Apple said that a wholly-owned subsidiary of the company would be responsible for checking users' credit and providing users with short-term loans for Apple's upcoming short-term loan service "Apple pay later". The new service, announced at Apple's Developer Conference on Monday, will compete with similar services from confirm and paypal.

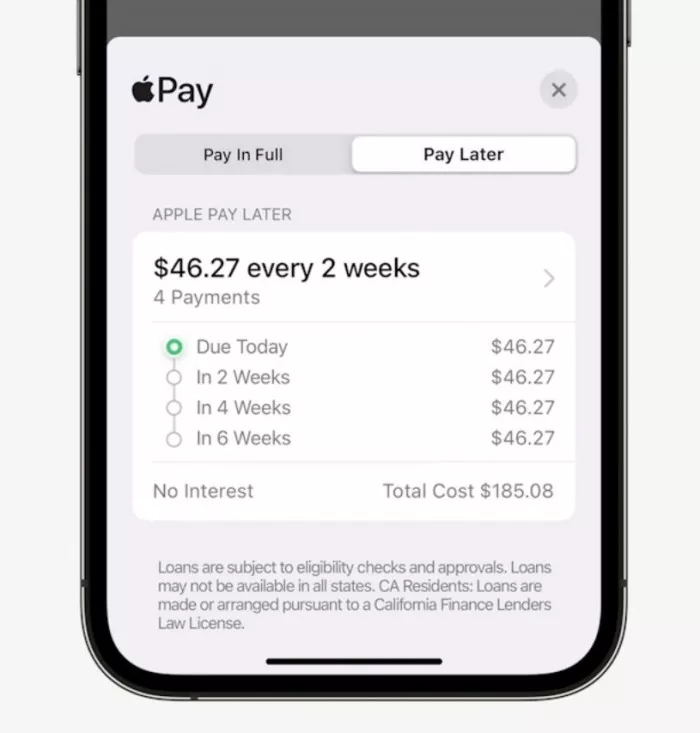

Later this year, when Apple released the new IOS 16 iphone When using the software, users will be able to use the apple pay service to purchase products, and pay the remaining amount in 4 equal installments within 6 weeks. This is a "buy now, pay later" (bnpl) service.

Apple has entered into a partnership with MasterCard, which interacts with suppliers and provides a white label bnpl product called "installations", which apple is using. Apple said that Goldman Sachs Group, which issued the "Apple card", was also the technology issuer of the loan, but Apple would not use Goldman Sachs' credit decisions or its balance sheet to issue loans.

The behind the scenes structure of this new loan product, coupled with the fact that apple is handling loan decisions, credit checks and loans, shows that the technology giant's strategy is to introduce its financial service framework and infrastructure into the company as much as possible.

Apple is increasingly entering the financial technology industry through its wallet applications and financial services. The core of these services is to make the iPhone more valuable and useful to users, while users will tend to continue to buy Apple hardware, which is still the main source of the company's sales.

In the short term, the loan of Apple pay later product is unlikely to have a great impact on apple, but it indicates that the company may use its huge balance sheet to provide more financial services in the future. According to Apple's previously released financial report, the company's revenue in 2021 was $378.55 billion.

Apple said it would conduct a so-called "soft credit check" to ensure that borrowers are able to repay their loans, which may be capped at about $1000. If Apple pay later's loan is not repaid, Apple will no longer provide credit to these users, but the company said it will not report the arrears to the credit bureau.

Apple will initially launch the apple pay later product in the United States. Apple card, another credit card product of the company, is currently available only in the United States.