As prices plunged 99.7% in a week, Terra's Luna crypto token investors experienced their worst week in recent months On this day alone, the loss of the token reached 96% – down from $60 earlier this week and a high of $120 in mid April – which prompted the back-end of the system to mint more tokens to stabilize the value of UST.

As of press time, the value of Luna currency after falling through hovered at more than 10 cents. (screenshot via tradingview)

Changes in market dynamics have led to the Luna currency falling below multiple support levels at an alarming rate. Originally, the stable currency of terrausd (UST) algorithm should be anchored at 1:1 with the US dollar, but the general environment of the cryptocurrency market does not support the platform to maintain its false prosperity.

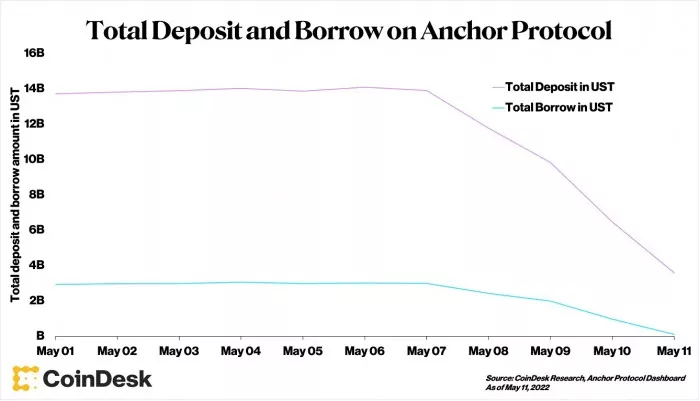

The analysis shows that Luna has been facing the pressure of being sold since last weekend. At that time, investors liquidated their earnings on anchor, a terra agreement used to make a profit on UST, and then fell sharply.

(Figure via coindesk Research)

Algorithms such as ust stabilize coins, whose operation mode is that Luna tokens equivalent to US $1 can be exchanged or forged at any time. Theoretically, this will help ust maintain its currency stability and create a certain market demand for the two tokens.

Traders could have made a profit by continuing to buy and sell Luna and ust while maintaining a 1:1 anchor with the US dollar. However, this week's stampede - which fell to a low of 22 cents on Wednesday) - resulted in additional Luna tokens being produced and put on the open market.

The circulation of messes has more than doubled to 7.7 billion on Thursday. In the case of a large increase in supply, Luna tokens are also under great selling pressure.

(screenshot via MESARI)

On the other hand, Luna tried its best to embark on the road of recovery by sacrificing its own way and stabilizing the currency of ust algorithm. In early European trading on Thursday, its currency returned to 60 cents.

After a week on the roller coaster, Terra proposed several measures on Thursday to save the UST stable currency and prevent Luna from being seriously diluted.

Last week, the value of these tokens was close to $4 billion. However, this week's sharp decline has pushed Luna out of the top 10 list of cryptocurrencies (temporarily #81), and its market value has shrunk to $720 million.

Even so, some market observers remain optimistic about the long-term prospects for a stable currency. Brian Gallagher, co-founder of partisia blockchain, said in a telegram message:

The algorithmic stable currency is still in the early stage of development. Since most currencies are experimental, it is inevitable to encounter some setbacks in the process of maintaining the anchor. But to grow, we must experience the test of these storms.

Embarrassingly, with the spread of panic, even tether (usdt), the top 1 of the stable currency market, suffered a sudden break from the anchor with the US dollar in early trading on Thursday.