It is a common challenge for new energy automobile manufacturers that the "100 times" price increase still can not fill the gap of required chips. However, with the full resumption of production and work of Shanghai semiconductor industry chain, the "core shortage" problem is expected to be further alleviated. On June 1, the first financial reporter learned from a number of semiconductor industry chain companies that with the improvement of production and logistics efficiency, the chip capacity will be gradually expanded, and the production peak of master control, power, analog, sensing and storage chips in the automotive core chip sector is expected to usher in.

"Taking the automobile MCU as an example, it is estimated that more than 100 automobile customers have used our MCU products, and there are nearly 100 fixed-point projects, which will be mass produced in the second half of this year." The person in charge of Shanghai Fudan Microelectronics Group Co., Ltd. told the first finance and economics reporter that at present, the market side is also continuing to maintain communication with downstream customers, doing a good job of supply and demand docking and supply chain resource planning.

"The cost of electric vehicle chip has exceeded the battery pack"

Since this year, the demand for chips in many industries, including mobile phones and PCs, has entered a "downward stage", but the automotive industry is an exception.

On the afternoon of May 31, Shenhui, CEO of Weima automobile, sent a document on his personal social account, saying that recently, there has been another round of price increase in automotive chips, and according to the price increase, the chip cost of intelligent electric vehicles has exceeded that of battery packs.

Shenhui said: "Bosch's price increase is not hearsay. There are other Tier1. The electric vehicle industry has shifted from batteries to chips. Enterprises still need to do a good job in lean management to avoid the price increase of terminal products."

In the view of analysts, the biggest incentive behind the price rise is that the capacity of the supply chain cannot keep up.

Williamli, an analyst at counterpoint, a market research institution, told China business news that according to the market feedback received, the automotive industry is still in a state of shortage of key components. Even if the inventory continues to increase, it still cannot meet the orders accumulated from last year to now. Some end customers can only "wait hard", and some can't get new car orders in the second half of this year.

Helmut gassel, chief marketing officer of Infineon, an automotive chip supplier, disclosed the current order situation in mid May. He said that, including unconfirmed orders, the backlog of orders in Infineon from January to March 2022 increased by 19.4% month on month, reaching 37billion euros (about 263362 million yuan), more than three times the company's revenue in 2021 (111 euros). Another large power semiconductor manufacturer, Italy France semiconductor, has also sold out of capacity in 2022, and the backlog of orders is about 18 months.

In addition to key chips, common chips are also out of stock.

On May 26, hexiaopeng, chairman of Xiaopeng automobile, posted a video of "urgent demand for chips" on his microblog, saying that the most out of stock chips were "proprietary chips". "The absolute number of chips in a smart car is more than 5000, involving hundreds of kinds. At present, many of the chips out of stock are proprietary chips, and most of the missing chips are cheap chips, rather than the chips that need entrepreneurship or very expensive chips that everyone cares about." Hexiaopeng said.

Shanghai "core chain" and epidemic situation "race"

The resumption of work and production of Shanghai chip enterprises has an important impact on the normal operation of the national chip supply chain.

According to the statistics of China Semiconductor Association, in 2020, the output value of the integrated circuit industry in Shanghai accounted for 23% of the country, of which the design industry accounted for as much as 25% of the country, while the manufacturing and package testing accounted for 18% and 17% respectively.

"At present, our R & D team in Shanghai has 40 or 50 people, and the VP level has participated in at least hundreds of online conferences in the past few months." Xiang Zhichu, co-founder and vice president of strategy of houmo intelligence, told reporters that the executives went to the office for sanitation on May 31, and everyone was looking forward to meeting in the office.

Last year, houmo completed the streaming of the first memory computing integrated AI chip with great computing power, which was successfully lit up in May this year and ran through the mainstream intelligent driving algorithm. In order to meet the requirements of returning to work, houmo has prepared various disinfection materials in the office and provided an "emergency isolation point". Once a case occurs, there will be an isolation area.

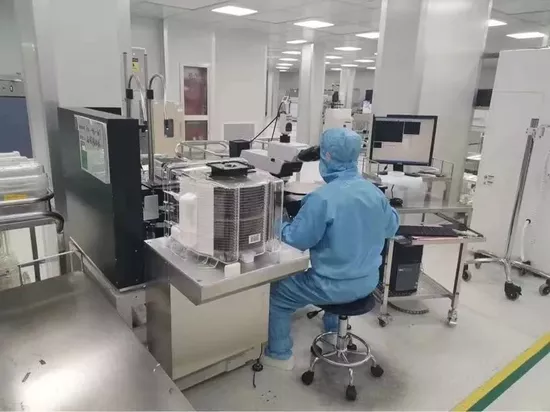

There are more than 50 chip design companies such as houmo, which are listed only in Shanghai. In addition to the necessary operation and maintenance personnel, these design companies can usually complete the design online during the epidemic prevention and control period. However, in order to ensure efficiency, some companies choose to stay in customer companies.

"As Shenzhen and Shanghai have been sealed off in succession, we have also made many options to mobilize resources in Shenzhen, Shanghai, Nanjing and other places, including FAE, business, R & D and other aspects." An engineer of Xinchi technology, a domestic car gauge chip enterprise, told the reporter that in order not to affect the progress, some employees have been stationed in the customer's office since March to carry out development work together. Some of them worked overtime until more than 12 a.m. on the first day and until 10 p.m. on the subsequent days due to tight project time.

At present, the car gauge chip of Xinchi covers more than 70% of the car factories in China. It is understood that the company's most MUC chip E3 has opened samples and development board applications to customers, and is expected to achieve mass production in the third quarter of this year. "During the whole epidemic prevention and control period, we actually felt like we were in a race with the epidemic." Said the engineer.

For chip enterprises, the speed of the "race" against the epidemic directly determines whether the orders can be kept. According to the data of Shanghai Municipal Commission of economy and information technology, Shanghai chip manufacturing enterprises have maintained more than 90% of their production capacity in the past few months.

In order to relieve the pressure of chip delivery, some chip companies have also adopted the "direct delivery" mode.

"On the eve of the sealing control, dozens of personnel from the company's testing and analysis, warehousing and logistics departments took the initiative to stay in the company. At the same time, they made efforts to carry out offline delivery and reduce the pressure of delivery. In addition, in order to ensure delivery, we adjusted the logistics path in advance and delivered the wafers to customers in the form of direct delivery from the film manufacturer to the testing supplier, direct delivery from the sealing and testing factory to the customer, and logistics combination relay." Fudan Microelectronics told reporters that during the epidemic, the company urgently expanded its warehouse in Shenzhen and entrusted some suppliers as temporary logistics transit stations. Taking Pudong as an example, Fudan Microelectronics temporarily borrowed its subsidiary Shanghai Hualing warehouse as a logistics transit station to realize the company's external circulation.

These measures successfully ensured the normal circulation of the whole production process of the above-mentioned enterprises and customers' demand for goods during the sealing and control period. It is reported that at present, the Fudan micro electric fm17660a has been evaluated for the digital key and vehicle mounted aromatherapy projects of several automobile OEMs, and has successively entered the small batch trial production. Among them, the SAIC digital key and Weilai vehicle mounted aromatherapy projects have been put into mass production.

According to the analysis institutions, with the gradual stabilization of the epidemic in various regions, the chip industry chain tends to be normal, and the synchronous promotion of both supply and demand sides will boost the demand and market confidence of various industries.

Elvis Hsu, general manager of cinno research semiconductor business unit, told reporters that the semiconductor market demand has undergone structural differentiation, and the demand for chips in automotive parts, HPC, servers and power is still strong. These are the future market driving forces. Enterprises should make more preparations to quickly meet the new opportunities after the epidemic.

Author / Li Na