On tiktok, young people are catching up with fashion in a faster way. Putting aside the cumbersome process of traditional online payment, bnpl (buy now pay later) service can complete shopping with just a few clicks on the screen, and it doesn't even need to pay a penny in the whole process. It's hard for young consumers not to be excited about it.

Bnpl provides a more flexible payment method for the young generation who do not have credit cards and do not have sufficient cash flow, but are eager to "have fun in time".

With the wide spread of social media to capture the hearts of generation Z and millennials, the 100 billion market brought by bnpl is rising.

According to the data reported in the global payments report 2022 by world pay, bnpl will account for nearly 3% (about US $157 billion) of global e-commerce transactions in 2021. By 2025, bnpl will account for 5% of global e-commerce transactions, which is expected to exceed US $500 billion. With the continuous improvement of financing amount, transaction scale and valuation of more and more bnpl companies, the development momentum of bnpl will remain strong in the future.

How did bnpl "capture" the minds of Post-00 users in Europe and America in just a few years? How do you inadvertently "empty" these young people?

More importantly, is bnpl a sustainable track?

01

Spend money quickly

"Chanel and pearl, that's the trick to keep the girls." In tiktok's noisy background music, the younger generation is keen to show off their own fashion, money, jewelry and famous brand bags.

Want to become a fashion talent, but don't have enough financial support?

Tiktok has many recommended videos about bnpl | tiktok

Tiktoker will tell you "then use buy now, pay later", and claim that bnpl can give you everything you want even if you are penniless; On youtube, you can also see a series of long videos detailing what bnpl is and how to use bnpl.

"Buy now, pay later" (bnpl) is an emerging payment method. This service allows consumers to order first and then pay. It mainly supports small payments of hundreds to one or two thousand dollars. Consumers can usually choose to pay in 3-4 installments within a few weeks, with little interest or handling charges.

Millennials (born from 1980 to 1999) and generation Z (born from 1995 to 2009) are the "main forces" using bnpl services.

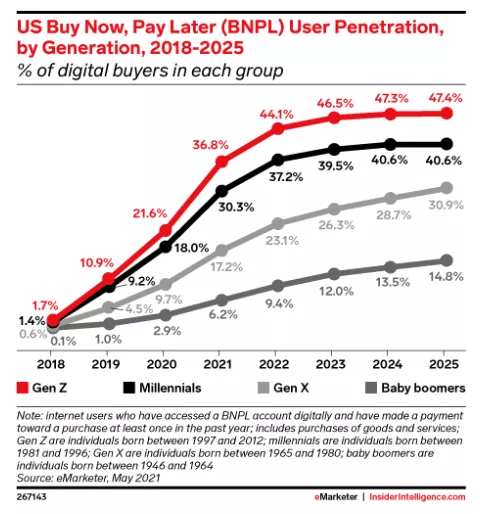

According to the data provided by emarketer, the proportion of generation Z using bnpl services in the United States increased from 10.9% in 2019 to 36.8% in 2021, a more than threefold increase. It is expected that this year, the use proportion of generation Z will increase to 44.1%, and the use proportion of millennials is expected to reach 37.2%.

Proportion of using bnpl services by age | emarketer

Bnpl can attract many young consumers the trick is also very simple, that is fast enough, simple enough.

Overseas, the online payment process is more complex. After each order, you have to enter the payment information such as bank card number, receiving address and contact information. Many consumers can't stand the long payment process and give up buying.

According to a survey conducted by Barclaycard payment, 69% of generation Z consumers will give up paying for the goods they have purchased. Among the reasons for giving up, "the payment process is too long" accounts for 29%, nearly one-third.

When using bnpl service, consumers only need to fill in the relevant information when binding the card for credit. After that, they don't need to fill in the payment information again every time they place an order. They just need to check bnpl payment in the payment page. In case of offline scenario payment, you only need to open bnpl app to scan the code.

In addition to bringing a more "silky" experience when paying, bnpl also provides a faster path for young "exquisite poor" in the matter of "borrowing".

It takes at least 4-6 working days to apply for a credit card, while bnpl service takes only a few minutes from registration, card binding, credit granting to use.

After registration, bnpl will call the internal risk control data system or the local third-party credit investigation system for risk verification according to the identity id provided by the user.

Taking afterpay, the head company of bnpl, as an example, its risk control model includes two types: one is the risk model, which estimates the monthly repayment probability of users and evaluates the credit situation of users by simulating the repayment behavior of users; One is the anti fraud model, which judges whether it is necessary to organize transactions or submit them for manual review by scoring the user's identity file and combining with other data such as the category of purchased goods and the harvest address of goods.

In general, bnpl's model can complete the calculation and evaluation in only a few seconds.

Bnpl provides a faster payment method for the younger generation | PayPal

Imagine that when you are surfing the Internet, you see a pair of $200 co branded sneakers. When you are worried about the lack of bank card balance, you see the bnpl link in the page. Click in and find that you can pay interest free in four times, only $50 each time, and the waiting time for applying for the service is almost negligible.

From the desire to complete shopping, there is no resistance and it is done at one go.

In addition, the lower trust of millennials and z-era in credit cards also provides an opportunity for the rise of bnpl services.

According to TD Bank's customer data, 25% of millennials do not apply for credit cards.

Due to the complexity of charge marking and interest settlement methods of credit card companies, users often find that the repayment amount exceeds their expectations when receiving the bill. In the long run, it is inevitable to question the repayment mechanism of credit card.

In contrast, after confirming the selection of bnpl for payment, the number of repayment periods, the amount payable in each period, the repayment date limit and other contents will be displayed in bnpl's app. Users can determine all the arrears they need to pay before repayment.

02

Not just payment

By focusing on the young user groups that are usually ignored in traditional financial services, coupled with the outbreak of e-commerce caused by the epidemic, the bnpl market has risen rapidly.

According to the global payments report 2022 of world pay, bnpl accounts for the highest proportion of e-commerce transactions in the European market, reaching 8%; North American bnpl accounts for 4% of e-commerce transactions, with a transaction volume of US $56.2 billion; In Australia, nearly 5 million people use bnpl services, that is, one in five people is a bnpl user.

The prosperity of the buy before pay market in these three regions has something to do with the first attempt of bnpl by local fintech companies.

Klarna in Europe, afterpay in Australia and confirm in North America are the three giants in the bnpl field. Due to their early development and mature business model, they have greatly promoted the prosperity of the local bnpl market. In klarna's hometown Sweden, the proportion of first buy and then pay in e-commerce transactions is even as high as 25%.

However, although several companies mainly focus on buy before pay services, their specific business models are still slightly different. Some of the business models of bnpl are as follows:

Geek Park mapping | data source: the company's official website, Investopedia, Oriental Securities Research Institute

According to the table, although the business models of different companies are slightly different, in summary, bnpl service basically does not charge interest, installment handling fee, management fee, etc., and the repayment period is more flexible.

Under normal circumstances, if the user fails to repay on schedule, bnpl will send an email reminder first, and then charge a low overdue fine. Some companies do not even need to pay an overdue fine.

Different from credit card business and traditional micro consumer loans, bnpl's interest free repayment model can get rid of the existing regulatory framework and adopt a more flexible business plan to a certain extent.

Affected by the subprime mortgage crisis in 2008, the United States enacted the credit card act in 2009 to restrict the credit card issuing mechanism and require that credit cards should not be issued to consumers under the age of 21. However, due to its unique business model, bnpl is not limited by the act, and even its main users are young people without credit cards.

In the UK, according to the relevant provisions of the financial services and markets act, short-term interest free credit has certain regulatory immunity; In Australia, bnpl, which does not involve interest expenses, can also avoid the supervision of relevant regulations.

The interest free business model also determines the difference between bnpl's profit model and other lending businesses.

The income source of credit card service is mainly the handling fee and interest charged from users, supplemented by the service fee charged when cooperating with merchants to launch preferential activities; The traditional micro consumer loan has a weak ability to cooperate with businesses, and almost all of its income depends on charging high interest to users; Because most bnpl services adopt interest free repayment without additional management fees and late fees, charging commissions and transaction handling fees from cooperative merchants is the main source of income for bnpl.

According to the financial report of afterpay, the capital income brought by merchants accounts for 76% of the total income, and the rest is the income of late fees. Therefore, it is not difficult for us to imagine that the proportion of merchant commission income will be higher in the business of bnpl without late fees.

Geek Park mapping

A natural question is: Why are businesses willing to pay for bnpl?

The answer is actually very simple, or "fast enough, simple enough" mentioned above.

A very direct impact of bnpl on reducing payment friction and reducing consumers' psychological burden is that the sales volume of goods has increased.

A report by global payments shows that bnpl can bring 20% - 30% transaction conversion rate to merchants and increase customer unit price. The three giants of bnpl have disclosed that the customer unit price of businesses supporting bnpl services has increased by more than 60% on average, and the customer unit price of a single customer can even increase by 200%.

In an interview with the media last year, Max Levchin, co-founder of confirm, said bluntly that "our business is to bring new customers to merchants, increase the scale of their shopping carts and increase their conversion rate at the point of sale." With the popularity of bnpl among young people, Zara, Nike, Burberry, Dyson and other major brands have supported bnpl payment.

Klarna's app interface | klarna

The survival of bnpl is to enhance the purchasing power of consumers and generate income for merchants.

In the apps of bnpl services such as klarna and afterpay, the website links of settled merchants, promotion information and consumer evaluation are aggregated. Colorful interface design and exquisite and intuitive commodity pictures all cause consumers' shopping desire.

In order to attract more young traffic, bnpl companies have also made great efforts in advertising and marketing, and they can often be seen in social media.

In May this year, Forbes conducted a survey on bnpl for 2000 American adults. 43% of the respondents made it clear that they had seen bnpl related advertisements on social media such as Facebook, instagram and tiktok.

In this way, bnpl is not just a payment tool, and becoming a new generation of traffic portal may be its ultimate goal.

03

Still debt

But no matter how bnpl is marketed and how flexible its repayment period is, debt is still debt and it will not disappear out of thin air.

Australian media once reported that a young man who sought help from financial consulting was burdened with multiple liabilities of bnpl, totaling $8000. In the real world, he also needed to rely on a youth allowance of $522 every two weeks.

Before his financial situation completely collapsed, he didn't even realize that bnpl was still a debt to bear.

In fact, many people don't realize it.

At the beginning of this year, creditspring conducted a survey in the UK. About one-third of all respondents did not think bnpl was a form of borrowing. 43% did not know that some companies would charge late fees for bnpl services, and more than half (53%) did not realize that bnpl's debt was also at risk of accumulation.

The rapid growth of bnpl is mainly driven by young consumers, but young people may not be able to bear the consequences of debt.

According to a survey by walnut unlimited, 52% - 53% of young consumers in the UK are "less confident" about paying the current bnpl due to the rising cost of living.

The situation is not optimistic.

Using bnpl for "painless" consumption can indeed bring people instant happiness, but when people get goods immediately, they will also get debt immediately. And once young people's spending power is overdrawn, who can tell the truth about it?

As bnpl usually pays the goods in full first, the subsequent fraud and refusal risks will be borne by bnpl, which is a great test of the company's ability to resist bad debts (the enterprise has not recovered its accounts receivable).

When considering this problem, the bad debt rate and gross profit margin are two important indicators to be measured.

If the gross profit margin of a bnpl company is high enough and the bad debt rate is low enough, the company will be able to survive the crisis, at least its survival will not be threatened.

But at present, the actual situation may be the opposite of the ideal situation.

Many bnpl companies claim that their bad debt rate is controlled at a very low level, even only a few percent. However, the data in a detailed study of afterpay shows that its 1% bad debt rate algorithm is not consistent with the traditional caliber. If calculated according to the traditional caliber, its bad debt rate may reach about 15%, which is not low.

Bnpl's gross profit margin is not high.

According to a Redburn study last year, a bnpl company charged an average of about 4% commission and handling fee from merchants. After deducting credit card network fee (0.6%), average capital cost (0.5%), payment channel fee (1.3%), virtual card issuance fee (0.1%) and average bad debt rate (1.2%), the gross profit was only about 0.3%.

When the gross profit margin is low, bnpl needs to rely on the scale effect formed by the lending scale to resist the bad debt risk. If the lending scale can not cover the bad debt cost, it is easy to cause the rupture of the capital chain.

When young people are in debt, their personal fate may be rewritten; If bnpl is unable to resist bad debts and goes bankrupt on a large scale, the economic situation of the whole society will be severely damaged, which may affect the future and destiny of more people.

Regulation will not sit idly by.

In the past six months, many countries, including the UK and the United States, have begun to pay attention to bnpl services.

UK financial regulators have banned some of klarna's advertisements and said they are studying the consumer credit act to restrict this fast-growing industry by improving regulatory measures.

The Australian Securities and Investment Commission also decided to strengthen its intervention in bnpl services because nearly one sixth of Australian users had overdraft and loan backed loans after using bnpl.

In December last year, the US consumer financial protection agency also launched an investigation on the top five bnpl companies, including klaena, confirm, afterpay, paypal and zip, and expressed concerns about debt accumulation, regulatory arbitrage and data collection.

When the policy will be tightened gradually, bnpl company will have to rethink its business positioning and what adjustments should be made. The period of savage growth has passed, but it may not be a bad thing for its long-term development.