Amd today announced its first quarter financial results for fiscal year 2022. The report shows that AMD's revenue in the first quarter was US $5.887 billion, an increase of 71% compared with us $3.445 billion in the same period last year and 22% compared with us $4.826 billion in the previous quarter; The net profit was US $786 million, an increase of 42% compared with us $555 million in the same period of last year and a decrease of 19% compared with us $974 million in the previous quarter;

The adjusted net profit not in accordance with us gaap was US $1.589 billion, an increase of 148% compared with us $642 million in the same period last year and 42% compared with us $1.122 billion in the previous quarter.

AMD's first quarter results exceeded Wall Street analysts' previous expectations, its second quarter revenue outlook also exceeded expectations, and raised its full year revenue outlook, pushing its after hours share price up nearly 5%.

Main achievements:

In the quarter ended March 26, AMD's net profit was $786 million and diluted earnings per share was $0.56, which was much better than the same period last year. In the first quarter of fiscal year 2021, AMD's net profit was $555 million and diluted earnings per share was $0.45.

Excluding some one-time items (not in accordance with U.S. GAAP), AMD's adjusted net profit in the first quarter was $1.589 billion, compared with $642 million in the same period last year, a year-on-year increase of 148%; The adjusted diluted earnings per share was $1.13, compared with $0.52 in the same period last year, a year-on-year increase of 117%, which exceeded analysts' previous expectations. According to the data provided by Yahoo Finance Channel, 10 analysts had expected AMD's earnings per share to reach $0.91 in the first quarter on average.

AMD's revenue in the first quarter was $5.887 billion, up 71% from $3.445 billion in the same period last year and 22% from $4.826 billion in the previous quarter, exceeding analysts' expectations. According to the data provided by Yahoo Finance Channel, 10 analysts expect AMD's revenue to reach $5.52 billion in the first quarter on average.

Excluding the performance of Xilinx recently acquired, AMD's adjusted revenue in the first quarter was US $5.328 billion, an increase of 55% compared with us $3.445 billion in the same period last year and 10% compared with us $4.826 billion in the previous quarter.

By business unit:

-The revenue of AMD's computing and graphics products division in the first quarter was US $2.8 billion, an increase of 33% compared with the same period of last year and 8% compared with the previous quarter; Operating profit was US $723 million, compared with us $485 million in the same period of last year and US $566 million in the previous quarter;

-The revenue of AMD enterprise, embedded and semi customized products in the first quarter was US $2.5 billion, an increase of 88% compared with the same period of last year and 13% compared with the previous quarter; Operating profit was US $881 million, compared with us $277 million in the same period last year and US $762 million in the previous quarter;

-In the first quarter (since the completion of the acquisition), part of the revenue of Xilinx department was US $559 million and the operating profit was US $233 million;

-All other divisions of AMD had an operating loss of $886 million in the first quarter, compared with $100 million in the same period last year and $121 million in the previous quarter.

AMD's operating profit in the first quarter was $951 million, an increase of 44% compared with the operating profit of $662 million in the same period last year, and a decrease of 21% compared with the operating profit of $1.207 billion in the previous quarter. Excluding some one-time items (not in accordance with US GAAP), AMD's adjusted operating profit in the first quarter was US $1.837 billion, an increase of 141% compared with us $762 million in the same period last year and 38% compared with us $1.328 billion in the previous quarter.

Excluding the performance of Xilinx, which was recently acquired, AMD's adjusted operating profit in the first quarter was $1.604 billion, up 110% from $762 million in the same period last year and 21% from $1.328 billion in the previous quarter.

AMD's operating profit margin in the first quarter was 16%, down 3 percentage points from 19% in the same period last year and 9 percentage points from 25% in the previous quarter. Excluding some one-time items (not in accordance with U.S. GAAP), AMD's adjusted operating profit margin in the first quarter was 31%, up 9 percentage points from 22% in the same period last year and 4 percentage points from 27% in the previous quarter.

Excluding the performance of Xilinx, which was recently acquired, AMD's adjusted operating profit margin in the first quarter was 30%, an increase of 8 percentage points compared with 22% in the same period last year and 3 percentage points compared with 27% in the previous quarter.

AMD's gross profit in the first quarter was $2.818 billion, up 78% from $1.587 billion in the same period last year and 16% from $2.426 billion in the previous quarter. Excluding some one-time items (not in accordance with US GAAP), AMD's adjusted gross profit in the first quarter was US $3.100 billion, an increase of 95% compared with us $1.588 billion in the same period of last year and 28% compared with us $2.427 billion in the previous quarter.

Excluding the performance of Xilinx recently acquired, AMD's adjusted gross profit in the first quarter was US $2.712 billion, an increase of 71% compared with us $1.588 billion in the same period last year and 12% compared with us $2.427 billion in the previous quarter.

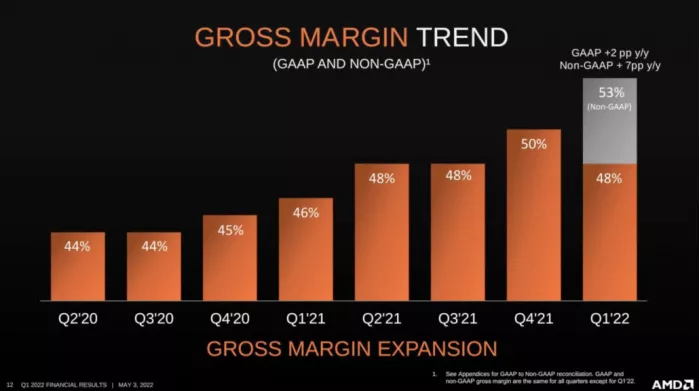

AMD's gross profit margin in the first quarter was 48%, up 190 basis points from 46% in the same period last year and down 240 basis points from 50% in the previous quarter. Excluding some one-time items (not in accordance with U.S. GAAP), AMD's adjusted gross profit margin in the first quarter was 53%, an increase of 660 basis points compared with 46% in the same period of the previous year and 240 basis points compared with 50% in the previous quarter.

Excluding the performance of Xilinx recently acquired, AMD's adjusted gross profit margin in the first quarter was 51% not in accordance with US GAAP, up 480 basis points from 46% in the same period last year and 60 basis points from 50% in the previous quarter.

AMD's operating expenses in the first quarter were US $1.95 billion, an increase of 110% compared with us $929 million in the same period last year and 59% compared with us $1.223 billion in the previous quarter. Among them, R & D expenditure was US $1.06 billion, compared with us $610 million in the same period of last year and US $811 million in the previous quarter; Marketing, general and administrative expenses were $597 million, compared with $319 million in the same period last year and $412 million in the previous quarter. Excluding some one-time items (not in accordance with U.S. GAAP), AMD's adjusted operating expenses in the first quarter were $1.346 billion, an increase of 62% compared with $830 million in the same period last year and 22% compared with $1.103 billion in the previous quarter.

Performance Outlook:

Amd expects that the revenue in the second quarter of fiscal year 2022 will reach about US $6.5 billion, floating up and down US $200 million, with a year-on-year increase of about 69% and a month on month increase of about 10%. This performance outlook exceeds analysts' expectations. According to the data provided by Yahoo Finance Channel, 10 analysts had expected AMD's second quarter revenue to reach $6.38 billion on average. Amd also expects that the gross profit margin not in accordance with U.S. GAAP will reach about 54% in the second quarter of fiscal year 2022.

Amd expects that the revenue in fiscal year 2022 will reach about US $26.3 billion, an increase of about 60% compared with fiscal year 2021, higher than the previous forecast of about 31% year-on-year growth, and higher than analysts' expectations. According to the data provided by Yahoo Finance Channel, 16 analysts had expected AMD's annual revenue to reach $25.15 billion on average. Amd also expects that the gross profit margin not in accordance with US GAAP in fiscal year 2022 will reach about 54%, higher than the previous forecast of about 51%.

Changes in share price:

On the same day, amd shares rose $1.29, or 1.44%, to close at $91.13 in regular trading on NASDAQ. In the subsequent after hours trading as of 4:47 p.m. Eastern time on the 3rd (4:47 a.m. Beijing time on the 4th), AMD's share price rose again by $4.20, or 4.61%, to $95.33. In the past 52 weeks, AMD's highest price was $164.46 and its lowest price was $72.50.