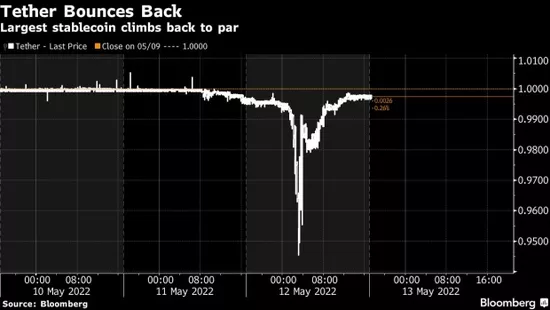

Recently, with the thunderstorm of terrausd (or UST), the third largest stable currency in the cryptocurrency market, the currency circle market is also alarmed. On Thursday, the world's largest stable currency, tether (usdt), also lost its 1:1 peg to the US dollar, falling to 94.55 cents at most. It is the lowest level since December 2020.

Subsequently, Paolo ardoino, tether's chief technology officer, rushed to appease investors. He stressed that there is an essential difference between usdt and ust: the company behind usdt has a large amount of US debt reserves. At present, there is no problem in dealing with redemption, and even repaid US $600 million in the past 24 hours.

Shortly after he calmed the market, the value of the usdt rebounded and has now resumed its peg to the US dollar.

CTO emphasizes that usdt is different from UST

This week, the world's third-largest stable currency ust (also known as terrausd), which should have been "stably linked" to the US dollar 1:1, has plummeted to less than 13 cents as of press time, far lower than the expected US dollar linked exchange rate. The value of Luna coin, another sister token used to absorb the impact of ust price, has almost completely evaporated, and its value has been less than 1 cent by the time of publication. Just a month ago, on April 5, the value of Luna reached a high of $119.5.

Affected by this, the world's largest stable currency, tether (i.e. usdt), also experienced a startling jump. Many traders worry that other stable currencies will follow suit after the UST crash. In addition, some users of usdt may be confused with the new encryption currency.

"It's definitely part of the chaos," ardoino said. "There are usdt related fears everywhere, and the market has become chaotic and panic."

In this regard, ardoino had an hour of conversation with cryptocurrency pioneer Samson mow and blockstream CEO Adam back on twitter space on Thursday, focusing on the differences between ust and usdt.

Ardoino stressed that ust's linked exchange rate system is mainly maintained through algorithms and transaction incentives, partially relying on bitcoin reserves. Usdt invests more than half of its foreign exchange reserves in US Treasury bonds. Therefore, when a large number of users want to redeem the fund, tether can quickly sell US Treasury bonds and avoid agreement default - which ust cannot do.

Usdt can still be redeemed normally

According to cryptocompare, usdt is the largest stable currency in the world, and about half of bitcoin is purchased through usdt. In contrast, the stable currency terrausd (also known as UST), which collapsed this week, is much smaller.

Ardoino said that after the collapse of UST, the company received $2 billion in redemption requests, which is an unusually high number. However, he said that as long as users request wire transfer, they can redeem usdt at 1:1 exchange rate at any time. Therefore, in fact, usdt has not been decoupled.

Ardoino also said that the mistake of ust was that it grew too fast to ensure normal redemption even if the price of cryptocurrency fell.

Ardoino also stressed that the use of ust is also limited to value-added - users invest it in decentralized finance and obtain up to 20% annual income - rather than payment or transaction. At the same time, usdt can be used to buy everything from daily necessities to homes.

"There is a real use behind usdt, which is not available in other projects." Samson mow said.