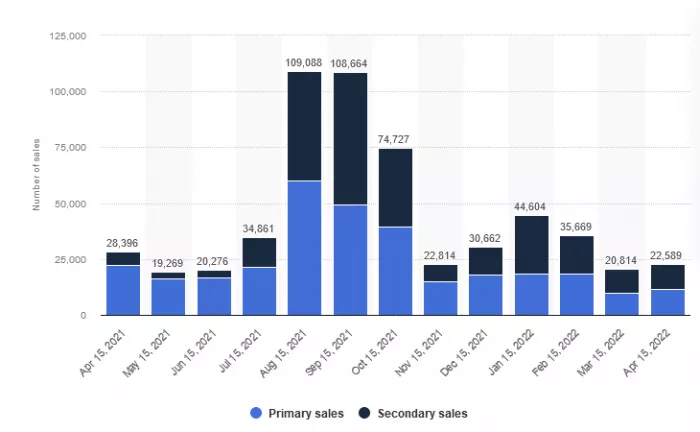

The Wall Street Journal wrote that if there is any sign of an average daily 19000 this week, the NFT market seems to be underperforming, down 92% from its high in September last year. At that time, there were about 225000 sales in the market. NFT's number of active wallets also fell by about 88%, with 14000 last week, rather than the high of 119000 in November.

The reasons for the depression include the rise of interest rates, squeezing risky bets in the financial market, among which NFT can be said to be the most speculative bet.

The technology focused Nasdaq composite index, like the account numbers of the NFT market, hit a high in November. But it has fallen by 23% in less than half a year, and bitcoin has fallen by 43%. To make matters worse, the Fed also plans to continue to raise interest rates in the coming weeks and next month. Market participants believe that with the end of the central bank's loose monetary policy, investors have to take more defensive positions, such as major consumer stocks.

Moreover, many NFT owners have found that their return on investment is not as good as when they bought it. The transaction price of some digital collections in April is even less than a fraction of the price when the hype was most intense. Reliability has also become a problem. It is reported that in the trading activities of NFT platform metaplex candy machine, due to the influx of robots, all heroes hope to use technical means to try to win the limited edition NFT, resulting in the paralysis of the blockchain for seven hours. It is reported that Solana was impacted by 6 million transaction requests per second, and eventually its memory was exhausted. Enough nodes in the 1730 nodes of the blockchain collapsed, resulting in insufficient votes to approve new blocks.