office field has been basically supplemented, covering seven product lines: notebook, desktop, display, tablet, printer, smart screen and wearable.

Another layout of Yu Chengdong also includes the expansion of Hongmeng OS at the b-end.

In 2021, when Hongmeng OS users exceeded 100 million, Huawei's consumer business unexpectedly jointly launched Hongmeng mining system with national energy group, named Kuang Hong. This is the first time that Hongmeng OS has expanded to the b-end, which also makes the outside world unable to understand.

Looking back, energy is one of the six major industries that Huawei terminals should focus on in the commercial field. First rely on Hongmeng OS software ecology to explore the way, and then keep up with the hardware system. Yu Chengdong can be said to have taken a long step.

Lenovo, nervous

Interestingly, on the same day that Huawei announced its entry into the commercial field, Lenovo also held a new product launch mainly for the commercial field, with a strong smell of gunpowder.

Lenovo's current revenue is mainly composed of smart device business, solution service business and infrastructure solution business. Among them, smart device business accounts for the majority of revenue, mainly including PC, mobile phone, IOT and other products.

Previously, when Huawei entered the notebook market, the outside world compared it with Lenovo. At that time, Lenovo CEO Yang Yuanqing responded to the media that Huawei needed a piece of advice: "new competitors, entering a new industry, must have certain learning opportunities, which may not be as beautiful as originally thought."

"Our opponent is too weak. Now Huawei PC has just begun to test the water, and its competitiveness will be stronger in the future." In 2019, Yu Chengdong once claimed that the NPs recommendation value of Huawei PC had ranked first in China, surpassing all its friends.

Although Huawei has been aggressive in the PC field, Lenovo's PC business is not only for individual consumers, but also a very huge market is government and enterprise procurement, that is, the commercial field.

At the recent 2022 Lenovo China business key customer Partner Conference, Lenovo executives said that the key customer business revenue in 2021 had exceeded 40 billion yuan, accounting for more than 40% of Lenovo's overall revenue in China. In April 2021, Liu Jun, President of Lenovo Group in China, disclosed Lenovo's situation in the field of commercial PC. According to the data, in the first three fiscal quarters of 2020 (April 2020 December 2020), the market share of PC sales volume of Lenovo's key customer business in China reached 55.5%. Among them, the market share of PC sales in the enterprise market reached 60.9%, with an annual increase of more than 3 percentage points, a record high; The market share of PC sales in the education market reached 59.1%, an increase of 3.4 percentage points year-on-year.

Now Huawei terminal officially announced to enter the commercial field, which also means that the two sides will compete fiercely on commercial PCs.

Both sides overlap not only PC, but also tablet and other products.

Liu Jun disclosed in April 2021 that Lenovo's sales of commercial tablets in China increased by 54% over the previous fiscal year, ranking first in market share; Consumer tablet sales were more than three times higher than in the previous fiscal year.

According to Wang Peng, associate professor of Renmin University of China, due to the shortage of chips in the mobile phone business, Huawei's terminal business really needs to find new growth points, and the commercial field is a direction that can be explored. Huawei's advantage is that the supply chain system, market reputation and marketing team owned by Huawei terminals for so many years can be reused in the commercial field; At the same time, Huawei's user base in operator business and enterprise business also coincides with Huawei's terminal in the commercial market, which can play a good chemical reaction and obtain more orders.

"Lenovo will face new strong competitors." He said.

An internal employee of Lenovo also told Sina technology that recently, Lenovo's internal and senior executives have indeed focused on key customer business. However, in his opinion, at present, Lenovo is still in the wait-and-see stage for Huawei terminals to enter the commercial field, and further actions of Huawei terminals need to be observed.

"Selling PCs to government and enterprise users may not be very effective. There is no neck like self-developed CPU." He said that Huawei's notebook used to be in the second quarter of the Chinese market, but then the market share began to decline all the way due to the interruption of chip supply.

It will take time to challenge the overlord

As the above Lenovo employees said, the first challenge for Huawei to make a difference in the field of commercial terminals is the problem of products and supply.

Xiang Ligang, a communications industry observer, told Sina technology that in a short period of time, we can't see that Huawei terminals will have a great impact on Lenovo's commercial products.

First, the commercial product series of Huawei terminals is relatively thin, and the selection range is not enough; Second, Huawei is more or less affected by chips, production and other factors. There is still a certain gap between Huawei terminals and Lenovo in the commercial field.

An industry person familiar with the government enterprise market said that in the government enterprise market, the performance can be less advanced, but the brand must be large and the quality and service must be reliable. Huawei should have no problem in these aspects. Next, the most important thing is how Huawei uses appropriate products to persuade the governments and enterprises that purchase Lenovo by default to change their strategies and turn to purchasing Huawei products.

Judging from the current market share, Huawei really needs to catch up in PC, tablet and other fields.

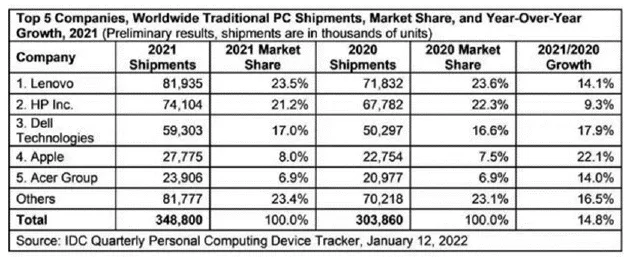

As far as PCs are concerned, IDC data shows that Lenovo PC (desktop, notebook and workstation) shipments accounted for 23.5% of the global share in 2021, ranking first in the world; Huawei was not on the list.

As for tablets, according to IDC data, Lenovo ranked third in the global tablet computers in 2021, selling 17.77 million units in 2021, with a year-on-year increase of 19.2% and a market share of 10.5%; The global market share of Huawei tablet was 5.7%, ranking fifth, and the shipment volume decreased by 32.1% year-on-year.

However, Xiang Ligang believes that in the long run, Huawei's R & D capability must be something Lenovo should fear in the commercial field. As Huawei terminals become richer and more competitive in product lines, it is expected to have a great impact on Lenovo in the commercial field.

In addition, it is worth noting that after Huawei terminals enter the commercial field, Huawei also needs to further sort out the internal architecture and solve the interest dispute between internal BGS.

Previously, Huawei's consumer business focused on individual users, while its enterprise business was oriented to the government and enterprise market, and its business lines and target users were very clear. However, when Huawei terminals also enter the government enterprise market, the boundaries of the two BGS overlap to a certain extent.

For example, Huawei terminal has a smart screen business for government and enterprises this time, and Huawei enterprise business also released the ideahub series of enterprise smart screen products for enterprise office scenes in 2020. Later, in the publicity caliber of Huawei's enterprise business, it was no longer called "enterprise smart screen", but "Huawei ideahub office treasure".

In the process of Yu Chengdong constantly expanding the boundary for Huawei terminals, this business coincidence has occurred more than once.

For example, Huawei terminal initially launched hicar system on the interconnection between mobile phones and car machines, and later even cooperated directly with car enterprises to sell cars in offline stores. This undoubtedly coincided with the business scope of intelligent vehicle solution bu. Later, Yu Chengdong served as CEO of intelligent vehicle Bu, and the problem was solved. However, Wang Jun, the former president of smart car Bu, was adjusted to coo, which was regarded as Yu Chengdong's victory in controlling the smart car business.

For another example, Huawei terminal has been developing its own Hongmeng OS, mainly for C-terminal; Huawei's computing product line is also developing its own Euler OS, mainly for the b-end. However, with the expansion of Hongmeng OS to the b-end, this balance is broken. Later, Huawei announced that it would connect the Hongmeng OS and Euler OS cores. The problem was partially solved, but the two OS still partially overlapped in the scene.

Overall, there are still many problems to be solved for Huawei terminals to make efforts in the commercial field, but its technical strength can not be underestimated. Lenovo needs to further adjust relevant strategies to deal with it.

However, according to Wang Peng, an associate professor at Renmin University of China, it is not a bad thing for the industry to have new competitors. "Competition will lead to better products and better teams, and users will ultimately benefit." He said.