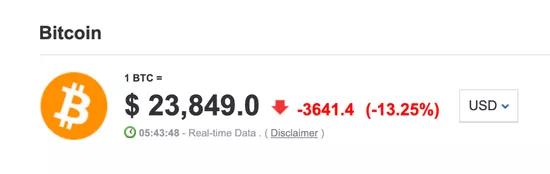

Bitcoin fell to an 18 month low due to the expansion of interest rate spread affected by US inflation, and Ethereum and other cryptocurrencies also suffered a large-scale sell-off. Bitcoin plummeted to its lowest level in about 18 months. Last Friday, US inflation data continued to impact global risky assets. In the trading session on Monday, June 13, bitcoin fell below US $24000 / piece, the first time since december2020, with a daily drop of more than 13%.

As the broader sell-off continued, other cryptocurrencies also fell. The MVIs cryptocompare digital asset 100 index, which measures 100 top-level tokens, fell 9.7%.

According to media reports, Antoni trenchev, co-founder and managing partner of NEXO, a cryptocurrency lender, said:

- cryptocurrency is still at the mercy of the Federal Reserve , maintaining a close relationship with NASDAQ and other risky assets.

The prediction we heard about bitcoin is only 10% or even 1% of a thousand, which tells you the type of macro environment faced by cryptocurrency for the first time and the degree of fear about it.

The data released on Friday showed that the US inflation rate jumped to a 40 year high in May, and traders increased their bets on a more aggressive interest rate hike by the Federal Reserve. In recent months, cryptocurrency has been particularly severely suppressed in the policies of the Federal Reserve. The collapse of terra/luna ecosystem last month and the suspension of withdrawal by Celsius, a crypto lending company, on Monday, Asian time, have further weakened people's confidence in this field.

Rick bensignor, President of bensignor investment strategy company and former strategist of Morgan Stanley, said:

For bitcoin futures, generally speaking, I suggest buying at this time.

But if you are really long, you may consider using call options or put options to limit risk. If the price drops at this time, there is no reliable support nearby.

Other cryptocurrencies also fell, with Ethereum once falling by 12% to the lowest level since February 2021; Avalanche fell 15%, Solana fell 14%, and dogecoin fell 11%.

Trenchev also said: "if Ethereum continues to fall towards $1200 (200 week moving average), the prospects for other alternative currencies will become more bleak."