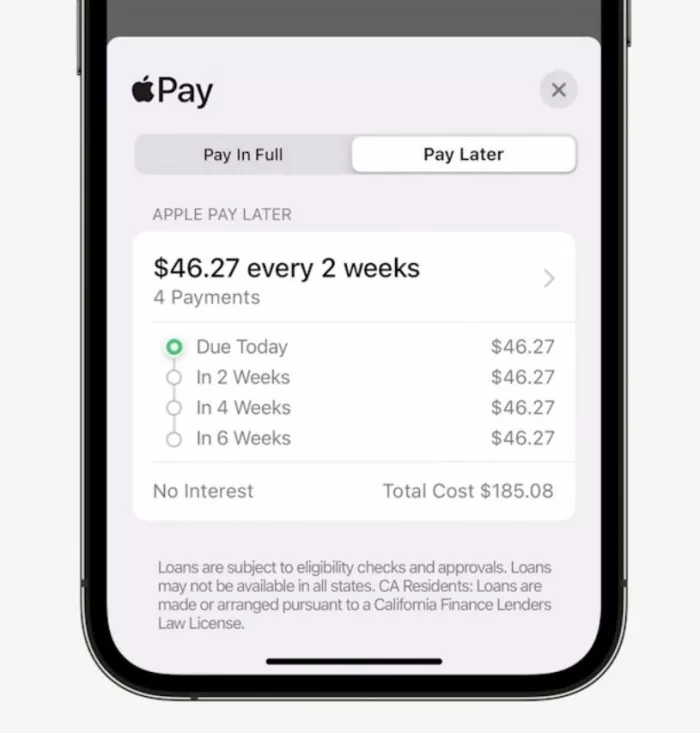

On wwdc22 last week, Apple announced that it had entered the crowded "buy now pay later (bnpl) field, putting pressure on the financial technology enterprises in the industry. Apple announced that it plans to launch "Apple pay later" loan service to expand a series of financial service products, including mobile payment and credit card. The service, nicknamed "apple flower", will allow users to pay interest free in four installments.

In addition to providing technical services on applications, Apple has also become a specialized subsidiary - Apple financing Inc., where users conduct credit reviews and loans.

The subsidiary operates separately from the main body of apple and has all necessary state-level loan licenses, which marks the first time that Apple has incorporated financial businesses such as loans and credit evaluation into the company.

Giants with a market value of more than RMB200 billion have entered the market, and iphone How many customers will Apple attract with the blessing of this artifact? This puts bnpl companies such as PayPal, confirm and klarna in an awkward position. Affected by this news, the share price of confirm fell 17% last week.

The bnpl market has already shown signs of trouble, not just the entry of giants. Last month, klarna in Sweden laid off 10% of the world's employees because of worries about the economic recession.

It is reported that the decrease in consumer spending, the rise in interest rates and the deteriorating credit environment have brought trouble to bnpl service providers and increased the possibility of industry integration.

According to GlobalData, a consultancy, bnpl is one of the fastest-growing segments in the consumer finance sector, with a transaction volume of $120billion in 2021, far higher than the $33billion in 2019.

Bnpl's business model was born in a low interest rate environment, which enables bnpl to raise funds at a lower cost and provide users with "point of sale" loans on shopping websites.

Buy before pay, as the name suggests, is a method that allows users to place an order first and pay after the goods arrive. Consumers can pay in installments over weeks or months, usually interest free, while bnpl charges online retailers for each transaction.

During the epidemic period, with the soaring volume of e-commerce transactions, bnpl model was popular among young consumers. GlobalData data shows that of every $100 e-commerce expenditure last year, $2 was completed through bnpl.

However, as the environment (epidemic, etc.) driving its explosive growth is coming to an end, the industry is facing liquidation. Consumer spending cuts and rising interest rates have pushed up the financing cost of bnpl and squeezed its profit margin. According to 451 research, an authoritative research institution, there are more than 100 bnpl companies in the world.

Apple's entry into bnpl this time will further intensify market competition. In fact, this news has briefly hit the stock prices of several listed companies, such as firm holdings, the largest bnpl company in the United States, zip and sezzle in Australia.

The share prices of these companies are already under pressure. The shares of firm holdings have fallen about 75% this year. In addition, the share price of block, the payment company of twitter co-founder Jack Dorsey, fell by about 48%. In January this year, block completed the acquisition of afterpay, an Australian bnpl provider.

Financing difficulties

Bryan Keane, senior payment analyst of Deutsche Bank, said: "at present, investors are more cautious about bnpl, and their investment desire is reduced. Because if we are in an economic slowdown or potential recession, financial risks may become obvious."

A year ago, klarna, a top Swedish bnpl company, was valued at US $46billion. But recently, the company announced that it would cut 700 jobs, accounting for 10% of its total employees. Klarna blamed the layoffs on changes in consumer sentiment, inflation and the volatile international situation. Klarna also said that he was negotiating with investors to raise more funds.

For smaller competitors, many of which are fledgling start-ups, financing will become more difficult.

"Most bnpl service providers cannot provide deposit services because they are usually not financial institutions. Of course, there are a few exceptions. But generally speaking, they need to borrow money to lend; as the interest rate related to borrowed money rises, their profit margin is bound to be under pressure," said Jordan McKee, chief research analyst at research

In contrast, companies such as klarna and block have banking licenses and can finance through depositors' deposits, so they are hardly affected.

Market regulation

In addition, the industry faces increasingly stringent scrutiny from regulators.

Last Tuesday, local time, the British charity Citizens Advice said that half of the people aged 18-34 in the UK used bnpl services. To this end, the UK Treasury has launched a consultation on how to regulate bnpl. In addition, the Australian Minister of financial services said on Tuesday that the government would regulate bnpl lending institutions in accordance with the credit law.

This did not scare some latecomers. Zopa, a British banking start-up, announced on Tuesday that it would launch bnpl products. Tim Waterman, chief commercial officer of Zopa, predicted that the regulatory regulations to be issued by the government would make the assessment of customers' ability to pay loans more stringent.

"Affordability checks will cause more friction in the customer experience and may reverse the balance of businesses. Currently, bnpl is very efficient in promoting sales and conversion rates, which may change slightly in the future," Waterman said

Deutsche bank analyst Keane said that if bnpl can bring more customers to the merchant website, the merchant may bear higher fees, but only bnpl often has this strength.

"I think some small companies in the industry may go bankrupt, or establish links with other technology companies, or integrate into large companies. Some large financial institutions may also be interested in M & A opportunities in the industry," Keane said

Rob galtman, senior director of Fitch Ratings, believes that any loan product may face a higher default rate during the economic downturn; However, bnpl companies may be protected because they can control the credit line provided according to user behavior. In addition, the loans they provide are usually short-term. Gartman also said that the entry of Apple also proved the effectiveness of this service in the market.

Deutsche Bank predicts that by 2025, the market will reach US $482billion, accounting for 5.6% of e-commerce expenditure (including tourism and various activities).

"Apple's entry into the market sends a signal that bnpl is increasingly regarded as a function rather than an independent business," said McKee, an analyst at research