After giving up the scientific innovation board, Weima automobile officially went to Hong Kong for IPO On June 1, Weima Holdings Co., Ltd. submitted the listing application to the Hong Kong stock exchange, with Haitong international, China Merchants Bank International and Bank of China International as the joint sponsors. In February last year, Weima automobile completed the guidance on the listing of the scientific innovation board, but it was soon revealed that it had given up its IPO application.

If it goes well, Weima automobile is expected to become another new car making force landing in Hong Kong stock market after "Wei Xiaoli".

44152 vehicles sold in 2021

According to public information, WM motor was founded in 2015, headquartered in Shanghai, China. Its name is from weltmeister, a German speaking world champion. It is an emerging domestic provider of new energy vehicle products and travel solutions.

As of December 31, 2021, Weima automobile has delivered 83485 electric vehicles in total. In 2021, the sales volume of electric vehicles was 44152, more than double that of 2020.

Although last year's sales volume increased significantly year-on-year, compared with the sales data of other new domestic auto makers, Weima automobile is still in a backward state. According to the data, in 2021, the deliveries of Xiaopeng, ideal and Weilai were 98155, 90491 and 91429 respectively, all of which were close to the annual sales target of 100000.

However, in the prospectus, Weima automobile stressed that according to the information of insight consulting, the company's electric vehicle sales and intelligent electric vehicle sales in 2021 ranked third among all local automobile manufacturers in China's mainstream market according to the cumulative sales as of December 31, 2021. Among them, Weima Ex5 is the largest electric SUV in China's mainstream market. In addition, Weima is also the first pure electric vehicle manufacturer in China to establish its own production facilities from the beginning. The company's two self owned production facilities in Zhejiang and Hubei Province have a total maximum annual production capacity of 250000 vehicles.

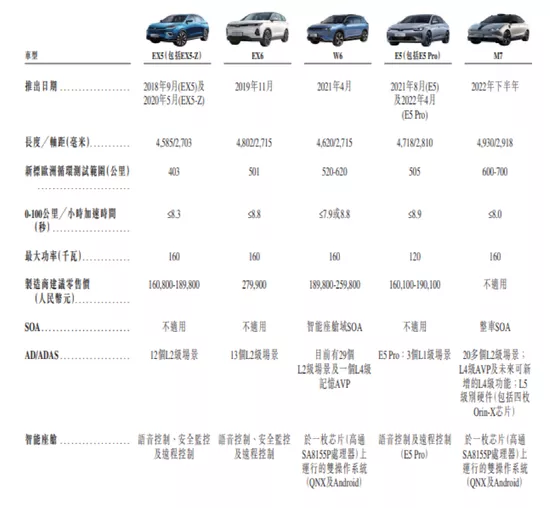

In terms of products, Weima automobile said in the prospectus that when building the product portfolio, the company first developed SUV models, including Ex5, EX6, W6, E5, M7, etc. M7 will be launched in the second half of this year. Weima automobile said that it would launch new SUV, sedan and MPV models based on the Caesar platform in 2023, and would fully cover the full range of models and products from Class A to class B.

Steady growth of revenue in recent three years

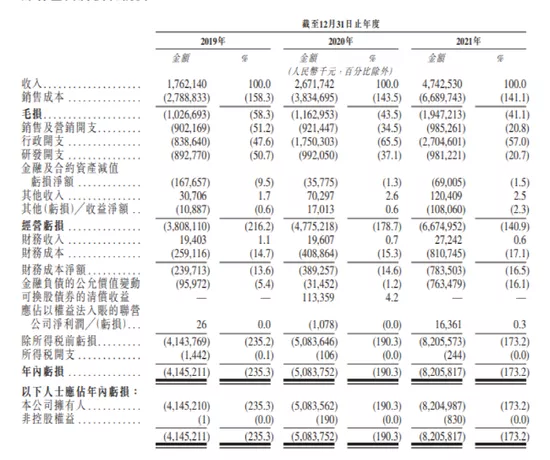

In terms of performance, the prospectus shows that the company's revenue has grown steadily in the past three years. From 2019 to 2021, the revenue was RMB 1.762 billion, RMB 2.672 billion and RMB 4.743 billion respectively, and the cumulative revenue in the three years exceeded RMB 9billion.

However, like other new forces of car building, Weima automobile is still in a state of loss. Among them, the adjusted losses from 2019 to 2021 were RMB 4.04 billion, RMB 4.225 billion and RMB 5.363 billion respectively. The gross loss rate has improved, from 58.3% in 2019 to 43.5% in 2020, and further to 41.1% in 2021.

In terms of R & D, the prospectus shows that the company's R & D expenditure has exceeded 2.8 billion yuan in the past three years, but the proportion of R & D investment has declined. From 2019 to 2021, the proportion of R & D investment is 50.7%, 37.1% and 20.7% respectively.

Weima automobile said that the company has R & D centers in Chengdu, Shanghai and Wenzhou, and has ad/ ADAS related joint R & D centers with a leading Chinese technology company. As of December 31, 2021, the company has 1141 R & D personnel, accounting for 54.1% of the total number of employees except blue collar employees. About 91.0% of the R & D personnel have bachelor's degree or above.

In addition, it is worth noting that at the end of last year, Weima automobile was exposed to three fire accidents in four days. As the first batch of new energy vehicle enterprises in China, Weima automobile once ranked among the top three among the new forces of car making in 2019. Since then, with the successful listing of ideal vehicles and the reshuffle of the new forces of car making, Weima automobile has slipped to the second echelon. In addition, it has been frequently exposed to fire accidents. There are also many doubts and concerns in the industry.

However, for the future of Weima automobile, founder and CEO Shen Hui is full of confidence, and has publicly said: "the new energy automobile market has just begun to take shape in a real sense. Now it is only the first half, and success or failure depends on the second half. Weima's product line focusing on mainstream intelligent electric vehicles will not waver. I am confident that Weima will become the leader of new forces in automobile manufacturing."

Accumulated financing of 35billion yuan held by Baidu and Yaleju

In recent years, Weima automobile has been favored by many funds in the capital market.

Tianyancha shows that at present, Weima automobile has completed 11 rounds of financing. With the D1 and D2 rounds of financing exceeding 500million US dollars, the total amount of financing has exceeded 35billion yuan.

Among them, the D1 round of financing obtained more than US $300million, which was led by PCCW, a global well-known communication giant under the Li Ka Shing family, and Shun Tak Group, a large comprehensive industry group under the ho family. Subsequently, Weima automobile signed the round D2 financing agreement with other internationally renowned US dollar investment institutions. This also makes Weima automobile become the new power of making cars with the largest amount of US dollar investment in the past year.

In addition, the investors of Weima automobile include well-known strategic investment institutions such as far east Hongxin, Yuanjing energy, SAIC Group, Minmetals Group and Hongta Group; Tencent, Baidu and other Internet giants; There are top vc/pe funds such as light source capital, Sequoia Capital and SIG Haina Asia; It also includes the support of large state-owned funds and local industrial investment funds, and the capital operation is very strong.

Compared with the total financing amount of 15billion yuan before the listing of Weilai, 18.8 billion yuan before the listing of Xiaopeng and 12billion yuan before the ideal listing, the financing of more than 35billion yuan of Weima automobile is really eye-catching. It is no wonder that many insiders frankly say that Weima automobile is only one foot away from the listing.

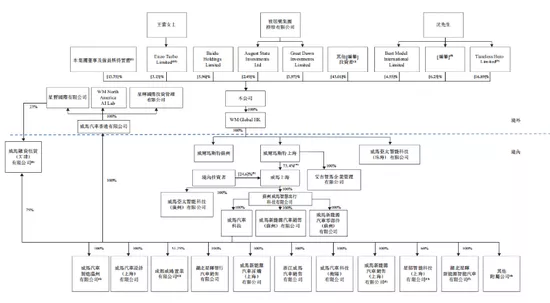

In terms of equity structure, according to the prospectus, before the IPO, Baidu's shareholding ratio was 5.96%, agile group's shareholding ratio was 6.46%, founder Shenhui and his wife Wang Lei's shareholding ratio was 30.82%, and directors' and employees' shareholding ratio was 13.75%.

For the purpose of fund-raising, Weima automobile said that it would be used to develop an automobile development platform and the next generation of intelligent electric vehicles; Expand sales and service network and brand promotion activities; Production related investment; Repayment of syndicated loans (totaling RMB 1.3 billion), general corporate purposes and working capital as of March 31, 2022.