Tencent music (NYSE: TME) today announced its unaudited financial results for the first quarter of fiscal year 2022 as of March 31. Tencent reported a year-on-year decrease of RMB 1.54 billion, or about RMB 1.56 billion, compared with the first quarter of last year; The net profit attributable to shareholders of the company was 609 million yuan (about 96 million US dollars), down 34% from 926 million yuan in the same period last year.

Tencent music (NYSE: TME) today announced its unaudited financial results for the first quarter of fiscal year 2022 as of March 31. Tencent reported a year-on-year decrease of RMB 1.54 billion, or about RMB 1.56 billion, compared with the first quarter of last year; The net profit attributable to shareholders of the company was 609 million yuan (about 96 million US dollars), down 34% from 926 million yuan in the same period last year

According to the data provided by Yahoo Finance website, the average of 10 Wall Street analysts had expected that Tencent music's earnings per share in the first quarter would reach US $0.07 based on non international financial reporting standards. According to the financial report, excluding the amortization of intangible assets and other assets, equity incentive expenses, net investment loss / income and income tax impact caused by business merger, Tencent music's diluted earnings per American depositary share in the first quarter of non international financial reporting standards was 0.54 yuan (about US $0.09), exceeding analysts' expectations.

In addition, on average, 12 Wall Street analysts had expected Tencent music's revenue to reach $1.23 billion in the first quarter. According to the financial report, the total revenue of Tencent music in the first quarter was 6.64 billion yuan (about $1.05 billion), less than analysts expected.

Financial and Operational Highlights:

-Tencent music's net profit in the first quarter was 649 million yuan ($102 million). The net profit of Tencent music in the first quarter of non International Financial Reporting Standards (excluding the amortization of intangible assets and other assets arising from business merger, equity incentive expenditure, net investment loss / income and income tax impact) was 939 million yuan (about US $148 million), an increase of 7.6% compared with the previous quarter.

-Tencent music's total revenue in the first quarter was 6.64 billion yuan (about US $1.05 billion), down 15.1% from the same period last year;

-Tencent music's revenue from music subscription services in the first quarter was 1.99 billion yuan ($314 million), an increase of 17.8% over the same period last year.

-The number of paying users of Tencent music online music services in the first quarter was 80.2 million, an increase of 31.7% over the same period last year. Compared with the previous quarter, the number of paying users of Tencent music online music services increased by 4 million in the first quarter. The payment rate of Tencent music's online music service in the first quarter was 13.3%, higher than 12.4% and 9.9% in the fourth quarter and the first quarter of fiscal 2021 respectively;

-Tencent music's net profit attributable to the company's shareholders in the first quarter was 609 million yuan ($96 million). Tencent music's net profit attributable to the company's shareholders in the first quarter (excluding the amortization of intangible assets and other assets, equity incentive expenses, net investment loss / income and income tax impact arising from business merger) was 899 million yuan (about 142 million US dollars).

Peng Jiaxin, executive chairman of Tencent Music Entertainment Group, said: "Based on the continuous deepening of the 'one body and two wings' strategy of content and platform, our online music subscription revenue increased by 18% in the same proportion in the first quarter, with more than 80 million online music paying users. Our efforts to optimize the cost structure and improve the efficiency of business operation have also achieved initial results, and the profitability of the company has improved month on month. In this era of increasing entertainment methods, we firmly believe that those who can provide users with Enterprises with differentiated experience have the ability to maintain their advantages. We are also pleased to see that the company's long-term investment in the original content production support system and Tencent musician platform continues to bring benefits to our users, musicians and the overall content ecology. Through these measures, we will continue to move forward to our long-term strategic goals and create more value for the music industry. "

Liang Zhu, CEO of Tencent Music Entertainment Group, said: "In the first quarter of 2022, we will continue to build an immersive music entertainment ecosystem and actively bring more possibilities for innovation to music lovers' listening, watching, singing and playing experiences. We will continue to refine and meet the personalized needs of multi circle groups and deepen the sense of identity and belonging between products and users. We have also further strengthened the all-round linkage with Tencent ecosystem, and the benefits are becoming more and more remarkable. In addition, we also provide more services for users Alienated long audio content, and committed to continue to improve the commercialization efficiency of the business through the membership model. Looking forward to the future, we will continue to improve the differentiation and specialization of our ecosystem, content, products and services, better provide high-quality services for the majority of music lovers, music creators and the whole music industry, and further release the infinite possibilities of music. "

Business highlights

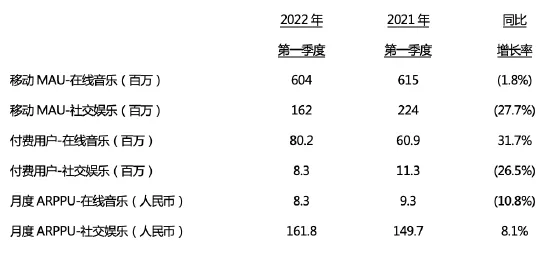

-The number of mobile Maus (monthly active users) of Tencent music's online music service in the first quarter was 604 million, down 1.8% from 615 million in the same period last year;

-Tencent music's mobile Mau of social entertainment services in the first quarter was 162 million, down 27.7% from 224 million in the same period last year;

-The number of paying users of Tencent music online music services in the first quarter was 80.2 million, an increase of 31.7% compared with 60.9 million in the same period last year;

-The number of paying users of social entertainment services of Tencent music in the first quarter was 8.3 million, down 26.5% from 11.3 million in the same period last year;

-The monthly arppu (average revenue per paid user) of Tencent music's online music service in the first quarter was 8.3 yuan, down 10.8% from 9.3 yuan in the same period last year;

-The monthly arppu of social entertainment services of Tencent music in the first quarter was 161.8 yuan, an increase of 8.1% compared with 149.7 yuan in the same period last year.

In the first quarter of 2022, thanks to high-quality content and services, effective promotion measures and the improvement of paying user loyalty, the company's online music paying users continued to achieve strong year-on-year and month on month growth, reaching a new breakthrough of 80.2 million. Although the company's online music mobile Mau decreased slightly year-on-year due to the short loss of some mild users and the reduction of promotion expenses brought by the company's cautious cost control.

In the first quarter of 2022, affected by the intensification of industry competition and changes in the macro environment, the company's social entertainment Mau and paying users decreased month on month. However, the company will continue to carry out product innovation and strengthen the exploration in more vertical fields of social entertainment, such as audio live broadcast, business going to sea and virtual interactive content, so as to continuously improve the competitiveness of the company.

Through Tencent musician platform, the company provides all-round services for emerging new musicians to help them show their talents and achieve their music dreams.

It has established a sustainable and diversified commercialization model for musicians to help them gain a more stable life while focusing on honing their skills. In the past 12 months, Tencent music has given more than 200 million yuan of income incentives to musicians.

Launched a new behind the scenes producer service, with more than 100000 creators joining in the first quarter; At the same time, it provides customized self-service operation tools for musicians to effectively improve the creation and exposure efficiency of musicians.

Based on rich creative scenes and strong online and offline publicity resources, continue to support high-quality music talents with ideals such as Liu Shuang and Qian Runyu, accelerate their career growth and continue to break the circle.

Based on the perfect original content production support system for systematically creating, evaluating and promoting music works, the company's support ability for original content production continues to increase.

With the support of QQ music "Galaxy plan" and cool dog music "Xingyao plan", the company is committed to comprehensively supporting the production, distribution, promotion and other stages of original content with technology, and helping the content improve its value in the core aspects such as the potential evaluation of song samples and the excavation of high-quality singers. In the first quarter, the company brought a series of original popular songs to the majority of music fans, including "mirage" and "dive". Once launched, these two songs were a great success, ranking at the top of many music lists, and both achieved a daily broadcast peak of more than 13 million in the first quarter.

The original content launched by the company in the core vertical fields such as game music, national style music and pop music is among the best both inside and outside the platform. In the first quarter, the company cooperated with popular games such as "peace elite", "glory of the king" and "hero League hand tour" under Tencent games to produce original songs sung by well-known singers such as Hua Chenyu, Chen Linang, Mao Buyi and Huang Zitao. These songs all reached the top of the list.

Through its Tencent music list, the company further laid a solid foundation for the new infrastructure of the industry and promoted the healthy and sustainable development of the industry. In the first quarter, the company released the annual inventory of Tencent music list. Through data scoring and professional evaluation of more than 1800 songs, the company comprehensively, truly, fairly and objectively reflected the overall picture of Chinese music in 2021. Once the inventory was released, it attracted extensive attention and heated discussion from professionals and music lovers in the society.

Based on the platform strategy of "one body and two wings", the company continues to enhance the four pillars of music and entertainment "listening, watching, singing and playing", create a more immersive use experience for users, and deepen the implementation of the company's commitment to continuous product innovation.

Listening: take the lead in launching three professional playing functions in China to significantly improve the sound quality and balance the music volume, so as to bring users a smoother music listening experience. By the end of the first quarter, driven by the optimization algorithm, the penetration rate of intelligent recommendation of QQ music of the company had reached a new high. The upgraded music index function also greatly enhances the user's sense of participation.

See: continue to strengthen the deepening linkage with wechat video number, launch the large-scale live benefit performance of "non Closing Concert in spring", create more active music scenes for artists and musicians during the epidemic, and help them enhance their music promotion ability. In addition to video, the company's platforms continue to improve in terms of pictures and more visualization, such as comment display and page dynamic effect.

Singing: the company launched the industry's first external sound correction and cloud mixing functions to greatly improve the effect of users' singing works.

Play: continue to upgrade the tmeland experience, and plan to launch special activities such as virtual concert in this virtual Music Carnival scene in the second quarter. In addition, the company also opened special virtual rooms for singers and musicians. For example, recently, the company opened VR rooms for Jay Chou and Wang Yuan respectively to realize the continuous integration of user listening experience and VR interactive experience.

Long audio: by activating the podcast ecology and strengthening the joint operation with popular IP, the company continues to expand the differentiated long audio content matrix, and helps the middle waist and long tail podcasts flourish in the TME ecology. Take the podcast laoshiqi's audio novel "notes on Tomb raiding of the northern school" as an example. The work has received 23 million broadcasts in only one month after it was launched on the platform.

The company is continuously committed to fulfilling its social responsibility. In the first quarter, the company launched the special project of "if music has shape" music care on World Autism day, and launched TME's first music public welfare digital collection "the most beautiful star". Through different online and offline contents and art forms, music can not only be heard, but also be seen and cherished, so as to advocate more social attention and love connection for autism groups.

Financial analysis:

Revenue:

Tencent music's total revenue in the first quarter was 6.64 billion yuan (about US $1.05 billion), a decrease of 1.18 billion yuan or 15.1% year-on-year compared with 7.82 billion yuan in the same period last year.

-Tencent music's revenue from online music services in the first quarter was 2.62 billion yuan ($413 million), down 4.8% from 2.75 billion yuan in the same period last year. The revenue of music subscription service of Tencent music in the first quarter was 1.99 billion yuan (about US $314 million), an increase of 17.8% compared with 1.69 billion yuan in the same period last year, mainly due to the year-on-year increase of 31.7% in the number of paying users. Arppu of online music service decreased to 8.3 yuan in the first quarter from 9.3 yuan in the same period of last year, mainly due to the company's promotional activities to attract users. Tencent music focuses on the high-quality growth of subscription revenue while maintaining a stable arppu. Due to the impact of industry adjustment on open screen advertising and the COVID-19 in some big cities, the revenue from advertising decreased year-on-year. Due to the agreement restructuring with some record companies, the sublicense revenue also decreased year-on-year.

Tencent music's revenue from social entertainment services and other businesses in the first quarter was 4.03 billion yuan (about $635 million), down 20.6% from 5.08 billion yuan in the same period last year. Compared with the same period in 2021, arppu of social entertainment services increased by 8.1% in the first quarter of 2022, while the number of paying users decreased by 26.5%. The decline is mainly due to changes in the macro environment and increased competition from other pan entertainment platforms.

Revenue cost:

The revenue cost of Tencent music in the first quarter was 4.78 billion yuan (about US $755 million), down 10.7% from 5.36 billion yuan in the same period last year. This decline was mainly due to the decrease in revenue from social entertainment services and advertising services, resulting in a decrease in revenue sharing fees and agency fees, while the revenue sharing ratio remained stable year-on-year. Due to the improvement of efficiency, the cost of content has also decreased.

Gross profit:

Tencent music's gross profit in the first quarter was 1.86 billion yuan (US $293 million), down 24.6% from 2.47 billion yuan in the same period last year. Tencent music's gross profit margin in the first quarter was 28.0%, compared with 31.5% in the same period last year, a year-on-year decrease of 3.5%. The decline in gross profit margin is mainly due to the increase in the proportion of online music revenue to revenue, while the gross profit margin of online music business is usually low.

Operating expenses during the period:

Tencent music's total operating expenditure in the first quarter was 1.34 billion yuan (about US $212 million), down 13.7% from 1.56 billion yuan in the same period last year. Tencent music's operating expenses accounted for 20.2% of total revenue in the first quarter, compared with 19.9% in the same period last year. After deducting the impact of post acquisition incentives, equity incentive expenses and amortization of intangible assets arising from the acquisition of lazy audio (lazy listening), the percentage of Tencent music's operating expenses in total revenue in the first quarter decreased by 0.4% year-on-year.

-Tencent music's sales and marketing expenditure in the first quarter was 330 million yuan (about US $52 million), down 50.9% from 672 million yuan in the same period last year. This decline is mainly due to the strengthening of the control of marketing expenses and the optimization of the overall promotion structure to improve operational efficiency. Tencent music continues to effectively manage the efficiency of external promotion channels and make better use of internal traffic to attract users and promote the company's brand.

Tencent music's general and administrative expenditure in the first quarter was 1.01 billion yuan (about 160 million US dollars), an increase of 14.6% compared with 883 million yuan in the same period last year. This growth is mainly due to the company's increased R & D investment to expand its competitive advantage in product and technological innovation. At the same time, Tencent music is closely monitoring staff related expenses and improving staff staffing efficiency. The post acquisition incentives, equity incentive expenses and amortization of intangible assets arising from the acquisition of lazy audio are also one of the reasons for the increase in general and administrative expenses.

Operating profit during the period:

Tencent music's operating profit in the first quarter was 749 million yuan ($118 million), compared with 1.16 billion yuan in the same period last year.

Income tax expenditure

The effective tax rate of Tencent music in the first quarter was 12.2%, compared with 11.5% in the same period in 2021. The increase of effective tax rate is mainly due to the fact that some entities of the company enjoy different tax preferences in 2021 and 2022. The effective tax rate represents Tencent music's specific estimate of the tax obligations and benefits applicable to the company each quarter.

Net profit and non IFRS net profit during the period:

Tencent music's net profit attributable to the company's shareholders in the first quarter was 609 million yuan (about US $96 million), down 34% from 926 million yuan in the same period last year. Tencent music's net profit attributable to shareholders of the company in the first quarter (excluding the amortization of intangible assets and other assets, equity incentive expenses, net investment loss / income and income tax impact arising from business merger) was 899 million yuan (about 142 million US dollars), compared with 1.18 billion yuan in the same period last year.

Loss per American depositary share:

Tencent music's basic and diluted earnings per American depositary share in the first quarter were 0.37 yuan (about US $0.06) and 0.37 yuan (about US $0.06) respectively. Excluding the amortization of intangible assets and other assets, equity incentive expenses, net investment loss / income and income tax impact arising from business merger, the basic and diluted earnings per American depositary share of Tencent music in the first quarter were RMB 0.55 (about US $0.09) and RMB 0.54 (about US $0.09) respectively. The weighted total outstanding shares of Tencent's 1.6 billion basic depositary shares and Tencent's 1.6 billion basic depositary shares in the first quarter were 400 million, respectively. Each American depositary share of Tencent music represents 2 class a ordinary shares.

Cash and cash equivalents:

As of March 31, 2022, the total amount of cash, cash equivalents, time deposits and short-term investments held by Tencent music was 25.93 billion yuan (about US $4.09 billion), compared with 24.69 billion yuan as of December 31, 2021. The increase in total cash, cash equivalents, time deposits and short-term investments was mainly due to the cash flow generated from business operations reaching 2.49 billion yuan (about US $393 million), which was partially offset by cash used to purchase land use rights and share repurchases. The above consolidated balance is also affected by changes in the exchange rate of RMB against the US dollar on different balance sheet dates. On March 31, 2022, the exchange rate of RMB against the US dollar was 6.3393 to 1.

Share repurchase plan:

According to the 2022 stock repurchase plan announced by Tencent music on March 28, 2021, as of the date of this financial report, Tencent music has repurchased about 73.3 million American Depositary Shares in cash from the open market, with a total amount of about $674 million.

Teleconferencing:

After the release of the financial report, Tencent music management team will hold a financial report teleconference at 8 p.m. Eastern time on May 16 (8 a.m. Beijing time on May 17). The telephone numbers for listening to the teleconference are as follows:

Us: + 1-888-317-6003

International: + 1-412-317-6061

Chinese Mainland: 400-120-6115

Hong Kong, China: 800-963-976

Access code: 2636670

Before May 23, 2022, you can listen to the conference call recording by dialing the following numbers:

Us: + 1-877-344-7529

International: + 1-412-317-0088

Access code: 4475331

In addition, Tencent music investor relations channel https://ir.tencentmusic.com/ Teleconference, webcast and audio recording will be provided.

Stock price response:

On the same day, Tencent music shares rose $0.05, or 1.22%, to $4.15 in regular trading on the New York Stock Exchange. In the subsequent after hours trading as of 5:43 p.m. Eastern time on Monday (5:43 a.m. Beijing time on Tuesday), Tencent music shares rose another $0.06, or 1.45%, to $4.21. In the past 52 weeks, the highest price of Tencent music was $16.53 and the lowest price was $2.95. (Tang Feng)