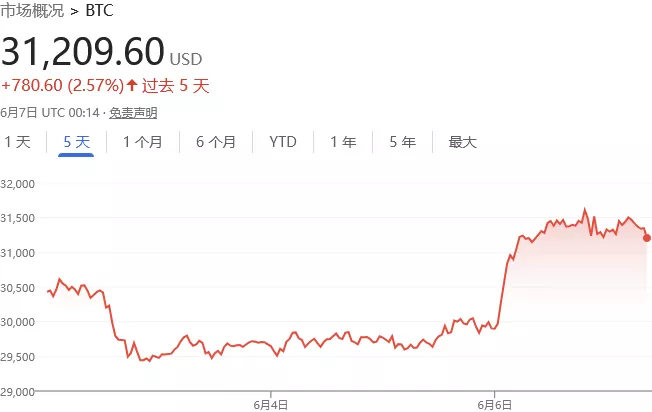

After six months of selling, cryptocurrency investors continued to explore the "bottom", and bitcoin rose over the weekend. According to the data of coin metrics, a blockchain data research company, on Monday, the cryptocurrency with the largest market value rose by 4.3% to US $31278.09. Ethereum rose nearly 2% to $1852.64.

Cryptocurrency continued to fluctuate in sync with the stock market. On Monday, the three major stock indexes also rose on average. Investors have been holding their breath to watch the price of risky assets rise. They are not sure whether these trends are temporary or have finally seen a more lasting reversal.

However, some people still think it is too early.

"We believe that this rebound is a bull market trap. Bitcoin may rise briefly, but it is likely to continue the downward trend of the past two months," said Josh olszewicz, research director of Valkyrie investments, a digital asset management company, "Due to the uncertainty of the global economy caused by the possibility of high inflation and recession, and the general interest rate hike by central banks, these factors may force the depreciation of all assets, and this trend will continue until at least the end of this summer."

"We still believe that before bitcoin rebounds later this year, the combination of the above factors may lead to bitcoin falling to $22000, mainly because this is the purchase price of many institutions and large enterprises, and they are unlikely to let their transactions fall too much," he added.

According to the data of coin metrics, last week, both bitcoin and ethercoin saw their first rise in nine weeks. This was the longest consecutive decline of cryptocurrency.

Bitcoin has fallen by more than half since it reached an all-time high of $68982.20 last November. Since this year,

Bitcoin trading has been fluctuating in a narrow range until it fell below $30000 after Terra's crash this month.

In a report on Monday, Kenneth Worthington, research analyst at JPMorgan Chase, said: "the token price fell by 27% in May after falling by 20% in April."

"The situation in April has been very serious. In May this year, the collapse of ust algorithm stable currency intensified, resulting in forced selling and uncertainty, which had a negative impact on the broader encryption ecosystem. Although the trading volume in May seemed to be higher than that in the depressed April, almost all other growth indicators fell last month."

Worthington also said that cryptocurrency "needs a new catalyst", which may be the merger of Ethereum.

Last month, Nikolaos panigirtzoglou, another strategist at JPMorgan Chase in London, said that he thought bitcoin would rise about 30% after the recent decline.