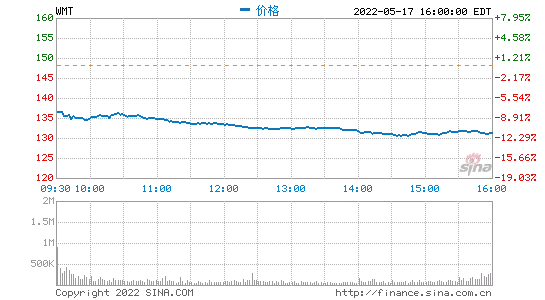

Retail giant Wal Mart fell nearly 11.4 percent to $131.35 on Tuesday, the biggest one-day decline since 1987. This means that the wealth of the Walton family (the world's richest family) behind it evaporated nearly $19 billion a day. The latest financial report shows that Wal Mart's net profit in the first quarter fell by nearly 25% year-on-year, while reducing the annual profit guidelines. The surge in US inflation has increased the pressure on Wal Mart's profit space and put the company's willingness to raise prices to the test.

According to the financial report, Wal Mart's revenue in the first quarter was US $141.57 billion, a year-on-year increase of 2.4%, exceeding the market expectation of US $138.94 billion. The net profit was US $2.05 billion, a year-on-year decrease of 25%; Diluted earnings per share was $0.74, down from $0.97 in the same period last year. Excluding special items, Wal Mart's adjusted earnings per share was $1.3, lower than the expected $1.48.

The company said that affected by inflation and employment cost pressure, it adjusted the annual EPS guideline to decrease by 1%, which had previously expected to achieve "medium single digit percentage increase" in this fiscal year.

Brett Biggs, Wal Mart's chief financial officer, said the sharp rise in fuel prices, rising labor costs and aggressive inventory levels had put pressure on the company's profits.