After several weeks of stalemate, the twitter board of directors made another major concession this week, agreeing to authorize musk team to view Twitter's internal operation data in order to identify the scale of false accounts on the platform** This is the nth time for both sides to fight in the past two months. Musk once again seems to have the upper hand.

Sina Technology Zhengjun from Silicon Valley

This acquisition deal, like a soap opera with twists and turns, is destined to be included in the business school curriculum. It often seems to be a foregone conclusion, but it is always a new variable; The two sides have been pushing back and forth, and the prospects are still uncertain. However, if musk could go back to April 25, he might persuade the complacent self to be cautious before signing the agreement, because he jumped into a "big pit".

Step by step in the first half

The first half of this transaction was Musk's step-by-step approach, which was bound to be won. From the end of January to the end of March, musk spent $2.6 billion to quietly acquire 9.2% of Twitter's shares in the open market, becoming the largest shareholder of twitter at one fell swoop. After acquiring enough shares, musk began to build momentum on the twitter platform at the end of March, privately contacted the twitter board of directors to understand their intentions, and finally announced the shareholding information on April 4.

Under the banner of "defending freedom of speech", musk made a $44billion takeover offer to the twitter board of directors on April 14. Despite being resisted by the "poison pill plan" of the twitter board of directors, the world's richest man identified the fatal weakness of the lack of voting rights on the board of directors, and jointly raised purchase funds with many institutional investors to put public pressure, forcing the twitter board of directors to change its attitude, and finally signed a purchase agreement with Musk on April 25.

At that time, musk seemed complacent, and twitter was in his pocket. What the outside world pays more attention to is how he will transform this social media platform after taking twitter into account. The focus of American society is whether musk will overturn the current content control policy of Twitter and let former president trump and many right-wing people return to twitter.

However, the world's richest man may not think that there is still the second half of the acquisition contest, and the situation will change. As the macroeconomic situation began to cool down in May, the stock market turned sharply lower, and Musk's personal wealth increased with Tesla A sharp shrinkage. The real competition around this acquisition has just begun, with various commercial and political forces competing secretly.

From the signing of the acquisition agreement on April 25 to the beginning of May, musk has been promoting the acquisition financing step by step. His initial plan for the US $44billion acquisition fund was to borrow US $13billion from the bank, mortgage US $12.5 billion with Tesla equity (need to mortgage Tesla shares worth US $65billion), and raise US $21billion in cash.

On the one hand, musk sold Tesla shares at the end of April and cashed out $8.5 billion. On the other hand, musk actively introduced other investors and raised more than $7billion from nearly 20 billionaires and institutional investors. Among them, his good friend, Oracle Ellison, the founder, contributed US $1billion.

Sudden changes in the second half

A major change occurred on May 4. Under the severe inflationary pressure at a 40 year high, the Federal Reserve announced a one-time interest rate increase of 50 basis points, the largest interest rate increase since 2000. In addition, the Federal Reserve also announced that it had begun to reduce its portfolio in an attempt to reduce inflation through a two pronged approach.

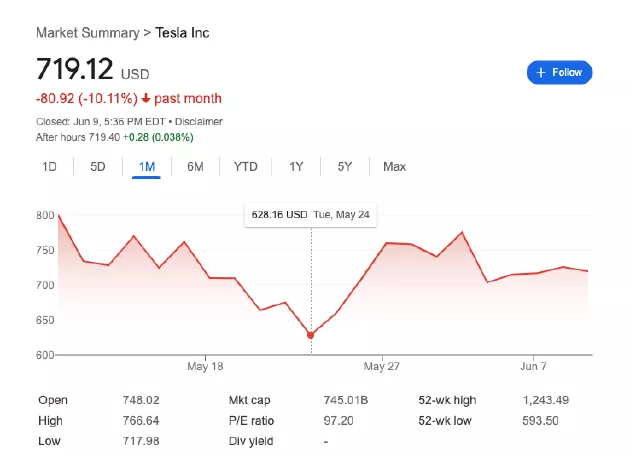

As investors began to seek refuge, technology stocks, which led the stock market in the past two years, became the most severely depressed sector. Tesla's share price plummeted by 8% the next day, and then plummeted from $952 to $625 on May 24. The market value evaporated by one third. Although it has slowly recovered to the current level of $725 in the past two weeks, there is still a huge gap from the $1145 in early April this year.

In other words, since musk announced its shareholding in twitter and launched a malicious acquisition, Tesla's market value has evaporated by more than one third, and Musk's personal wealth has also shrunk by more than $60 billion over the same period. This may explain why musk publicly broke his face with gates, the former world's richest man.

Gates not only invested $500million to short Tesla's share price, but also spoke out publicly and invested against Musk's acquisition of twitter. After musk announced its acquisition of twitter, 26 non-governmental organizations in the United States publicly called on advertisers to boycott Musk's acquisition of twitter. Among them, 11 organizations are long-term supporters of the Gates Foundation, and they have received a total of $460million from the Gates Foundation.

The decline of Tesla's share price also brought more trouble to musk. Musk previously set a position covering line of $740 with the margin loan mortgaged by Tesla's equity, that is, if Tesla's share price falls below this level, it means that Musk's Tesla equity used for mortgage has insufficient value, and he needs to mortgage more equity, or sell equity to make up his position. In mid May, Tesla's share price has fallen below this position covering line.

In addition, Tesla executives can only pledge up to 25% of their shares at most. Musk currently holds 170million Tesla shares and 73million options. Although he can't sell options to cash out, he can use them for mortgage loans. By the end of last year, musk had pledged more than 80million Tesla shares for margin loans, approaching the stock mortgage limit, which means that he has been unable to mortgage more shares to cover his position.

Affected by the sharp drop in Tesla's share price, musk had to reduce the equity margin loan in the acquisition of twitter. On May 26, musk submitted regulatory documents, planning to increase the personal financing portion of the $44billion financing to $33.5 billion, and seek additional financing guarantees, so as to completely abandon the use of margin loans in the acquisition of twitter.

Undercut the price with the problem of water army

Although the margin loan problem has been solved, Musk's acquisition of Twitter has more worrying things. While Tesla's share price plummeted, Twitter's share price was also not spared. On April 14, musk offered a purchase price of $44billion. At that time, the market value of twitter was $400, but a month later, the market value of twitter had dropped to $30billion, which meant that musk would purchase twitter at a premium of $14billion. In other words, the more twitter shares fall, the more musk loses.

If twitter shareholders may have hesitated to accept Musk's offer before, as Twitter's share price plummeted, selling it to the world's richest man at the high price promised by musk has become the best choice for twitter shareholders now. Now the party dissatisfied with the acquisition contract has become musk, the winner of the previous acquisition. However, the twitter board, which launched the poison pill plan to resist musk, is constantly stressing that it plans to "complete the sale transaction at the agreed price and implementation terms".

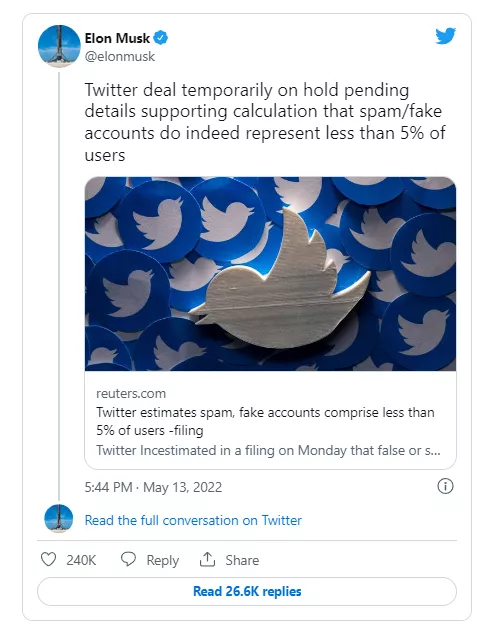

Musk is obviously unwilling to be a wrongdoer. As Tesla and twitter share prices continued to plummet, he used a new means of pressure. Since May 13 (Tesla's share price fell below the $740 position replenishment line), he has continuously fired public shots on the twitter platform: questioning the existence of water army in Twitter's user data, questioning the true scale of the false robot account, asking twitter to prove its real user data, or threatening to withdraw from the acquisition transaction.

Fake accounts on the twitter platform have been a problem musk has been attacking over the past few years. When twitter applied for listing in 2013, it was mentioned in the risk statement in the prospectus that according to the internal sampling evaluation, the false account number was less than 5% of the monthly life of the platform. In the past nine years, Twitter has claimed that the proportion of false accounts on its platform is less than 5%.

However, musk did not raise any objection to this data when signing the acquisition agreement, nor did he ask for access to Twitter's internal data. However, both Tesla's and Twitter's share prices have fallen sharply, which means that the cost of his acquisition of Twitter has increased in both directions; At this time, musk moved out the issue of false accounts, obviously to use this as a reason to pressure the twitter board to renegotiate the purchase price or even abandon the purchase transaction.

However, to Musk's disadvantage, when he signed the acquisition contract with the twitter board of directors at the end of April, he was perhaps too complacent. Musk did not require due diligence and gave up the right to view Twitter's financial and internal data. According to the acquisition contract, unless musk proves that there is misleading fraud in the twitter board of directors or that major events affect the valuation of twitter, musk must complete the $44billion acquisition transaction according to the contract.

Send the CEO of twitter a piece of shit

Although the scale of breach of contract set in the acquisition contract is US $1billion, this does not mean that musk can directly stop loss and leave after handing over US $1billion. The twitter board of directors still has the right to file a lawsuit in the state of Delaware, where it is registered, to force musk to complete the acquisition transaction, or to seek compensation of more than 15% of the transaction amount (equivalent to more than $6 billion). There is a precedent in Delaware courts.

In January2001, the largest chicken supplier in the United States Tyson Foods (Tyson Foods) reached an agreement to spend US $3.2 billion to acquire IBP, a beef packaging plant. However, only one month later, Tyson food asked to cancel the acquisition on the ground that it found problems in the IBP audit. IBP then filed a lawsuit with the Delaware court, claiming that Tyson food was informed of relevant issues when signing the acquisition agreement, and asked the court to force Tyson food to complete the acquisition transaction.

Finally, the court supported IBP's claim, held that the acquisition agreement signed by both parties was legal and should be implemented, and ordered Tyson food to complete the transaction. Tyson Foods was forced to complete the acquisition. More than 20 years have passed, and now IBP is the pork and beef subsidiary of Tyson Foods.

Over the past few weeks, musk has been sparring with the twitter board over the issue of fake accounts. On May 17, when twitter CEO Parag Agrawal publicly said on twitter that he refused to investigate the scale of Twitter's fake account, musk directly replied to him "a piece of shit" without any disguise.

On Monday, musk threatened again that if twitter did not give him access to internal data, it would constitute a breach of contract, and he would cancel the $44billion acquisition of twitter. At the same time, his team of lawyers sent a letter to Twitter's chief legal counsel, requesting comprehensive access to Twitter's internal data flow. They proposed that this is a necessary means to understand the scale of water army and fraud accounts on the twitter platform.

After weeks of stalemate, the twitter board of directors made another concession on Wednesday, deciding to allow the musk team to comprehensively view the original data inside twitter. Musk's acquisition team may be able to obtain comprehensive twitter data as soon as this week to assess the true number of false and fraudulent accounts. At present, the outside world cannot predict the true scale of false accounts on the twitter platform, but some external studies predict that the true proportion of false accounts may exceed 10% or even as high as 15%.

Take the initiative to jump into the political fire pit

Although Twitter is the most influential social media platform in the world, its revenue performance and stock market value are far from other social platforms. This inversion of influence and business value has made twitter shareholders dissatisfied for a long time, and put heavy pressure on the management and the board of directors. Twitter has not set up super voting rights, and the board of directors' shareholding accounts for less than 2.5% of the voting rights, which makes the board of directors unable to resist the pressure from major shareholders and institutional investors.

However, the value of twitter can not be measured by market value and revenue. This is not an ordinary consumer Internet company, but a network platform with huge political energy. In the past few years, Disney And salesforce Both of them have seriously negotiated to buy twitter, but they all chose to give up in the end. Perhaps they are also considering the political risks that the acquisition of twitter may cause.

But musk jumped into the "big hole" on his own initiative. Due to the billionaires' wealth tax, the new crown vaccine and the trade union policy, Musk's relationship with the Biden administration of the Democratic Party is extremely cold, and he has repeatedly linked up with Warren and other democratic radical senators. Musk and Tesla moved from dark blue California to dark red Texas, which is also seen as his public support for the Republican Party's light tax and light regulatory policies.

In the past year, President Biden of the Democratic Party frequently visited Detroit's traditional automobile enterprises to win the support of blue collar workers in the Great Lakes region. At the same time, he was obviously indifferent to musk, and was even unwilling to invite or mention Tesla and musk in public activities supporting the development of electric vehicles (mainly because of Tesla's anti union position). This intentional neglect has left mask, the global leader in electric vehicles and new energy, neglected and complained constantly.

This time, musk bought twitter for the reason of "safeguarding freedom of speech", publicly supported Trump's return, and planned to overturn the content review standard of twitter, which is tantamount to placing himself at the forefront of the public opinion storm between the left and right sides of the United States, and choosing to stand in the red in the political struggle in the United States.

After Tesla's share price plummeted in early May, musk directly vented his anger at the democratic government on twitter, and continuously criticized Biden for "only reading teleprompters, bad economic policies, and the U.S. economy may fall into recession", accusing the Democratic Party of becoming a "divided and hateful political party"; This series of public statements is equivalent to musk declaring his support for the Republican Party.

On May 20, musk suddenly hinted that "he will become a political target because he supports the Republican Party." The next day, American media exposed that musk sexually harassed female flight attendants on private planes in 2016, and SpaceX paid a $250000 sealing fee for this. Musk completely denied this, scolded the other party for not even saying his own physical characteristics, and accused it of splashing dirty water for political purposes.

The outlook remains uncertain

After various changes in the past two months, musk has reached the acquisition agreement, but the prospect of this transaction has never been settled. After being allowed to view Twitter's internal original data, it is still unknown what conclusion the musk team will draw about the scale of the false account, whether it requires a substantial reduction in the transaction price, or whether it will directly withdraw from the acquisition agreement.

If the time can be reversed by one month, musk may persuade himself to consider carefully before signing the acquisition agreement on April 25, and at least complete the due diligence. Compared with musk, who regretted signing too quickly, twitter shareholders now prefer to promote the transaction according to the original agreement. Twitter's chief legal adviser said that the company is waiting for the SEC to approve the proxy document and plans to hold a shareholder vote on the acquisition agreement at the end of July or early August. On June 3, this acquisition transaction has passed the review and evaluation period of the US regulatory authorities.

Maybe in the next month, musk and Twitter's board of directors will continue to push forward, even not excluding the possibility of litigation settlement and more shareholder lawsuits. Ajit Pai, former chairman of the US Federal Communications Commission (FCC), publicly suggested that the twitter board of directors should resolve the current differences with musk as soon as possible, and even make concessions.

At the same time, Musk's acquisition of Twitter is also facing joint resistance from leftist social organizations. More than a dozen leftist NGOs supported by billionaires such as gates formed a public opinion offensive of "stop the deal", hoping to put pressure on the SEC, advertisers and other institutions, and block the deal through class actions.

The world's richest individual invested US $33billion to acquire the world's most influential social media at a total price of US $44billion. This transaction not only set a record amount of leveraged buyouts, but also stirred the sensitive nerves of American society. Musk himself has also openly stood by the Republican Party and stood at the forefront of the political struggle between the two parties.

Important time nodes of Musk's acquisition of Twitter:

On January 31, musk began to quietly acquire twitter shares in the open market.

On March 14, musk held more than 5% of the shares in twitter. According to the regulations, he should submit documents to disclose his shareholding within 10 days, but musk did not disclose it until 21 days later. During this period, he has been increasing his shareholding. This serious violation has triggered investor lawsuits and SEC investigations, and musk obviously has to pay a price for it.

On March 24, musk began to warm up public opinion for the acquisition of twitter. He publicly pressed twitter to publish its algorithm and questioned that Twitter did not abide by the principle of freedom of speech.

On March 26, musk contacted two twitter directors: co-founder Dorsey and Egon Durban, CEO of Silver Lake capital, to discuss the future development direction of social media and the possibility of him joining the twitter board.

On March 27 and 31, musk met twice with Twitter chairman Taylor and CEO Aggarwal to discuss his interest in twitter and whether to join the twitter board.

On April 4, musk submitted regulatory documents to disclose that he has become the largest shareholder of twitter. Speculation began about his intentions, and twitter shares soared 25 percent.

On April 5, twitter publicly announced that it would invite musk to join the board of directors on the condition that it would not increase its shareholding by more than 15%. This invitation is considered as a means for Twitter to defuse the threat of acquisition.

On April 10, the day musk officially joined the twitter board of directors, twitter announced that musk had rejected the invitation of directors. The outside world began to confirm that musk might buy twitter.

On April 14, musk officially issued a takeover offer, proposing to acquire twitter with us $44billion, 38% higher than the share price on the trading day before musk disclosed its shareholding in twitter on April 1.

On April 15, the twitter board of directors launched the poison pill plan to show its rejection of Musk's acquisition.

On April 21, musk presented US $46.5 billion in financing vouchers, including US $13billion in bank loans, US $21billion in cash financing and US $12.5 billion in margin loans for Tesla shares.

On April 25, the twitter board of directors reached a $44billion acquisition agreement with musk.

On April 29, musk sold Tesla shares to cash in $8.5 billion to raise funds for the acquisition of twitter.

On May 4, musk submitted a document that he had raised $7billion from billionaires and institutional investors such as Ellison, coin security and red shirt capital. Tesla shares fell 8.4%.

On May 6, musk told investors that he planned to increase twitter revenue from $5billion in 2021 to $26.4 billion in 2028. His revenue plan includes launching subscription payment and payment services, and reducing dependence on advertising revenue.

On May 10, musk admitted that the account of former president trump would be restored after the acquisition of twitter, saying that it was a mistake to block trump.

On May 11, Tesla's share price fell sharply by 8.3%, falling below the musk margin loan covering line of $740.

On May 13, musk publicly questioned the proportion of false twitter accounts and threatened to suspend the acquisition transaction. Three days later, musk replied "a piece of shit" to twitter CEO Aggarwal's tweet.

On May 17, musk again threatened to suspend the acquisition of twitter unless he knew the scale of Twitter's fake account. He said that the proportion of false twitter accounts may be as high as 20%, and called on the SEC to investigate.

On May 18, musk announced his support for the Republican Party and accused the Democratic Party of becoming a party of "division and hatred".

On May 21, the media exposed that musk sexually harassed flight attendants on private planes in 2016, and subsequently gave a $250000 sealing fee. Musk denied the allegations of sexual harassment, saying it was retaliation for political purposes. Tesla shares fell below $700.

On May 26, musk submitted regulatory documents, planning to increase the equity financing part of the $44billion financing to $33.5 billion, and seek additional financing guarantees, so as to completely abandon the use of margin loans in the acquisition of twitter.

On May 26, twitter investors filed a class action against musk, arguing that musk deliberately delayed disclosing that his shareholding in twitter had reached 5% and continued to increase his shareholding at a low price, thus obtaining real benefits and deliberately manipulating the stock price.

On June 3, Musk's acquisition of twitter passed the review and evaluation period of the US regulatory authorities. FTC has not taken any measures, which means musk can promote the acquisition of twitter.

On June 3, musk suddenly sent an internal email, saying that Tesla needed to cut 10% of its staff because of its poor economic expectations. On the same day, Tesla's share price fell 9% again. A day later, he retracted his remarks, saying that the total number of Tesla employees would continue to increase, and the number of employees would not change.

On June 6, musk again threatened to cancel the acquisition of twitter. His lawyer team sent a letter to Twitter's chief legal adviser, requesting that Musk's team be authorized to review Twitter's internal data to determine the size of false accounts. On the same day, the Republican Attorney General of Texas announced an investigation into the false twitter account.

On June 8, the twitter board of directors agreed to allow musk to comprehensively view internal information and data.