After the earnings announcement, Wal Mart and target both recorded the largest one-day decline since 1987. Wal Mart and target, the two largest retailers in the United States, recorded their biggest one-day declines since 1987 on Tuesday and Wednesday local time, with a total market value of more than $65 billion. Wall Street is worried that soaring inflation is threatening consumer demand and eroding corporate profitability. The tide of US stock selling continued, spreading from the technology and growth sector to other sectors.

Profits "eaten" by inflation

On Wednesday local time, target reported revenue of $25.17 billion in the last quarter, slightly higher than market expectations. However, dragged down by higher transportation costs, greater price cuts and lower than expected sales of non essential consumer goods, target's adjusted earnings per share in the last quarter was $2.19, a year-on-year decrease of nearly 41%, lower than the market expected $3.07.

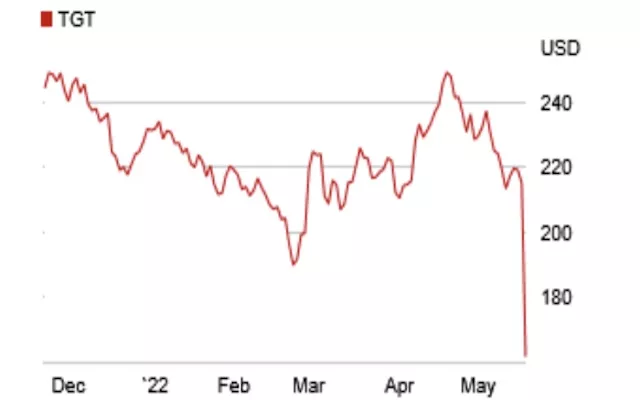

On Wednesday, target's share price plunged nearly 25%.

Coincidentally, Wal Mart's financial report released on Tuesday showed that its revenue in the last quarter was $141.57 billion, better than the market expectation, and the adjusted profit was $1.30, less than the market expectation of $1.48. The company also expects that earnings per share in the current fiscal year may decline by about 1%, which was previously predicted to be a single digit growth.

Wal Mart shares plunged more than 11% on Tuesday and fell 6.8% overnight.

With U.S. inflation hovering at a 40 year high, coupled with the crisis in Ukraine and the still paralyzed global supply chain, retail supermarkets are facing the dual pressure of soaring costs and consumption degradation.

Last quarter, target's operating profit margin fell to 5.3%, far less than the 8% expected by the market. The company said that factors such as the failure of inventory to arrive at the agreed time, as well as the increase in the number of employees employed in the distribution center and salary had an impact on profits.

At the earnings conference call, target CEO Brian Cornell admitted that "unusually high costs" were the main reason why enterprises failed to achieve their profit objectives. He warned that cost pressures "will continue in the short term" and have partially exceeded the scope of enterprise control.

Target warned that freight costs this year will be $1 billion higher than estimated three months ago.

On the other hand, as consumers seek better and cheaper goods, Wal Mart's price and scale advantages continue to highlight, boosting its share in the consumer market of daily groceries. Changes in consumer behavior put further pressure on corporate profits, and businesses sold more low profit commodities such as eggs and bread.

For example, Brett Biggs, Wal Mart's chief financial officer, said: "some customers with tight budgets have turned to cheaper brands or smaller specifications, such as self owned meat or half a gallon of milk."

U.S. Department of labor data show that U.S. food prices rose 9.4% in the past 12 months, the highest since April 1981.

Stephen wissink, an analyst at Jeffrey, an investment bank, said the two companies were sending similar signals, including rising operating costs and consumers turning more to spending on essential consumer goods and limiting non essential consumption.

According to the data released by the U.S. Department of labor on the 11th, the U.S. consumer price index (CPI) increased by 8.3% year-on-year in April, 0.2 percentage points lower than that in March, ending the continuous upward momentum since August 2021, indicating that the strongest inflation impact in 40 years may have reached its peak.

"Although most Wall Street analysts predict that this round of inflation is expected to peak in March this year, these retail enterprises send different signals that costs are still rising faster than consumer goods prices." Wessink added.

According to the data released by the U.S. Department of labor on the 12th, the U.S. producer price index (PPI) rose 11% year-on-year in April, maintaining double-digit growth for the fifth consecutive month, higher than the expected 10.7% and slightly lower than the previous value of 11.5%.

Selling tide spread

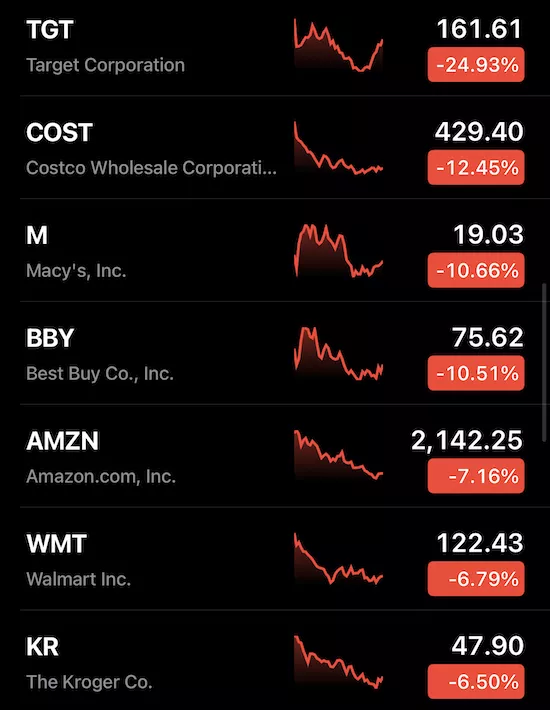

Overnight, the retail and consumer goods industries were heavily sold by investors, with Dick's sporting goods down 14.2%, Costco wholesale down 12.5% and best buy down 10.5%.

On the same day, the three major stock indexes of US stocks collapsed. The Dow Jones Industrial Average fell 1164.52 points, or 3.57%, to 31490.07, the largest one-day decline since June 2020.

With inflation and higher US bond yields, growth stocks and "home stocks" represented by Facebook's parent companies meta platforms and Naifei took the lead in opening this round of US stock selling earlier this year. However, with investors' concerns that the Fed's too fast interest rate hike may drag the economy into recession rising, more sectors are also struggling.

Since the beginning of the year, target and Wal Mart's shares have fallen by 30.17% and 15.38% respectively. In the same period, Netflix fell 70.59%, meta platforms fell 42.85%, Amazon fell 35.75%, Apple Down 20.7%.

Increased stagflation risk

On Tuesday local time, Fed chairman Powell reiterated that the Fed's determination to fight inflation is beyond doubt, even if it may lead to higher unemployment.

On Wednesday, US Treasury Secretary Janet Yellen warned before attending the G7 leaders' meeting that the rise in food and energy prices could drag the global economy into a period of stagflation and erode the living standards of people in all countries.

Therefore, in the current economic situation, the "open source" strategy of enterprises to further pass on price increases to consumers is being limited.

Tajit said that in order to remain competitive, he still preferred to bear higher costs rather than raise the price. "We have to make sure we don't lose our value proposition." The company's CEO Cornell said.

"We will first try to control the cost of suppliers." However, the chief financial officer of Wal Mart said, "if the inflation of some commodities continues to rise, we will have to go higher than Gus."

Overnight, Macy's plunged 10.66%, Nordstrom fell 9.35% and gap fell 9.84%. The three retail enterprises will successively announce their financial reports next week. As Wal Mart said that consumers began to reduce spending on non essential consumer goods, investors were worried that the performance of these enterprises might be further pressured.

Paul lejuez, an analyst at Citigroup, expects that Wal Mart may start to increase discounts to clean up excessive inventory of daily necessities in the previous quarter and put further pressure on its peers. In response to high inflation and supply chain uncertainty, Wal Mart's inventory rose 33% year-on-year in the last quarter.