On June 8, the reporter of Beijing business daily noted that on the eve of the "June 18" e-commerce Festival, ICBC announced that it would stop its e-commerce platform from financing e-shopping personal mall at the end of June.

Since the first platform was launched in 2012, the banking e-commerce platform has gone through ten years. However, after the tepid and Buddhist e-commerce carnival, some banks have adjusted their strategies to integrate their e-commerce platforms with the bank's mobile banking or credit card mall. Only a few platforms are still running. At the moment of fierce competition among Internet e-commerce platforms, the banking e-commerce platform has little future.

Relevant services of Ronge shopping mall will be stopped

The annual e-commerce Carnival "6.18" is coming, and the Internet e-commerce platform is entering the final stage of promotion. However, a large state-owned bank announced that it would stop the personal mall service of its e-commerce platform. Recently, industrial and Commercial Bank of China (ICBC) issued the important announcement of financial e-shopping mall, saying that due to business adjustment, the bank will stop the relevant services of financial e-shopping mall at 24:00 on June 30.

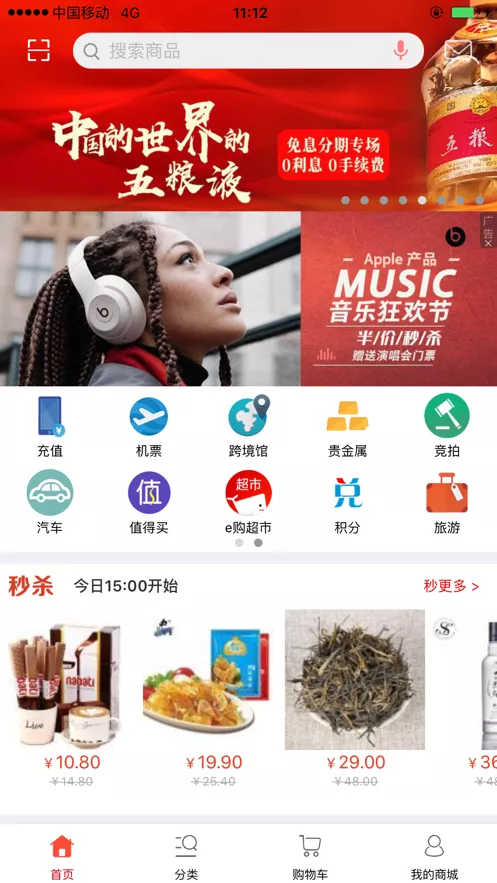

It is understood that Ronge shopping is an e-commerce platform officially launched by ICBC on January 12, 2014. It has been operating for eight years, and has developed into a comprehensive e-commerce platform covering B2C, B2B and other businesses with complete functions. Ronge shopping personal mall collects more than a dozen categories, including digital appliances, automobiles, financial products, clothing, shoes and hats, food and beverage, jewelry and gifts, transportation and tourism, hundreds of well-known brands and nearly 10000 best-selling commodities, and supports users' credit cash payment orders of ICBC.

Since its launch, Ronge shopping has been known as the leading example of banks' e-commerce business layout. According to the annual report data of ICBC, in 2016, Ronge shopping platform achieved a total transaction volume of more than 1trillion yuan, which was 1.03 trillion yuan in 2017, and increased to 1.11 trillion yuan in 2018.

According to the customer service personnel of Ronge shopping, the services of Ronge shopping personal mall will be stopped from 24:00 on June 30. If users need to exchange points, purchase precious metals and make public donations, they can log in to the mobile bank of ICBC.

Referring to ICBC's consideration of closing the financial e-shopping mall service this time, Yu Baicheng, President of zero one research institute, said that in the past, banks' e-commerce platforms were mostly operated by independent apps, but compared with internet giants' e-commerce platforms, they have a gap in Internet thinking, user operation and commodity richness. Even large commercial banks are difficult to take advantage of e-commerce business competition, and the investment in e-commerce platforms is large. Therefore, it is not difficult to understand the closure of banking e-commerce platforms in the context of the peak of mobile Internet dividends.

The reporter of Beijing business daily noted that as early as December 29, 2021, ICBC adjusted some functions of Ronge shopping mall, closed the pure cash purchase mode of non self operated goods or services, and consumers need to pay personal comprehensive points (667 points) of no less than 1 yuan when purchasing Ronge shopping.

An insider said that ICBC has been gradually cooling down the financial e-purchase business for more than a year. The reason is that the influence of the platform is not great and the operating cost is high.

In addition to shutting down the personal mall services, ICBC also said that it would stop the public sales, business district sales, cross-border trade and other related services of the financial e-purchase enterprise mall at 24:00 on June 30, and the service function portals such as Bill brokerage, ICBC centralized purchase, and judicial auction would be moved to the homepage of ICBC's portal website. The reporter of Beijing business daily contacted the relevant person in charge of ICBC for an interview with regard to the suspension of financial e-shopping related services and the future transformation and layout plan of e-commerce business, but no reply has been received as of press time.

"6 · 18" banking is the collective "dumb fire" of e-commerce

In 2012, China Construction Bank established the first domestic banking e-commerce platform, Shanrong commerce, which started the development of banking e-commerce business. After that, Bank of communications jiaobohui, e-commerce steward of Agricultural Bank of China, Bank of China e-commerce, industrial and Commercial Bank of China Ronge shopping, Everbright Bank shopping wonderful and other platforms were launched one after another, and banking e-commerce platforms "blossomed everywhere".

However, after several years of development, some banks have adjusted their strategies to integrate their e-commerce platforms with the bank's mobile banking or credit card mall. Only a few platforms are still running. The "6.18" e-commerce carnival is coming soon. The reporter of Beijing Business Daily found that the publicity of "6.18" activities by various banking e-commerce platforms this year is relatively low-key. As of the press release, no publicity has been carried out in advance.

The e-commerce platform of China Construction Bank, Shanrong commerce, provides consumers with information on a variety of commodities, including digital, household appliances, daily necessities, home textiles, personal care, quality wine, food, tea, clothing, shoes and bags. However, the platform does not indicate the "6.18" activity on the web page, and the latest content in the promotion information column also stays on October 18, 2021.

Not long ago, China Construction Bank announced that due to business adjustment, from April 25, the business entity of Shanrong will be changed from China Construction Bank to CCB Financial Services Technology Development Co., Ltd. (hereinafter referred to as "CCB financial services"), and CCB financial services will be responsible for Shanrong business operation.

Similarly, due to the suspension of personal mall services at the end of June, ICBC's financial e-shopping platform did not build momentum for the "6.18" e-commerce carnival, but the platform launched a number of activities to consumers, such as points discount and points for goodies.

Among joint-stock banks, Everbright Bank's e-commerce platform shopping mall did not mark the "6.18" related publicity words. In addition to providing consumers with cosmetics, food, wine, digital appliances and other commodities, the platform also provides the sale of commemorative banknotes, gold and silver coins, stamps and other commodities. At present, the e-commerce platforms of the banking sector mainly participate in activities in two ways: e-Voucher deduction and integral deduction. In addition, users can also choose to purchase goods by installments without interest.

Compared with the "6.18" battle of the banking e-commerce platform, the promotion activities of the Internet e-commerce platform are much stronger. JD's "6.18" wonderful night of goodies, tmall's "6.18" and other momentum building activities have started early. In this regard, wangpengbo, a senior analyst in the financial industry of Broadcom, said in an interview with the Beijing Business Daily that the e-commerce platform is one of the signs that banks embrace the transformation of mobile Internet. However, with the development, enterprises have gradually realized that there is still a certain gap between banks' E-commerce business and the real e-commerce platform. The e-commerce market pattern has long been stable in terms of operation and cost accounting, and cannot be easily shaken; In addition, from the data retained by users, the transformation results are insufficient. "6.18" banking is the overall "dumb fire" of e-commerce platform, which belongs to the behavior of choice under the normal marketization, and also marks that the digital transformation of banks has entered a more pragmatic stage.

How to go in the next decade

At the beginning of the birth of e-commerce, banks had high hopes. The reason is that banks have rich C-end and b-end customer resources and can rely on the provision of financial services to obtain income, such as income from payment channels and financing services.

From the perspective of operation mode, the current banking e-commerce platform mainly has three modes: the first is only B2B, the second is only B2C, and the third is a comprehensive "b2b+b2c" platform, which provides comprehensive services for enterprises and individuals throughout the production chain. However, no matter which model is adopted, the main purpose of the bank's e-commerce platform layout is not to make profits, but to turn the platform into a link with customers and complete the secondary utilization and development of customer value.

Suxiaorui, senior analyst of Analysys analysis in the financial industry, pointed out that at present, some banks are e-commerce platforms and do not build an evaluation system for commodities and stores. Their technical support and innovation are far inferior to traditional e-commerce platforms. Poor experience makes it difficult for the platforms to retain customers. As a traditional financial institution, the bank is rooted in offline outlets, and has not made enough efforts in publicity and momentum, and its brand awareness is not high.

With the rapid development of Internet e-commerce platforms, banking e-commerce platforms undoubtedly survive in the cracks. In Baicheng's view, the banking e-commerce platform is a way for banks to build their own scenarios and ultimately serve financial businesses. The positioning of banking e-commerce platform is mainly to serve customers, improve customer stickiness and accumulate customer data, rather than to maximize sales. Therefore, the strategy is different from that of Internet e-commerce platform, which usually drives sales with low prices and promotions to achieve scale effect. Banking e-commerce can hardly be competitive in price reduction without scale effect.

The external competitive environment is unfavorable, and there are no advantages in logistics, service, system and customer experience. How will the banking e-commerce platform develop in the future? Wangpengbo further pointed out that from the perspective of user operation, banking e-commerce platforms should be controlled from the type of products to the scale, and should not continue to be built into such a large scale as Internet e-commerce platforms; From the perspective of marketization, banking e-commerce business lacks competitive advantages in all aspects.

In suxiaorui's view, the future development of banking e-commerce platform depends on the coordination and overall planning ability among bank capital flow, information flow and logistics. It is necessary to break through the shackles of traditional banks and integrate more into Internet thinking.

Beijing Business Daily reporter songyitong