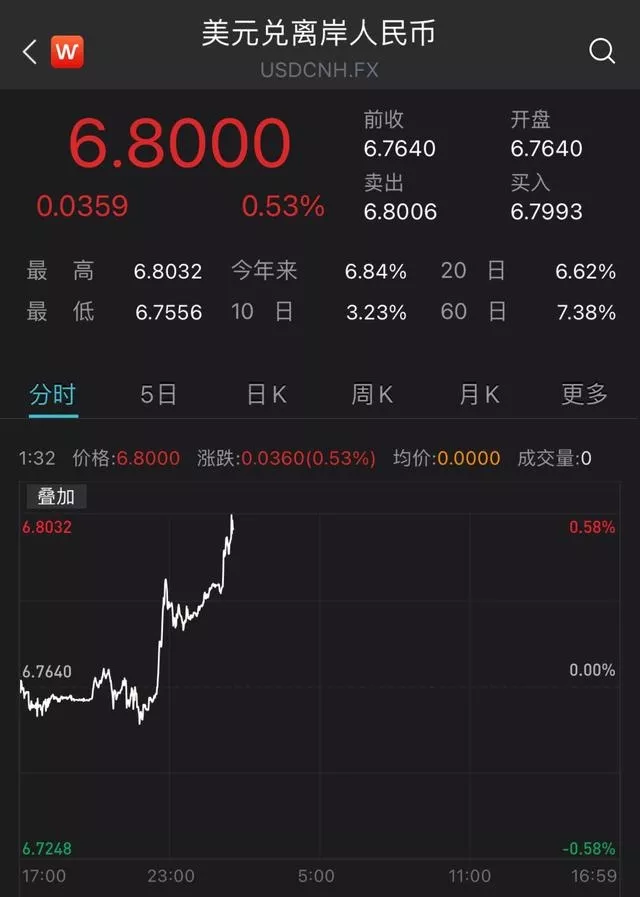

As the US dollar index stood at 104, the RMB exchange rate against the US dollar continued to fall. On May 12, more reflecting the expectations of international investors, the offshore RMB fell below 6.77, 6.78, 6.79 and 6.80 against the US dollar. On May 12, after opening at 6.7355, the spot exchange rate of RMB against the US dollar fell below 6.74, 6.75 and 6.76 successively, down more than 350 basis points compared with the previous trading day.

Generally speaking, after the devaluation of the RMB, the import will be under pressure, but it is good for the export Some experts also believe that over the past year, the RMB exchange rate has accumulated a large appreciation and has been overestimated. Now it can adapt to the appropriate adjustment of the market and, in a sense, cooperate with domestic monetary policy to help support exports and economic growth, which is not necessarily a bad thing

When replying to investors on the interactive platform, many listed companies talked about the impact of RMB devaluation. Many companies said that the company's overseas sales revenue accounted for 65.27% of the company's total sales. The company's procurement was mainly domestic, and RMB devaluation was good for the company to a certain extent; The company's products exported to the North American market are settled in US dollars, and the depreciation of RMB is conducive to increasing the company's exchange earnings.

Since the beginning of this year, the exchange rate of RMB against the US dollar has fallen by more than 6%. Cheng Qiang, chief Macro Analyst of CITIC Securities, pointed out that the United States raised interest rates by 25 basis points and 50 basis points in March and may respectively, and may raise interest rates by 50 basis points in June and July respectively. There is still a certain depreciation pressure on the RMB exchange rate in the short term.

In the medium and long term, there is limited room for further depreciation of the RMB, because it is expected that China's exports will re support the RMB exchange rate and China's economic fundamentals will gradually improve after the epidemic improves.

Wang Chunying, deputy director and spokesman of the State Administration of foreign exchange, pointed out at a press conference on April 22 that we think there will be two-way fluctuations and will remain basically stable at a reasonable and balanced level.

China's economy is relatively resilient, the long-term development trend has not changed, the balance of payments structure is stable, the current account maintains a reasonable scale surplus, and RMB assets still have long-term investment value, which will provide fundamental support for the basic stability of the RMB exchange rate**