Chips, the 'most familiar stranger' in most people's lives.

It exists in almost every corner of life, and even this one article is only here because of the countless chips that work in tandem to make it appear before your eyes. For modern people, chips are as essential as water, air and electricity.

The chip is the foundation of the electrified age. From the iPhone running King of Glory, to the Koda Duck dancing to music, it's all powered by a tiny chip inside.

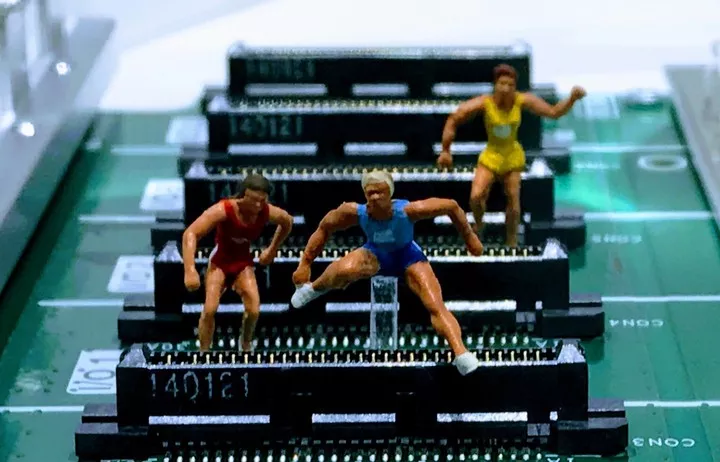

Although the difference in process technology and complexity is greater than the difference between a Tyrannosaurus Rex and a Yankee, the principles of operation are not far off - both are miniaturized integrated circuits that represent data through the 1's and 0's of transistors, with only a 'billion' point difference in the degree of integration.

In the past, when you think of chips, most people think of Intel Core CPUs, Apple A series and other high-end chips with 10nm and 5nm advanced processes.

Because powerful chips are always the absolute protagonists at digital new product launches, the percentage of performance increase generated by the chip replacement is the most powerful tool to mobilize the audience's adrenaline, and the greater the increase, the greater the cheers harvested.

The power management chip, keyboard input detection chip and other "small chips" related to direct computing performance, often do not get more attention from consumers, as if their presence or absence does not have an impact on the consumer's purchase decision, for a long time, consumers will only pay for the chip performance.

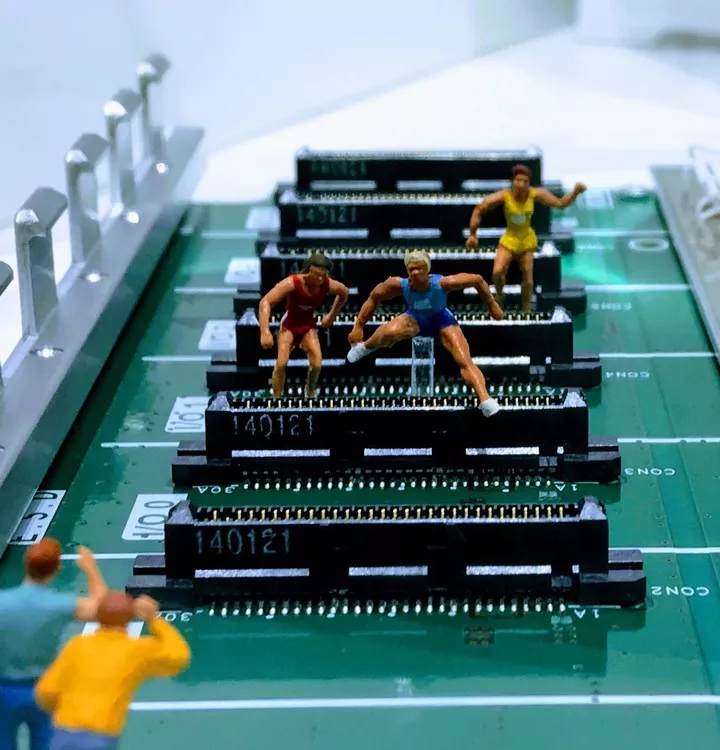

However, a sudden wave of core shortage has changed the rules of the game, and this time, the "small chip" has become a big player.

A life choked by a chip

Just as people realize that tap water is not easy to come by until after the water is stopped, it is not until the wave of core shortage hits that people realize that their lives have actually been shaped by countless small chips, and one hair will move the whole body.

Since 2020, the chip industry has been hit by multiple "black swan events" such as the US-China trade war, the globally spreading New Crown Pneumonia epidemic, local geopolitical conflicts and natural disasters.

According to a Goldman Sachs survey released in 2021, at least 169 industries are affected by the global chip shortage, with the automotive and consumer electronics industries being the most directly relevant to us.

In the past two years, if you have purchased a car or a digital product such as a mobile phone or computer, you should have noticed that the number of "pre-sales", "out of stock", "late deliveries" and other bad things that stop you from spending your money has become more and more frequent.

In the laptop category, for example, we used to wait for notebook manufacturers to offer big discounts on double 11, 618 and other shopping festivals to get them at an absolutely affordable price; nowadays, if you don't get some popular models when they debut, all you have is a long wait for restocking, and you still want discounts? It's good enough that you didn't run into a price hike.

In addition to the fact that demand for laptops has increased, a large part of this is due to the lack of supply of chips resulting in a continued tight supply of products.

Last year both HP and Dell, the PC industry's head supplier, warned that a shortage of computer component chips was making it difficult to meet the market's booming demand.

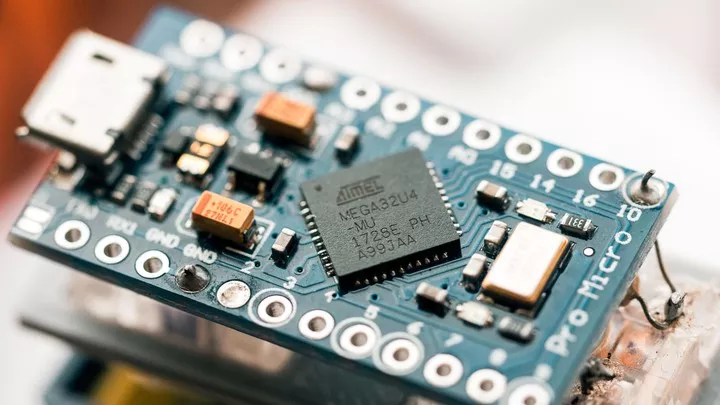

Surprisingly, it's not the high-end processors made by Intel and AMD that are tripping these giants up, but rather the 'humble' Wi-Fi connectivity chips, power management chips and other basic chips.

Compared to processors that use advanced 7nm processes at every turn, these base chips with mature processes (28nm and above) are much cheaper, and normally they should be the least of manufacturers' worries.

However, these mature chips have borne the brunt of this chip drought, with supply quickly breaking down, turning the 'small supporting role' into the 'Achilles heel' of laptops in one fell swoop.

Until now, the supply of power management chips has remained an unstable factor for manufacturers such as Asus, and the vendors' ability to meet their shipment targets as expected has depended on a shortage of these small chips.

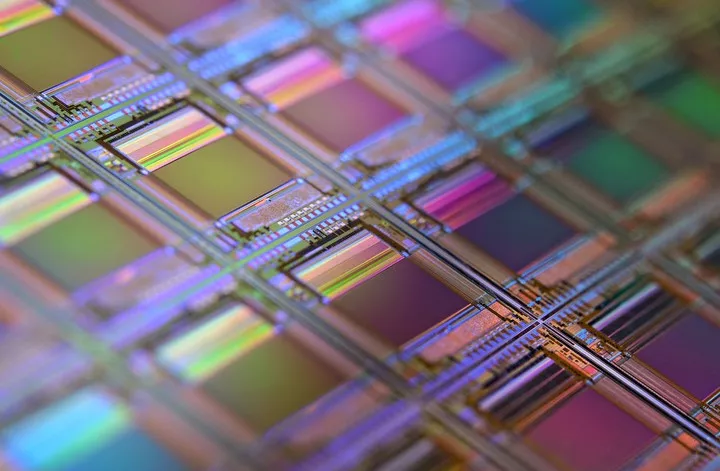

In response to the chip crisis, chip makers including TSMC, Intel, Samsung and SMIC have been actively investing in the construction of new factories located around the world for the past two years, with an investment scale of tens of billions of dollars to increase chip production capacity.

However, in the short term, this "distant water" is still very difficult to solve the urgent needs of the moment. As a heavy asset and strong cycle industry, it takes at least 3-5 years from investment to mass production, and the long recovery cycle means that this international crisis needs more time to be solved.

At the end of April this year, Intel CEO Pat Gelsinger told the World Economic Forum (WEF) in Davos that the global chip shortage is unlikely to end until 2024 and that the current state of supply is not promising.

It's hard to turn around a ship

The automotive industry is also plagued by the lack of cores.

Since 2020, news of car factories being forced to shut down and cut production due to lack of cores has been incessant, with car giants such as Toyota, Volkswagen, BMW and Daimler all reducing their production schedules to varying degrees.

According to AutoForecast Solutions, an automotive industry data forecasting company, as of the end of April this year, the cumulative production reduction in the global automotive market due to chip shortage is about 1,585,500 vehicles this year, and with the 10.5 million vehicles to be reduced in 2021, the cumulative production reduction in the global automotive market due to chip shortage has exceeded 12 million vehicles.

It's an indiscriminate blow to the auto industry, and whether you're a new power or an old one, you're inevitably in deep.

The most direct impact of the lack of a core on consumers is that the delivery time is greatly lengthened, which is particularly evident in the new energy vehicle industry.

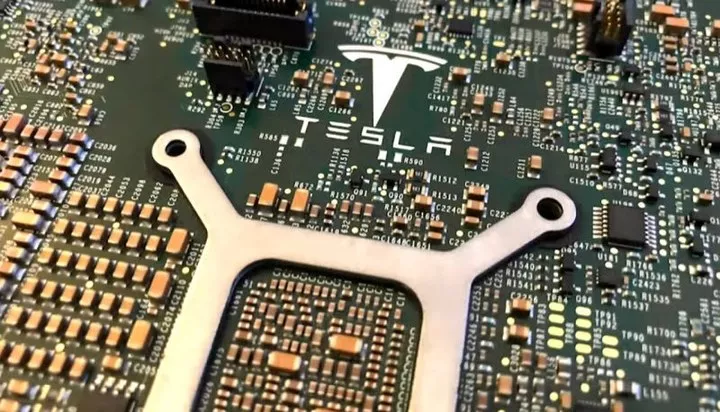

If you want to buy a Tesla Model 3, the official website shows that the delivery time is already at least 5 months away, and if you choose one of the new domestic brands represented by "Ui Xiaoli", you will have to wait 2-3 months for delivery.

In addition to the long waiting period, consumers will also encounter another headache when purchasing a car - car manufacturers will have a certain degree of 'downsizing' in the production process due to the lack of supply of some chips and components.

Or take Tesla for example, in November 2021 Tesla because of the chip shortage of Model 3 and Model Y vehicle interiors minus the center and rear USB- C port, mobile phone wireless charging function also can not be used, after the consumer questioning Tesla only responded that will be followed by the appropriate replacement parts, but the specific time can not be guaranteed.

In February this year, Tesla's internal letter rumored that Tesla would reduce the number of Model 3 and Model Y vehicles made in Shanghai by removing one of the two electronic control units in the electronic power steering system, a move also in response to the lack of core crisis.

"Reduced car lift" is not a new tactic for car companies, car manufacturers including BMW, Ideal and Xiaopeng have all had similar operations in the past year, with Ideal and Xiaopeng promising to make up for consumers' losses with retrofitting after picking up the car, while BMW and Tesla have rarely responded to the reduction.

Whether or not consumers will be compensated for the reduction depends entirely on the sincerity of the automaker.

The reason why automakers are risking reputational bankruptcy by using the reduced package lift option is ultimately because of the auto industry's heavy reliance on chips.

According to industry surveys, a traditional fuel car requires an average of more than 1,000 chips, while in the case of smart cars equipped with features such as autonomous driving, the chip usage will reach more than 3,000 chips.

Automotive manufacturers use automotive-grade chips and ordinary consumer electronics chips are different, in order to allow the vehicle to drive properly for a long time, automotive-grade chips for environmental adaptability, reliability, consistency requirements will be quite high.

And with the amount of validation work that goes into developing each part, and the need to do it again each time a component is replaced, automotive companies are choosing to establish stable supply relationships with suppliers such as Bosch, and will rarely choose to replace parts easily.

Once there is a supply problem with some of the small driving-related chips, automakers have little better choice than to wait for suppliers to resume supply or pay a hefty premium to brokers.

For chips that don't directly affect driving safety, automakers can only cut and paste, stripping out some of the features for sale, or else they have to shut down their production lines. In North America, Cadillac, Ford and other manufacturers are already selling reduced versions of vehicles with car phones, heated seats and more.

Recently, Peng's chairman, He Xiaopeng, used the 'urgent need for chips' Dakota Duck toy on his social media platform to reflect the team's supply status. He said that the core problem of the current supply chain is not the lack of the traditional impression of 'high precision' chips, but the cheap chips, it is only the low substitutability of this part of the chip that makes the supply problematic.

The chip industry's high input and long output characteristics predetermine that there will be no "special medicine" for the "chip shortage" in a short time, leaving the market more time to adjust.

The semiconductor industry has seen many boom and bust cycles to date, only for sudden epidemic demand to accelerate the cycle, triggering a sudden boom that has reshaped the fortunes of the tech and auto industries.

Just how long will this semiconductor boom last, and how long will it take for the various industries that have been pushed to pause to regain their growth dynamics, no one can yet put a price tag on such a grand thesis. All that can only be hoped for in a future full of uncertainty.