Wen Liande, by Dorje

Big short in the encryption Market: Terra Gemini is sniped

Crypto circle is experiencing a wonderful drama comparable to "big short", and an accurate blocking battle around Terra ecological algorithm to stabilize the currency ust is quietly staged.

Under the multiple effects of the Federal Reserve's announcement of interest rate hike and table contraction and the economic downturn, US stocks continued to decline. The Dow fell for five consecutive trading days, the lowest since early March 2021. With the decline of US stocks, the digital money market also ushered in a new round of cold winter. Bitcoin market sentiment was not boosted. It once fell below the US $30000 mark, with a single day decline of more than 10%, a 10 month low.

The overall downturn of the encryption market and the "ust anchor breaking event" are also the main incentives behind it. Luna and ust are highly sniped and fall into the death spiral.

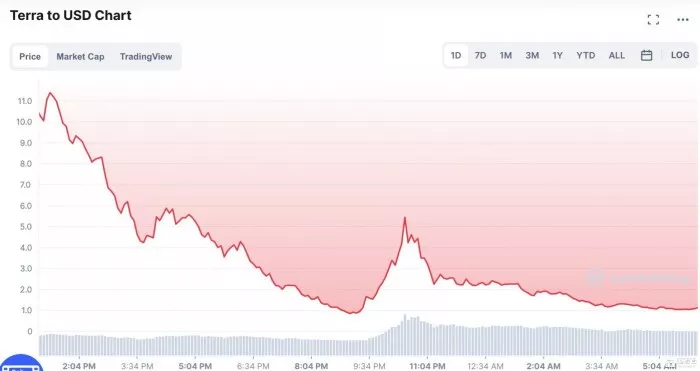

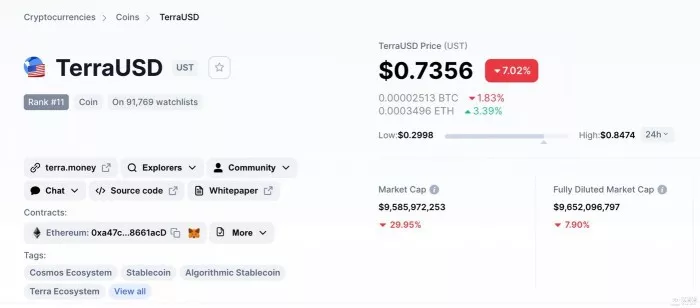

As of press time, the lowest price of ust has reached US $0.21, the current price has rebounded to US $0.823, and the lowest price of Luna has reached US $0.85, which is now reported as US $1.07, with a 24-hour decline of 93.09%.

Ust price trend

According to defillama's data, Terra's TVL is only $2.85 billion after experiencing a significant market contraction: anchor is $1.79 billion, mirror is $156 million and Lido is $142 million.

Terra's TVL

Behind Terra's ecological Prosperity: the hidden danger behind high TVL, ust seriously off anchor

In the encrypted world, the stable currency has always served as a bridge between the real world and the encrypted world, and the decentralized algorithm stable currency is known as the "coinage right" belonging to the encrypted aborigines.

The UST sit still algorithm is the top stable currency, which was once ranked in the top three in the category of stable currencies. Different from the way that usdt's real dollar reserves are anchored, TVL amounts to $20 billion. Terra ecology uses the dual currency mechanism of ust and Luna to dynamically balance the algorithm, and Luna acts as a "shock absorber" to absorb the volatility of UST. Ust is also jokingly called "arbitrage stable currency". When the price of ust moves up and down, Through Luna's financial algorithms such as burning arbitrage and additional issuance, we can maintain the price anchor of US $1.

The foundation for the normal operation of Terra's mechanism is that Luna's market value is higher than UST. Once there was an extreme situation that led to the upside down of market value, Luna will not be able to achieve price anchoring, and there will be a downward death spiral.

In order to prevent the problem of price de anchoring, Luna foundation guard (hereinafter referred to as LFG) under Terra ecology purchases and reserves a large number of BTCs through Luna and endorses ust by binding BTCs to deal with the problem of price de anchoring and upside down of market value.

In the past, the twin stars of ust and Luna once ranked among the top 20 in the encryption market. In addition to the aura of "seigniorage" of algorithmic stable currency, ust relies more on the liquidity provided by Terra ecological loan pledge platform anchor protocol, which has become one of the most used stable currencies. More than 70% of Terra ecological liquidity comes from the stimulation of nearly 20% apy of anchor protocol platform and the degenbox circular mortgage provided by abracadabra money for UST.

Excessive incentives are not all good. That's why the market has been questioning UST. As early as January, the founder of makerdao publicly shouted Terra USD (UST) and abracadabra on twitter Money's magic Internet money (MIM) is a reliable Ponzi scheme. You can certainly make a lot of money from them. But they are not built for flexibility. Once the market really changes, they will become zero.

The founder of makerdao said ust and MIM were reliable Ponzi schemes

The prosperity of the defi market has created Terra's ecological high TVL, but the problems of high savings and high leverage have also planted a bomb for the future. In particular, the stable currency agreement based on interest bearing assets, the "Dolly liquidity" provided by abracadabra for UST. On abracadabra, the UST mortgage is deposited into its degenbox Treasury, the MIM is mortgaged through UST, and the MIM is put into the curve platform for circular pledge. The two stable currencies are magically circular arbitrage. Right, The pattern of the story sounds very much like the template of the film big bear.

After the UST incident, Zhao CHANGPENG also tweeted: a "stable" currency with excessive leverage.

Zhao CHANGPENG said that ust is a "stable" currency with excessive leverage

Of course, Terra is also aware of the problem. On the one hand, Terra labs purchases BTC through Luna to anchor and endorse the value of UST, and serves as the foreign exchange reserve of Terra labs to prevent the problem of selling pressure caused by insufficient liquidity. On the other hand, it creates a 4pool including usdt, usdc, ust and FraX on curve, the largest defi agreement platform known as "defi legal savings account", to reduce the huge capital cost of 20% apy of anchor loan agreement, And thus to challenge the dominance of 3crv (usdc, usdt, DAI) on curve. Ust also hopes to focus on sniping Dai.

The sniper battle against ust took place at this time point. After terraform labs transferred $150 million of ust from curve to the capital exposure of reserve 4pool, some people were acutely aware of the problem of insufficient liquidity and reserves of UST. A sum of 84 million ust was sold across the chain to Ethereum, followed by a large number of ust whales began to sell on the exchange, causing ust decoupling.

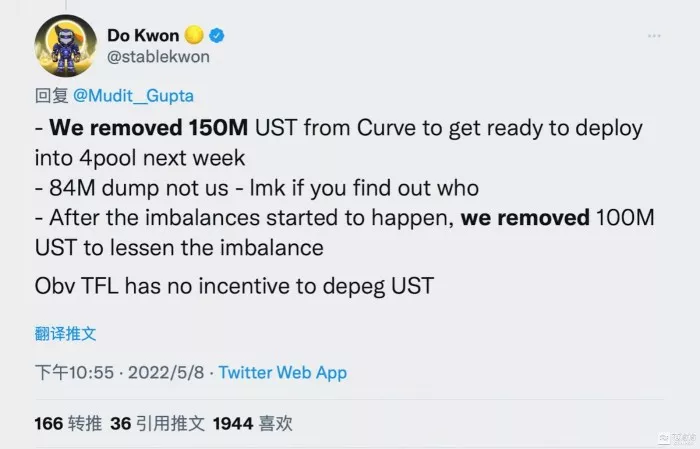

Do Kwon, founder of Terra, responded to clarification on the removal of liquidity, and LFG withdrew $100 million of ust from the capital pool to alleviate the problem of disconnection. "We removed 150 million ust from the curve to be deployed to 4pool next week, and the selling of 84 million ust was not us. After ust was de anchored, we removed 100 million ust to reduce de anchoring. Terrain labs had no motivation to remove ust anchoring.".

Do Kwon, founder of Terra, responded to clarification on the removal of liquidity

For a time, there were rumors in the market and even conspiracy theories that it was the drama directed and performed by the project party. Of course, Terra's LFG has been actively rescuing the market since then. More reasons may be that the exposure of capital exposure and the unhealthy ecology of asset packaging mortgage similar to synthetic CDO have been targeted by the long-planned encryption giant whale.

After ust broke its anchor, Terra ecology tried to actively rescue the market. The market maker behind ust emptied more than 50000 eth, while 42000 BTCs in LFG's account have also been transferred, and announced that it would loan us $750 million BTCs to help protect the UST link. And there is news that LFG is seeking more than $1 billion in financing to support UST, and jump trading, Celsius and Jane street have committed about $700 million.

LFG announced that it would link the loan to BTC to help protect UST

However, the market sentiment did not seem to be boosted. Controlled by the long-term negative market sentiment of breaking off the anchor of ust price and the downward sentiment of the market, a large number of ust funds began to withdraw. The market value and currency price of twin stars fell sharply by ust and Luna. Anchor funds began to flee in a large area, and panic triggered a double currency death spiral run.

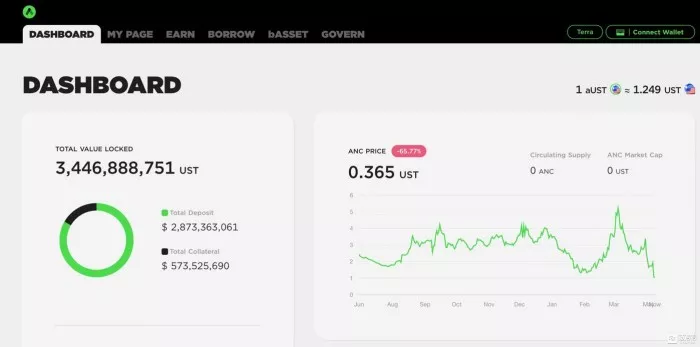

About $8 billion of funds fled from anchor, which is also the main source of pressure after being maliciously sniped. Although anchor actively recalled this part of funds through the redemption mechanism, the effect is not ideal under the market stampede. At present, the stock of ust on anchor is only $2.8 billion.

Ust stock on anchor

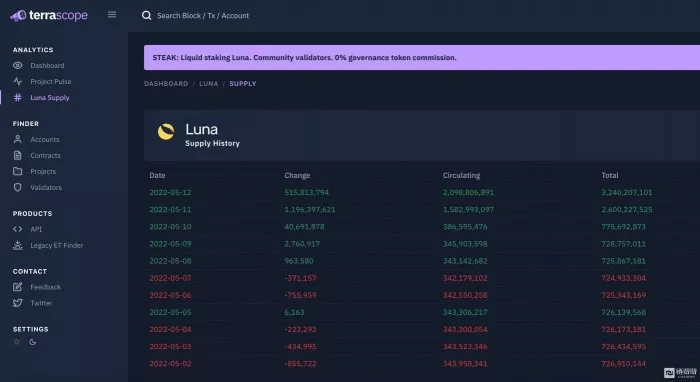

Luna market flow flux

Seems to be because of the "smashing the market rescue plan" "After it didn't have any effective effect, Terra realized that if she continued to smash the market rashly, she might continue to be sniped. Therefore, during the rapid decline of ust and Luna on the 11th, she didn't see any new actions of Terra team until the currency price hit the bottom. Within more than three hours from 12:00 p.m. on the 11th, ust fell from US $0.83 to US $0.3, while Luna, as the price anchor, fell from US $13.7 to US $6, and fell that night Break the $1 mark.

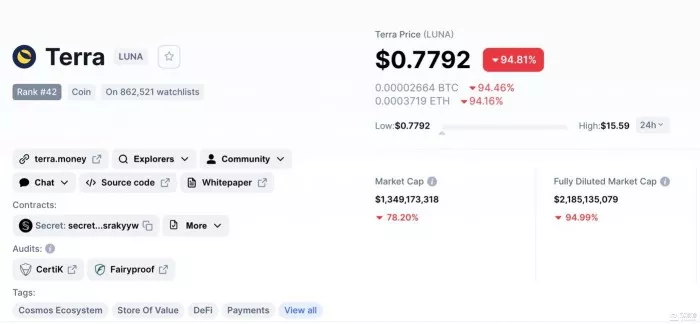

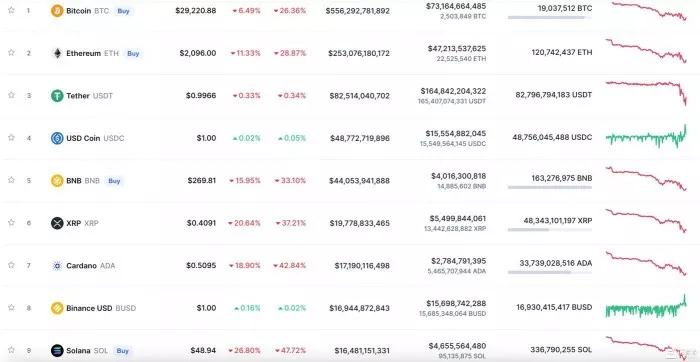

According to coinmarketcap data, the total market value of algorithmic stable currency ust has fallen to US $6.82 billion, which is lower than Dai (US $7.3 billion), ranking fifth in the stable currency market, after usdt (US $83.1 billion), usdc (US $48.4 billion), bus (US $17.1 billion) and Dai.

As of press time, Luna's market value stood at US $1.34 billion, while ust was US $9.5 billion. The upside down problem of market value is still serious.

Market follow-up dynamics: panic spread and the encryption market continued to decline

After the explosion of Terra ecological Gemini, South Korea encryption exchange upbit listed Luna as a prudent investment project, and coin security will also postpone the contract replacement between ust (shuttle) and ust (wormhole).

Terra analytics data show that the circulation supply of Luna has increased by 1.19 billion on May 11, and 416 million on May 12, with a total circulation supply of 1.754 billion, a record high of one-day additional issuance.

The resulting continuous shock continues, and LFG's follow-up rescue plan is not smooth. Larry cermak, vice president of the block research, said in reply to netizens that LFG's over $1 billion financing plan has failed. As far as I know, this transaction has failed.

The follow-up impact of the market continues. Although the UST price has rebounded, the problem of breaking the anchor has not been solved. The cryptocurrency market has experienced a wave of blood washing as a whole. Bitcoin has fallen below the $30000 mark, which is a new waist cut compared with the history since last November. The downward trend of mainstream currencies in the market has not been interrupted. 96 of the top 100 tokens in the market value show a downward trend, and the market confidence has been completely broken down.

In addition, the disaster of algorithmic stable currency may attract strong supervision from the government. In the financial stability report, the Federal Reserve stressed that the stable currency still has structural vulnerability. U.S. Treasury Secretary Yellen also publicly called for Congress to regulate the so-called "stable currency." digital assets may pose risks to the financial system. We are drafting a report on risks and "regulatory gaps". It is necessary to increase and coordinate regulatory attention. "

According to a document obtained by coindesk, the European Commission is considering stricter restrictions on the wide use of the stabilization currency.

Algorithmic stable currency has also encountered a new doubt in the market. Although algorithmic stable currency is a relatively decentralized digital currency in the stable currency track, the Ponzi doubt caused by its lack of value anchor has always existed, and now the breakdown of ust seems to overturn the possibility of BTC as collateral. Now we have to put a question mark on the future of algorithmic stable currency.

After experiencing an unprecedented crash, Terra founder do Kwon responded to the sharp decline of Luna and the disconnection of ust on social media. Do Kwon first acknowledged the failure of the current situation and the difficulties faced by the team, and then proposed the only solution.

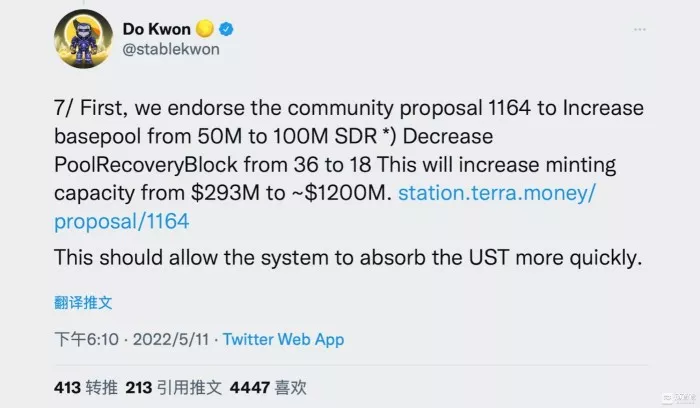

As for how to solve the current dilemma, Terra founder do Kwon said on Twitter: We support community proposal 1164 to increase the basic pool from 50m to 100m SDR and reduce poolrecoveryblock from 36 to 18, which will increase the mint capacity from US $293 million to about US $1.2 billion. "This is the only way. Luna is facing setbacks, but we will return.".

Do Kwon responded how to rescue the market

At present, Terra's solution is to focus on solving the problem of destocking of UST, accelerate the casting and additional issuance of Luna by burning UST, and realize the regression and anchoring of ust value. It seems that this is indeed an effective method after the failure of the asset rescue plan. However, whether Terra can succeed in saving the market in the end, a broken algorithm stable currency will lose nearly 80% of the stable currency at most, and an unlimited additional Luna, Will it be recognized by the market again? Not to mention whether people who suffered heavy losses because of Terra will continue to believe the story of this team.

More painful than the loss in the whole event is the collapse of consensus. After all, in the investment market, confidence is more important than gold**

With the overall shrinkage of cryptocurrency, the share prices of Companies in the encryption industry are also falling one after another. Coinbase, a US compliant cryptocurrency exchange, fell more than 25% last night, the largest intraday decline in history. In the past two months, the share price fell more than 70%, MicroStrategy fell nearly 12%, Jianan technology and marathon digital fell more than 6%, and riot blockchain fell nearly 6%. It seems that a cold winter of encryption is coming quietly.

As of press time, bitcoin's recent offer fell below $28000 and Ethereum's fell below $1900.