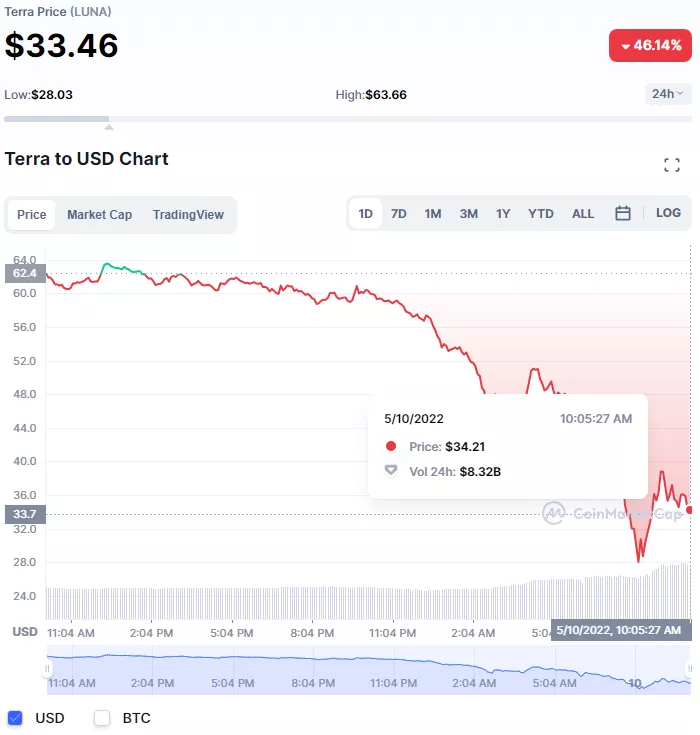

Coinmarketcap pointed out that terrausd (UST) was decoupled from the dollar for the second time in three days and fell to a low of $0.9009 on Monday** At the same time, the price of its sister token Luna has also declined by 30% to $46 in the past 24 hours** Earlier, Luna foundation guard (hereinafter referred to as LFG) announced to call its huge BTC reserve to maintain the currency value of ust stable currency.

Coindesk pointed out that ust maintains its peg to the US dollar through a chain coinage and destruction mechanism. In theory, the platform side can help traders always exchange 1 ust for 1 US dollar - for example, with the help of Luna with floating price to cushion the fluctuation of the value of the stable currency.

However, as Luna's market value falls below UST, this situation may endanger the foundation of ust - which means that Terra runs or causes some users to no longer realize the cryptocurrency exchange of 1:1 US dollars.

Early in the weekend, ust deviated from the anchored exchange rate of US $1 for the first time. After falling to $0.985 on Saturday, it returned to the $1 mark on Sunday.

Although this is not the first (or largest) de peg event in Terra's history, the controversy it triggered has shaken the mentality of many investors.

On Sunday evening, LFG announced that it would allocate $1.5 billion of BTC reserves - trying to actively safeguard the stability of the currency value of ust by "lending" this encrypted asset to professional market makers.

In an interview with coindesk on Monday, Jos é Maria Macedo, one of Delphi digital's partners and a member of LFG's board of directors who helped the agency manage its reserves, said that the mechanism was undergoing a huge stress test.

Even so, he added: LFG has sufficient reserve assets, so you don't have to worry too much about the reversal of the market value of ust-luna. Shortly after the call, Terra seemed to have emptied about $1.3 billion from its known BTC wallet address.

A few minutes later, do Kwon, CEO of terraform labs, tweeted that they would allocate more funds to maintain the stability of the currency.