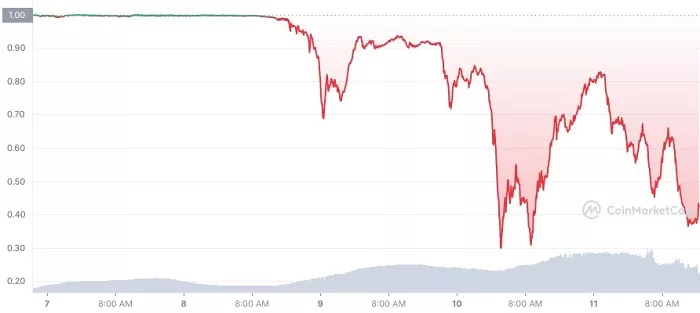

Terra's stable currency project (UST) has just had a very difficult and dark week. After losing its 1:1 anchor with the dollar, its price once fell to 40 cents Although LFG claimed to seek more than $1 billion in financial capital to maintain the currency stability of UST, it further fell below 30 cents on May 10 In order to survive the cryptocurrency crash, the troubled terrausd project frozen the entire blockchain (and the UST assets of investors) for about two hours on Thursday.

May 7-12 trend (screenshot via coinmarketcap)

Considering the attribute of "decentralized finance" advocated by the cryptocurrency community, freezing the blockchain is definitely a heavy blow.

Gu Ronghui, founder and CEO of blockchain security company certik, pointed out that although this is not the first time we have seen emergency actions affecting the whole chain, it has been a long time since the last time we traced back through hard bifurcation.

After investors lost confidence, the stampede resulted in the evaporation of $200 billion in one day. Even BTC, regarded as the first brother of the currency circle, fell to the level of December 2020 (less than $25000) on Thursday morning, less than half of the peak in November 2021.

The situation quickly spread to other cryptocurrencies, such as eth, which also lost about 20% of its market value in 24 hours. Terra's problems began on May 9, when the price of ust algorithm stable currency began to decline sharply.

In order to maintain the stability of ust currency, Terra designed a special mechanism for it. As a result, in the case of market collapse, the supply chain of Luna encrypted tokens matching with it in the opposite direction increased significantly.

Luna tokens more than tripled in two days. As a result, both it and ust fell into a "death spiral" and failed to recover.

This week's nightmare is obviously not what Terra and its investors want to see. However, the reality is that ust has fallen to 40 cents (not a dollar), and Luna has changed from a hundred dollars to almost worthless (about a penny).

In addition to Terra's UST, other stable currencies were also impacted by market panic. For example, on Thursday morning, tether (usdt), with the largest circulation, once fell below $1 (95 cents) on some exchanges, and then rebounded.

The reality of the sudden decline reminds people that even if they claim to remain anchored to the dollar, the economic concept behind most stable currencies is still highly experimental and far from as simple as ordinary people think.

On the other hand, under the chaos, US Treasury Secretary Janet Yellen has also been trying to promote the regulation of stable currency by the end of 2022, so as to avoid significant risks to the whole financial market.