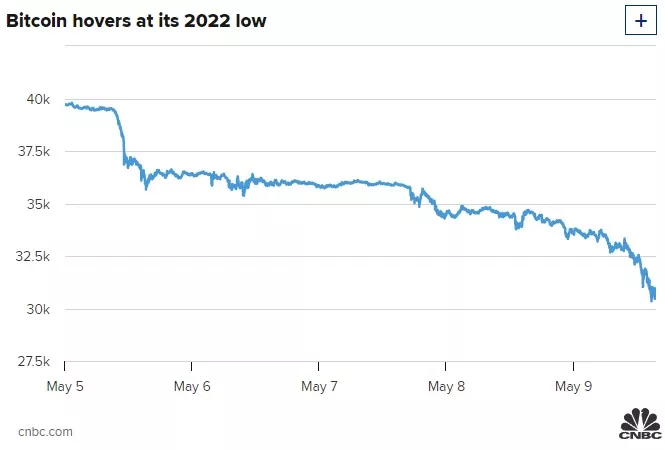

According to coin metrics, bitcoin fell 10.5% to $30953.94 on May 9. Last week, bitcoin just hit a recent high of $40000 / piece. After hitting an all-time high last November, bitcoin has fallen by about 53% so far. Ethereum also fell sharply, down 11.6% to US $2269.39/piece.

In the past year or so, cryptocurrency led by bitcoin has been highly correlated with the trend of stocks, especially technology stocks. On May 9, the three major stock indexes of the United States all fell, and the cryptocurrency also fell. In fact, since May 5, cryptocurrencies have continued to fall against the backdrop of a sell-off in the stock market.

Steven McClurg, chief investment officer of Valkyrie investments, said investors had sold off in the stock and cryptocurrency markets in order to avoid risks. Due to the large number of listed companies involved in blockchain and digital assets, the correlation between stocks and cryptocurrencies has become more obvious in recent months, and may develop synchronously for some time in the future.

Yuya Hasegawa, an analyst at bitbank, Japan's bitcoin exchange, said that the key inflation data of the United States in April to be released on May 11 could be a temporary "turning point" for bitcoin. If CPI shows signs of slowing down, it may help alleviate market concerns and restore risk appetite.

Hasegawa also pointed out that bitcoin needs to be maintained at the key psychological level of $33000 / piece to prevent further deterioration of technology sentiment. He expects bitcoin to trade at $30000 to $38000 this week.