Recently, a number of money laundering gangs that "ran away with points" in Telecom fraud were killed by the police, and some involved as much as 20million yuan. Many people think that it is "part-time job to earn extra money", but in fact it is "running points" to launder money for criminals, which has become "white gloves". The money laundering method often used by criminals called "running points" is actually a trap.

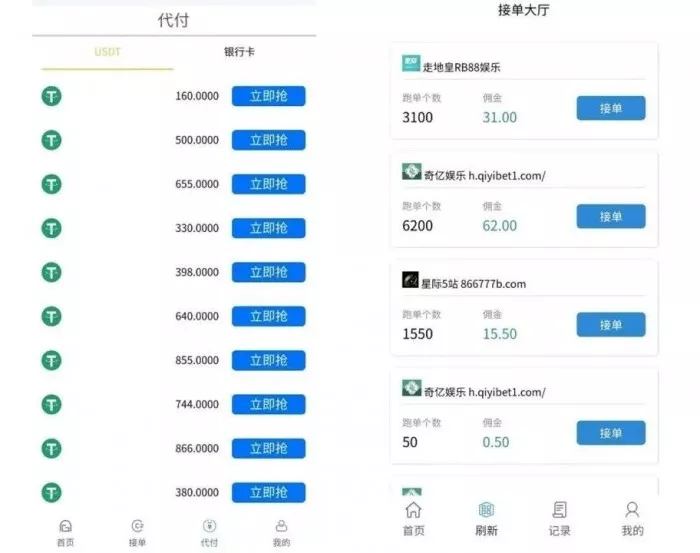

The investigation found that with the rise of virtual currency, some fraud gangs began to use virtual currency to transfer and launder stolen money. They publish part-time information on the Internet, recruit some social workers, buy and sell virtual currencies on the trading platform, and withdraw cash from the part-time workers to the platform wallet, so as to realize capital cleaning.

Due to the anonymity of blockchain wallets, only part-time workers actually leave traces in the process of trading, while criminals hide behind. From the published cases, many of the part-time workers who engage in "running points" for illegal profits are still students. I wanted to find a part-time job to earn some money, but I was cheated and punished by law.

In recent years, under the severe crackdown of the national public security organs, banks and other multi-party "card breaking action", the traditional means of money laundering, such as buying, selling, renting other people's bank cards and other layers of transfer and transfer of stolen money, have been effectively curbed, and instead, the use of virtual currency to launder money on the "running platform". Relevant reports show that in 2021, global cyber criminals laundered US $8.6 billion through cryptocurrency, an increase of 30% over 2020. Among them, the illegal use of virtual currency for cross-border money laundering has attracted great attention of relevant law enforcement departments. According to statistics, in 2021, for the new channel of virtual currency money laundering, the national public security organs cracked 259 related cases and confiscated more than 11billion yuan of virtual currency.

Virtual currency is not a natural protective film for illegal activities, and it is not a legitimate profession to engage in "running points" part-time jobs. To publicly expose the true nature of "off platform" transaction cash out, we should make the public open their eyes. We must not covet small profits and be confused by the so-called "low risk and high profit". The act of providing technical support or help to others who knowingly use information networks to commit crimes has violated the law. To see through the essence of the illegal act of money laundering, we should resolutely reject the temptation and report through legal channels.

In order to actively control the online black and grey products engaged in illegal money laundering, relevant departments should strengthen supervision and regulation, and cooperate with banks and third-party payment platforms to jointly control. The Internet platform should make full use of its advantages in mastering a large number of user resources, account information and communication data, strengthen research and judgment, establish and improve the risk prevention mechanism, and give early warning in case of any change.