The virtual money market collapsed! On May 12, the virtual money market staged a super storm! Luna coins, once called "Maotai" by coin circle players, have plunged by more than 99%. The latest price of this cryptocurrency, which once reached US $119.5, has been less than 3 cents, and the wealth of tens of billions of dollars has almost returned to zero. At the same time, only dozens of virtual currencies with trading volume fell by 90% or more. Mainstream cryptocurrencies such as bitcoin and Ethereum also plummeted, with a decline of more than 10% and 20%.

According to the Bloomberg billionaires index, coinbase founder Brian Armstrong's wealth has evaporated by about 83% to $2.3 billion. Zhao CHANGPENG, chief executive of Qian'an, reduced his personal wealth from US $96 billion to US $11.6 billion, with an evaporation rate of nearly 90%. Since Tesla has previously announced the purchase of bitcoin, and the cost is about $32000, if the company still holds this currency, it may lose nearly $200 million.

It is worth mentioning that May 12 can be regarded as a "Black Thursday". In addition to the virtual currency, commodities almost fell across the board. So, what will be the impact on a shares?

Holocaust day

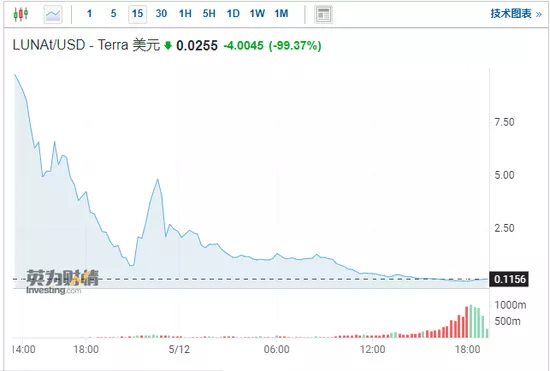

On May 12, the price of Luna currency continued to plummet from about US $6. The lowest price was less than 3 cents, only US $0.0255, a decline of 99.37%. This decline can be described as a "blood avalanche".

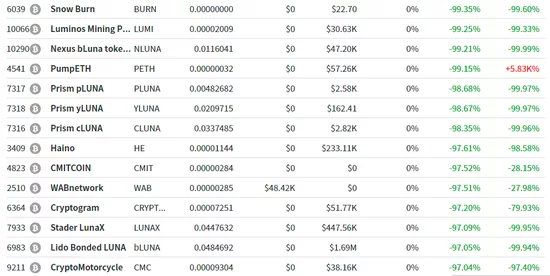

In fact, it is not only this virtual currency that has seen such a huge decline. Dozens of virtual currencies fell sharply on May 12.

The market value of bitcoin and ether, which are relatively high, fell by more than 10% and 20% respectively, and then stabilized. Previously, the dog coins brought by musk plummeted by nearly 25%.

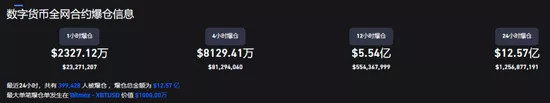

According to the data, nearly 400000 people broke their positions in the past 24 hours, with the largest single position breaking of US $10 million.

With the decline of virtual currency, 43 companies or institutions, including gray-scale investment, have held 1225600 bitcoins, according to the data of master on the chain of OPEC cloud chain quoted by financial news agency. More than $13 billion of bitcoin held by institutions and companies including Tesla has evaporated. Among them, Aker ASA lost US $21.62 million, metu lost US $19.75 million and plunwra lost US $16.95 million, ranking the top three. In addition, Tesla holds 40900 bitcoins, with an average price of $32000.

At the same time, the value of investment leaders has also plummeted recently. According to the Bloomberg billionaires index, coinbase founder Brian Armstrong's personal wealth was $13.7 billion in November last year. So far, his wealth has evaporated by about 83% to $2.3 billion.

CHANGPENG Zhao, chief executive of Qian'an, suffered more losses than Armstrong. According to the Bloomberg billionaire index in January, Zhao CHANGPENG's personal wealth was $96 billion, which had shrunk to $11.6 billion as of May 11, an evaporation rate of nearly 90%.

What happened

According to foreign media reports, a large part of the responsibility for the collapse of virtual currency is attributed to a virtual currency called terrausd.

Terrausd is one of the largest so-called "stability currencies", which means that it should remain close to the value of the legal tender (in this case, the US dollar). Virtual currency investors regard the stable currency as a checkpoint in the crypto game. When they do not buy more volatile currencies, they can "safely" store their investments. However, the value of terrausd fell to the lowest point of 30 cents this week, but terrausd "usually fluctuates by only a few thousandths".

Unlike some other stable currencies, terrausd is linked to virtual currency rather than directly to the legal tender that it should maintain parity. Terrausd is linked to Luna, which is built on the same blockchain. Terrausd and Luna's reserves are created and destroyed through algorithms to maintain their relative value. The rebound in either direction is less than a cent, making them worth buying and selling - the transactions between them also help stabilize the value.

Until this week, when the value of Luna fell by more than 75%, the value of terrausd also fell. At this time, do Kwon, the founder of terrausd, opened his reserve. He bought $3.5 billion worth of bitcoin to support terrausd and set off a shock wave in the already volatile virtual currency market.

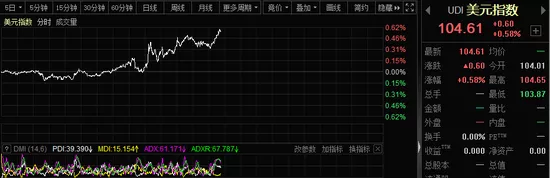

Analysts believe that the fundamental reason may be related to the continued rise of the US dollar index and the tightening of the liquidity of the US dollar. Due to the Fed's interest rate hike and table contraction, the stock market has continued to fall sharply recently. The structural varieties of the whole market are rich and complex. Some investors may use virtual currency as collateral or configure virtual currency in their portfolio. With the stock market falling, there is the possibility of sudden selling of virtual currency.

How does the decline of commodities affect a shares

It is worth mentioning that not only virtual currencies, but also commodities fell across the board. In the European session on May 12, LME tin fell by more than 10%, the lowest since September last year.

At the same time, the dollar index continued to rise, rising to more than 104.6 on May 12.

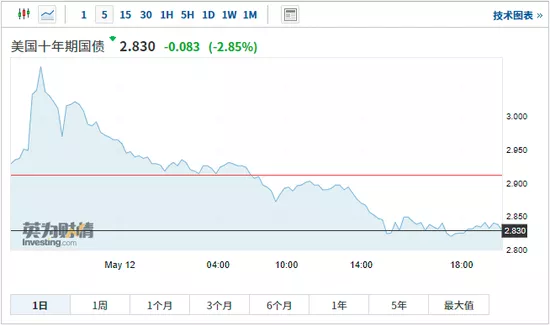

So, how will this be interpreted into the A-share market? This may also start with us debt. Recently, there was a strange phenomenon in the market. Although the US dollar rose, with the decline of all commodities, US bonds rebounded sharply, and the corresponding US bond yield fell sharply.

Analysts believe that if you want to find the support direction of a shares, it is US debt.

First, US bond yields continued to rise in the early stage and formed a rare upside down with China's treasury bond yields. To some extent, this will bring some constraints to China's monetary policy. With the correction of US bond yields, the upside down between the two has continued to narrow.

Secondly, from the correlation between US bond yield and A-share growth stocks, there is a high negative correlation. In other words, during the period of rising US bond yields, the valuation of A-share growth stocks will often be suppressed; On the contrary, it will help to improve the valuation of growth stocks. Therefore, with the decline of US bond yield, it may be conducive to the deduction of A-share growth stocks.

Third, we should also note that there may be two expectations for the decline of US bond yields this time: one is that inflation peaked and the other is risk aversion. From the perspective of global supply chain status, the peak of inflation and the decline of bulk commodities are very conducive to reducing the cost of China's manufacturing industry, which is conducive to the improvement of the valuation of growth stocks dominated by manufacturing industry. However, if funds enter the Treasury bond market for risk avoidance, it may affect the interpretation of growth stocks emotionally.