On June 6 local time, Tesla CEO Elon Musk said that Twitter had "seriously violated relevant obligations" in the process of providing it with spam and false account numbers, and warned that it might abandon the acquisition Although this is not the first time musk has publicly stated that his plan to acquire twitter may not be realized, the warning issued by his lawyer in his letter to twitter marks an escalation of the situation.

Author / lijunling

As of press time, twitter fell 0.86% after hours, and the stock closed down 1.49% on Monday.

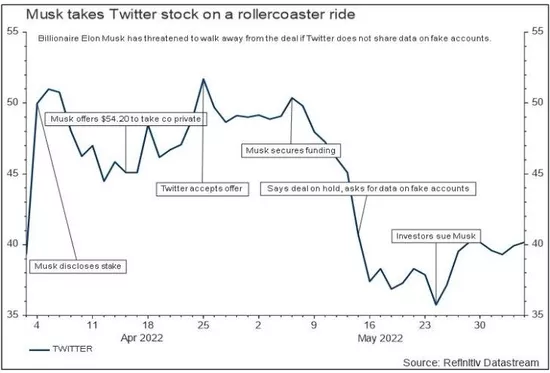

It is understood that in the letter to twitter, Musk's lawyer asked the company to provide information to help it evaluate the number of junk and false accounts on the platform, and warned that if twitter refused to provide it, it would constitute a material violation of the merger agreement, and musk would reserve the right to not complete the transaction and the right to terminate the merger agreement. After the news was announced, twitter shares immediately fell more than 5% in the opening trading.

Subsequently, twitter said in an email statement to the media that it had cooperated and would continue to share information with musk to complete the transaction in accordance with the terms of the merger agreement. In addition, twitter also said that this transaction is in the best interests of all shareholders and will continue to complete the transaction at the agreed price and terms.

It is reported that Twitter has actually been rejecting the data musk has asked for since May 9. Whether it is written documents or oral explanations, Twitter is always providing additional information about its own test methods. This practice simply wants to confuse the problem, which is tantamount to rejecting Musk's request. Musk has made it clear that he does not believe that the twitter crotch test method is sufficient, so he needs to carry out his own analysis and ask the company to provide corresponding data.

At the same time, since May, musk has been holding on to the problem of "false account proportion" on social media platforms, which has also triggered speculation about whether the world's richest man feels "expensive" because of the sharp fall in technology stocks, and wants to bargain or exit the transaction directly.

From the time line, musk proposed a $44billion acquisition in April this year and obtained the consent of the twitter board of directors in the same month. Subsequently, the world's richest man found 19 investors to reduce his financing burden. At present, he is also negotiating with Twitter's existing shareholders.

Will musk buy twitter at a lower price

Legal experts said that the disclaimer used by twitter in predicting the virtual account provides some protection to avoid potential litigation, including litigation from musk about the transaction and litigation from shareholders about the accuracy of the company's regulatory statement. Even if Twitter's prediction is wrong, musk must prove that Twitter is trying to deliberately mislead - a high legal threshold.

Dennis Dick, a proprietary trader at Bright Trading LLC, said: "it is clear that musk has a buyer who regrets. He is trying his best to reduce prices. I think he may succeed." Dan ives, an analyst at wedbush, said: "Musk tried to exit the twitter transaction. This was his first shot."

However, what is certain now is that even if the law is on Twitter's side, musk may still give up or renegotiate the deal. Because any lawsuit may be protracted, twitter may think that agreeing to a lower price or getting compensation from musk is more meaningful than trying to force him to complete the transaction in court.

If musk wants to negotiate a lower purchase price with Twitter, he can threaten to withdraw from the deal unless the twitter board agrees to restart the negotiations. According to the signed agreement, although musk may need to pay a $1billion breakup fee, twitter will have to file a lawsuit to obtain damages of more than $1billion, or try to force musk to complete the transaction.

In addition, it is understood that it is not uncommon for enterprises to decide to renegotiate or abandon the acquisition when the COVID-19 broke out in 2020 and severely damaged the global economy. For example, LVMH, a French retailer, threatened to withdraw from the transaction with tiffany&co, which finally agreed to reduce the purchase price by US $425million to US $15.8 billion; Simon Property Group, the largest shopping center operator in the United States, successfully reduced its acquisition price of controlling interest in its competitor Taubman centers by 18% to US $2.65 billion.

What are the risks of acquiring twitter

Musk tries to renegotiate or risks paying more money. First, musk had to convince twitter that he would really quit the deal. In addition, there are legal obstacles, including the "specific performance agreement" clause that twitter can invoke, by which judges can force musk to complete the transaction. It is worth noting that acquirers who lose such lawsuits are almost never forced to complete the acquisition, but the target company can seek monetary compensation for abandoning the transaction.

The companies that went to court with the acquirers included channel medsystems, a medical technology company, which sued Boston Science (bsx.us) for trying to abandon the $275million deal. In 2019, the judge ruled that the transaction should be completed, and Boston science paid a settlement amount to channel medsystems. The specific amount was not disclosed.

Acquirers seeking to withdraw from the transaction sometimes use the "material adverse effect" clause in the merger agreement to argue that the target company has been seriously damaged. However, like many recent M & A transactions, the wording in the twitter transaction agreement does not allow musk to exit due to the deterioration of the business environment, such as the decline in advertising demand or the sharp fall in Twitter's share price.

In terms of regulation, the US antitrust regulator decided last week not to further review Musk's acquisition of twitter, which makes the transaction unlikely to be frustrated in terms of regulation.

But twitter may face a regulatory investigation. According to reports, Texas attorney general Ken Paxton said on Monday local time that his department would investigate the number of robot accounts on twitter. The Texas attorney general's office said in a statement: "attorney general Paxton issued a civil investigation summons to investigate whether Twitter's reports about its real and false users violated the 'false, misleading and deceptive' provisions of the Texas fraudulent trade practices act."

Paxton asked twitter to hand over documents as part of the investigation. In response, a twitter spokesman said that the company insisted on submitting documents to the securities and Exchange Commission of the United States.