When the artificial meat foam was punctured, none of the myths fabricated on the air outlet was innocent. Not long ago, beyond meat, the "first stock of artificial meat" bet by Bill Gates, attracted market attention. The performance loss exceeded market expectations and showed an expanding trend. The company's share price also fell nearly 90% from the historical peak. According to the financial report, in Q1 of 2022, beyond meat's revenue was $109 million, an increase of 1.19% over the same period last year; However, the net loss expanded to US $100.5 million, and the profit decreased by 268.44% year-on-year.

Artificial meat brand: beyond meat

The poor efficiency of foreign artificial meat market also affects the domestic market. For example, Shuangta food, an important raw material supplier of beyond meat and a concept stock of Chinese artificial meat, also fell into the dilemma of declining revenue and profit and asset impairment. The first quarter report of 2022 shows that the company's revenue is 449 million yuan, a year-on-year decrease of 4.06%; The net profit was 51.4825 million yuan, a year-on-year decrease of 48.3%.

In 2019, beyond meat was listed on the US stock market on Nasdaq, and the stock rose sharply, becoming the best stock on the first day since the 2008 financial crisis. China's capital market was excited about this, and China also ushered in a wave of artificial meat boom. Artificial meat concept stocks caused agitation in the A-share market, and Shuangta food, Weiwei and other companies pulled out multiple trading boards at that time; In 2020, there were 21 domestic investment events for plant-based companies, and the number of financing blowout.

However, after 2021, the domestic artificial meat market has the trend of stalling, and the consumer market and capital market are both cold. Due to the backward core technology, low acceptance of Chinese consumers, limited channels and other reasons, China's artificial meat market is still in the primary stage of development and has not yet jumped out of the niche consumer market, so the tide of capital has ebbed.

The development of domestic artificial meat market still has a long way to go.

Consumer retail market cold

Since 2019, many family meat brands have entered the domestic consumer market. One is beyond meat, Nestle, Unilever and other international companies, seizing the Chinese artificial meat market; One is the start-up companies standing on the tuyere and making efforts to make artificial meat in recent years, such as Sunday zero, hey Maet, etc; And the entry and transformation of traditional A-share companies such as Shuangta food and JINZI ham.

In order to form a brand effect, artificial meat enterprises must reach the C-end consumer market, and chain convenience stores, supermarkets and e-commerce platforms have become key targets. For example, on Saturday, it reached cooperation with Rosen, Meiyijia, xisdor and other chain convenience stores to launch joint brand vegetable meat products; Beyond meat products enter the supermarket of box horse fresh food, Metro and other retailers; In addition, most artificial meat brands have opened flagship stores of tmall and jd.com.

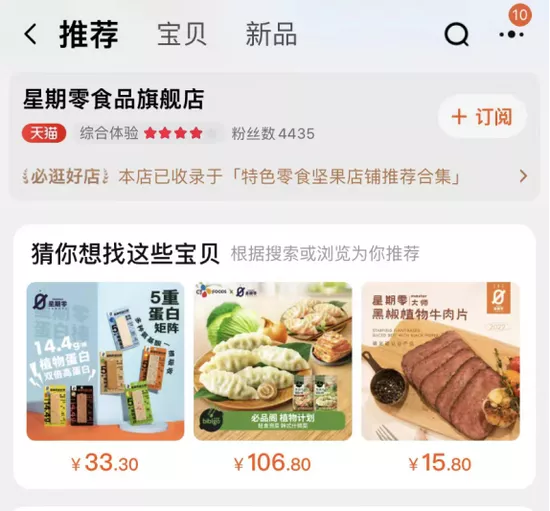

"Sunday zero" tmall flagship store

Enterprises spread channels widely and took the opportunity to increase market share, but the sales performance of artificial meat brands on major platforms seems to be unsatisfactory, and consumer demand is still in the wake-up stage. So far, no third-party platform has released statistics on the consumption of artificial meat products in the past two years, which may be related to the small and scattered sample number. From the tmall channel alone, at present, the number of fans in beyond eat stores has only exceeded 10000, and more than 400 people pay for the best products; There were more than 4000 fans in the store on Sunday, and only 95 paid for the best vegetable meat products; The artificial meat plant meat cake previously sold in Jinhua JINZI ham flagship store has been taken off the shelf.

In fact, the attitude of domestic consumers towards artificial meat has been relatively cold. Only consumers in first and second tier cities know about it, and fewer groups are willing to consume it. Zhu danpeng, an analyst of China's food industry, said: "the new category market is divided into three different stages: recognition, cognition and recognition. At present, the recognition of artificial meat on the whole consumer side is not high, let alone recognition."

There are many reasons for the cold of the consumer side. Among them, taste and price are the two mountains that hinder domestic consumers, which reflects the insurmountable technical barriers of artificial meat companies in the short term.

Compared with foreign countries, although China has relatively mature technology in the production and processing of vegetarian products, it has never broken through the technical route of "dry extrusion", resulting in the product being sticky and soft, difficult to simulate the fiber structure of animal meat, and there is a certain degree of bean fishy smell. The core advantage of the artificial meat industry is the extrusion technology of simulating real meat. Taking beyond meat as an example, the high wet extrusion process based on twin-screw extrusion technology makes it different from other enterprises.

Even if the production technology problems can be solved, the differences between Chinese and American food culture will also bring more problems. According to the report on the development of plant meat industry, the most popular plant meat products in China are not American simple meals such as hamburgers and meat rolls, but Chinese dishes such as hot pot, barbecue, stewed and fried dishes, which also puts forward higher requirements for the production technology of plant meat products.

The high price of artificial meat products on the market also discourages many consumers. Take Hangzhou HEMA fresh meat as an example. A box of 230g new vegetarian plant "sauce beef" is priced at about 30 yuan, while 500g fresh beef can be bought at the same price. On tmall platform, a box of 226g beyond meat plant meat hamburger beef patty is about 26 yuan, while in a beef product tmall flagship store, 1000g beef patty can be bought for 99 yuan.

Screenshot of fresh box horse

The fundamental reason is that the technology of the whole artificial meat industry is imperfect, resulting in the high cost of processing links. Beyond meat disclosed in its latest financial report that the company's newly launched vegetable beef jerky products adopt complex and high-cost manufacturing processes, further expanding its loss range.

In addition, the plight of the supply chain under the epidemic environment and the reduction of consumers' shopping under the economic depression have also led to the cooling of the artificial meat retail market.

There are many brands, and there are many monks

Under the 2C mode, the artificial meat brand needs to deal with various pressures such as product innovation, precision marketing and subdivided channels. In contrast, the 2B model is easier to implement in the Chinese market, and it is also the main business model of artificial meat brand at present. In cooperation with large catering brands, the company only needs to do a good job in the "raw materials" part, and it may achieve scale effect in a short time.

For example, on Sunday, it provided raw materials for plant chicken hamburgers for nearly 2600 stores across the country; Beyond meat has reached global supply agreements with McDonald's, Starbucks and other catering giants.

Among them, Shuangta food is a special existence. Although it has made efforts to the downstream products and launched its own brand Shuangta qiban since 2020, its most well-known identity is still the raw material supplier of beyond meat.

However, the 2B model can not become a shelter for enterprises, and artificial meat companies still face many difficulties.

Artificial meat companies are science and technology enterprises supported by technology. The advancement of core technology has greatly affected the competitiveness of their products in the market. Therefore, various brands have invested a lot of energy in it. However, the renewal of technology requires huge capital investment. Head companies such as beyond meat still feel hard, and it is even more stressful for other start-ups.

When selecting suppliers, large catering brands will first consider the company's technical level, supply cost and production scale. At present, most artificial meat brands have no obvious technical advantages and are too replaceable.

Compared with foreign markets, the chain scale and concentration of domestic catering industry still have great room for improvement, and the b-end market that can be provided is limited. According to the data disclosed by meituan, by 2020, the domestic catering chain rate was 15%, while the catering chain rate in the United States has reached 50%. There are a large number of street independent small shops in the domestic catering market, which are difficult to reach long-term and large-scale cooperation with artificial meat companies.

Therefore, when a small number of artificial meat companies reached cooperation with chain catering brands, most emerging start-ups fell into the dilemma of "nowhere to supply". According to tianyancha data, as of 2021, there are more than 5000 companies with names and business scope including "vegetarian, artificial meat, vegetarian meat, plant meat, plant alternative meat and cell meat".

Wu Yanzi, CEO of the company, once said on Monday that "the chain of Chinese restaurants is not high and there are many choices. If we only do the b-end of catering, it is difficult for us to reach the target population accurately and efficiently, and we can only reach consumers in the scene of dining."

In addition, despite the brand effect of chain restaurants, artificial meat products have not opened the consumer market and even attracted controversy. In March last year, Haidilao replaced the beef kernels in a regional market store with the "flavor partner" of plant meat products, which aroused the dissatisfaction of many consumers. Haidilao said that the launch of "flavor partner" is for innovation, and its cost is higher than beef kernels, but most consumers prefer traditional meat products.

Haidilao online "flavor partner"

The downturn in the consumer market has also prompted catering brands to adjust their cooperation with artificial meat enterprises and reduce product supply and demand. Zinc financial survey found that at present, Hangzhou Starbucks stores only sell one artificial meat product. According to the clerk, the sales volume is not good; Starbucks stores in first tier cities such as Beijing and Nanjing have offline related products. And Hangzhou Dexter stores no longer provide products such as plant meat hamburgers.

The false fire of capital goes out

In the first two years, artificial meat was once the "sweet pastry" in the eyes of capital.

When beyond meat was listed in US stocks, China was suffering from African swine fever, pork shortage and soaring prices. In the context of the supply gap of pork, the emergence of artificial meat provides a new idea for the domestic capital market - it may become a substitute for meat products.

At that time, China's artificial meat industry was just in its infancy. There were no head enterprises in the whole track. China's huge market capacity and population purchasing power had not been stimulated. In addition, influenced by the social trend of thought of "double carbon" goal and public health consumption view, a large number of capital poured in to try to lay out the future.

In 2020, China's artificial meat industry will usher in a small upsurge of investment and financing. According to the 2021 white paper on insight into China's vegetable meat industry, from December 2019 to December 2020, there were 21 domestic investment events for plant-based companies, with a year-on-year increase of 500%, accounting for about 10% of the whole food and health products market.

However, since 2021, the capital has gradually stalled. There are only four investment events in a year, and most of them are round a financing.

The main reason why they give up investing in artificial meat is that the consumer side remains depressed and the capital can't see profit space. Zhu danpeng believes that "in the short term, capital values the volume and profit, and in the medium and long term, it values the market prospect." Capital pursues short, flat and fast, but at present, the development of artificial meat market is far away, and capital will naturally stall.

In addition, the current artificial meat technology has not reached the expected level of the industry, which is far from the "future meat" envisaged by capital. Previously, capital classified artificial meat as a new consumption field focusing on marketing, but in essence, the development of artificial meat companies is driven by technology. Therefore, in the future, capital may prefer enterprises that pay attention to technological development and will no longer pay for the business stories fabricated by some start-ups.

In January this year, the b-round financing of US $100 million was completed on Sunday. For the planning after the current round of financing, Zhou zero said that it would focus on the layout of production and research construction and laboratory equipment investment, and constantly explore the innovation of plant protein technology.

With the passing of the investment period, the problems of the artificial meat industry have also surfaced. In case of cold, which meat making enterprise can overcome the technical difficulties and go deep into the consumer market demand can seize the opportunity and usher in a new round of reshuffle in the artificial meat market.